Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-274223

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated September 18, 2023)

ATLAS

LITHIUM CORPORATION

Up

to $25,000,000

Common

Stock

We

have entered into an At The Market Offering Agreement dated as of November 22, 2024 (the “Sales Agreement”)

with H.C. Wainwright & Co., LLC (“Wainwright”), relating to the sale of shares of our common stock, par

value $0.001 per share (“Common Stock”) offered by this prospectus supplement and the accompanying prospectus.

In accordance with the terms of the Sales Agreement, we may offer and sell shares of our Common Stock having an aggregate offering price

of up to $25,000,000 from time to time through Wainwright acting as our sales agent.

Sales

of our Common Stock, if any, under this prospectus supplement and the accompanying prospectus will be made in transactions that are deemed

to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended (the “Securities

Act”). Subject to terms of the Sales Agreement, Wainwright is not required to sell any specific number or dollar amount

of shares but will act as a sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices,

on mutually agreed terms between Wainwright and us. There is no arrangement for funds to be received in any escrow, trust or similar

arrangement.

The

compensation to Wainwright for sales of Common Stock sold pursuant to the Sales Agreement will be a fixed commission rate of up to 3.0%

of the gross sales price of the shares of Common Stock sold under the Sales Agreement. In connection with the sale of our shares of Common

Stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

of Wainwright will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution

to Wainwright with against certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). See the section titled “Plan of Distribution” on page S-10

of this prospectus supplement.

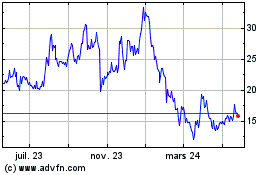

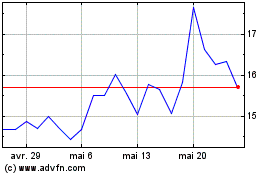

Our

Common Stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ATLX.” On November

21, 2024, the last reported sale price of our Common Stock was $7.77 per share.

Investing

in our securities involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement, as well as

the risk factors contained in the accompanying prospectus and the documents incorporated by reference herein and therein, for a discussion

of factors you should consider before buying shares of our Common Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is November 22, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document has two parts, a prospectus supplement, dated November 22, 2024, and an accompanying prospectus. This prospectus supplement

and the accompanying prospectus are part of a shelf registration statement on Form S-3, registration statement file number 333-274223

that we filed with the Securities and Exchange Commission (the “SEC”) on August 25, 2023 and that was declared

effective on September 18, 2023. Under the shelf registration process, we may offer and sell, from time to time, shares of our Common

Stock and/or preferred stock in one or more offerings.

The

accompanying prospectus provides you with a general description of our Common Stock. This prospectus supplement contains specific information

about the terms of this offering of our shares of Common Stock. This prospectus supplement may also add to, update or change information

contained in the accompanying prospectus or in any documents that we have incorporated by reference into this prospectus supplement or

the accompanying prospectus and, accordingly, to the extent inconsistent, information in the accompanying prospectus or incorporated

by reference herein or therein is superseded by the information in this prospectus supplement.

You

should rely only on the information contained in this prospectus supplement, the accompanying prospectus and any related free-writing

prospectus that we or Wainwright provide to you, including any information incorporated by reference. We and Wainwright have not authorized

any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. You should not assume that the information appearing in this prospectus supplement, the accompanying prospectus, any

related free-writing prospectus or any document incorporated by reference herein or therein is accurate at any date other than as of

the date of each such document. Our business, financial condition, results of operations and prospects may have changed since the date

indicated on the cover page of such documents.

This

prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement. The

registration statement filed with the SEC includes or incorporates by reference exhibits that provide more details about the matters

discussed in this prospectus supplement and the accompanying prospectus. You should carefully read this prospectus supplement, the accompanying

prospectus and the related exhibits filed with the SEC, together with the additional information described herein and in the accompanying

prospectus under the headings “Where You Can Find More Information” and “Documents Incorporated by Reference.”

Unless

the context otherwise indicates, references in this prospectus supplement to “we,” “us,” “our,” and

the “Company” are to Atlas Lithium Corporation and its subsidiaries. The term “you” refers to a prospective investor.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained in this prospectus supplement and does not contain all of the information that is important

to you. This summary is qualified in its entirety by the more detailed information included in or incorporated by reference into this

prospectus supplement and the accompanying prospectus. Before making your investment decision with respect to our Common Stock, you should

carefully read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and

therein.

Company

Overview

Atlas

Lithium Corporation is a mineral exploration and development company with a developing lithium project and multiple lithium exploration

properties. In addition, we own exploration properties in other battery minerals, including nickel, copper, rare earths, graphite, and

titanium. Our current focus is the development from exploration to future active mining of our hard-rock lithium project located in the

state of Minas Gerais in Brazil at a well-known pegmatitic district in Brazil, which has been denominated by the government of Minas

Gerais as “Lithium Valley.” We intend to mine and then process our lithium-containing ore to produce lithium concentrate

(also known as spodumene concentrate), a key ingredient for the battery supply chain.

Our

modular plant targeted at producing up to 150,000 tons of lithium concentrate per annum (“tpa”) in what we

describe as Phase I is in final phase of fabrication. We plan on adding additional modules to the plant with the intent of doubling its

production capacity to up to 300,000 tpa in Phase II. However, there can be no assurance that we will have the necessary capital resources

to develop such facility or, if developed, that we will reach the production capacity necessary to commercialize our products and with

the quality needed to meet market demand.

All

our mineral projects and properties are located in Brazil, a well-established mining jurisdiction. Our lithium properties include approximately

53,942 hectares (539 km2) divided in 95 mineral rights (2 in pre-mining concession stage, 85 in exploration stage, and 8 in

pre-exploration stage).

In

addition, we also have a few additional lithium mineral rights that are in the process of being acquired and not yet titled in our name.

We

are primarily focused on advancing and developing our hard-rock lithium project located in the state of Minas Gerais, Brazil. Our Minas

Gerais Lithium Project (“MGLP”) consists of 85 mineral rights spread over approximately 468 km2 and

predominantly located within the Brazilian Eastern Pegmatitic Province which has been surveyed by the Brazilian Geological Survey and

is known for the presence of hard rock formations known as pegmatites which contain lithium-bearing minerals such as spodumene and petalite.

Our primary area of focus is the Neves Project, which is part of MGLP. The Neves Project has been drilled extensively and presents spodumene-bearing

deposits amenable to open pit mining, with generation of ore material that can be processed by dense media separation technique to yield

lithium concentrate, a commercial product within the battery supply chain.

As

of September 30, 2024, we own approximately 44.74% of the shares of common stock of Apollo Resources Corporation (“Apollo

Resources”), a private company primarily focused on the development of its initial iron mine.

As

of September 30, 2024, we also own approximately 21.01% of the shares of common stock of Jupiter Gold Corporation (“Jupiter

Gold”), a company with an operating quartzite quarry and gold projects in exploration phase, the common stock of which

is quoted on the OTCQB marketplace under the symbol “JUPGF.

The

results of operations from both Apollo Resources and Jupiter Gold are consolidated in our financial statements under U.S. Generally Accepted

Accounting Principles (“GAAP”).

Corporate

Information

We

were incorporated in the State of Nevada on December 15, 2011 as Flux Technologies, Corp. On January 22, 2013 we changed our name to

Brazil Minerals, Inc., and on September 26, 2022 an amendment to our articles of incorporation was filed with the Nevada Secretary of

State changing our name to Atlas Lithium Corporation. Our principal executive offices outside of the U.S. are located at Rua Antonio

de Albuquerque, 156 – 17th Floor, Belo Horizonte, Minas Gerais, Brazil, 30.112-010 and our telephone number is (833)

661-7900. Our corporate website address is www.atlas-lithium.com. Information contained on, or that can be accessed through, our website

is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Rule 12b-2 under the Exchange Act and rely on exemptions from certain disclosure

requirements that are available to smaller reporting companies. We will continue to be a smaller reporting company after this offering

so long as (i) our Common Stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal

quarter or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and our Common Stock held

by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter. For so long as we remain

a smaller reporting company, we are permitted and plan to rely on exemptions from certain disclosure and other requirements that are

applicable to other public companies that are not smaller reporting companies.

Recent

Developments

On

October 26, 2024, we received the operational permit for our Neves Project from the government of the state of Minas Gerais in

Brazil. This triphasic permit (known as “LP/LI/LO” in the local regulatory terminology) is the most expeditious licensing

modality available as it encompasses the initial, installation, and operating licenses all within this same issued authorization. The

permit authorizes us to assemble and operate our lithium processing plant, to process mined ore from one of our deposits at the facility,

and to sell the lithium concentrate that we produce. The permit was unanimously approved by a voting board comprised of twelve representatives

from the local civil society and government on October 25, 2024, and formally published in the official gazette of the Minas Gerais government

on October 26, 2024. This outcome followed the technical recommendation for approval issued by the Environmental Foundation of Minas

Gerais in September 2024. This key development came after an extensive technical review process that began with our initial permit application

on September 1, 2023.

On

October 31, 2024, Jupiter Gold and Apollo Resources entered into an agreement and plan of merger pursuant to which Apollo would merge

with and into Jupiter, with Jupiter continuing its corporate existence as the surviving corporation. This transaction closed on November

19, 2024, following which we became the beneficial owners of approximately 35.06% of the total shares outstanding of Jupiter Gold.

THE

OFFERING

| Common

Stock offered by us |

|

Shares

of our Common Stock having an aggregate offering price of up to $25,000,000. |

| |

|

|

| Common

Stock to be outstanding after this offering |

|

Up

to 3,217,503 shares of Common Stock, assuming sales at a price of $7.77 per share, which was the last reported sale price of

our Common Stock on Nasdaq on November 21, 2024. The actual number of shares issued will vary depending on the sales price under

this offering. |

| |

|

|

| Plan

of Distribution |

|

“At

the market offering” that may be made from time to time through Wainwright as sales agent. See “Plan of Distribution”

on page S-10 of this prospectus supplement for more information. |

| |

|

|

| Use

of Proceeds |

|

We

intend to use the net proceeds from this offering for general corporate purposes, including the development and commercialization

of our lithium concentrate product, general and administrative expenses, and working capital and capital expenditures. See

“Use of Proceeds” on page S-8 of this prospectus supplement. |

| |

|

|

| Risk

Factors |

|

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” on page S-5 of this prospectus supplement

and the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus for

a discussion of factors you should carefully consider before deciding to invest in our Common Stock. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

“ATLX” |

The number of shares of

Common Stock to be outstanding after this offering is based on 15,416,023 shares of our Common Stock outstanding as of November 20, 2024,

which excludes:

| |

● |

one

share of Series A Preferred; |

| |

|

|

| |

● |

45,716

shares of Common Stock issuable upon the exercise of outstanding common stock options granted to certain officers, directors and

consultants between 2019 and 2022; and |

| |

|

|

| |

● |

281,667

warrants to purchase shares of Common Stock issuable upon the exercise of such warrants. |

Our

2023 Stock Incentive Plan has 2,000,000 shares of Common Stock reserved for issuance with no shares remaining available for issuance

thereunder.

RISK

FACTORS

An

investment in our Common Stock involves a high degree of risk. Prior to making a decision about investing in our securities, you should

carefully consider the specific factors discussed under the section in the applicable prospectus supplement captioned “Risk Factors,”

together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated

by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under “Part I. Item

1A. Risk Factors” of our most recent amendment to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023,

filed with the SEC on November 8, 2024 (the “2023 Annual Report”) that are incorporated herein by reference, as may

be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. Any of these risks could

materially and adversely affect our business, operating results, financial condition, or prospects and cause the value of our Common

Stock to decline, which could cause you to lose all or part of your investment. The risks and uncertainties we have described are not

the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect

our operations.

We

have identified a material weakness in our internal control over financial reporting and if our remediation of the material weakness

is not effective, or if we fail to design and maintain an effective internal control over financial reporting, our ability to produce

timely and accurate financial statements or comply with applicable laws and regulations could be impaired.

In

connection with the change in our independent registered public accounting firm on May 7, 2024, our consolidated financial statements

for the two fiscal years ended December 31, 2023 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

filed with the SEC on March 27, 2024 (the “Original Form 10-K”) were re-audited. In connection with the re-audit,

we identified certain accounting errors related to the presentation, timing, omission and classification of a number of items in the

Original Form 10-K, our condensed consolidated financial statements for the period ending March 31, 2024 as presented in our Quarterly

Report on Form 10-Q for the period ending March 31, 2024, filed with the SEC on May 15, 2024 (the “Original Q1 Form 10-Q”)

and our condensed consolidated financial statements for the period ending June 30, 2024 as presented in our Quarterly Report on Form

10-Q for the period ending June 30, 2024, filed with the SEC on August 9, 2024 (the “Original Q2 Form 10-Q,”

and together with the Original Form 10-K and the Original Q1 Form 10-Q, the “Previously Issued Financial Statements”).

In order to make the required corrections necessary to comply with U.S. GAAP, the Previously Issued Financial Statements were restated

and filed as an amendment to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023, the Quarterly Report on Form

10-Q/A for the period ending March 31, 2024 and the Quarterly Report on Form 10-Q/A for the period ending June 30, 2024, respectively,

each filed with the SEC on November 8, 2024 (the “Restated Financial Statements”).

We

have concluded that in light of the errors as described in our Restated Financial Statements, a material weakness exists in our internal

control over financial reporting and that our disclosure controls and procedures were not effective as of December 31, 2022, December

31, 2023, March 31, 2024, June 30, 2024 and September 30, 2024. A material weakness, as defined in the standards established by the Sarbanes-Oxley

Act of 2002 (the “Sarbanes-Oxley Act”) is a deficiency, or a combination of deficiencies, in internal control

over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated

financial statements will not be prevented or detected on a timely basis. During this period, we outsourced our day-to-day accounting

tasks due to limited accounting and financial reporting personnel and other resources needed to ensure adherence to our internal controls

and procedures. We had limited finance and accounting professionals with the requisite experience to appropriately perform the supervision

and review of the information received from our third-party accounting service provider. The lack of U.S GAAP experience from the outsourced

accounting firm combined with the limited availability of an experienced team to supervise the third-party service provider resulted

in a material weakness.

We

have begun to design and implement certain remediation measures to address the above-described material weakness and enhance our internal

control over financial reporting, which includes insourcing our accounting and finance functions and hiring capable and experienced professionals

to build a strong in-house accounting team; and implementing SAP Enterprise Resource Planning

software to strengthen our ability to adequately keep records of our accounting and financial information. Our remediation efforts are

ongoing and we will continue our initiatives to consider additional skilled resources in program management, accounting, and finance

related functions and to expand the effort to implement and document policies, procedures, and internal controls.

The

implementation of these remediation measures is in the early stages and will require validation and testing of design and operating effectiveness

of internal controls over a number of financial reporting cycles. Implementing the necessary changes to internal controls will be time

consuming, will involve substantial costs, divert our management’s attention from other matters that are important to the operation

of our business and place significant demands on our financial and operational resources. We anticipate that remediation of the identified

material weakness and strengthening of our internal control environment will require a substantial effort through the end of 2024 and

beyond.

We

cannot assure you that the measures we have taken to date, and actions we may take in the future, will be sufficient to remediate the

material weakness in our internal control over financial reporting or that they will prevent or avoid potential future material weaknesses.

Our current controls and any new controls that we develop may become inadequate because of changes in conditions in our business. Further,

additional material weaknesses and significant deficiencies in our internal control over financial reporting may be discovered in the

future. Any failure to design or maintain effective controls or any difficulties encountered in their implementation or improvement could

harm our operating results or cause us to fail to meet our reporting obligations and may result in a restatement of our annual or interim

financial statements.

Our

independent registered public accounting firm is not required to attest to management’s assessment of the effectiveness of our

internal control over financial reporting as long as we are a smaller reporting company. When we are required to comply with such attestation

requirements, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with

the level at which our internal control over financial reporting is documented, designed or operating. Any failure to design, implement

and maintain effective internal control over financial reporting could adversely affect the results of periodic management evaluations

and annual independent registered public accounting firm attestation reports regarding the effectiveness of our internal control over

financial reporting that we will eventually be required to include in our periodic reports that are filed with the SEC.

A

failure to remediate this material weakness, or future material weaknesses, in a timely manner to be able to comply with the requirements

of SEC rules and regulations and Section 404 of the Sarbanes-Oxley Act and assert that our internal control over financial reporting

is effective, may result in a material misstatement of our annual or interim financial statements that would not be prevented or detected

on a timely basis, which, in turn, could jeopardize our ability to comply with our reporting obligations, including those under certain

agreements which may give rise to a default thereunder, restrict our access to the capital markets, cause investors to lose confidence

in the accuracy, completeness or reliability of our financial reports and adversely impact the trading price of our Common Stock.

Furthermore,

as a result of this material weakness and related errors described in our Restated Financial Statements, we may become subject to a number

of additional risks and uncertainties and have incurred and may continue to incur unanticipated costs for accounting, legal and other

fees and expenses. We may become subject to investigations or sanctions by the SEC, the Nasdaq or other regulatory authorities and litigation

from investors and stockholders, which could harm our reputation and divert financial and management resources. Any of the foregoing

impacts, individually or in the aggregate, may have a material adverse effect on our business, financial position and results of operations.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

We

intend to use the net proceeds from this offering for general corporate purposes, including the development and commercialization of

our products, general and administrative expenses, and working capital and capital expenditures. However, our management will have broad

discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results

of operations or enhance the value of our Common Stock. The failure by management to apply these funds effectively could result in financial

losses that could have a material adverse effect on our business and cause the price of our Common Stock to decline.

The

Common Stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will

likely pay different prices.

Investors

who purchase shares of our Common Stock in this offering at different times will likely pay different prices per share, and as a result,

may experience different levels of dilution, and different outcomes in their investment results. We will have discretion, subject to

market demand, to vary the timing, prices, and number of shares sold in this offering. Investors may experience a decrease in the value

of the shares of our Common Stock that they purchase in this offering as a result of sales made at prices lower than the prices that

they paid.

The

actual number of shares we will issue under the Offering Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver instructions to Wainwright

to sell shares of our Common Stock at any time throughout the term of the Sales Agreement. The number of shares of our Common Stock that

are sold through Wainwright after our instructions will fluctuate based on a number of factors, including the market price of our Common

Stock during the sales period, the limits we set with Wainwright in any instruction to sell shares of our Common Stock, and the demand

for our Common Stock during the sales period. Because the price per share of each share of our Common Stock sold will fluctuate during

this offering, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection

with those sales.

FORWARD-LOOKING

STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain “forward-looking

statements.” We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements

contained in Section 27A of the Securities Act and Section 21E of the Exchange Act.

All

statements other than statements of historical fact contained in this prospectus supplement, the accompanying prospectus and the documents

incorporated by reference herein and therein are forward-looking statements, including, without limitation, statements regarding current

expectations, as of the date of each such document, our future results of operations and financial position; our ability to effectively

process our minerals and achieve commercial grade at scale; risks and hazards inherent in the mining business (including risks inherent

in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically

related conditions); uncertainty about our ability to obtain required capital to execute our business plan; our ability to hire and retain

required personnel; changes in the market prices of lithium and lithium products and demand for such products; the uncertainties inherent

in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related

to our projects; and uncertainties inherent in the estimation of lithium resources. These statements involve known and unknown risks,

uncertainties and other important factors that may cause actual results, performance, or achievements to differ materially from any future

results, performance or achievement expressed or implied by these forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”,

or “continue” or the negative of these terms or other similar expressions. Factors that could cause future results to materially

differ from the recent results or those projected in forward-looking statements include, but are not limited to: unprofitable efforts

resulting not only from the failure to discover mineral deposits, but also from finding mineral deposits that, though present, are insufficient

in quantity and quality to return a profit from production; our ability to complete the assembly, and render operational, the modular

plant; successfully remediate the material weakness to our internal control over financial reporting; market fluctuations; government

regulations, including regulations relating to permitting, royalties, allowable production, importing and exporting of minerals, and

environmental protection; competition; the loss of services of key personnel; unusual or infrequent weather phenomena, litigation, sabotage,

government or other interference in the maintenance or provision of infrastructure as well as general economic conditions.

The

forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein are based largely on our current expectations and projections about future events and financial trends that we believe may

affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this

prospectus supplement and are subject to a number of important factors that could cause actual results to differ materially from those

in the forward-looking statements, including the factors described under the sections titled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our 2023 Annual Report, Quarterly Reports on Form

10-Q and other filings made with the SEC. Additional information regarding risk factors that may affect us is included in this prospectus

supplement and the accompanying prospectus and our 2023 Annual Report. The risk factors contained in our 2023 Annual Report are updated

by us from time to time in Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings that we make with the SEC.

You

should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein completely

and with the understanding that our actual future results may be materially different from what we expect. Given these uncertainties,

we caution you not to place undue reliance on these forward-looking statements. Except as required by applicable law, we do not plan

to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events,

changed circumstances or otherwise.

USE

OF PROCEEDS

We

may issue and sell shares of our Common Stock having aggregate sales proceeds of up to $25,000,000 from time to time. The amount of proceeds

we receive, if any, will depend on the actual number of shares of our Common Stock sold and the market price at which such shares are

sold. Because there is no minimum offering amount required as a condition to this offering, the net proceeds to us, if any, are not determinable

at this time. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales Agreement with Wainwright

as a source of financing.

We

currently intend to use the net proceeds from this offering for general corporate purposes, including the development and commercialization

of our lithium concentrate product, general and administrative expenses, and working capital and capital expenditures. We have

not currently planned or committed any specific amounts to spend on the areas listed above or the timing of these expenditures. As a

result, our management will have broad discretion to allocate the net proceeds from this offering.

DILUTION

If

you invest in our Common Stock in this offering, your ownership interest will be diluted immediately to the extent of the difference

between the public offering price per share of our Common Stock in this offering and the net tangible book value per share of our Common

Stock giving effect to this offering.

Our

net tangible book value as of September 30, 2024, was approximately $23.3 million, or $1.53 per share of Common Stock based upon

15,257,792 shares of Common Stock outstanding as of September 30, 2024. Net tangible book value per share is equal to our total tangible

assets, less our total liabilities, divided by the total number of shares of Common Stock outstanding as of September 30, 2024.

After

giving effect to the issuance and sale of 3,217,503 shares of Common Stock in the aggregate amount of $25,000,000 in this offering, at

an assumed public offering price of $7.77 per share, the last reported sale price of our Common Stock on the Nasdaq on November 21, 2024,

and after deducting the estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2024 would

have been $47.5 million, or $2.57 per share of Common Stock. This represents an immediate increase of $1.04 per

share in net tangible book value to our existing stockholders and immediate dilution of $5.20 per share to new investors purchasing

our Common Stock in this offering. The following table illustrates this calculation on a per share basis:

| Assumed public offering price per share | |

| | | |

$ | 7.77 | |

| Historical net tangible book value per share as of September 30, 2024 | |

$ | 1.53 | | |

| | |

| Increase in as adjusted net tangible book value per share attributable to new investors purchasing shares of Common Stock in this offering | |

$ | 1.04 | | |

| | |

| As adjusted net tangible book value per share immediately after this offering | |

| | | |

$ | 2.57 | |

| Dilution per share to new investors purchasing shares of Common Stock in this offering | |

| | | |

$ | 5.20 | |

The

above discussion and table are based on 15,257,792 shares of Common Stock outstanding as of September 30, 2024, which excludes:

| |

● |

one

share of Series A Preferred; |

| |

|

|

| |

● |

45,716

shares of Common Stock issuable upon the exercise of outstanding common stock options granted to certain officers, directors and

consultants between 2019 and 2022; and |

| |

|

|

| |

● |

281,667

warrants to purchase shares of Common Stock issuable upon the exercise of such warrants. |

Our

2023 Stock Incentive Plan has 2,000,000 shares of Common Stock reserved for issuance with no shares remaining available for issuance

thereunder.

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of the outstanding options described above. To

the extent that outstanding options are exercised, you will experience further dilution.

In

addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of such securities may result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We

have entered into the Sales Agreement, dated as of November 22, 2024, under which we may offer and sell shares of our Common Stock

having an aggregate gross sales price of up to $25,000,000 from time to time through Wainwright as our sales agent.

The

Sales Agreement provides that sales of our Common Stock, if any, under this prospectus supplement and the accompanying prospectus may

be made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act,

including sales made directly on or through Nasdaq, the existing trading market for our Common Stock, or any other existing trading market

in the United States for our Common Stock, sales made to or through a market maker other than on an exchange or otherwise, directly to

Wainwright as principal, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing

market prices, and/or in any other method permitted by law.

Wainwright

will offer shares of our Common Stock at prevailing market prices subject to the terms and conditions of the Sales Agreement as agreed

upon by us and Wainwright. We will designate the number of shares which we desire to sell, the time period during which sales are requested

to be made, any limitation on the number of shares that may be sold in one day and any minimum price below which sales may not be made.

Subject to the terms and conditions of the Sales Agreement, Wainwright will use its commercially reasonable efforts and applicable laws

and regulations to sell on our behalf all of the shares requested to be sold by us. We or Wainwright may suspend the offering of the

shares of Common Stock being made through Wainwright under the Sales Agreement at any time upon proper notice to the other party.

Settlement

for sales of Common Stock will occur on the first trading day or any other settlement cycle as may be in effect under Exchange Act Rule

15c6-1 from time to time, following the date on which any sales are made in return for payment of the net proceeds to us, or on some

other date that is agreed upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds

to us. Sales of our shares of our Common Stock as contemplated in this prospectus supplement and the accompanying prospectus will be

settled through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There is no

arrangement for funds to be received in an escrow, trust or similar arrangement.

We

will pay Wainwright a cash commission of up to 3.0% of the gross sales price of the shares of our Common Stock that Wainwright sells

pursuant to the Sales Agreement. Because there is no minimum offering amount required as a condition to this offering, the actual total

offering amount, commissions and proceeds to us, if any, are not determinable at this time. Pursuant to the terms of the Sales Agreement,

we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in connection with entering

into the transactions contemplated by the Sales Agreement in an amount not to exceed $50,000 in the aggregate. We will report at least

quarterly the number of shares of our Common Stock sold through Wainwright under the Sales Agreement, the net proceeds to us and the

compensation paid by us to Wainwright in connection with the sales of shares of our Common Stock.

In

connection with the sales of shares of our Common Stock on our behalf, Wainwright will be deemed to be an “underwriter” within

the meaning of the Securities Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts.

We have agreed in the Sales Agreement to provide indemnification and contribution to Wainwright against certain liabilities, including

liabilities under the Securities Act.

The

offering of our shares of our Common Stock pursuant to this prospectus supplement will terminate upon the earlier of the sale of all

of the shares of our Common Stock provided for in this prospectus supplement or termination of the Sales Agreement as permitted therein.

To

the extent required by Regulation M, Wainwright will not engage in any market making activities involving our Common Stock while the

offering is ongoing under this prospectus supplement.

Wainwright

and certain of its affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of

business with us or our affiliates. Wainwright and such affiliates may in the future receive customary fees and expenses for these transactions.

In addition, in the ordinary course of its various business activities, Wainwright and its affiliates may make or hold a broad array

of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (which may

include bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve

securities and/or instruments of ours or our affiliates. Wainwright or its affiliates may also make investment recommendations and/or

publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients

that they acquire, long and/or short positions in such securities and instruments.

This

prospectus supplement and the accompanying prospectus may be made available in electronic format on a website maintained by Wainwright,

and Wainwright may distribute this prospectus supplement and the accompanying prospectus electronically.

The

foregoing does not purport to be a complete statement of the terms and conditions of the Sales Agreement. A copy of the Sales Agreement

is filed as an exhibit to our Current Report on Form 8-K, filed with the SEC on November 22, 2024, and such agreement is incorporated

by reference into the registration statement of which this prospectus supplement forms a part. See “Where You Can Find More Information”

in this prospectus supplement for more information.

Our

Common Stock is listed on Nasdaq under the symbol “ATLX.” Our transfer agent and registrar is VStock Transfer, LLC with its

address at 18 Lafayette Place, Woodmere, New York 11598, and its telephone number is (212) 828-8436.

LEGAL

MATTERS

The

validity of the Common Stock covered by this prospectus supplement has been passed upon for us by Brownstein Hyatt Farber Schreck, LLP,

Las Vegas, Nevada. H.C. Wainwright & Co., LLC is being represented in connection with this offering by Ellenoff Grossman & Schole

LLP, New York, New York.

EXPERTS

The

consolidated financial statements of Atlas Lithium Corporation appearing in Atlas Lithium Corporation’s amended 2023 Annual Report,

have been audited by Pipara & Co LLP, independent registered public accounting firm, as set forth in its reports thereon, included

therein, and incorporated herein by reference. Such financial statements have been incorporated herein by reference in reliance upon

such reports given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are

also available on our website at www.atlas-lithium.com. Information accessible on or through our website is not a part of this

prospectus supplement.

DOCUMENTS

INCORPORATED BY REFERENCE

The

SEC allows us to incorporate by reference into this prospectus supplement much of the information that we file with the SEC, which means

that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate

by reference in this prospectus supplement is considered to be part of this prospectus supplement and the accompanying prospectus. Because

we are incorporating by reference future filings with the SEC, this prospectus supplement and the accompanying prospectus are continually

updated and those future filings may modify or supersede some of the information included or incorporated by reference in this prospectus

supplement and the accompanying prospectus. This means that you must look at all of the SEC filings that we incorporate by reference

to determine if any of the statements in this prospectus supplement or the accompanying prospectus or in any document previously incorporated

by reference have been modified or superseded. This prospectus supplement and the accompanying prospectus incorporates by reference the

documents listed below and all future filings filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act (in each case, other than those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current

Report on Form 8-K and, except as may be noted in any such Form 8-K, exhibits filed on such form that are related to such information)

until the offering of the securities under the registration statement of which this prospectus supplement forms a part is terminated

or completed:

| |

● |

our

amendment to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2023, filed with the SEC on November 8, 2024; |

| |

|

|

| |

● |

our

amendment to the Quarterly Report on Form 10-Q/A for the period ended March 31, 2024, filed with the SEC on November 8, 2024; |

| |

|

|

| |

● |

our

amendment to the Quarterly Report on Form 10-Q/A for the period ended June 30, 2024, filed with the SEC on November 8, 2024; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the period ended September 30, 2024, filed with the SEC on November 8, 2024; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 5, 2024, February 12, 2024, March 25, 2024, April 1, 2024 (Item 1.01 only),

May 6, 2024, May 10, 2024, May 30, 2024, July 23, 2024, August 22, 2024, August 27, 2024, and November 8, 2024. |

| |

|

|

| |

● |

our

Registration Statement on Form 8-A (File No. 001-41552), filed with the SEC on November 8, 2022, which describes the terms, rights,

and provisions applicable to our outstanding capital stock; and |

| |

|

|

| |

● |

the

Description of Atlas Lithium Corporation’s Securities Registered Pursuant to Section 12 of the Exchange Act of 1934, as filed

with the SEC on March 27, 2024 as Exhibit 4.1 to our Annual Report on Form 10-K. |

Any

statement contained in this prospectus supplement or the accompanying prospectus, or in a document incorporated or deemed to be incorporated

by reference herein or therein, shall be deemed to be modified or superseded to the extent that a statement contained herein or therein,

or in any subsequently filed document that also is incorporated or deemed to be incorporated by reference herein, modifies or supersedes

such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part

of this prospectus supplement.

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

Atlas

Lithium Corporation

Rua

Antonio de Albuquerque, 156 – 17th Floor

Belo

Horizonte, Minas Gerais, Brazil, 30.112-010

(833)

661-7900

PRELIMINARY

PROSPECTUS

Atlas

Lithium Corporation

$75,000,000

Common

Stock

Preferred

Stock

We

may issue securities from time to time in one or more offerings, in amounts, at prices and on terms determined at the time of offering.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We

will provide the specific terms of these securities in supplements to this prospectus, which will also describe the specific manner in

which these securities will be offered and may also supplement, update or amend information contained in this prospectus. You should

read this prospectus and any applicable prospectus supplement before you invest. The aggregate offering price of the securities we sell

pursuant to this prospectus will not exceed $75,000,000.

The

securities may be sold directly to you, through agents or through underwriters and broker-dealers. If agents, underwriters or broker-dealers

are used to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public

of those securities and the net proceeds we expect to receive from that sale will also be set forth in a prospectus supplement.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “ATLX.” Each prospectus supplement will indicate whether

the securities offered thereby will be listed on any securities exchange. As of August 24, 2023, the aggregate market value of our common

stock held by our non-affiliates, as calculated pursuant to the rules of the Securities and Exchange Commission, was approximately $137,704,670,

based upon approximately 5,657,546 shares of our outstanding common stock held by non-affiliates at the per share price of $24.34, the

closing sale price of our common stock on the Nasdaq Capital Market on August 24, 2023.

Investing

in these securities involves risks. Please carefully read the information under “Item 1A. Risk Factors” of our most recent

report on Form 10-K and Form 10-Q for the quarter ending March 31, 2023, and any other filings we make with the Securities and Exchange

Commission and that is incorporated by reference in this prospectus before you invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, (the “SEC” or the

“Commission”), using a “shelf” registration process. Under this shelf registration process, we may from time

to time sell any combination of the securities described in this prospectus in one or more offerings.

This

prospectus provides you with a general description of the securities that may be offered. Each time we sell securities, we will provide

one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement

may also add, update or change information contained in this prospectus. You should read both this prospectus and any applicable prospectus

supplement together with the additional information described under the heading “Where You Can Find More Information.”

We

have not authorized anyone to provide you with information that is different from that contained, or incorporated by reference, in this

prospectus, any applicable prospectus supplement or in any related free writing prospectus. We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. This prospectus and any applicable prospectus

supplement or any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the securities described in the applicable prospectus supplement or an offer to sell or the solicitation of an offer to buy

such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing

in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate

only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially

since those dates.

PROSPECTUS

SUMMARY

This

summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus.

It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities,

you should carefully read this entire prospectus, including the matters set forth under the section of this prospectus captioned “Risk

Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including

our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Unless the context indicates otherwise, references in this prospectus

to “Atlas Lithium Corporation,” the “Company,” the “Registrant,” “we,” “our”

and “us” refer, collectively, to Atlas Lithium Corporation, a Nevada corporation, and its subsidiaries taken as a whole.

Company

Overview

Atlas

Lithium Corporation is a U.S. mineral exploration and mining company with lithium projects and properties in other critical battery metals

to power the green energy revolution - nickel, rare earths, graphite, and titanium. Our current focus is on developing our hard-rock

lithium project located in Minas Gerais state in Brazil at a well-known, premier pegmatitic district in Brazil. We intend to produce

and sell lithium concentrate, a key ingredient for the battery supply chain. Lithium is essential for batteries in electric vehicles.

We

are in the initial stages of planning to develop and own a lithium concentration facility capable of producing up to 300,000 tons of

lithium concentrate annually. However, there can be no assurance that such a facility may ultimately come to fruition or, if developed,

that the production capacity will meet our expectations.

All

of our mineral projects and properties are located in Brazil and our mineral rights portfolio for battery minerals includes approximately

75,542 acres (306 km2) for lithium in 61 mineral rights, 137,883 acres for nickel (558 km2) in 37 mineral rights,

30,009 acres (121 km2) for rare earths in seven mineral rights, 22,050 acres (89 km2) for titanium in seven mineral

rights, and 13,766 acres (56 km2) for graphite in three mineral rights. We believe that we hold the largest portfolio of exploration

properties for battery minerals in Brazil, a premier and well-established mining jurisdiction.

We

are primarily focused on advancing and developing our hard-rock lithium project located in the state of Minas Gerais, Brazil, where some

of our high-potential mineral rights are adjacent to or near large lithium deposits that belong to Sigma Lithium Corporation (Nasdaq:

SGML). Our Minas Gerais Lithium Project (“MGLP”) is our largest project and consists of 54 mineral rights spread over 59,275

acres (240 km2) and predominantly located within the Brazilian Eastern Pegmatitic Province which has been surveyed by the

Brazilian Geological Survey and is known for the presence of hard rock formations known as pegmatites which contain lithium-bearing minerals

such as spodumene and petalite. Generally, lithium derived

from pegmatites is less costly to purify for uses in high technology applications than lithium obtained from brine. Such applications

include the battery supply chain for electric vehicles (“EVs”), an area of expected high growth for the next several decades.

We

believe that we can materially increase our value by the acceleration of our exploratory work and quantification of our lithium mineralization.

Our initial commercial goal is to be able to enter production of lithium-bearing concentrate, a product which is highly sought

after in the battery supply chain for EVs.

As

of the date of this prospectus, we own approximately 45% of the shares of common stock of Apollo Resources Corporation (“Apollo

Resources”), a private company primarily focused on the development of its initial iron mine.

As

of the date of this prospectus, we own approximately 28% of the shares of common stock of Jupiter Gold Corporation (“Jupiter Gold”),

a company focused on the exploration of two gold projects and the operation of a producing quartzite mine, and whose common stock are

quoted on the OTCQB marketplace under the symbol “JUPGF.”

The

results of operations from both Apollo Resources and Jupiter Gold are consolidated in our financial statements under accounting principles

generally accepted in the United States (“U.S. GAAP”).

Risks

Associated with Our Business

Business

Risks

| ● | Our

future performance is difficult to evaluate because we have a limited operating history. |

| | | |

| ● | We

have a history of losses and expect to continue to incur losses in the future. |

| | | |

| ● | We

are an exploration stage company, and there is no guarantee that our properties will result

in the commercial extraction of mineral deposits. |

| | | |

| ● | Because

the probability of an individual prospect ever having reserves is not known, our properties

may not contain any reserves, and any funds spent on exploration and evaluation may be lost. |

| | | |

| ● | We

face risks related to mining, exploration and mine construction, if warranted, on our properties. |

| | | |

| ● | Our

long-term success will depend ultimately on our ability to achieve and maintain profitability

and to develop positive cash flow from our mining activities. |

| | | |

| ● | We

depend on our ability to successfully access the capital and financial markets. Any inability

to access the capital or financial markets may limit our ability to fund our ongoing operations,

execute our business plan or pursue investments that we may rely on for future growth. |

| | | |

| ● | Our

quarterly and annual operating and financial results and our revenue are likely to fluctuate

significantly in future periods. |

| | | |

| ● | Our

ability to manage growth will have an impact on our business, financial condition and results

of operations. |

| | | |

| ● | We

depend upon Marc Fogassa, our Chief Executive Officer and Chairman. |

| | | |

| ● | Our

growth will require new personnel, which we will be required to recruit, hire, train and

retain. |

| | | |

| ● | Certain

executive officers and directors may be in a position of conflict of interest. |

Regulatory

and Industry Risks

| ● | The

mining industry subjects us to several risks. |

| | | |

| ● | Our

mineral projects will be subject to significant government regulations. |

| | | |

| ● | We

will be required to obtain governmental permits in order to conduct development and mining

operations, a process which is often costly and time-consuming. |

| | | |

| ● | Compliance

with environmental regulations and litigation based on environmental regulations could require

significant expenditures. |

| | | |

| ● | Our

operations face substantial regulation of health and safety. |

| | | |

| ● | Our

operations are subject to extensive environmental laws and regulations. |

| | | |

| ● | Mineral

prices are subject to unpredictable fluctuations. |

Country

and Currency Risks

| ● | Our

ability to execute our business plan depends primarily on the continuation of a favorable

mining environment in Brazil and our ability to freely sell our minerals. |

| | | |

| ● | The

perception of Brazil by the international community may affect us. |

| | | |

| ● | Exposure

to foreign exchange fluctuations and capital controls may adversely affect our costs, earnings

and the value of some of our assets. |

Common

Stock Risks

| ● | Our

common stock price has been and may continue to be volatile. |

| | | |

| ● | We

do not intend to pay regular future dividends on our common stock and thus stockholders must

look to appreciation of our common stock to realize a gain on their investments. |

| | | |

| ● | We

may seek to raise additional funds, finance acquisitions, or develop strategic relationships

by issuing securities that would dilute your ownership. |

| | | |

| ● | Our

Series A Preferred Stock has the effect of concentrating voting control over us in Marc Fogassa,

our Chief Executive Officer and Chairman. |

| | | |

| ● | Marc

Fogassa, our Chief Executive Officer and member of our board of directors (the “Board

of Directors” or the “Board”), owns greater than 50% of our voting securities,

which means we are deemed a “controlled company” under the rules of Nasdaq. |

| | | |

| ● | Our

stock price may be volatile, and you could lose all or part of your investment. |

| | | |

| ● | You

will experience dilution as a result of future equity offerings. |

| | | |

| ● | Our

existing stockholders have substantial influence over us and their interests may not be aligned

with the interests of our other stockholders, which may discourage, delay or prevent a change

in control is us, which could deprive our stockholders of an opportunity to receive a premium

for their securities. |

| | | |

| ● | Sales

of a substantial number of shares of our common stock by our stockholders in the public market

could cause our stock price to fall. |

Costs

as a result of operating as a public company are significant, and our management is required to devote substantial time to compliance

with our public company responsibilities and corporate governance practices.

| ● | Our

internal control over financial reporting may not meet the standards required by Section

404 of the Sarbanes-Oxley Act, and failure to achieve and maintain effective internal control

over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act, could

have a material adverse effect on our business and share price. |

Corporate

Information

We

were incorporated in the State of Nevada on December 15, 2011 as Flux Technologies, Corp. On January 22, 2013 we changed our name to

Brazil Minerals, Inc., and on September 26, 2022 an amendment to our articles of incorporation was filed with the Nevada Secretary of

State changing our name to Atlas Lithium Corporation. Our principal executive offices outside of the U.S. are located at Rua Bahia, 2463

– Suite 205, Belo Horizonte, Minas Gerais, Brazil, 30.160-012 and our telephone number is +55-11-3956-1109. Our corporate website

address is www.atlas-lithium.com. Information contained on, or that can be accessed through, our website is not incorporated by

reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Controlled

Company

Marc

Fogassa, our Chief Executive Officer and Chairman, by way of his ownership of our common stock and 100% of our Series A Convertible Preferred

Stock, par value $0.001 per share (the “Series A Preferred”) currently controls approximately 66.20% of the voting power

of our capital stock and will continue to control a majority of the voting power of our capital stock upon completion of this offering,

and we believe that we are a “controlled company,” as such term is defined under the Nasdaq Listing Rules. Accordingly, the

voting rights of purchasers of our common stock or preferred stock will be qualified by the right of the holder of our Series A Preferred

to exercise 51% of the voting power of our capital stock.

The

Securities That May Be Offered

We

may offer or sell common stock and preferred stock in one or more offerings. The aggregate offering price of the securities we sell pursuant

to this prospectus will not exceed $75,000,000. Each time securities are offered with this prospectus, we will provide a prospectus supplement

that will describe the specific amounts, prices and terms of the securities being offered and the net proceeds we expect to receive from

that sale.

The

securities may be sold to or through underwriters, broker-dealers or agents or directly to purchasers or as otherwise set forth in the

section of this prospectus captioned “Plan of Distribution.” Each prospectus supplement will set forth the names of any underwriters,

broker-dealers, agents or other entities involved in the sale of securities described in that prospectus supplement and any applicable

fee, commission or discount arrangements with them.

Common

Stock

We

currently have authorized 200,000,000 shares of common stock, par value $0.001 per share. As of August 25, 2023, 10,662,060 shares of

common stock were issued and outstanding. We may offer shares of our common stock either alone or underlying other registered securities

convertible into or exercisable for our common stock.

Preferred

Stock

We

currently have authorized 10,000,000 shares of preferred stock, par value $0.001, one share of which is issued and outstanding. As of

August 25, 2023, one share of our preferred stock has been designated as Series A Convertible Preferred Stock, which one share of Series

A Convertible Preferred Stock is issued and outstanding, and 1,000,000 shares of our preferred stock have been designated as Series D

Convertible Preferred Stock, of which zero shares are issued and outstanding.

The

rights, preferences, privileges, and restrictions granted to or imposed upon any series of preferred stock that we offer and sell under

this prospectus and applicable prospectus supplements will be set forth in a certificate of designation relating to the series. We will

incorporate by reference into the registration statement of which this prospectus is a part the form of any certificate of designation

that describes the terms of the series of preferred stock we are offering before the issuance of shares of that series of preferred stock.

You should read any prospectus supplement and any free writing prospectus that we may authorize to be provided to you related to the

series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable

series of preferred stock.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. The prospectus supplement applicable to each offering of our securities

will contain a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our

securities, you should carefully consider the specific factors discussed under the section in the applicable prospectus supplement captioned

“Risk Factors,” together with all of the other information contained or incorporated by reference in the prospectus supplement

or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed

under “Part I. Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk

Factors” in our most recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference,

as may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our operations.

FORWARD-LOOKING

STATEMENTS

This

prospectus contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements

of historical fact contained in this prospectus are forward-looking statements, including without limitation, statements regarding current

expectations, as of the date of this prospectus, our future results of operations and financial position, our ability to effectively

process our minerals and achieve commercial grade at scale; risks and hazards inherent in the mining business (including risks inherent

in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically

related conditions); our ability to derive any financial success from the Memorandum of Understanding entered into with Mitsui & Co.,

Ltd. in December 2022; uncertainty about our ability to obtain required capital to execute our business plan; our ability to hire

and retain required personnel; changes in the market prices of lithium and lithium products and demand for such products; the uncertainties

inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays

related to our projects; uncertainties inherent in the estimation of lithium resources. These statements involve known and unknown risks,

uncertainties and other important factors that may cause actual results, performance, or achievements to differ materially from any future

results, performance or achievement expressed or implied by these forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”,

or “continue” or the negative of these terms or other similar expressions. Factors that could cause future results to materially

differ from the recent results or those projected in forward-looking statements include, but are not limited to: unprofitable efforts

resulting not only from the failure to discover mineral deposits, but also from finding mineral deposits that, though present, are insufficient

in quantity and quality to return a profit from production; market fluctuations; government regulations, including regulations relating

to royalties, allowable production, importing and exporting of minerals, and environmental protection; competition; the loss of services

of key personnel; unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision

of infrastructure as well as general economic conditions.

The

forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current

expectations and projections about future events and financial trends that we believe may affect our business, financial condition and

results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of important

factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described

under the sections in titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” in our annual and quarterly filings made with the SEC. Therefore, you should not place undue reliance

on these forward-looking statements.

You

should read this prospectus and the documents that we reference in this prospectus completely and with the understanding that our actual

future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary

statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events, changed circumstances or otherwise.

USE

OF PROCEEDS

Except

as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend

to use the net proceeds from the sale of the securities offered under this prospectus for general corporate purposes, including the development

and commercialization of our products, general and administrative expenses, and working capital and capital expenditures. We have not

determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad

discretion in the allocation of the net proceeds and investors will be relying on the judgment of our management regarding the application

of the proceeds of any sale of the securities.

Each

time we offer securities under this prospectus, we will describe the intended use of the net proceeds from that offering in the applicable

prospectus supplement. The actual amount of net proceeds we spend on a particular use will depend on many factors, including, our future

capital expenditures, the amount of cash required by our operations, and our future revenue growth, if any. Therefore, we will retain

broad discretion in the use of the net proceeds.

DESCRIPTION

OF CAPITAL STOCK

Common

Stock

Holders

of our common stock are entitled to such dividends as our Board may declare from time to time out of legally available funds, subject

to the preferential rights of the holders of any shares of our preferred stock that are outstanding or that we may issue in the future.

Currently, we do not pay any dividends on our common stock. Each holder of our common stock is entitled to one vote per share held on

all matters submitted to a vote of our shareholders. Unless otherwise provided by our articles of incorporation, our bylaws, the Nevada