During the first half of 2014, we made some impressive key

R&D hires, including Dr Paul Whittaker, the previous head of

respiratory biomarker R&D at Novartis, as we continue building

our in-house R&D team under the leadership of Dr Chris Poll,

the previous head of Chronic Obstructive Pulmonary Disease (COPD)

research at Novartis.

We are seeking to develop a range of new human models of

disease, including in airways diseases such as asthma and COPD.

Both of these respiratory diseases represent large, global, high

value markets with considerable unmet needs. Importantly, they are

known to be exacerbated by viral infections and certain challenge

agents, including allergens, providing an ideal opportunity for

Retroscreen to develop human models of these diseases. These can

then be used both to validate investigational new drugs for

clients, providing further revenue opportunities for Retroscreen,

and to discover important new biomarkers that we can then

commercialise ourselves or with partners.

In June 2014, we were pleased to announce the start of our

first-ever asthma study in the development of a safe, reproducible

and clinically-relevant asthma human disease model, using "HRV-16"

viral challenge. I am pleased to update that the study is

progressing well and we have collected our first samples from

subjects during the course of an asthma exacerbation, which will

trigger the start of our hunt for novel biomarkers in asthma. We

also announced that we had achieved the First Subject, First Sample

(FSFS) in an Over 45's study designed to establish safety in an

older population as a precursor to developing a COPD model.

Since the end of the first half, we have announced Retroscreen's

involvement in landmark studies for Gilead Sciences Inc. and Alios

BioPharma Inc. in "RSV" infection, highlighting the power of hVIVO

in product validation. Retroscreen was able to deliver dose ranging

and proof of concept results for both products in only

approximately six months and ten months respectively, demonstrating

the power of our hVIVO human models of disease. This highlights

hVIVO's ability to surpass field-based studies in producing clean

compelling data in an accelerated timeframe, with the ability to

gain product insights not normally available until pivotal

field-based studies, through targeted subject recruitment and

defined timing of infection. The ability to accelerate the

development of new drugs underpins our expansion into new disease

models, including asthma and COPD.

As we embark on our broader growth strategy, a number of

important Board changes were made in the first half of the year. In

June, we appointed Jaime Ellertson as Non-Executive Chairman,

succeeding David Norwood who continues as a Non-Executive Director.

Jaime has an impressive track record in growing high tech

companies, with ground breaking technologies, in a range of

different industries. Other Board changes included the retirement

of Professor John Oxford, Duncan Peyton and Charles Winward,

together with the appointment of Dr Trevor Nicholls and Dr Alison

Fielding as Non-Executive Directors.

I believe that under the leadership of our Board, the Company is

in an excellent position to capitalise fully on its ground breaking

hVIVO platform.

Financial Review

Statement of Comprehensive Income

Revenue for the six months ended 30 June 2014 was GBP15.0

million (H1'13 - GBP12.0 million; 2013 - GBP27.5 million), due to a

busy schedule of client engagements across two quarantine

facilities.

Gross profit was GBP4.8 million and gross margin 32.1% (H1'13 -

GBP3.4 million and 28.3%; 2013 - GBP8.3 million and 30.2%). The

continuing improvement in gross margin is due to the busy period of

client engagements, achieving better utilisation of staff and

facilities, operational efficiencies and economies of scale.

Research and development expense (excluding provision against

virus inventory) was GBP3.1 million (H1'13 - GBP0.5 million; 2013 -

GBP1.2 million), as we continue to build our in-house R&D

capability and preparations are made to implement our R&D

plan.

Administrative expense was GBP7.3m (H1'13 - GBP2.9 million; 2013

- GBP7.3m) with the increase due to investing in an increasing

staff cost base and infrastructure to support Retroscreen's

expanding capability and workload for the hVIVO platform from

client revenue engagements and internal R&D studies.

Loss before taxation was GBP5.4 million (H1'13 - Profit before

taxation of GBP0.03 million; 2013 - Loss before taxation of GBP1.2

million).

Balance Sheet and Cash Flow

As at 30 June 2014 net assets amounted to GBP43.4m (H1'13

GBP16.9 million; 2013 GBP42.9 million), including cash and cash

equivalents of GBP31.6 million (H1'13 - GBP13.2 million; 2013 -

GBP35.8 million).

Retroscreen raised GBP33.6 million (before expenses) by way of a

placing, which completed after the period end on 1 September

2014.

Net cash used in operating activities over the six months was

GBP3.6 million (H1'13 - GBP1.1 million; 2013 - GBP2.2 million).

Outlook

Retroscreen is embarking on the next leg of its exciting

journey. The recent GBP33.6 million (before expenses) fundraise,

completed on 1 September 2014, will allow the Company to accelerate

its biomarker discovery programme in 'flu and asthma, refine the

asthma model for product validation use, initiate COPD model

development as the second airways disease opportunity and broaden

the Company's challenge agent repertoire.

Retroscreen has reached an inflection point where it now needs

to achieve a balance of external client revenue engagements with

internal R&D studies. In order to accelerate the R&D

programme, we announced as part of the fundraise that we are

targeting a 70:30 balance of external client revenue engagements to

internal R&D studies, which in time is expected to become an

equal 50:50 balance as overall workload increases. This will be a

significant transition for Retroscreen, such that in the next

twelve months there may be lumpiness in balancing the

prioritisation and timing of client revenue engagements and

internal R&D studies. Accordingly, in the short term this is

expected to lead to lower revenue for the second half of 2014 than

in the first half of the year. However, longer term, as the Company

diversifies its workload and expands its capacity, including the

introduction of Chesterford Research Park in summer 2015, we

believe that the balancing of client revenue engagements and

internal R&D studies should increase Retroscreen's overall

utilisation of staff and facilities. This can be expected to drive

cost efficiencies and gross profit margin improvement, which will

in part contribute to the Company's increasing investment in

R&D expense and requirement for cash.

We anticipate strong progress with the new model development

programme and in-house R&D programmes over the next 24 months.

Our goal is to calibrate hVIVO in both asthma and COPD models,

while elucidating a circuit plan for at least one target disease

with the subsequent discovery of a first candidate biomarker. Once

identified, the Company intends to meet with the regulators

including the FDA to determine the most appropriate development

pathway. This will allow us to start the clinical validation of our

first biomarker while seeking a collaboration or partnership for

product development and commercialisation. In parallel, we continue

to perform well with our product validation services to clients and

we are excited to be expanding our offering into new disease areas,

with our asthma model progressing well in development. Our pipeline

for product validation services to clients continues to show good

growth, with the overall value increasing by 83% over this time

last year. A number of the opportunities in our 2015 pipeline are

for products in the 'flu and RSV space which experienced drug

development delays in 2014. We may still be able to land these

engagements with quarantines in 2014, alternatively they may push

out into 2015. In addition to commencing conversations with clients

for our new asthma model, we have also developed new ways in which

our clients can harvest the benefits of our hVIVO platform - for

example, we recently launched a new hVIVO OTC (Over the Counter)

model, which aims at securing higher value performance claims for

OTC cold and flu products. As we diversify into new disease areas

and continue to evolve exciting and beneficial ways for our clients

to leverage our platform - including our biomarker capabilities -

we expect to work more closely, and more broadly, with our clients

than ever before.

The Company also announced that, in line with its expanded

vision for the business, it will be changing its name to hVIVO plc

which is currently the Company's proprietary name for its

technology platform. The name change is expected to be implemented

in Q4 2014.

I am delighted that the recent fundraise and the broader vision

for the Company, including the proposed name change, was extremely

well supported by our existing and new investors. I would like to

thank them all for their continuing support and we look forward to

delivering further updates on our progress as we expand our hVIVO

platform.

Kym Denny

Chief Executive Officer

24 September 2014

Retroscreen Virology Group plc

Condensed Consolidated Statement of Comprehensive Income

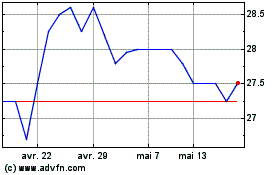

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024