Arch Capital Group Ltd. (NASDAQ: ACGL) reports that net income

available to common shareholders for the 2006 first quarter was

$129.6 million, or $1.71 per share, compared to $115.9 million, or

$1.57 per share, for the 2005 first quarter. The Company also

reported after-tax operating income available to common

shareholders of $143.1 million, or $1.89 per share, for the 2006

first quarter, compared to $111.9 million, or $1.51 per share, for

the 2005 first quarter. The Company's after-tax operating income

available to common shareholders represented a 22.8% annualized

return on average common equity for the 2006 first quarter,

compared to 19.8% for the 2005 first quarter. After-tax operating

income available to common shareholders, a non-GAAP measure, is

defined as net income available to common shareholders, excluding

net realized gains or losses and net foreign exchange gains or

losses, net of income taxes. See page 6 for a further discussion of

after-tax operating income available to common shareholders and

Regulation G. The Company's book value per common share increased

to $34.53 at March 31, 2006 from $33.82 per share at December 31,

2005 (see "Calculation of Book Value Per Common Share" in the

Supplemental Financial Information section of this release). Gross

and net premiums written for the 2006 first quarter were $1.17

billion and $873.7 million, respectively, compared to $980.7

million and $799.8 million, respectively, for the 2005 first

quarter. The Company's combined ratio was 88.3% for the 2006 first

quarter, compared to 88.8% for the 2005 first quarter. All per

share amounts discussed in this release are on a diluted basis. The

following table summarizes the Company's underwriting results: -0-

*T (Unaudited) Three Months Ended March 31, (U.S. dollars in

thousands) 2006 2005 ----------- --------- Gross premiums written

$1,167,814 $980,692 Net premiums written 873,719 799,801 Net

premiums earned 761,601 697,068 Underwriting income 90,228 83,308

Combined ratio 88.3% 88.8% *T The following table summarizes, on an

after-tax basis, the Company's consolidated financial data,

including a reconciliation of after-tax operating income available

to common shareholders to net income available to common

shareholders and related diluted per share results: -0- *T

(Unaudited) Three Months Ended March 31, (U.S. dollars in

thousands, except per share data) 2006 2005 ---------- ----------

After-tax operating income available to common shareholders $

143,081 $ 111,935 Net realized gains (losses), net of tax (2,912)

318 Net foreign exchange gains (losses), net of tax (10,546) 3,639

---------- ---------- Net income available to common shareholders $

129,623 $ 115,892 ========== ========== Diluted per common share

results: After-tax operating income available to common

shareholders $ 1.89 $ 1.51 Net realized gains (losses), net of tax

(0.04) 0.01 Net foreign exchange gains (losses), net of tax (0.14)

0.05 ---------- ---------- Net income available to common

shareholders $ 1.71 $ 1.57 ========== ========== Weighted average

common shares and common share equivalents outstanding - diluted

75,855,309 74,013,546 *T The combined ratio represents a measure of

underwriting profitability, excluding investment income, and is the

sum of the loss ratio and expense ratio. A combined ratio under

100% represents an underwriting profit and a combined ratio over

100% represents an underwriting loss. The combined ratio of the

Company's insurance and reinsurance subsidiaries consisted of a

loss ratio of 61.5% and an underwriting expense ratio of 26.8% for

the 2006 first quarter, compared to a loss ratio of 61.0% and an

underwriting expense ratio of 27.8% for the 2005 first quarter. The

loss ratio of 61.5% for the 2006 first quarter was comprised of

29.0 points of paid losses, 12.2 points related to reserves for

reported losses and 20.3 points related to incurred but not

reported reserves. Of the 29.0 points of paid losses during the

2006 first quarter, 5.4 points related to claims resulting from the

2004 and 2005 catastrophic events. In establishing the reserves for

losses and loss adjustment expenses, the Company has made various

assumptions relating to the pricing of its reinsurance contracts

and insurance policies and also has considered available historical

industry experience and current industry conditions. The Company

primarily uses the expected loss method of reserving, which is

commonly applied when limited loss experience exists. Any estimates

and assumptions made as part of the reserving process could prove

to be inaccurate due to several factors, including the fact that

limited historical information has been reported to the Company

through March 31, 2006. For a discussion of underwriting activities

and a review of the Company's results by operating segment, see

"Segment Information" in the Supplemental Financial Information

section of this release. Consolidated cash flow provided by

operating activities for the 2006 first quarter was $423.2 million,

compared to $327.8 million for the 2005 first quarter. The increase

in operating cash flows in the 2006 period was due to growth in

premiums written and net investment income, partially offset by a

higher level of paid losses as the Company's insurance and

reinsurance loss reserves have continued to mature and due to

payments related to the 2004 and 2005 catastrophic events. Net

investment income for the 2006 first quarter increased to $80.3

million from $49.9 million for the 2005 first quarter. The higher

level of net investment income in the 2006 first quarter resulted

from a higher level of average invested assets in the 2006 period

and an increase in the pre-tax investment income yield to 4.3% for

the 2006 first quarter, compared to 3.4% for the 2005 first

quarter. The Company's investment portfolio, which mainly consists

of high quality fixed income securities, had an average Standard

& Poor's quality rating of "AA+" at March 31, 2006, December

31, 2005 and March 31, 2005. The average effective duration of the

Company's investment portfolio was reduced to 3.0 years at March

31, 2006, from 3.3 years at December 31, 2005 and 3.8 years at

March 31, 2005, while the average yield to maturity (book yield)

increased to 4.6% at March 31, 2006, from 4.2% at December 31, 2005

and 3.6% at March 31, 2005. Net foreign exchange losses for the

2006 first quarter of $10.3 million consisted of net unrealized

losses of $7.9 million and net realized losses of $2.4 million,

compared to net foreign exchange gains for the 2005 first quarter

of $3.2 million, which consisted of net unrealized gains of $2.7

million and net realized gains of $0.5 million. Net unrealized

foreign exchange gains or losses result from the effects of

revaluing the Company's net insurance liabilities required to be

settled in foreign currencies at each balance sheet date. The

Company holds investments in foreign currencies which are intended

to mitigate its exposure to foreign currency fluctuations in its

net insurance liabilities. However, changes in the value of such

investments due to foreign currency rate movements are reflected as

a direct increase or decrease to shareholders' equity and are not

included in the statement of income. For the 2006 and 2005 first

quarters, the net unrealized foreign exchange gains or losses

recorded by the Company were largely offset by changes in the value

of the Company's investments held in foreign currencies. On January

1, 2006, the Company adopted the fair value method of accounting

for share-based awards using the modified prospective method of

transition as described by FASB Statement No. 123(revised 2004),

"Share-Based Payment." As required by the provisions of SFAS

123(R), the Company recorded after-tax share-based compensation

expense related to stock options of $1.1 million, or $0.01 per

share, in the 2006 first quarter. Under the modified prospective

method of transition, no expense related to stock options was

recorded in the 2005 first quarter. For the remaining nine months

of 2006, the Company expects to record after-tax share-based

compensation expense related to stock options of approximately $4.4

million, or $0.06 per share. For the 2006 and 2005 first quarters,

the effective tax rates on income before income taxes were 7.9% and

7.5%, respectively, and the effective tax rates on pre-tax

operating income available to common shareholders were 7.5% and

8.0%, respectively. The reduction in the effective tax rate on

pre-tax operating income available to common shareholders in the

2006 first quarter, compared to the 2005 first quarter, resulted

from a change in the relative mix of income reported by

jurisdiction. The Company's effective tax rates may fluctuate from

period to period based on the relative mix of income reported by

jurisdiction primarily due to the varying tax rates in each

jurisdiction. The Company's quarterly tax provision is adjusted to

reflect changes in its expected annual effective tax rates, if any.

The Company currently expects that its annual effective tax rate on

pre-tax operating income available to common shareholders for 2006

will be in the range of 6.5% to 9.5%. On February 1, 2006, the

Company issued in a public offering $200.0 million of its 8.00%

series A non-cumulative preferred shares with a liquidation

preference of $25.00 per share and received net proceeds of

approximately $193.5 million. Dividends, as and if declared by the

Company's board of directors, are payable from the date of original

issue on a non-cumulative basis, quarterly in arrears, commencing

on May 15, 2006, at an annual rate of 8.00%. The Company declared a

dividend on its series A non-cumulative preferred shares and

recorded $2.7 million in the 2006 first quarter. At March 31, 2006,

the Company's capital of $3.05 billion consisted of $300.0 million

of senior notes, representing 9.8% of the total, $200.0 million of

series A preferred shares, representing 6.6% of the total, and

common shareholders' equity of $2.55 billion, representing the

balance. The increase in the Company's capital during the 2006

first quarter of $269.0 million was primarily attributable to the

issuance of series A non-cumulative preferred shares and net income

for the 2006 first quarter, partially offset by an after-tax

decline in the market value of the Company's investment portfolio

of $67.0 million which was primarily due to an increase in the

level of interest rates at March 31, 2006. Diluted weighted average

common shares and common share equivalents outstanding, used in the

calculation of after-tax operating income and net income per common

share, was 1.8 million shares, or 2.5%, higher in the 2006 first

quarter than in the 2005 first quarter. The increase was primarily

due to increases in the dilutive effects of stock options and

nonvested restricted stock calculated using the treasury stock

method and the exercise of stock options. Under the treasury stock

method, the dilutive impact of options and nonvested stock on

diluted weighted average shares outstanding increases as the market

price of the Company's common shares increases. The Company will

hold a conference call for investors and analysts at 11:00 a.m.

Eastern Time on Friday, April 28, 2006. A live webcast of this call

will be available via the Media-Earnings Webcasts section of the

Company's website at http://www.archcapgroup.bm and will be

archived on the website from 1:00 p.m. Eastern Time on April 28

through midnight Eastern Time on May 28, 2006. A telephone replay

of the conference call also will be available beginning on April 28

at 1:00 p.m. Eastern Time until May 5 at midnight Eastern Time. To

access the replay, domestic callers should dial 888-286-8010

(passcode 87029197), and international callers should dial

617-801-6888 (passcode 87029197). Arch Capital Group Ltd., a

Bermuda-based company with approximately $3.05 billion in capital

at March 31, 2006, provides insurance and reinsurance on a

worldwide basis through its wholly owned subsidiaries. Cautionary

Note Regarding Forward-Looking Statements The Private Securities

Litigation Reform Act of 1995 provides a "safe harbor" for

forward-looking statements. This release or any other written or

oral statements made by or on behalf of the Company may include

forward-looking statements, which reflect the Company's current

views with respect to future events and financial performance. All

statements other than statements of historical fact included in

this release are forward-looking statements. Forward-looking

statements can generally be identified by the use of

forward-looking terminology such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe" or "continue" or

their negative or variations or similar terminology.

Forward-looking statements involve the Company's current assessment

of risks and uncertainties. Actual events and results may differ

materially from those expressed or implied in these statements.

Important factors that could cause actual events or results to

differ materially from those indicated in such statements are

discussed below and elsewhere in this release and in the Company's

periodic reports filed with the Securities and Exchange Commission

(the "SEC"), and include: -- the Company's ability to successfully

implement its business strategy during "soft" as well as "hard"

markets; -- acceptance of the Company's business strategy, security

and financial condition by rating agencies and regulators, as well

as by brokers and the Company's insureds and reinsureds; -- the

Company's ability to maintain or improve its ratings, which may be

affected by the Company's ability to raise additional equity or

debt financings, by ratings agencies' existing or new policies and

practices, as well as other factors described herein; -- general

economic and market conditions (including inflation, interest rates

and foreign currency exchange rates) and conditions specific to the

reinsurance and insurance markets in which the Company operates; --

competition, including increased competition, on the basis of

pricing, capacity, coverage terms or other factors; -- the

Company's ability to successfully integrate, establish and maintain

operating procedures (including the implementation of improved

computerized systems and programs to replace and support manual

systems) to effectively support its underwriting initiatives and to

develop accurate actuarial data, especially in the light of the

rapid growth of the Company's business; -- the loss of key

personnel; -- the integration of businesses the Company has

acquired or may acquire into its existing operations; -- accuracy

of those estimates and judgments utilized in the preparation of the

Company's financial statements, including those related to revenue

recognition, insurance and other reserves, reinsurance

recoverables, investment valuations, intangible assets, bad debts,

income taxes, contingencies and litigation, and any determination

to use the deposit method of accounting, which for a relatively new

insurance and reinsurance company, like the Company, are even more

difficult to make than those made in a mature company since limited

historical information has been reported to the Company through

March 31, 2006; -- greater than expected loss ratios on business

written by the Company and adverse development on claim and/or

claim expense liabilities related to business written by the

Company's insurance and reinsurance subsidiaries; -- severity

and/or frequency of losses; -- claims for natural or man-made

catastrophic events in the Company's insurance or reinsurance

business could cause large losses and substantial volatility in the

Company's results of operations; -- acts of terrorism, political

unrest and other hostilities or other unforecasted and

unpredictable events; -- losses relating to aviation business and

business produced by a certain managing underwriting agency for

which the Company may be liable to the purchaser of the Company's

prior reinsurance business or to others in connection with the May

5, 2000 asset sale described in the Company's periodic reports

filed with the SEC; -- availability to the Company of reinsurance

to manage its gross and net exposures and the cost of such

reinsurance; -- the failure of reinsurers, managing general agents,

third party administrators or others to meet their obligations to

the Company; -- the timing of loss payments being faster or the

receipt of reinsurance recoverables being slower than anticipated

by the Company; -- material differences between actual and expected

assessments for guaranty funds and mandatory pooling arrangements;

-- changes in accounting principles or the application of such

principles by accounting firms or regulators; and -- statutory or

regulatory developments, including as to tax policy and matters and

insurance and other regulatory matters such as the adoption of

proposed legislation that would affect Bermuda-headquartered

companies and/or Bermuda-based insurers or reinsurers and/or

changes in regulations or tax laws applicable to the Company, its

subsidiaries, brokers or customers. In addition, other general

factors could affect the Company's results, including developments

in the world's financial and capital markets and the Company's

access to such markets. All subsequent written and oral

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these cautionary statements. The foregoing review of important

factors should not be construed as exhaustive and should be read in

conjunction with other cautionary statements that are included

herein or elsewhere. The Company undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise. Comment on

Regulation G Throughout this release, the Company presents its

operations in the way it believes will be the most meaningful and

useful to investors, analysts, rating agencies and others who use

the Company's financial information in evaluating the performance

of the Company. This presentation includes the use of after-tax

operating income available to common shareholders, which is defined

as net income available to common shareholders, excluding net

realized gains or losses and net foreign exchange gains or losses,

net of income taxes. The presentation of after-tax operating income

available to common shareholders is a "non-GAAP financial measure"

as defined in Regulation G. The reconciliation of such measure to

net income available to common shareholders (the most directly

comparable GAAP financial measure) in accordance with Regulation G

is included on page 2 of this release. The Company believes that

net realized gains or losses and net foreign exchange gains or

losses in any particular period are not indicative of the

performance of, or trends in, the Company's business performance.

Although net realized gains or losses and net foreign exchange

gains or losses are an integral part of the Company's operations,

the decision to realize investment gains or losses and the

recognition of foreign exchange gains or losses are independent of

the insurance underwriting process and result, in large part, from

general economic and financial market conditions. Furthermore,

certain users of the Company's financial information believe that,

for many companies, the timing of the realization of investment

gains or losses is largely opportunistic, and, under applicable

GAAP accounting, losses on the Company's investments can be

realized as the result of other-than-temporary declines in value

without actual realization. Due to these reasons, the Company

excludes net realized gains or losses and net foreign exchange

gains or losses from the calculation of after-tax operating income

available to common shareholders. The Company believes that showing

net income available to common shareholders exclusive of the items

referred to above reflects the underlying fundamentals of the

Company's business since the Company evaluates the performance of

and manages its business to produce an underwriting profit. In

addition to presenting net income available to common shareholders,

the Company believes that this presentation enables investors and

other users of the Company's financial information to analyze the

Company's performance in a manner similar to how the Company's

management analyzes performance. The Company also believes that

this measure follows industry practice and, therefore, allows the

users of the Company's financial information to compare the

Company's performance with its industry peer group. The Company

believes that the equity analysts and certain rating agencies which

follow the Company and the insurance industry as a whole generally

exclude these items from their analyses for the same reasons. -0-

*T ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF INCOME (U.S. dollars in thousands, except share data)

(Unaudited) Three Months Ended March 31, 2006 2005 -------------

------------ Revenues Net premiums written $ 873,719 $ 799,801

Increase in unearned premiums (112,118) (102,733) -------------

------------ Net premiums earned 761,601 697,068 Net investment

income 80,326 49,916 Net realized gains (losses) (3,383) 461 Fee

income 1,805 6,112 ------------- ------------ Total revenues

840,349 753,557 Expenses Losses and loss adjustment expenses

468,178 425,536 Acquisition expenses 129,672 126,133 Other

operating expenses 82,977 74,175 Interest expense 5,555 5,636 Net

foreign exchange (gains) losses 10,253 (3,237) -------------

------------ Total expenses 696,635 628,243 Income before income

taxes 143,714 125,314 Income tax expense 11,424 9,422 -------------

------------ Net Income 132,290 115,892 Preferred dividends 2,667

-- ------------- ------------ Net income available to common

shareholders $ 129,623 $ 115,892 ============= ============ Net

income per common share Basic $ 1.78 $ 3.37 Diluted $ 1.71 $ 1.57

Weighted average common shares and common share equivalents

outstanding Basic (1) 72,899,249 34,364,818 Diluted (1) 75,855,309

74,013,546 (1) For the 2005 period, basic weighted average common

shares and common share equivalents outstanding excluded 37,331,402

series A convertible preference shares. Such shares were included

in the diluted weighted average common shares and common share

equivalents outstanding. During the 2005 fourth quarter, all

remaining series A convertible preference shares were converted

into an equal number of common shares. ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (U.S. dollars in

thousands, except share data) (Unaudited) March 31, December 31,

2006 2005 ------------ ------------ Assets Investments and cash:

Fixed maturities available for sale, at fair value (amortized cost:

2006, $5,488,075; 2005, $5,310,712) $ 5,414,156 $ 5,280,987

Short-term investments available for sale, at fair value (amortized

cost: 2006, $1,052,669; 2005, $679,530) 1,052,753 681,887

Short-term investment of funds received under securities lending

agreements, at fair value 882,950 893,379 Other investments, at

fair value (cost: 2006, $89,100; 2005, $59,839) 102,351 70,233 Cash

247,906 222,477 ------------ ------------ Total investments and

cash 7,700,116 7,148,963 ------------ ------------ Accrued

investment income 59,936 62,196 Fixed maturities and short-term

investments pledged under securities lending agreements, at fair

value 858,283 863,866 Premiums receivable 872,975 672,902 Funds

held by reinsureds 131,968 167,739 Unpaid losses and loss

adjustment expenses recoverable 1,441,412 1,389,768 Paid losses and

loss adjustment expenses recoverable 63,803 80,948 Prepaid

reinsurance premiums 376,815 322,435 Deferred income tax assets,

net 83,595 71,139 Deferred acquisition costs, net 327,491 317,357

Other assets 444,746 391,123 ------------ ------------ Total Assets

$12,361,140 $11,488,436 ============ ============ Liabilities

Reserve for losses and loss adjustment expenses $ 5,760,939 $

5,452,826 Unearned premiums 1,867,250 1,699,691 Reinsurance

balances payable 226,892 150,451 Senior notes 300,000 300,000

Deposit accounting liabilities 49,646 43,104 Securities lending

collateral 882,950 893,379 Payable for securities purchased 35,690

12,020 Other liabilities 488,219 456,438 ------------ ------------

Total Liabilities 9,611,586 9,007,909 ------------ ------------

Commitments and Contingencies Shareholders' Equity Series A

non-cumulative preferred shares ($0.01 par value, 50,000,000 shares

authorized, issued: 2006, 8,000,000) 80 -- Common shares ($0.01 par

value, 200,000,000 shares authorized, issued: 2006, 73,827,467;

2005, 73,334,870) 738 733 Additional paid-in capital 1,794,410

1,595,440 Deferred compensation under share award plan -- (9,646)

Retained earnings 1,030,971 901,348 Accumulated other comprehensive

income (loss), net of deferred income tax (76,645) (7,348)

------------ ------------ Total Shareholders' Equity 2,749,554

2,480,527 ------------ ------------ Total Liabilities and

Shareholders' Equity $12,361,140 $11,488,436 ============

============ ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (U.S. dollars in

thousands) (Unaudited) Three Months Ended March 31, 2006 2005

----------- ----------- Series A Convertible Preference Shares

Balance at beginning of year $ -- $ 373 Converted to common shares

-- (0) ----------- ----------- Balance at end of period -- 373

----------- ----------- Series A Non-Cumulative Preferred Shares

Balance at beginning of year -- -- Preferred shares issued 80 --

----------- ----------- Balance at end of period 80 -- -----------

----------- Common Shares Balance at beginning of year 733 349

Common shares issued, net 5 2 ----------- ----------- Balance at

end of period 738 351 ----------- ----------- Additional Paid-in

Capital Balance at beginning of year 1,595,440 1,560,291 Cumulative

effect of change in accounting for unearned stock grant

compensation (9,646) -- Series A non-cumulative preferred shares

issued 193,378 -- Common shares issued 160 1,127 Exercise of stock

options 12,152 3,710 Common shares retired (647) (838) Amortization

of share-based compensation 3,299 -- Other 274 198 -----------

----------- Balance at end of period 1,794,410 1,564,488

----------- ----------- Deferred Compensation Under Share Award

Plan Balance at beginning of year (9,646) (9,879) Cumulative effect

of change in accounting for unearned stock grant compensation 9,646

-- Restricted common shares issued -- -- Deferred compensation

expense recognized -- 1,985 ----------- ----------- Balance at end

of period -- (7,894) ----------- ----------- Retained Earnings

Balance at beginning of year 901,348 644,862 Dividends declared on

preferred shares (2,667) -- Net income 132,290 115,892 -----------

----------- Balance at end of period 1,030,971 760,754 -----------

----------- Accumulated Other Comprehensive Income (Loss) Balance

at beginning of year (7,348) 45,910 Change in unrealized

appreciation (decline) in value of investments, net of deferred

income tax (67,032) (74,772) Foreign currency translation

adjustments, net of deferred income tax (2,265) (346) -----------

----------- Balance at end of period (76,645) (29,208) -----------

----------- Total Shareholders' Equity $2,749,554 $2,288,864

=========== =========== ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (U.S. dollars in

thousands) (Unaudited) Three Months Ended March 31, 2006 2005

--------- --------- Comprehensive Income Net income $132,290

$115,892 Other comprehensive income (loss), net of deferred income

tax Unrealized decline in value of investments: Unrealized holding

losses arising during period (67,987) (75,341) Reclassification of

net realized losses, net of income taxes, included in net income

955 569 Foreign currency translation adjustments (2,265) (346)

--------- --------- Other comprehensive loss (69,297) (75,118)

--------- --------- Comprehensive Income $ 62,993 $ 40,774

========= ========= ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (U.S. dollars in thousands)

(Unaudited) Three Months Ended March 31, 2006 2005 ---------

--------- Operating Activities Net income $132,290 $115,892

Adjustments to reconcile net income to net cash provided by

operating activities: Net realized losses 783 426 Share-based

compensation 3,299 2,095 Changes in: Reserve for losses and loss

adjustment expenses, net of unpaid losses and loss adjustment

expenses recoverable 256,469 250,323 Unearned premiums, net of

prepaid reinsurance premiums 113,179 103,071 Premiums receivable

(200,073) (122,096) Deferred acquisition costs, net (10,134)

(19,429) Funds held by reinsureds 35,771 19,927 Reinsurance

balances payable 76,441 (20,032) Accrued investment income 2,260

185 Paid losses and loss adjustment expenses recoverable 17,145

(2,861) Deferred income tax assets, net (7,352) 3,646 Deposit

accounting liabilities 6,542 4,180 Other liabilities 22,460 7,155

Other items, net (25,902) (14,642) --------- --------- Net Cash

Provided By Operating Activities 423,178 327,840 ---------

--------- Investing Activities Purchases of fixed maturity

investments (4,330,266) (938,227) Proceeds from sales of fixed

maturity investments 4,121,591 548,030 Proceeds from redemptions

and maturities of fixed maturity investments 83,394 74,943 Net

(purchases) sales of other investments (27,237) 1,786 Net purchases

of short-term investments (444,527) (39,102) Change in securities

lending collateral 10,429 -- Purchases of furniture, equipment and

other (4,602) (3,020) --------- --------- Net Cash Used For

Investing Activities (591,218) (355,590) --------- ---------

Financing Activities Proceeds from common shares issued, net of

repurchases 8,690 2,125 Net proceeds from preferred shares issued

193,527 -- Change in securities lending collateral (10,429) --

Excess tax benefits from share-based compensation 2,450 --

--------- --------- Net Cash Provided By Financing Activities

194,238 2,125 --------- --------- Effects of exchange rate changes

on foreign currency cash (769) (704) --------- --------- Increase

(decrease) in cash 25,429 (26,329) Cash beginning of year 222,477

113,052 --------- --------- Cash end of period $247,906 $ 86,723

========= ========= Income taxes paid, net $ 9,591 $ 15,796

========= ========= Interest paid $ 42 $ 58 ========= =========

Declaration of preferred dividends to be paid $ 2,667 -- =========

========= ARCH CAPITAL GROUP LTD. AND SUBSIDIARIES SUPPLEMENTAL

FINANCIAL INFORMATION The following table provides information on

the Company's investing activities, including investment income

yield (net of investment expenses), average effective duration and

average credit quality. (Unaudited) Three Months Ended March 31,

Net investment income yield (at amortized cost) 2006 2005

------------ ------------ Pre-tax 4.3% 3.4% After-tax 4.1% 3.2%

(Unaudited) March 31, December 31, Fixed maturities and short-term

investments (1) 2006 2005 ------------ ------------ Average

effective duration (in years) 3.0 3.3 Average credit quality

(Standard & Poors) AA+ AA+ Imbedded book yield (2) 4.6% 4.2%

(Unaudited) Three Months Ended March 31, 2006 2005 ------------

------------ Annualized operating return on average common equity

(3) 22.8% 19.8% (1) Includes fixed maturities pledged under

securities lending agreements and excludes short- term investment

of funds received under securities lending agreements. (2) Before

investment expenses. (3) Annualized operating return on average

common equity, a non-GAAP measure, equals annualized operating

income available to common shareholders divided by average common

shareholders' equity (calculated using the beginning and ending

values during the period). See "Comment on Regulation G" above. *T

Segment Information The Company classifies its businesses into two

underwriting segments - insurance and reinsurance - and a corporate

and other segment (non-underwriting). The Company's insurance and

reinsurance operating segments each have segment managers who are

responsible for the overall profitability of their respective

segments and who are directly accountable to the Company's chief

operating decision makers, the President and Chief Executive

Officer of ACGL and the Chief Financial Officer of ACGL. The chief

operating decision makers do not assess performance, measure return

on equity or make resource allocation decisions on a line of

business basis. The Company determined its reportable operating

segments using the management approach described in SFAS No. 131,

"Disclosures About Segments of an Enterprise and Related

Information." Management measures segment performance based on

underwriting income or loss. The Company does not manage its assets

by segment and, accordingly, investment income is not allocated to

each underwriting segment. In addition, other revenue and expense

items are not evaluated by segment. The accounting policies of the

segments are the same as those used for the preparation of the

Company's consolidated financial statements. Inter-segment

insurance business is allocated to the segment accountable for the

underwriting results. The insurance segment consists of the

Company's insurance underwriting subsidiaries which primarily write

on both an admitted and non-admitted basis. The insurance segment

consists of eight specialty product lines, including: casualty;

construction and surety; executive assurance; healthcare;

professional liability; programs; property, marine and aviation;

and other (consisting of collateralized protection business). The

reinsurance segment consists of the Company's reinsurance

underwriting subsidiaries. The reinsurance segment generally seeks

to write significant lines on specialty property and casualty

reinsurance treaties. Classes of business include: casualty; marine

and aviation; other specialty; property catastrophe; property

excluding property catastrophe (losses on a single risk, both

excess of loss and pro rata); and other (consisting of

non-traditional and casualty clash business). The corporate and

other segment (non-underwriting) includes net investment income,

other fee income, net of related expenses, other expenses incurred

by the Company, interest expense, net realized gains or losses, net

foreign exchange gains or losses and income taxes. In addition,

results for the corporate and other segment include dividends on

the Company's series A non-cumulative preferred shares. The

following tables set forth underwriting income or loss by segment,

together with a reconciliation of underwriting income to net income

available to common shareholders: -0- *T (Unaudited) Three Months

Ended March 31, 2006 ----------------------------------- (U.S.

dollars in thousands) Insurance Reinsurance Total -----------

----------- ----------- Gross premiums written (1) $615,484

$564,668 $1,167,814 Net premiums written 397,254 476,465 873,719

Net premiums earned $380,254 $381,347 $ 761,601 Policy-related fee

income 937 -- 937 Other underwriting-related fee income 467 401 868

Losses and loss adjustment expenses (248,002) (220,176) (468,178)

Acquisition expenses, net (37,885) (91,787) (129,672) Other

operating expenses (62,076) (13,252) (75,328) --------- ---------

----------- Underwriting income $ 33,695 $ 56,533 90,228 =========

========= Net investment income 80,326 Net realized losses (3,383)

Other expenses (7,649) Interest expense (5,555) Net foreign

exchange losses (10,253) ----------- Income before income taxes

143,714 Income tax expense (11,424) ----------- Net income 132,290

Preferred dividends (2,667) ----------- Net income available to

common shareholders $ 129,623 =========== Underwriting Ratios Loss

ratio 65.2% 57.7% 61.5% Acquisition expense ratio (2) 9.7% 24.1%

16.9% Other operating expense ratio 16.3% 3.5% 9.9% ---------

--------- ----------- Combined ratio 91.2% 85.3% 88.3% =========

========= =========== (1) Certain amounts included in the gross

premiums written of each segment are related to intersegment

transactions and are included in the gross premiums written of each

segment. Accordingly, the sum of gross premiums written for each

segment does not agree to the total gross premiums written as shown

in the table above due to the elimination of intersegment

transactions in the total. (2) The acquisition expense ratio is

adjusted to include policy-related fee income. (Unaudited) Three

Months Ended March 31, 2005 -----------------------------------

(U.S. dollars in thousands) Insurance Reinsurance Total -----------

----------- ----------- Gross premiums written (1) $506,744

$488,795 $ 980,692 Net premiums written 322,108 477,693 799,801 Net

premiums earned $321,036 $376,032 $ 697,068 Policy-related fee

income 917 -- 917 Other underwriting-related fee income 572 4,623

5,195 Losses and loss adjustment expenses (206,862) (218,674)

(425,536) Acquisition expenses, net (26,681) (99,452) (126,133)

Other operating expenses (57,287) (10,916) (68,203) ---------

--------- ----------- Underwriting income $ 31,695 $ 51,613 83,308

========= ========= Net investment income 49,916 Net realized gains

461 Other expenses (5,972) Interest expense (5,636) Net foreign

exchange gains 3,237 ----------- Income before income taxes 125,314

Income tax expense (9,422) ----------- Net income 115,892 Preferred

dividends -- ----------- Net income available to common

shareholders $ 115,892 =========== Underwriting Ratios Loss ratio

64.4% 58.2% 61.0% Acquisition expense ratio (2) 8.0% 26.4% 18.0%

Other operating expense ratio 17.8% 2.9% 9.8% --------- ---------

----------- Combined ratio 90.2% 87.5% 88.8% ========= =========

=========== (1) Certain amounts included in the gross premiums

written of each segment are related to intersegment transactions

and are included in the gross premiums written of each segment.

Accordingly, the sum of gross premiums written for each segment

does not agree to the total gross premiums written as shown in the

table above due to the elimination of intersegment transactions in

the total. (2) The acquisition expense ratio is adjusted to include

policy-related fee income. *T The following table sets forth the

insurance segment's net premiums written and earned by major line

of business, together with net premiums written by client location:

-0- *T (Unaudited) Three Months Ended March 31, 2006 2005

--------------------- --------------------- INSURANCE SEGMENT % of

% of (U.S. dollars in thousands) Amount Total Amount Total

---------- ---------- ---------- ---------- Net premiums written

Construction and surety $ 80,629 20.3 $ 62,440 19.4 Property,

marine and aviation 68,646 17.3 42,092 13.1 Professional liability

62,454 15.7 46,901 14.6 Programs 60,534 15.2 53,267 16.5 Casualty

50,750 12.8 63,799 19.8 Executive assurance 45,591 11.5 24,017 7.4

Healthcare 18,115 4.6 16,436 5.1 Other 10,535 2.6 13,156 4.1

--------- ---------- --------- ---------- Total $397,254 100.0

$322,108 100.0 ========= ========== ========= ========== Net

premiums earned Construction and surety $ 66,703 17.5 $ 50,664 15.8

Property, marine and aviation 62,968 16.6 43,549 13.6 Professional

liability 54,045 14.2 46,802 14.5 Programs 57,389 15.1 55,311 17.2

Casualty 62,808 16.5 69,266 21.6 Executive assurance 50,076 13.2

24,635 7.7 Healthcare 16,677 4.4 17,000 5.3 Other 9,588 2.5 13,809

4.3 --------- ---------- --------- ---------- Total $380,254 100.0

$321,036 100.0 ========= ========== ========= ========== Net

premiums written by client location United States $324,465 81.7

$285,924 88.8 Europe 47,580 12.0 27,106 8.4 Other 25,209 6.3 9,078

2.8 --------- ---------- --------- ---------- Total $397,254 100.0

$322,108 100.0 ========= ========== ========= ========== *T The

following table sets forth the reinsurance segment's net premiums

written and earned by major line of business and type of business,

together with net premiums written by client location: -0- *T

(Unaudited) Three Months Ended March 31, 2006 2005

--------------------- --------------------- REINSURANCE SEGMENT %

of % of (U.S. dollars in thousands) Amount Total Amount Total

---------- ---------- ---------- ---------- Net premiums written

Casualty $162,988 34.2 $210,869 44.1 Property excluding property

catastrophe 106,782 22.4 88,195 18.5 Other specialty 93,264 19.6

91,029 19.1 Property catastrophe 70,336 14.7 44,563 9.3 Marine and

aviation 41,352 8.7 30,029 6.3 Other 1,743 0.4 13,008 2.7 ---------

---------- --------- ---------- Total $476,465 100.0 $477,693 100.0

========= ========== ========= ========== Net premiums earned

Casualty $171,197 44.9 $213,260 56.7 Property excluding property

catastrophe 79,620 20.9 57,495 15.3 Other specialty 57,919 15.2

50,754 13.5 Property catastrophe 49,106 12.8 24,761 6.6 Marine and

aviation 23,650 6.2 21,991 5.8 Other (145) (0.0) 7,771 2.1

--------- ---------- --------- ---------- Total $381,347 100.0

$376,032 100.0 ========= ========== ========= ========== Net

premiums written Pro rata $272,534 57.2 $319,647 66.9 Excess of

loss 203,931 42.8 158,046 33.1 --------- ---------- ---------

---------- Total $476,465 100.0 $477,693 100.0 ========= ==========

========= ========== Net premiums earned Pro rata $295,288 77.4

$277,612 73.8 Excess of loss 86,059 22.6 98,420 26.2 ---------

---------- --------- ---------- Total $381,347 100.0 $376,032 100.0

========= ========== ========= ========== Net premiums written by

client location United States $277,315 58.2 $259,414 54.3 Europe

127,263 26.7 155,495 32.5 Bermuda 43,839 9.2 27,064 5.7 Canada

9,556 2.0 21,336 4.5 Asia and Pacific 6,389 1.4 5,570 1.2 Other

12,103 2.5 8,814 1.8 --------- ---------- --------- ----------

Total $476,465 100.0 $477,693 100.0 ========= ========== =========

========== *T Discussion of 2006 First Quarter Performance The

insurance segment had underwriting income of $33.7 million for the

2006 first quarter, compared to $31.7 million for the 2005 first

quarter. The combined ratio for the insurance segment was 91.2% for

the 2006 first quarter, compared to 90.2% for the 2005 first

quarter. Gross premiums written by the insurance segment were

$615.5 million for the 2006 first quarter, compared to $506.7

million for the 2005 first quarter, and ceded premiums written were

35.5% of gross premiums written for the 2006 first quarter,

compared to 36.4% for the 2005 first quarter. Net premiums written

by the insurance segment were $397.3 million for the 2006 first

quarter, compared to $322.1 million for the 2005 first quarter.

Roughly half of the growth in net premiums written was generated by

the insurance segment's U.S. operations through increases in the

executive assurance, construction and surety, property and program

lines, partially offset by a reduction in U.S. primary casualty

business. The balance of the growth was generated by the insurance

segment's European and Canadian operations through increases in the

professional liability, property and executive assurance lines. Of

the $21.6 million increase in executive assurance net premiums

written, approximately 40% resulted from adjustments to ceded

reinsurance related to prior periods with the balance due, in part,

to additional premiums associated with Side A coverage (of which

the insurance segment retains a higher percentage than other

executive assurance business) and additional premiums from

geographic expansion, coverage for non-public entities and runoff

policies. Growth in net premiums written in the insurance segment's

program business of $7.3 million resulted, in part, from a lag in

the reporting of premiums on one program in the 2005 first quarter

which resulted in lower reported gross premiums written, a full

quarter contribution from a program which commenced during the 2005

first quarter and rate increases on certain programs. Net premiums

earned by the insurance segment were $380.3 million for the 2006

first quarter, compared to $321.0 million for the 2005 first

quarter, and reflect changes in net premiums written over the

previous five quarters, including the mix and type of business

written. The loss ratio for the insurance segment was 65.2% for the

2006 first quarter, compared to 64.4% for the 2005 first quarter.

The loss ratio for the 2006 first quarter reflected estimated net

adverse development in prior year loss reserves of $7.9 million,

compared to net favorable development of $0.6 million in the 2005

first quarter. The net impact of the change in prior year

development was a 2.2 point increase in the 2006 first quarter loss

ratio. The net adverse development in the 2006 first quarter

reflected an increase in losses incurred of $18.5 million related

to Hurricane Wilma and $3.3 million related to the 2005 third

quarter hurricanes, partially offset by favorable development in

healthcare, construction and surety and program business. The

underwriting expense ratio for the insurance segment was 26.0% in

the 2006 first quarter, compared to 25.8% in the 2005 first

quarter. The acquisition expense ratio was 9.7% for the 2006 first

quarter, compared to 8.0% for the 2005 first quarter. The

acquisition expense ratio is influenced by, among other things, (1)

the amount of ceding commissions received from unaffiliated

reinsurers and (2) the amount of business written on a surplus

lines (non-admitted) basis. The increase in the acquisition expense

ratio was due, in part, to changes in the mix of business. The

insurance segment's other operating expense ratio was 16.3% for the

2006 first quarter, compared to 17.8% for the 2005 first quarter.

The lower ratio in the 2006 first quarter resulted from growth in

net premiums earned which was higher than the attendant growth in

operating expenses. The reinsurance segment had underwriting income

of $56.5 million for the 2006 first quarter, compared to $51.6

million for the 2005 first quarter. The combined ratio for the

reinsurance segment was 85.3% for the 2006 first quarter, compared

to 87.5% for the 2005 first quarter. Gross premiums written by the

reinsurance segment were $564.7 million in the 2006 first quarter,

compared to $488.8 million for the 2005 first quarter. Ceded

premiums written by the reinsurance segment were 15.6% of gross

premiums written for the 2006 first quarter, compared to 2.3% for

the 2005 first quarter. The higher ceded percentage in the 2006

first quarter resulted from the cession of $82.4 million of

business to Flatiron Re Ltd. under a 45% quota-share reinsurance

treaty of certain lines of property and marine business

underwritten by Arch Reinsurance Ltd. ("Arch Re Bermuda"), the

reinsurance segment's Bermuda operations, for unaffiliated third

parties. The quota-share reinsurance treaty with Flatiron Re Ltd.

allows the reinsurance segment to participate further in the

greatly improved market conditions without significantly increasing

its probable maximum loss. The quota-share reinsurance treaty also

provides for a profit commission to Arch Re Bermuda based on the

underwriting results for the 2006 and 2007 underwriting years on a

cumulative basis. Arch Re Bermuda will record such profit

commission based on underwriting experience recorded each quarter.

As a result, the profit commission arrangement with Flatiron Re

Ltd. may increase the volatility of the reinsurance segment's

reported results of operations on both a quarterly and annual

basis. Net premiums written by the reinsurance segment were $476.5

million for the 2006 first quarter, compared to $477.7 million for

the 2005 first quarter. Growth in international property and marine

lines was offset by a reduction in casualty and other business. The

growth in property and marine lines was in response to current

market opportunities as prices for catastrophe-exposed property and

marine lines have increased significantly in the wake of the 2005

storms. The reduction in casualty business was primarily in

response to increased competition for European business. Net

premiums earned by the reinsurance segment were $381.3 million for

the 2006 first quarter, compared to $376.0 million for the 2005

first quarter, and generally reflect changes in net premiums

written over the previous five quarters, including the mix and type

of business written. Underwriting income for the reinsurance

segment in the 2006 first quarter benefited from estimated net

favorable development in prior year loss reserves, net of related

adjustments, of $1.5 million. Such amount consisted of $20.8

million of favorable development, primarily in other specialty and

other short-tail lines, partially offset by $13.1 million related

to Hurricane Wilma and $6.2 million related to the 2005 third

quarter hurricanes and the European floods. For the 2005 first

quarter, underwriting income benefited from estimated net favorable

development in prior year loss reserves, net of related

adjustments, of $21.7 million. The loss ratio for the reinsurance

segment was 57.7% for the 2006 first quarter, compared to 58.2% for

the 2005 first quarter. The reinsurance segment's losses incurred

for the 2006 first quarter included approximately $8.2 million

related to U.S. storm activity and $8.1 million related to Cyclone

Larry, which impacted Australia in March 2006, compared to losses

of $10.0 million for Windstorm Erwin in the 2005 first quarter. The

higher level of catastrophic activity in the 2006 first quarter

resulted in a 1.6 point increase in the 2006 first quarter loss

ratio. As noted above, the 2006 first quarter benefited from

estimated net favorable development in prior year loss reserves,

net of related adjustments, of $1.5 million. Such amount consisted

of an increase to losses incurred of $2.4 million, offset by $3.9

million of reductions in acquisition expenses. Estimated net

favorable development in the 2005 first quarter of $21.7 million

consisted of a decrease in losses incurred of $24.7 million, offset

by an increase to acquisition expenses of $3.0 million. The net

impact of the change in estimated net prior year development was a

7.1 point increase in the 2006 first quarter loss ratio. The 2006

first quarter loss ratio also reflected a lower level of claims

recorded in property excluding property catastrophe and other

short-tail lines of business than in the 2005 first quarter, and

changes in the reinsurance segment's mix of business. The

underwriting expense ratio for the reinsurance segment was 27.6% in

the 2006 first quarter, compared to 29.3% in the 2005 first

quarter. The acquisition expense ratio for the 2006 first quarter

was 24.1%, compared to 26.4% for the 2005 first quarter. The net

impact of the change in acquisition expenses related to the

estimated net prior year development noted above was a 1.8 point

decrease in the 2006 first quarter acquisition expense ratio. The

reinsurance segment's other operating expense ratio was 3.5% for

the 2006 first quarter, compared to 2.9% for the 2005 first

quarter. Calculation of Book Value Per Common Share The following

presents the calculation of book value per common share for March

31, 2006 and December 31, 2005. The shares and per share numbers

set forth below exclude the effects of 6,073,040 and 5,637,108

stock options and 95,870 and 93,545 restricted stock units

outstanding at March 31, 2006 and December 31, 2005, respectively.

-0- *T (Unaudited) March 31, December 31, (U.S. dollars in

thousands, except share data) 2006 2005 ----------- ------------

Total shareholders' equity $2,749,554 $2,480,527 Less preferred

shareholders' equity (200,000) -- ----------- ----------- Common

shareholders' equity $2,549,554 $2,480,527 Common shares

outstanding 73,827,467 73,334,870 ----------- ----------- Book

value per common share $ 34.53 $ 33.82 =========== =========== *T

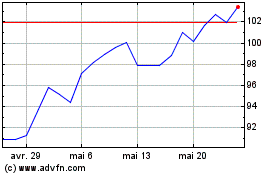

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Août 2024 à Sept 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Sept 2023 à Sept 2024