TIDMORPH

RNS Number : 5966B

Open Orphan PLC

31 January 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA,

CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR IN OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR

ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE

OF ANY SECURITIES OF OPEN ORPHAN PLC IN ANY JURISDICTION WHERE TO

DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

31 January 2020

Open Orphan plc

("Open Orphan", the "Company" or the "Group")

Results of Placing and Subscription

Open Orphan plc (ORPH), the rapidly growing specialist

pharmaceutical services company which has a focus on orphan drugs,

announces that, further to its announcement at 7.00 a.m. today (the

"Fundraising Announcement"), it has successfully completed the

oversubscribed Fundraising which is now closed.

The conditional Placing and Subscription has raised GBP5.3

million (before expenses) through the placing of 71,254,110 new

Ordinary Shares and subscription of 15,631,143 new Ordinary Shares

with certain institutional and new shareholders at an Issue Price

of 6.1 pence per share.

As outlined in the Fundraising Announcement, the net proceeds of

the Fundraising will be used to fund the growth and synergies

programme of the business following the completion of the hVIVO

acquisition on 17 January 2020. The complementary fit, the shared

vision and strong shareholder support on both sides of the

businesses has allowed Open Orphan to move swiftly to complete the

public takeover from the first discussions in November.

hVIVO is an industry leading services provider in viral

challenge studies and virology laboratory services. It has the only

24-bedroom state of the art quarantine clinic with on-site virology

laboratory and provides a high level of infection control that

allows multiple studies and virus-types to be used simultaneously.

It has a world leading portfolio of viral challenge models

including 2 Flu, 2 RSV, 1 Asthma, 1 Cough and 1 COPD viral

challenge models.

Director Participation

The following Director of the Group participated in the

Placing:

Name of Director Number of Placing Total Ordinary Total interest

Shares subscribed Shares following in the enlarged

for the Fundraising issued share

capital

Cathal Friel,

Executive Chairman 4,918,030 45,965,011 8.6 %

------------------- ------------------ -----------------

The Placing participation from Cathal Friel is considered a

related-party transaction for the purposes of Rule 13 of the AIM

Rules for Companies. The directors (other than Cathal Friel)

consider, having consulted with Arden Partners, the Company's

nominated adviser, that the Placing participation is fair and

reasonable in so far as Open Orphan's shareholders are

concerned.

The Placing participation from Cathal Friel is considered a

related-party transaction for the purposes of the Euronext Growth

Rules. The directors (other than Cathal Friel) consider, having

consulted with Davy, the Company's Euronext Growth Adviser, that

the Placing participation is fair and reasonable in so far as Open

Orphan's shareholders are concerned.

Admission and Total Voting Rights

The Fundraising is conditional on Admission, and is being

carried out within the Company's existing share authority to issue

Ordinary Shares for cash.

It is expected that the Fundraising Shares will be admitted to

trading on AIM and Euronext Growth at 8.00 a.m. on or around 6

February 2020 (or such later date as may be agreed between the

Company and Arden, but no later than 28 February 2020).

Following Admission of the Fundraising Shares, the total number

of Ordinary Shares in the Company in issue will be 532,507,627.

This figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in the

Company under the FCA's Disclosure and Transparency Rules.

Cathal Friel, Executive Chairman of Open Orphan, said:

"As I said in our RNS announcement of the 20(th) of January, I

am hugely excited by the combination of Open Orphan and hVIVO. We

have a fantastic team, substantial revenue potential and the

opportunity to grow a profitable business quickly in the year

ahead. I am personally participating in the placing as I believe in

the strategy of the business and its ability to deliver substantial

returns to shareholders in the next 12 months.

Furthermore, I am particularly excited as to the opportune

timing of our acquisition of hVIVO, as virology, vaccines and

viruses are particularly topical all around the world in recent

days and weeks and hVIVO have the unique reputation as being the

world leader in this space of providing services for over 30 years

to the vaccine production companies around the world. Furthermore,

hVIVO has quite a large database of anonymised patient data

including genomic data and which we can now upload and potentially

monetise through our Open Orphan Genomic Health Data platform.

We are delighted we have completed the Fundraising of over GBP5

million and welcome the new investors to the shareholder register,

where our original Open Orphan founders and management team still

retain a substantial stake in excess of 20% of the enlarged company

because of our original personal investment in the business and

which remains locked up for three years post our June 2019 IPO. The

Fundraising strengthens the balance sheet to help us realise the

full potential of the enlarged group. We are excited by the growth

potential of the Company and look forward to creating value for all

our shareholders."

Capitalised terms in this Announcement shall have the meanings

given to such terms in the Group's announcement at 7.00 a.m.

today.

For further information please contact

Open Orphan plc

Cathal Friel, Executive Chairman +353 (0)1 644 0007

Trevor Phillips, Chief Executive Officer +44 (0)20 7347 5350

Arden Partners plc (Nominated Adviser and Joint Broker) +44

(0)20 7614 5900

John Llewellyn-Lloyd / Benjamin Cryer

Davy (Euronext Growth Adviser and Joint Broker) +353 (0)1 679

6363

Anthony Farrell

Camarco (Financial PR) +44 (0)20 3757 4980

Tom Huddart / Daniel Sherwen

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Cathal Friel

2 Reason for the notification

a) Position/status Executive Chairman

b) Initial notification/ Amendment Initial Notification

Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

a) Name Open Orphan plc

b) LEI 213800VT5KBM7JLIV118

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

a) Description of the financial instrument, type of instrument Ordinary Shares

Identification code

ESVUFR

ISIN GB00B9275X97

b) Nature of the transactions Purchase of 4,918,030 ordinary shares

c) Price(s) and volume(s) Price(s) Volume(s)

6.1p 4,918,030

----------

d) Aggregated information

- Aggregated volume 4,918,030

- Price GBP299.999.83

e) Date of the transaction 31/01/2020

f) Place of the transaction Dublin

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIBBMBTMTMJBJM

(END) Dow Jones Newswires

January 31, 2020 06:23 ET (11:23 GMT)

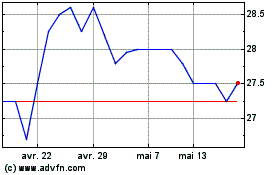

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024