ACI Worldwide Scamscope Projects APP Scam Losses to Hit $7.6 Billion by 2028

20 Novembre 2024 - 8:00AM

Business Wire

- Losses to APP scams are expected to record an average

CAGR of 12% from 2023-2028.

- Real-time payment APP scam losses are expected to grow to $6.1

billion by 2028, comprising 80% of total APP scam values.

- One in four scam victims will leave their current financial

institution, underscoring the critical need for FIs to protect

customers and maintain trust.

Authorized push payment (APP) scam losses are on the rise,

expected to climb to $7.6 billion by 2028 across six leading

real-time payment markets (U.S., U.K., India, Brazil, Australia and

UAE), according to the latest Scamscope report from ACI Worldwide

(NASDAQ: ACIW), an original innovator in global payments

technology, in partnership with GlobalData, a leading data and

analytics company.

APP scammers prey on trust by deceiving individuals into

willingly transferring funds to them. This trust-based manipulation

makes APP scams particularly challenging to detect as the

transaction appears legitimate and bypasses traditional fraud

detection systems and controls. As rapid global adoption of

real-time payments transforms the speed and velocity of how money

moves, enabling faster and more accessible transactions, scammers

are exploiting the immediacy of these transactions to steal funds

before they can be traced, spurring growth in real-time payment APP

scams. The Scamscope report projects that APP scam losses through

real-time payments will see a combined 2023-2028 compound annual

growth rate (CAGR) of 17% vs. 12% CAGR for total APP scam losses

worldwide over the same period and will comprise 80% of total APP

scam values by 2028.

Financial institutions also face significant erosion of trust

and rising customer attrition as consumers fall victim to APP

scams. The 2024 Scamscope report reveals that 25% of scam victims

will leave their current financial institution, and around 20%

close their accounts without opening new ones. Government mandates

that penalize non-compliance with fraud prevention measures and

require victim reimbursement underscore the urgency for financial

institutions to strengthen their defense and ensure compliance.

Artificial intelligence (AI)-driven fraud management systems can

help analyze transaction data, flag anomalies, and facilitate

real-time collaboration with other banks.

"Integrating AI in financial services is a double-edged sword,

both in enabling sophisticated financial crimes and fortifying

defenses against them. Scammers are using AI to boost inherited

trust to unprecedented levels, automating hits and driving more

effective social engineering techniques," said Cleber Martins, head

of payments intelligence and risk solutions at ACI Worldwide. "The

rise of real-time payment APP scams requires a coordinated

cross-industry defense to share precise and collective intelligence

in real time. By breaking down silos and fostering cross-border

collaboration, mule networks can be dismantled to better protect

consumers."

Key report findings

Country highlights

- Australia: APP scam losses in Australia have surged

dramatically over the past five years, with a 2018-2023 CAGR of

42.4%. Australia has made some progress in addressing this issue

with strategic initiatives such as Scamwatch and improved

collaboration among industry stakeholders, leading to a projected

growth slowdown over the next five years, with a 2023-2028 CAGR of

7.6%.

- Brazil: As the second-largest real-time payments market

globally, Brazil is projected to experience the highest growth in

APP scam losses compared to other analyzed markets. APP scam losses

in Brazil hit almost $380 million in 2023 and are projected to

increase by almost 40% by 2028. According to Brazil's banking

association, nearly one in three Brazilians have been victims of

financial scams.

- India: As the biggest and most developed real-time

payments market worldwide, India has seen a huge spike in APP and

real-time payment scam losses in the last five years. However, APP

scam losses are forecast to be the lowest in India compared to

other analyzed markets, with a 2023-2028 CAGR of 5.9%. India is

beginning to address scams more effectively than any other market

in the study.

- UAE: Despite having the lowest APP scam losses ($8.3

million) among analyzed markets in 2023, the UAE is witnessing a

rise in sophisticated scams, particularly investment and SMS-based

card fraud. Real-time payment APP scam losses are expected to hit

$26.8 million by 2028 (2023-2028 CAGR of 30%) as real-time payments

pick up momentum in the UAE.

- U.K.: The U.K. is the only country in this year’s report

with a year-over-year (YoY) decrease in APP fraud loss values from

2022-23 (5%). Although there has been a notable increase in APP

fraud cases, there has been a slight decrease in overall financial

losses, indicating more effective fraud prevention measures and

lower losses per case. The new regulation that holds recipient

banks jointly accountable for compensating APP scam victims could

help this trend continue.

- U.S.: In 2023, the U.S. saw more than $2 billion in APP

scam losses. The U.S. is also a hotspot for card fraud, with more

than $13 billion in losses last year. As real-time payments

adoption accelerates in the U.S., APP scams will threaten consumers

and financial institutions significantly, with real-time payment

APP scams projected 2023-2028 CAGR at 19%, far outpacing the total

APP scam 2023-2028 CAGR of 7.4%.

Country data at a glance

- APP scam losses by country by 2028

- Australia: $1,172 million

- 8% 2023-2028 CAGR

- 88% of losses through real-time payments

- Brazil: $1,937 million

- 38% 2023-2028 CAGR

- 94% of losses through real-time payments

- India: $601 million

- 6% 2023-2028 CAGR

- 88% of losses through real-time payments

- UAE: $30 million

- 30% 2023-2028 CAGR

- 90% of losses through real-time payments

- U.K.: $811 million

- 7% 2023-2028 CAGR

- 79% of losses through real-time payments

- U.S.: $3,083 million

- 7% 2023-2028 CAGR

- 67% of losses through real-time payments

- Top 3 APP scams by country

- Australia: Purchase (26%), Investment (20%), Advance Payments

(17%)

- Brazil: Purchase (22%), Investment (21%), Advance Payments

(17%)

- India: Impersonation (21%), Investment (18%), Advance Payments

(15%)

- UAE: Investment (29%), Advance Payment (17%),

Purchase/Impersonation (15%)

- U.K.: Advance Payment (26%), Purchase (23%), Impersonation

(16%)

- U.S.: Impersonation/Advance Payment (18%), Investment/Invoice

(14%), Romance (12%)

Note to editors:

- Authorized push payment (APP) scams: The term describes a

method of fraud in which criminals coerce legitimate users to

initiate a payment to a destination account under their control.

Funds leaving legitimate customers' accounts will travel through

one or several mule accounts before being collected by the

fraudsters or converted by them into hard-to-trace digital assets,

such as crypto or NFTs.

- Other terms for APP scams include "PIX fraud" in Brazil,

"scams" in Australia and "APP fraud" in the U.K. This report uses

the terms "APP scam" and "scams" interchangeably to refer to the

same problem.

- Mule networks are a collection of linked accounts belonging to

individuals or businesses that are used to move the proceeds of

crime.

About ACI Worldwide ACI Worldwide, an original innovator

in global payments technology, delivers transformative software

solutions that power intelligent payments orchestration in real

time so banks, billers, and merchants can drive growth, while

continuously modernizing their payment infrastructures, simply and

securely. With nearly 50 years of trusted payments expertise, we

combine our global footprint with a local presence to offer

enhanced payment experiences to stay ahead of constantly changing

payment challenges and opportunities.

© Copyright ACI Worldwide, Inc. 2024 ACI, ACI Worldwide,

ACI Payments, Inc., ACI Pay, Speedpay, and all ACI product/solution

names are trademarks or registered trademarks of ACI Worldwide,

Inc., or one of its subsidiaries, in the United States, other

countries, or both. Other parties’ trademarks referenced are the

property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120169302/en/

Media Contacts Nick Karoglou | Head of Communications and

Corporate Affairs | nick.karoglou@aciworldwide.com Lyn Kwek |

Communications and Corporate Affairs Director, APAC/Middle

East/Africa | lyn.kwek@aciworldwide.com

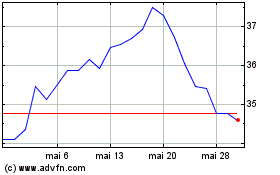

ACI Worldwide (NASDAQ:ACIW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ACI Worldwide (NASDAQ:ACIW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025