UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 18, 2024

ALPHAVEST

ACQUISITION CORP

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41574 |

|

N/A |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

205

W. 37th Street

New

York, NY 10018

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code 203-998-5540

Not

Applicable

(Former name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Units,

each consisting of one ordinary share and one right |

|

ATMVU |

|

The

Nasdaq Stock Market LLC |

| Ordinary

Shares, par value $0.0001 per share |

|

ATMV |

|

The

Nasdaq Stock Market LLC |

| Rights,

each right entitling the holder thereof to one-tenth of one ordinary share |

|

ATMVR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement |

As

approved by the shareholders of AlphaVest Acquisition Corp (the “Company” or “AlphaVest”),

by ordinary resolution, at an extraordinary general meeting of shareholders held on December 18, 2024 (the “Meeting”),

on December 18, 2024, the Company entered into an amendment (the “Trust Agreement Amendment”) to the Investment

Management Trust Agreement, dated as of December 19, 2022, with Continental Stock Transfer & Trust Company. Pursuant to the Trust

Agreement Amendment, the Company has extended the date by which it has to complete a business combination from December 22, 2024 (the

“Termination Date”) up to (9) times, with each extension comprised of one month, from the Termination Date,

or extended date, as applicable, to September 22, 2025 by providing five days’ advance notice to the trustee prior to the applicable

Termination Date, or extended date, and depositing into the trust account (the “Trust Account”) $55,000 for

each monthly extension until September 22, 2025 (assuming a business combination has not occurred) in exchange for a non-interest bearing,

unsecured promissory note payable upon the consummation of a business combination (the “Trust Agreement Amendment Proposal”).

The

foregoing description of the Trust Agreement Amendment is a summary only and is qualified in its entirety by reference to the full text

of the Trust Agreement Amendment which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant. |

The disclosure

related to the non-interest bearing, unsecured promissory note, the form of which is included in the Trust Agreement Amendment contained

in Item 1.01 is incorporated by reference to this Item 2.03.

| Item

5.03. |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

As

approved by the Company’s shareholders at the Meeting on December 18, 2024, by special resolution, the Company amended the Company’s

Second Amended and Restated Memorandum and Articles of Association (the “Existing Charter”) on December 18,

2024, by adopting the Amendment to the Existing Charter in the form set forth in Annex A to the definitive proxy statement, as supplemented,

filed with the Securities and Exchange Commission on December 3, 2024 (the “Articles Amendment”), reflecting

(i) the extension of the date by which the Company must consummate a business combination from the Termination Date up to nine (9) extensions

comprised of one month each (each an “Extension”) up to September 22, 2025 (i.e., for a period of time ending

up to 33 months after the consummation of its initial public offering for a total of nine (9) months after the Termination Date (assuming

a business combination has not occurred) and (ii) the deletion of the limitation that the Company shall not redeem public shares to the

extent that such redemption would cause the Company’s net tangible assets to be less than $5,000,001.

The

foregoing description of the Articles Amendment is a summary only and is qualified in its entirety by reference to the full text of the

Second Amended and Restated Memorandum and Articles of Association, as amended by the Articles Amendment, which is attached hereto

as Exhibit 3.1 and incorporated by reference herein.

| Item

5.07. |

Submission

of Matters to a Vote of Security Holders. |

On

December 18, 2024, the Company held the Meeting. At the Meeting, the Company’s shareholders approved the following proposals: (1)

a proposal to approve by special resolution the Articles Amendment (the “Articles Amendment Proposal”), (2)

a proposal to approve by ordinary resolution the Trust Agreement Amendment Proposal, and (3) a proposal to adjourn the Meeting to a later

date if, based upon the tabulated vote at the time of the Meeting, there are not sufficient votes to approve the Articles Amendment Proposal

and the Trust Agreement Amendment Proposal (the “Adjournment Proposal”).

The

Articles Amendment Proposal, the Trust Agreement Amendment Proposal and the Adjournment Proposal presented at the Meeting were approved

by the Company’s shareholders. The final voting results for each Proposal are set forth below.

Proposal

No. 1 – Articles Amendment Proposal

The

Articles Amendment Proposal was approved by special resolution of the Company’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

| 5,618,154 |

|

959,534 |

|

0 |

Proposal

No. 2 – Trust Agreement Amendment Proposal

The

Trust Agreement Amendment Proposal was approved by ordinary resolution of the Company’s shareholders, and received the following

votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

| 5,618,154 |

|

959,534 |

|

0 |

Proposal

No. 3 – Adjournment Proposal

The

Adjournment Proposal was approved by ordinary resolution of the Company’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

| 5,341,160 |

|

1,236,528 |

|

0 |

Although

Proposal 3 was approved, adjournment of the Meeting was not necessary or appropriate because the Company’s shareholders

approved Proposal No. 1 to approve the Articles Amendment Proposal and Proposal No.2 to approve the Trust Agreement Amendment Proposal.

In

connection with the shareholders’ vote at the Meeting, 3,151,473 ordinary shares of the Company exercised their right to redeem

such shares (the “Redemption”) for a pro rata portion of the funds held in the Trust Account. As a result,

approximately $35,956,676 (approximately $11.41 per share) will be removed from the Trust Account to pay such holders and approximately

$17,962,587 will remain in the Trust Account. Following the aforementioned redemptions, AlphaVest will have 3,854,856 ordinary shares

outstanding.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ALPHAVEST

ACQUISITION CORP |

| |

|

| |

By:

|

/s/

Yong (David) Yan |

| |

Name: |

Yong

(David) Yan |

| |

Title: |

Chief

Executive Officer |

Dated:

December 19, 2024

Exhibit

3.1

AMENDMENT

TO THE

THE

SECOND AMENDED AND RESTATED MEMORANDUM AND ARTICLES

OF

ASSOCIATION

OF

ALPHAVEST

ACQUISITION CORP

18

December 2024

RESOLVED,

as a special resolution, that:

| (i) |

Article

37.6 of the Second Amended and Restated Memorandum and Articles of Association of the Company as adopted by special resolution passed

on December 21, 2023 (the Existing Memorandum and Articles) be deleted in its entirety and replaced as follows: |

| 37.6 |

Any

Member holding Public Shares who is not a Founder, Officer or director may, contemporaneously with any vote on a Business Combination,

elect to have their Public Shares redeemed for cash (the IPO Redemption), provided that no such Member acting together with

any Affiliate of his or any other person with whom he is acting in concert or as a partnership, syndicate, or other group for the

purposes of acquiring, holding, or disposing of Shares may exercise this redemption right with respect to more than 15% of the Public

Shares without the Company’s prior consent, and provided further that any holder that holds Public Shares beneficially through

a nominee must identify itself to the Company in connection with any redemption election in order to validly redeem such Public Shares.

In connection with any vote held to approve a proposed Business Combination, holders of Public Shares seeking to exercise their redemption

rights will be required to either tender their certificates (if any) to the Company’s transfer agent or to deliver their shares

to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, at

the holder’s option, in each case up to two business days prior to the initially scheduled vote on the proposal to approve

a Business Combination. If so demanded, the Company shall pay any such redeeming Member, regardless of whether he is voting for or

against such proposed Business Combination or abstains from voting, a per-Share redemption price payable in cash, equal to the aggregate

amount then on deposit in the Trust Account calculated as of two business days prior to the consummation of a Business Combination,

including interest earned on the Trust Account not previously released to the Company to pay its income taxes, if any, divided by

the number of Public Shares then in issue (such redemption price being referred to herein as the Redemption Price), provided

that the Company shall not repurchase Public Shares in an amount that would cause the Company’s stock to be considered a “penny

stock”. |

| (ii) |

Article

37.2 of the Existing Memorandum and Articles be deleted in its entirety and replaced as follows: |

| 37.2 |

Prior

to the consummation of any Business Combination, the Company shall submit such Business Combination to its Members for approval.

In no event will the Company consummate the Tender Offer under Article 37 if such redemptions would cause the Company’s Shares

to be considered a “penny stock” (as defined in the Exchange Act). |

| (iii) |

Article

37.8 of the Existing Memorandum and Articles be deleted in its entirety and replaced as follows: |

| 37.8 |

The

Company has until December 22, 2024 (the Termination Date) to consummate a Business Combination, provided however that if

the Board of Directors anticipates that the Company may not be able to consummate a Business Combination by December 22, 2024, the

Company may, by Resolution of Directors, at the request of the Sponsor, extend the period of time to consummate a Business Combination

up to nine (9) times, each by an additional one (1) month, for a total of up to nine (9) months from the Termination Date (i.e. for

a total of up to thirty-three (33) months after the consummation of the IPO) to complete a Business Combination), subject to the

Sponsor depositing additional funds into the Trust Account upon five days advance notice prior to the applicable deadline in accordance

with terms as set out in the Trust Agreement and referred to in the Registration Statement. In the event that the Company does not

consummate a Business Combination by the Termination Date (or nine (9) months after the Termination Date (subject in the latter case

to valid extensions having been made in each case) or such later time as the Members of the Company may approve in accordance with

these Articles, the Company shall: |

| (a) |

cease

all operations except for the purpose of winding up; |

| (b) |

as

promptly as reasonably possible but not more than ten business days thereafter, redeem the Public Shares, at a per-Share price, payable

in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the funds held in the Trust

Account and not previously released to the Company to pay income taxes, if any (less up to US$100,000 of interest to pay dissolution

expenses), divided by the number of the Public Shares then in issue, which redemption will completely extinguish public Members’

rights as Members (including the right to receive further liquidation distributions, if any); and |

| (c) |

as

promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining Members and the

directors, dissolve and liquidate, subject

in each case, to its obligations under Cayman Islands law to provide for claims of creditors and in all cases subject to the other requirements

of Applicable Law. If the Company shall wind up for any other reason prior to the consummation of a Business Combination, the Company

shall, as promptly as reasonably possible but not more than ten business days thereafter, follow the foregoing procedures set out in

this Article with respect to the liquidation of the Trust Account, subject to its obligations under Cayman Islands law to provide for

claims of creditors and in all cases subject to the other requirements of Applicable Law. |

| (iv) |

Article

37.9 of the Existing Memorandum and Articles be deleted in its entirety and replaced as follows: |

| |

|

| 37.9 |

In

the event that any amendment is made to these Articles: |

| (a) |

that

would modify the substance or timing of the Company’s obligation to provide holders of Public Shares the right to: |

| (i) |

have

their shares redeemed or repurchased in connection with a Business Combination pursuant to Articles 37.2(b) or 37.6; or |

| (ii) |

redeem

100% of the Public Shares if the Company has not consummated an initial Business Combination by the Termination Date (or nine (9)

months after the Termination Date pursuant to Article 37.8 (subject in the latter case to valid extensions having been made in each

case); or |

| (b) |

with

respect to any other provision relating to the rights of holders of Public Shares, each holder of Public Shares who is not a Founder,

Officer or director shall be provided with the opportunity to redeem their Public Shares upon the approval of any such amendment

(an Amendment Redemption) at a per-Share price, payable in cash, equal to the aggregate amount then on deposit in the Trust

Account, including interest earned on the funds held in the Trust Account not previously released to the Company to pay income taxes,

if any, divided by the number of Public Shares then in issue. |

| (v) |

Article

37.11 of the Existing Memorandum and Articles be deleted in its entirety and replaced as follows: |

| |

|

| 37.11 |

After

the issue of Public Shares (including pursuant to the Over-Allotment Option), and prior to the consummation of a Business Combination,

the directors shall not issue additional Shares or any other securities that would entitle the holders thereof to: |

| (a) |

receive

funds from the Trust Account; or |

| (b) |

vote

as a class with the Public Shares: |

| (i) |

on

a Business Combination or on any other proposal presented to Members prior to or in connection with the completion of a Business

Combination; or |

| (ii) |

to

approve an amendment to these Articles to: |

| (A) |

extend

the time the Company has to consummate a Business Combination beyond the Termination Date or nine (9) months after the Termination

Date pursuant to Article 37.8 (subject in the latter case to valid extensions having been made in each case); or |

| (B) |

amend

the foregoing provisions of these Articles, unless (in connection with any such amendment), each holder of Public Shares who is not

a Founder, Officer or director shall be provided with the opportunity to redeem their Public Shares in accordance with these Articles. |

Exhibit

10.1

AMENDMENT

TO

THE

INVESTMENT

MANAGEMENT TRUST AGREEMENT

This

Amendment No. 2 (this “Amendment”), dated as of December 18, 2024, to the Original Trust Agreement (as defined below) is

made by and between AlphaVest Acquisition Corp (the “Company”) and Continental Stock Transfer & Trust Company, as trustee

(“Trustee”). All terms used but not defined herein shall have the meanings assigned to them in the Original Trust Agreement.

WHEREAS,

the Company and the Trustee entered into an Investment Management Trust Agreement dated as of December 19, 2022 (the “Original

Trust Agreement”);

WHEREAS,

the Company and the Trustee entered into the first amendment to the Investment Management Trust Agreement dated as of December 21, 2023

(together with the Original Trust Agreement, the “Trust Agreement”);

WHEREAS,

Section 1(i) of the Trust Agreement sets forth the terms that govern the liquidation of the Company’s trust account (the “Trust

Account”) under the circumstances described therein;

WHEREAS,

at an extraordinary general meeting of the Company held on December 18, 2024 (the “Special Meeting”), the Company’s

shareholders approved (i) a proposal to amend AlphaVest’s Second Amended and Restated Memorandum and Articles of Association, dated

as of December 19, 2022 to extend the date by which the Company must consummate a business combination up to nine (9) times from December

22, 2024 to September 22, 2025 (the “Termination Date”), with each extension comprised of one (1) month (i.e., for a period

of time ending up to 33 months after the consummation of its initial public offering for a total of nine (9) months after the Termination

Date (assuming a business combination has not occurred); and (ii) a proposal to amend the Trust Agreement, to permit the Company to extend

the Termination Date up to nine (9) times for an additional one (1) month each time from the Termination Date to September 22, 2025 by

providing five days’ advance notice to the Trustee prior to the applicable Termination Date and depositing into the Trust Account

$55,000 per one-month extension two (2) days prior to such Extension.

NOW

THEREFORE, IT IS AGREED:

| |

1. |

Section

1(i) of the Trust Agreement is hereby amended and restated in its entirety as follows: |

“(i)

Commence liquidation of the Trust Account only after and promptly after (x) receipt of, and only in accordance with the terms of, a letter

from the Company (“Termination Letter”) in a form substantially similar to that attached hereto as either Exhibit

A or Exhibit B, as applicable, signed on behalf of the Company by its Chief Executive Officer, Chief Financial Officer, President,

Executive Vice President, Vice President, Secretary or Chairwoman of the board of directors of the Company (the “Board”)

or other authorized officer of the Company, and, in the case of Exhibit A, acknowledged and agreed to by the Representative, and

complete the liquidation of the Trust Account and distribute the Property in the Trust Account, including interest earned on the funds

held in the Trust Account (which interest shall be net of taxes payable and, in the case of Exhibit B, up to $100,000 of interest

to pay dissolution expenses), only as directed in the Termination Letter and the other documents referred to therein, or (y) upon the

date which is the later of (1) 33 months after the closing of the Offering or (2) such later date as may be approved by the Company’s

shareholders in accordance with the Company’s amended and restated memorandum and articles of association if a Termination Letter

has not been received by the Trustee prior to such date, in which case the Trust Account shall be liquidated in accordance with the procedures

set forth in the Termination Letter attached as Exhibit B and the Property in the Trust Account, including interest earned on

the funds held in the Trust Account (which interest shall be net of taxes payable and up to $100,000 of interest to pay dissolution expenses),

shall be distributed to the Public Shareholders of record as of such date. It is acknowledged and agreed there should be no reduction

in the principal amount per share initially deposited in the Trust Account;”

| |

2. |

Exhibit E of the Original Trust Agreement is hereby amended and restated

in its entirety as follows: |

EXHIBIT

E

[Letterhead

of Company]

[Insert

date]

Continental

Stock Transfer & Trust Company

1

State Street, 30th Floor

New

York, NY 10004

Attn:

[●]

Re:

Trust Account No. [ ] Extension Letter

Dear

[●]:

Pursuant

to Section 1(m) of the Investment Management Trust Agreement between AlphaVest Acquisition Corp (“Company”) and Continental

Stock Transfer & Trust Company, dated as of December 19, 2022 (“Trust Agreement”), this is to advise you that

the Company is extending the time available to consummate a Business Combination for an additional one (1) month, from ________ to ________

(the “Extension”).

This

Extension Letter shall serve as the notice required with respect to Extension prior to the Applicable Deadline. Capitalized words used

herein and not otherwise defined shall have the meanings ascribed to them in the Trust Agreement.

In

accordance with the terms of the Trust Agreement, we hereby authorize you to deposit $55,000 per one-month extension two (2) days prior

to such Extension which will be wired to you, into the Trust Account investments upon receipt.

This

is the [first/second/third/fourth/fifth/sixth/seventh/eighth/ninth] of up to nine Extension Letters.

Very

truly yours,

| |

AlphaVest

Acquisition Corp |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

cc:

EarlyBirdCapital, Inc.

| |

2. |

All

other provisions of the Original Trust Agreement shall remain unaffected by the terms hereof. |

| |

|

|

| |

3. |

This

Amendment may be signed in any number of counterparts, each of which shall be an original and all of which shall be deemed to be

one and the same instrument, with the same effect as if the signatures thereto and hereto were upon the same instrument. A facsimile

signature or electronic signature shall be deemed to be an original signature for purposes of this Amendment. |

| |

|

|

| |

4. |

This

Amendment is intended to be in full compliance with the requirements for an Amendment to the Trust Agreement as required by Section

6(c) of the Trust Agreement, and every defect in fulfilling such requirements for an effective amendment to the Trust Agreement is

hereby ratified, intentionally waived and relinquished by all parties hereto. |

| |

|

|

| |

5. |

This

Amendment shall be governed by and construed and enforced in accordance with the laws of the State of New York, without giving effect

to conflicts of law principles that would result in the application of the substantive laws of another jurisdiction. |

[signature

page follows]

IN

WITNESS WHEREOF, the parties have duly executed this Amendment to the Investment Management Trust Agreement as of the date first written

above.

| CONTINENTAL

STOCK TRANSFER & TRUST COMPANY, as Trustee |

|

| |

|

|

| By: |

/s/ Francis Wolf |

|

| Name:

|

Francis

Wolf |

|

| Title: |

Vice

President |

|

| ALPHAVEST

ACQUISITION CORP |

|

| |

|

|

| By: |

/s/

David Yan |

|

| Name:

|

David

Yan |

|

| Title:

|

Chief

Executive Officer |

|

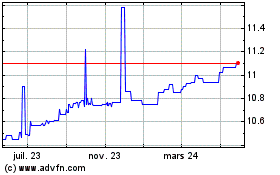

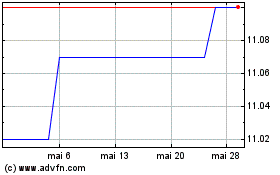

AlphaVest Acquisition (NASDAQ:ATMVU)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

AlphaVest Acquisition (NASDAQ:ATMVU)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024