The transaction has a minimum cash condition of

$100 million, including funds from the Arrowroot Acquisition SPAC

trust, a private convert with participation from Arrowroot Capital

Management and other institutional investors that brings immediate

capital into the company, and additional sources of capital that

are currently being negotiated.

Pro forma implied enterprise value of the combined company is

approximately $1.4 billion.

iLearningEngines (“iLearningEngines” or “the Company”), a leader

in AI-powered learning automation and information intelligence for

corporate and educational use, announced today that it has entered

into a merger agreement with Arrowroot Acquisition Corp.

(NASDAQ:ARRW), a publicly traded special purpose acquisition

company sponsored by Arrowroot Capital, a 10 year old private

equity firm specializing in enterprise software. Upon closing of

the transaction, the combined company will be named

iLearningEngines, Inc., and is expected to remain listed on the

NASDAQ under the new ticker symbol, ‘AILE’. The combined company

will continue to be led by iLearningEngines’ existing CEO and

founder, Harish Chidambaran.

In a globally distributed work environment, productizing

enterprise knowledge has significant impact on business success,

and remains a fundamental challenge given the sheer volumes of

content and data. This is the problem that iLearningEngines solves.

Uniquely positioned at the intersection of two massive, rapidly

growing global markets – global e-Learning and global AI systems,

each with an estimated total addressable market of greater than

$200 billion by 2025 according to Technavio and IDC MaturityScape1

– iLearningEngines leverages its AI and machine learning to build

Intelligent “Knowledge Clouds” from an organization’s internal and

external content and data, creating a central repository of all

enterprise intellectual property, and then distributes knowledge

into enterprise workflows to drive autonomous learning, intelligent

decision making , and process automation. iLearningEngines

currently serves 12 core verticals, including industrials, oil

& gas, education, healthcare and insurance.

Founded in 2010, iLearningEngines has grown rapidly since its

initial product launch with customers across a diverse set of

industries and geographic regions. Key business and company

highlights include:

- Powering over 1000 end-customers with over 3.2 million

users

- $309 million in revenue in 2022, up 42% year over year, and

positive adjusted EBITDA the past 3 years

- Net dollar retention of 119% with typical customer contract

length of 3-5 years

- Proprietary AI platform and highly specialized learning and

engagement data sets

- Over 100,000 research and development hours

- Top 20 in Deloitte Fast 500 for four years in a row, including

#5 in 2019

- Rule of 40 software business consistently for the past 5

years

Under Mr. Chidambaran, iLearningEngines has built a profitable

$300+ million annual revenue business while being very capital

efficient. “As an early pioneer in enterprise AI and its

application in learning and process automation, we believe

iLearningEngines is in a category of one – owning a unique space

with first mover advantage and significant moats built around

specialized learning and engagement data sets,” said Mr.

Chidambaran. “We are excited to be partnering with Arrowroot given

their expertise in growing enterprise software businesses. We

believe the capital raised in this transaction will allow us to

accelerate growth, capitalizing on the massive market opportunity

in front of us.”

“Arrowroot is in our 10th year; investing globally and

specifically in growing enterprise software companies. We explored

dozens of candidates for our first SPAC investment, searching for

the next category killer, a $1 billion plus business that could be

the next $10 billion company,” said Arrowroot CEO Matthew Safaii.

“We believe we found that in iLearningEngines. This is a company

with over 100,000 engineering research and development hours

invested in creating one of the biggest independent AI focused

software platform companies in the world. iLearningEngines is in an

enviable software metric position. The company is at scale and

posts high revenue growth along with profitability. Furthermore, we

believe their large enterprise customer base is extremely sticky.

We see iLearningEngines as not just a disruptor in enterprise grade

AI, but as a public company that can overtake this burgeoning

market space - with a huge opportunity for both organic growth and

accretive M&A opportunities. Arrowroot Capital is in this for

the long-term and is demonstrating this commitment by leading an

investment directly into the company today. We have also priced the

deal at 3.3x estimated 2023 revenue, a significant discount to a

group of publicly traded peers, which we view as a very attractive

entry point, especially for a company with top tier metrics.”

“We were early investors in iLearningEngines, and have been

impressed with the management team’s ability to deliver consistent

growth and profitability in this high growth AI segment,” said Rudy

Ruano, Investment Partner with Western Technology Investment (WTI).

iLearningEngines has been backed by WTI, a multi-stage venture

finance firm that specializes in investments into leading

technology companies. Founded in 1980, WTI has partnered with more

than 1,400 companies across major innovation sectors. The firm was

an early institutional investor in iconic technology companies like

Google, Facebook, and Palantir among others.

Transaction Overview

The transaction has been unanimously approved by the Board of

Directors of Arrowroot Acquisition Corp., as well as the Board of

Directors of iLearningEngines, and is subject to the satisfaction

of customary closing conditions, including the approval of the

stockholders of Arrowroot Acquisition Corp.

The agreement includes a minimum cash requirement of $100

million that will be funded through several sources. The combined

entity will receive approximately $43 million from Arrowroot

Acquisition Corp.’s trust account, assuming no redemptions by

Arrowroot Acquisition Corp.’s public stockholders. iLearningEngines

will receive proceeds of a private convertible offering with

participation from Arrowroot Capital and other institutional

investors at the time the transaction is announced.

iLearningEngines is also in discussions to raise additional capital

via institutional investors. The intended use of cash is primarily

for M&A and growth.

Additional information about the proposed transaction, including

a copy of the merger agreement and investor presentation, will be

provided in a Current Report on Form 8-K and in Arrowroot

Acquisition Corp.’s registration statement on Form S-4, which will

include a document that serves as a prospectus and proxy statement

of Arrowroot Acquisition Corp., referred to as a proxy

statement/prospectus, each of which will be filed by Arrowroot

Acquisition Corp. with the Securities and Exchange Commission

(“SEC”) and available at www.sec.gov.

Advisors

Cooley LLC is serving as legal counsel to iLearningEngines and

Goodwin Procter LLP is serving as legal counsel to Arrowroot

Acquisition Corp.

About iLearningEngines

iLearningEngines is the market leader in cloud-based, AI driven

mission critical training for enterprises. iLearningEngines has

consistently ranked as one of the fastest growing companies in

North America on the Deloitte Technology Fast 500.

iLearningEngines’ AI and Learning Automation platform is used by

enterprises to productize their enterprise knowledge for

consumption throughout the enterprise. The intense demand for

scalable outcome-based training has led to deployments in some of

the most regulated and detail-oriented vertical markets, including

Healthcare, Education, Insurance, Retail, Oil & Gas / Energy,

Manufacturing and Government. iLearningEngines was founded by

Harish Chidambaran in 2010, with headquarters in Bethesda, MD and

offices in Dubai, UAE, Sydney, Australia, and India.

About Arrowroot Acquisition Corp.

Arrowroot Acquisition Corp. is a special purpose acquisition

company formed for the purpose to effect a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization or

similar business combination with one or more businesses. The

company is sponsored by Arrowroot Capital, a leading investor in

enterprise software. Arrowroot Acquisition Corp. was founded on

November 5, 2020 and is headquartered in Marina Del Rey, CA.

Important Information About the Proposed Transaction and

Where to Find It

A full description of the terms of the transaction will be

provided in a registration statement on Form S-4 to be filed with

the SEC by Arrowroot Acquisition Corp. that will include a

prospectus with respect to the combined company’s securities to be

issued in connection with the business combination and a proxy

statement with respect to the shareholder meeting of Arrowroot

Acquisition Corp. to vote on the business combination. Arrowroot

Acquisition Corp. urges its investors, shareholders and

other interested persons to read, when available, the preliminary

proxy statement/ prospectus as well as other documents filed with

the SEC because these documents will contain important information

about Arrowroot Acquisition Corp., iLearningEngines and the

transaction. After the registration statement is declared

effective, the definitive proxy statement/prospectus to be included

in the registration statement will be mailed to shareholders of

Arrowroot Acquisition Corp. as of a record date to be established

for voting on the proposed business combination. Once available,

shareholders will also be able to obtain a copy of the S-4,

including the proxy statement/prospectus, and other documents filed

with the SEC without charge, by directing a request to: Arrowroot

Acquisition Corp., address. The preliminary and definitive proxy

statement/prospectus to be included in the registration statement,

once available, can also be obtained, without charge, at the SEC’s

website (www.sec.gov).

Forward-Looking Statements

This press release contains forward-looking statements that are

based on beliefs and assumptions and on information currently

available. In some cases, you can identify forward-looking

statements by the following words: “may,” “will,” “could,”

“expect,” “intend,” “plan,” “believe,” “estimate,” “continue” or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these words.

These statements involve risks, uncertainties and other factors

that may cause actual results, levels of activity, performance or

achievements to be materially different from the information

expressed or implied by these forward-looking statements. We

caution you that these statements are based on a combination of

facts and factors currently known by us and our projections of the

future, which are subject to a number of risks. Forward-looking

statements in this press release include, but are not limited to,

statements regarding the proposed business combination, including

the timing and structure of the transaction, the listing of the

combined company’s shares, the amount and use of the proceeds of

the transaction, iLearningEngines’ future growth and innovations,

the initial market capitalization of the combined company, the

amount of funds available in the trust account as a result of

stockholder redemptions or otherwise and the benefits of the

transaction, the total addressable market for global e-Learning and

global AI systems, and the existence of, as well as the potential

value and duration of, any return on investment for customers of

the combined company. In addition, iLearningEngines’ 2022 revenue

is a preliminary estimate, which is subject to the completion of

iLearningEngines’ quarter end close procedures and further

financial review. Actual results may differ as a result of the

completion of iLearningEngines’ quarter end closing procedures,

review adjustments and other developments that may arise between

now and the time such financial information for the period is

finalized. Such differences may be material. As a result, those

estimates are preliminary, may change and constitute

forward-looking information and, as a result, are subject to risks

and uncertainties. Neither iLearningEngines’ nor Arrowroot

Acquisition Corp.’s registered accounting firm has audited,

reviewed or compiled, examined or performed any procedures with

respect to the preliminary results, nor have they expressed any

opinion or any other form of assurance on the preliminary financial

information. We cannot assure you that the forward-looking

statements in this press release will prove to be accurate. These

forward looking statements are subject to a number of risks and

uncertainties, including, among others, changes in domestic and

foreign business, market, financial, political, and legal

conditions the ability of existing investors to redeem the ability

to complete the business combination due to the failure to obtain

approval from Arrowroot Acquisition Corp.’s shareholders, the

failure to satisfy other closing conditions in the business

combination agreement or otherwise, the occurrence of any event

that could give rise to the termination of the business combination

agreement, the failure to consummate the transactions contemplated

by the forward purchase agreements, the ability to recognize the

anticipated benefits of the business combination, risks relating to

the uncertainty of the projected financial information with respect

to iLearningEngines; risks related to the rollout of

iLearningEngines’ business and the timing of expected business

milestones; the effects of competition on iLearningEngines’

business, and other risks and uncertainties, including those to be

included under the header “Risk Factors” in the registration

statement on Form S-4 to be filed by Arrowroot Acquisition Corp.

with the SEC and those included under the header “Risk Factors” in

the final prospectus of Arrowroot Acquisition Corp. related to its

initial public offering. Furthermore, if the forward-looking

statements prove to be inaccurate, the inaccuracy may be material.

In addition, you are cautioned that past performance may not be

indicative of future results. In light of the significant

uncertainties in these forward-looking statements, you should not

rely on these statements in making an investment decision or regard

these statements as a representation or warranty by us or any other

person that we will achieve our objectives and plans in any

specified time frame, or at all. The forward-looking statements in

this press release represent our views as of the date of this press

release. We anticipate that subsequent events and developments will

cause our views to change. However, while we may elect to update

these forward-looking statements at some point in the future, we

have no current intention of doing so except to the extent required

by applicable law. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

No Offer or Solicitation

This communication is for informational purposes only and does

not constitute an offer or invitation for the sale or purchase of

securities, assets or the business described herein or a commitment

to the Company or iLearningEngines, nor is it a solicitation of any

vote, consent or approval in any jurisdiction pursuant to or in

connection with the business combination or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law.

Participants in Solicitation

Arrowroot Acquisition Corp. and iLearningEngines, and their

respective directors and executive officers, may be deemed

participants in the solicitation of proxies of Arrowroot

Acquisition Corp.’s stockholders in respect of the business

combination. Information about the directors and executive officers

of Arrowroot Acquisition Corp. is set forth in the Arrowroot

Acquisition Corp.’s filings with the SEC. Information about the

directors and executive officers of iLearningEngines and more

detailed information regarding the identity of all potential

participants, and their direct and indirect interests by security

holdings or otherwise, will be set forth in the definitive proxy

statement/prospectus for the business combination when available.

Additional information regarding the identity of all potential

participants in the solicitation of proxies to Arrowroot

Acquisition Corp.’s stockholders in connection with the proposed

Business Combination and other matters to be voted upon at the

special meeting, and their direct and indirect interests, by

security holdings or otherwise, will be included in the definitive

proxy statement/prospectus, when it becomes available.

1 Sources Technavio Global e-Learning Marketplace and IDC

MaturityScape: Artificial Intelligence 2.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230427005966/en/

For iLearningEngines: Investor Contact: Kevin Hunt

iLearningEnginesIR@icrinc.com

Media Contact: For Arrowroot Acquisition Corp.: Jessica Schmitt

jschmitt@arrowrootcapital.com 310-566-5967

For iLearningEngines: Kevin McLaughlin ICR Inc.

iLearningPR@icrinc.com

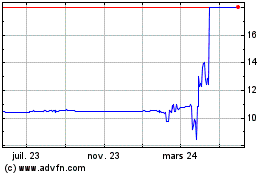

Arrowroot Acquisition (NASDAQ:ARRW)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

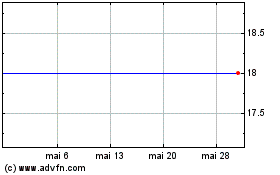

Arrowroot Acquisition (NASDAQ:ARRW)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025