- 168 consecutive quarters of profitability

- Net interest margin improved from 2.66% in the third quarter

of 2024 to 2.72% in the fourth quarter of 2024

- Efficiency ratio declined to 56.4% for the fourth quarter of

2024

- Continued strong performance in fee-based

businesses

- Completed acquisition of Crest Retirement Advisors LLC based

in Dublin, OH

- Wealth management assets under management increased to $4.2

billion at December 31, 2024 including the Crest addition

Farmers National Banc Corp. (“Farmers” or the “Company”)

(NASDAQ: FMNB) today reported net income of $14.4 million, or $0.38

per diluted share, for the quarter ended December 31, 2024,

compared to $14.6 million, or $0.39 per diluted share, for the

quarter ended December 31, 2023. Net income for the fourth quarter

of 2024 included certain pretax items. Excluding these items

(non-GAAP), net income for the fourth quarter of 2024 was $14.5

million, or $0.39 per diluted share.

Kevin J. Helmick, President and CEO, stated “Our team has done

an outstanding job navigating a dynamic economic and interest rate

cycle in 2024. We are proud to provide our Ohio and Pennsylvania

communities with diverse, personalized, and market-leading

financial solutions and are excited about expanding our fee

business into the greater Columbus market with the acquisition of

Crest Retirement. Our fourth quarter performance highlights the

positive momentum underway in our business and we continue to

believe Farmers is very well positioned to grow earnings in

2025.”

Balance Sheet

Total assets were $5.12 billion at December 31, 2024, compared

to $5.24 billion at September 30, 2024, and $5.08 billion at

December 31, 2023. Loans declined slightly to $3.27 billion at

December 31, 2024 from $3.28 billion at September 30, 2024, but

increased $70.2 million from December 31, 2023. The decrease from

the prior quarter was primarily due to declines in residential real

estate and indirect lending, while the increase from December 31,

2023, was driven by increased commercial real estate balances along

with increased HELOC balances.

Securities available for sale totaled $1.27 billion at December

31, 2024, compared to $1.29 billion at September 30, 2024 and $1.30

billion at December 31, 2023. Gross unrealized losses on the

portfolio totaled $244.1 million at December 31, 2024 compared to

$189.4 million at September 30, 2024 and $217.1 million at December

31, 2023. Interest rates rose sharply in the fourth quarter of 2024

from the third quarter of 2024 driving the increase in gross

unrealized losses during the quarter. Volatility in the bond market

is expected to continue in 2025.

Total deposits declined to $4.27 billion at December 31, 2024

from $4.36 billion at September 30, 2024, but increased $89.4

million from $4.18 billion at December 31, 2023. The increase since

December 31, 2023, was driven by the acquisition of $75.0 million

in brokered deposits in the third quarter of 2024 and growth in

customer deposits (non-brokered) of $14.4 million. The decline

since September 30, 2024 was driven by the seasonal decline in

public funds which totaled approximately $113.2 million.

Total stockholders’ equity declined to $406.0 million at

December 31, 2024, compared to $439.7 million at September 30, 2024

and $404.4 million at December 31, 2023. The decrease from

September 30, 2024 was primarily driven by an increase in the

unrealized losses on investment securities. The increase since

December 31, 2023 was primarily driven by an increase in retained

earnings offset by an increase in unrealized losses on investment

securities.

Credit Quality

Non-performing loans increased to $22.8 million at December 31,

2024, compared to $19.1 million at September 30, 2024 and $15.1

million at December 31, 2023. The increase since September 30, 2024

was primarily driven by the addition of a single commercial credit

with a balance of $2.6 million. The increase from December 31, 2023

resulted from the addition of a single commercial real estate

credit with a remaining balance of $8.1 million and the $2.6

million commercial credit mentioned above offset by declines in the

balances of other non-performing loans. The Company expects that a

single non-performing loan with a balance of $1.2 million will be

paid off in the first quarter of 2025 and two other non-performing

loans totaling $1.6 million will be sold in the first quarter of

2025 at par. Non-performing loans to total loans were 0.70% at

December 31, 2024 compared to 0.58% at September 30, 2024 and 0.47%

at December 31, 2023. The Company’s loans which were 30-89 days

delinquent were $13.0 million at December 31, 2024, or 0.40% of

total loans. This is down from $15.6 million at September 30, 2024

and $16.7 million at December 31, 2023.

The Company’s provision for credit losses and unfunded

commitments totaled $295,000 for the quarter ended December 31,

2024, compared to $286,000 for the quarter ended December 31, 2023.

Annualized net charge-offs as a percentage of average loans were

0.08% for the fourth quarter of 2024, compared to 0.10% for the

fourth quarter of 2023. The allowance for credit losses to total

loans was 1.10% at December 31, 2024, compared to 1.10% at

September 30 2024, and 1.08% at December 31, 2023.

Net Interest Income

The Company recorded $32.7 million of net interest income in the

fourth quarter of 2024 compared to $32.8 million in the fourth

quarter of 2023. Average interest earning assets increased to $4.91

billion in the fourth quarter of 2024 compared to $4.82 billion for

the fourth quarter of 2023. The increase was driven by an increase

in average loan balances of $82.2 million and an increase in

federal funds sold and other earning assets of $39.1 million. These

increases were offset by a decline in the average balance of

investment securities. The net interest margin declined to 2.72% in

the fourth quarter of 2024 compared to 2.78% in the fourth quarter

of 2023 but was up sharply from the 2.66% margin reported in the

third quarter of 2024. The year-over-year decline in net interest

margin was due to higher funding costs outstripping the increase in

yields on earning assets. The current rate cutting cycle by the

Federal Reserve that began in September of 2024 had a significant

impact on funding costs in the fourth quarter of 2024 and was the

primary reason for the net interest margin increasing during the

fourth quarter. The yield on interest bearing liabilities declined

from 2.84% in the third quarter of 2024 to 2.72% in the fourth

quarter of 2024. The Company expects its net interest margin will

continue to expand in 2025 as funding costs reprice lower.

Excluding acquisition marks and PPP interest, non-GAAP, the

Company’s net interest margin was 2.56% in the fourth quarter of

2024 compared to 2.48% in the third quarter of 2024 and 2.58% in

the fourth quarter of 2023.

Noninterest Income

Noninterest income declined from $12.2 million in the fourth

quarter of 2023 to $11.4 million in the fourth quarter of 2024

primarily due to a decline of $1.0 million in the net gain on sale

of loans. During the fourth quarter of 2023, the Company recognized

a gain on the sale of commercial loans totaling $915,000. No gain

was recognized on commercial loan sales in 2024.

Income from service charges on deposit accounts increased

$213,000 to $1.9 million for the fourth quarter of 2024 compared to

$1.7 million for the fourth quarter in 2023. The Company undertook

a review of all service charges in late 2023 and early 2024 and

implemented fee increases across deposit product lines in the

second quarter of 2024. Trust fees in the fourth quarter of 2024

increased by $318,000 to $2.7 million compared to $2.4 million in

the fourth quarter of 2023. The increase was due to continued

growth in the business unit. Insurance agency commissions declined

to $1.3 million in the fourth quarter of 2024 from $1.5 million in

the fourth quarter of 2023. The fourth quarter of 2023 included an

accrual adjustment that did not occur in 2024. Retirement plan

consulting fees increased from $631,000 in the fourth quarter of

2023 to $719,000 in the fourth quarter of 2024. The increase was

due to increased business in the division. The acquisition of Crest

Retirement Advisors LLC in late December of 2024 is expected to

further bolster this unit in 2025. Other mortgage banking fee

income increased to $285,000 during the fourth quarter of 2024 from

$139,000 in the fourth quarter of 2023. The increase was driven by

a recovery on the Company’s mortgage servicing rights in the fourth

quarter of 2024. Debit card income grew to $2.2 million in the

fourth quarter of 2024 from $1.7 million in the fourth quarter of

2023 as better volumes were realized in the current period. Other

noninterest income declined to $856,000 in the fourth quarter of

2024 from $1.6 million in the fourth quarter of 2023. The Company

recorded $1.1 million in SBIC income in the fourth quarter of 2023

compared to $527,000 in the fourth quarter of 2024. SBIC

investments continue to generate solid returns but income can

fluctuate wildly quarter to quarter.

Noninterest Expense

Noninterest expense declined to $26.2 million for the fourth

quarter of 2024 compared to $27.0 million for the fourth quarter of

2023. Salaries and employee benefits were $14.4 million for the

fourth quarter of 2024 compared to $14.9 million for the fourth

quarter of 2023. The decrease was primarily driven by lower

healthcare expenses. FDIC and state and local taxes were lower by

$465,000 in the fourth quarter of 2024 compared to the fourth

quarter of 2023. The decrease was primarily driven by a decrease in

FDIC premiums. Professional fees declined to $785,000 for the

period ended December 31, 2024, compared to $1.0 million for the

period ended December 31, 2023 due to lower legal and consulting

expense in the fourth quarter of 2024. The fourth quarter of 2024

included $92,000 of merger related charges for the Crest

acquisition compared to $452,000 of merger related charges in the

fourth quarter of 2023 for the Emclaire acquisition. Advertising

expense declined to $191,000 in the fourth quarter of 2024 compared

to $414,000 in the fourth quarter of 2023. The decline was due to

an over accrual for advertising expense that was not recognized.

Intangible amortization increased to $914,000 in the fourth quarter

of 2024 from $578,000 for the fourth quarter of 2023. This increase

was driven by acceleration in the amortization from the Cortland

acquisition. Other noninterest expense increased to $3.5 million in

the fourth quarter of 2024 up from the $3.2 million recognized in

the fourth quarter of 2023. The increase was primarily due to

$208,000 of operational losses during the fourth quarter of 2024

compared to operational recoveries of $102,000 in the fourth

quarter of 2024.

Liquidity

At December 31, 2024, the Company had access to an additional

$549.7 million of FHLB borrowing capacity, along with $414.0

million in available for sale securities that are available for

additional pledging. The Company’s loan to deposit ratio was 76.6%

at December 31, 2024 while the Company’s average deposit balance

per account (excluding collateralized deposits) was $25,188 for the

same period.

About Farmers National Banc Corp.

Founded in 1887, Farmers National Banc Corp. is a diversified

financial services company headquartered in Canfield, Ohio, with

$5.1 billion in banking assets. Farmers National Banc Corp.’s

wholly-owned subsidiaries are comprised of The Farmers National

Bank of Canfield, a full-service national bank engaged in

commercial and retail banking with 62 banking locations in

Mahoning, Trumbull, Columbiana, Portage, Stark, Wayne, Medina,

Geauga and Cuyahoga Counties in Ohio and Beaver, Butler, Allegheny,

Jefferson, Clarion, Venango, Clearfield, Mercer, Elk and Crawford

Counties in Pennsylvania, and Farmers Trust Company, which operates

five trust offices and offers services in the same geographic

markets. Total wealth management assets under care at December 31,

2024 are $4.2 billion. Farmers National Insurance, LLC, a

wholly-owned subsidiary of The Farmers National Bank of Canfield,

offers a variety of insurance products.

Non-GAAP Disclosure

This press release includes disclosures of Farmers’ tangible

common equity ratio, return on average tangible assets, return on

average tangible equity, net income excluding costs related to

acquisition activities and certain items, return on average assets

excluding merger costs and certain items, return on average equity

excluding merger costs and certain items, net interest margin

excluding acquisition marks and related accretion and PPP interest

and fees and efficiency ratio less certain items, which are

financial measures not prepared in accordance with generally

accepted accounting principles in the United States (GAAP). A

non-GAAP financial measure is a numerical measure of historical or

future financial performance, financial position or cash flows that

excludes or includes amounts that are required to be disclosed by

GAAP. Farmers believes that these non-GAAP financial measures

provide both management and investors a more complete understanding

of the underlying operational results and trends and Farmers’

marketplace performance. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for the numbers prepared in accordance with GAAP. The

reconciliations of non-GAAP financial measures to their GAAP

equivalents are included in the tables following Consolidated

Financial Highlights below.

Cautionary Statements Regarding Forward-Looking

Statements

We make statements in this news release and our related investor

conference call, and we may from time to time make other

statements, that are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including

statements about Farmers’ financial condition, results of

operations, asset quality trends and profitability. Forward-looking

statements are not historical facts but instead represent only

management’s current expectations and forecasts regarding future

events, many of which, by their nature, are inherently uncertain

and outside of Farmers’ control. Forward-looking statements are

preceded by terms such as “expects,” “believes,” “anticipates,”

“intends” and similar expressions, as well as any statements

related to future expectations of performance or conditional verbs,

such as “will,” “would,” “should,” “could” or “may.” Farmers’

actual results and financial condition may differ, possibly

materially, from the anticipated results and financial condition

indicated in these forward-looking statements. Factors that could

cause Farmers’ actual results to differ materially from those

described in certain forward-looking statements include significant

changes in near-term local, regional, and U.S. economic conditions

including those resulting from continued high rates of inflation,

tightening monetary policy of the Board of Governors of the Federal

Reserve, and possibility of a recession; and the other factors

contained in Farmers’ Annual Report on Form 10-K for the year ended

December 31, 2023 and subsequent Quarterly Reports on Form 10-Q

filed with the Securities and Exchange Commission (SEC) and

available on Farmers’ website (www.farmersbankgroup.com) and on the

SEC’s website (www.sec.gov). Forward-looking statements are not

guarantees of future performance and should not be relied upon as

representing management’s views as of any subsequent date. Farmers

does not undertake any obligation to update the forward-looking

statements to reflect the impact of circumstances or events that

may arise after the date of the forward-looking statements.

Farmers National Banc Corp. and Subsidiaries Consolidated

Financial Highlights (Amounts in thousands, except per share

results) Unaudited

Consolidated Statements of

Income For the Three Months Ended For the Twelve

Months Ended Dec. 31, Sept. 30, June 30,

March 31, Dec. 31, Dec. 31, Dec. 31,

Percent

2024

2024

2024

2024

2023

2024

2023

Change Total interest income

$

57,909

$

57,923

$

56,846

$

55,054

$

55,069

$

227,732

$

213,335

6.7

%

Total interest expense

25,170

26,047

24,780

23,367

22,239

99,364

75,549

31.5

%

Net interest income

32,739

31,876

32,066

31,687

32,830

128,368

137,786

-6.8

%

Provision (credit) for credit losses

295

7,008

1,112

(449

)

286

7,966

9,153

-13.0

%

Noninterest income

11,413

12,340

9,606

8,357

12,156

41,716

41,861

-0.3

%

Acquisition related costs

92

0

0

0

452

92

5,475

-98.3

%

Other expense

26,082

27,075

26,403

27,039

26,520

106,599

106,321

0.3

%

Income before income taxes

17,683

10,133

14,157

13,454

17,728

55,427

58,698

-5.6

%

Income taxes

3,292

1,598

2,374

2,214

3,151

9,478

8,766

8.1

%

Net income

$

14,391

$

8,535

$

11,783

$

11,240

$

14,577

$

45,949

$

49,932

-8.0

%

Average diluted shares outstanding

37,616

37,567

37,487

37,479

37,426

37,512

37,498

Basic earnings per share

0.38

0.23

0.32

0.30

0.39

1.23

1.34

Diluted earnings per share

0.38

0.23

0.31

0.30

0.39

1.22

1.33

Cash dividends per share

0.17

0.17

0.17

0.17

0.17

0.68

0.68

Performance Ratios Net Interest Margin (Annualized)

2.72

%

2.66

%

2.71

%

2.70

%

2.78

%

2.69

%

2.91

%

Efficiency Ratio (Tax equivalent basis)

56.42

%

58.47

%

60.80

%

61.54

%

57.84

%

59.26

%

59.24

%

Return on Average Assets (Annualized)

1.12

%

0.66

%

0.93

%

0.90

%

1.17

%

0.90

%

0.99

%

Return on Average Equity (Annualized)

13.43

%

8.18

%

12.15

%

11.47

%

17.98

%

11.28

%

13.97

%

Other Performance Ratios (Non-GAAP) Return on Average

Tangible Assets

1.16

%

0.69

%

0.97

%

0.93

%

1.22

%

0.94

%

1.03

%

Return on Average Tangible Equity

23.95

%

14.94

%

23.74

%

21.88

%

43.77

%

21.05

%

30.23

%

Consolidated Statements of Financial Condition

Dec. 31, Sept. 30, June 30, March 31,

Dec. 31,

2024

2024

2024

2024

2023

Assets Cash and cash equivalents

$

85,738

$

189,136

$

180,987

$

148,630

$

103,658

Debt securities available for sale

1,266,553

1,293,350

1,246,730

1,270,149

1,299,701

Other investments

45,405

33,617

37,594

34,619

35,311

Loans held for sale

5,005

2,852

2,577

1,854

3,711

Loans

3,268,346

3,280,517

3,237,369

3,181,318

3,198,127

Less allowance for credit losses

35,863

36,186

33,991

33,159

34,440

Net Loans

3,232,483

3,244,331

3,203,378

3,148,159

3,163,687

Other assets

483,740

473,217

485,587

476,599

472,282

Total Assets

$

5,118,924

$

5,236,503

$

5,156,853

$

5,080,010

$

5,078,350

Liabilities and Stockholders' Equity Deposits

Noninterest-bearing

$

965,507

$

969,682

$

968,693

$

977,475

$

1,026,630

Interest-bearing

3,226,321

3,317,223

3,237,142

3,220,650

3,150,756

Brokered time deposits

74,951

74,932

0

0

0

Total deposits

4,266,779

4,361,837

4,205,835

4,198,125

4,177,386

Other interest-bearing liabilities

391,150

371,038

494,890

433,777

443,663

Other liabilities

54,967

63,950

59,434

51,082

52,886

Total liabilities

4,712,896

4,796,825

4,760,159

4,682,984

4,673,935

Stockholders' Equity

406,028

439,678

396,694

397,026

404,415

Total Liabilities and Stockholders' Equity

$

5,118,924

$

5,236,503

$

5,156,853

$

5,080,010

$

5,078,350

Period-end shares outstanding

37,586

37,574

37,575

37,546

37,503

Book value per share

$

10.80

$

11.70

$

10.56

$

10.57

$

10.78

Tangible book value per share (Non-GAAP)*

5.80

6.69

5.53

5.52

5.71

* Tangible book value per share is calculated by dividing

tangible common equity by outstanding shares

For the

Three Months Ended For the Twelve MonthsEnded Dec.

31, Sept. 30, June 30, March 31, Dec.

31, Dec. 31, Dec. 31, Capital and

Liquidity

2024

2024

2024

2024

2023

2024

2023

Common Equity Tier 1 Capital Ratio (a)

11.26

%

10.91

%

10.94

%

10.88

%

10.61

%

Total Risk Based Capital Ratio (a)

14.67

%

14.34

%

14.42

%

14.38

%

14.06

%

Tier 1 Risk Based Capital Ratio (a)

11.75

%

11.39

%

11.43

%

11.37

%

11.10

%

Tier 1 Leverage Ratio (a)

8.37

%

8.20

%

8.26

%

8.19

%

8.02

%

Equity to Asset Ratio

7.93

%

8.40

%

7.69

%

7.82

%

7.96

%

Tangible Common Equity Ratio (b)

4.42

%

4.98

%

4.18

%

4.24

%

4.38

%

Net Loans to Assets

63.15

%

61.96

%

62.12

%

61.97

%

62.30

%

Loans to Deposits

76.60

%

75.21

%

76.97

%

75.78

%

76.56

%

Asset Quality Non-performing loans

$

22,818

$

19,076

$

12,870

$

11,951

$

15,063

Non-performing assets

22,903

19,137

12,975

12,215

15,321

Loans 30 - 89 days delinquent

13,032

15,562

18,546

14,069

16,705

Charged-off loans

928

5,116

661

1,282

972

7,987

2,937

Recoveries

293

504

98

271

172

1,166

681

Net Charge-offs

635

4,612

563

1,011

800

6,821

2,256

Annualized Net Charge-offs to Average Net Loans

0.08

%

0.58

%

0.07

%

0.13

%

0.10

%

0.21

%

0.07

%

Allowance for Credit Losses to Total Loans

1.10

%

1.10

%

1.05

%

1.04

%

1.08

%

Non-performing Loans to Total Loans

0.70

%

0.58

%

0.40

%

0.38

%

0.47

%

Loans 30 - 89 Days Delinquent to Total Loans

0.40

%

0.47

%

0.57

%

0.44

%

0.52

%

Allowance to Non-performing Loans

157.17

%

189.69

%

264.11

%

277.46

%

228.64

%

Non-performing Assets to Total Assets

0.45

%

0.37

%

0.25

%

0.24

%

0.30

%

(a) December 31, 2024 ratio is estimated (b) This is a

non-GAAP financial measure. A reconciliation to GAAP is shown below

For the Three Months Ended Dec. 31, Sept.

30, June 30, March 31, Dec. 31, End of

Period Loan Balances

2024

2024

2024

2024

2023

Commercial real estate

$

1,382,714

$

1,372,374

$

1,348,675

$

1,339,372

$

1,335,806

Commercial

349,966

358,247

343,694

335,747

346,354

Residential real estate

845,081

852,444

849,561

836,252

843,697

HELOC

158,014

155,967

151,511

143,696

142,441

Consumer

259,954

269,231

268,606

256,846

259,784

Agricultural loans

262,392

261,773

265,035

260,425

261,288

Total, excluding net deferred loan costs

$

3,258,121

$

3,270,036

$

3,227,082

$

3,172,338

$

3,189,370

For the Three Months Ended Dec. 31,

Sept. 30, June 30, March 31, Dec. 31,

End of Period Customer Deposit Balances

2024

2024

2024

2024

2023

Noninterest-bearing demand

$

965,507

$

969,682

$

968,693

$

977,474

$

1,026,630

Interest-bearing demand

1,366,255

1,453,288

1,380,266

1,381,383

1,362,609

Money market

682,558

676,664

677,058

646,308

593,975

Savings

414,796

418,771

433,166

452,949

468,890

Certificate of deposit

762,712

768,500

746,652

740,011

725,282

Total customer deposits

$

4,191,828

$

4,286,905

$

4,205,835

$

4,198,125

$

4,177,386

For the Three Months Ended For the Twelve

MonthsEnded Dec. 31, Sept. 30, June 30,

March 31, Dec. 31, Dec. 31, Dec. 31,

Noninterest Income

2024

2024

2024

2024

2023

2024

2023

Service charges on deposit accounts

$

1,890

$

1,992

$

1,846

$

1,583

$

1,677

$

7,311

$

6,322

Bank owned life insurance income, including death benefits

613

688

652

707

617

2,659

2,442

Trust fees

2,700

2,544

2,345

2,510

2,382

10,099

9,047

Insurance agency commissions

1,273

1,416

1,255

1,528

1,540

5,472

5,444

Security gains (losses), including fair value changes for equity

securities

10

(403

)

(124

)

(2,120

)

19

(2,638

)

(471

)

Retirement plan consulting fees

719

677

623

617

631

2,637

2,467

Investment commissions

621

476

478

432

589

2,007

1,978

Net gains on sale of loans

282

506

417

297

1,280

1,502

2,391

Other mortgage banking fee income (loss), net

285

(168

)

192

125

139

435

711

Debit card and EFT fees

2,164

1,993

1,760

1,567

1,697

7,484

7,059

Other noninterest income

856

2,619

162

1,111

1,585

4,748

4,471

Total Noninterest Income

$

11,413

$

12,340

$

9,606

$

8,357

$

12,156

$

41,716

$

41,861

For the Three Months Ended For the Twelve

MonthsEnded Dec. 31, Sept. 30, June 30,

March 31, Dec. 31, Dec. 31, Dec. 31,

Noninterest Expense

2024

2024

2024

2024

2023

2024

2023

Salaries and employee benefits

$

14,424

$

14,874

$

14,558

$

15,069

$

14,871

$

58,925

$

57,374

Occupancy and equipment

4,075

3,968

3,815

3,730

3,896

15,588

15,434

FDIC insurance and state and local taxes

1,019

1,480

1,185

1,345

1,484

5,029

5,848

Professional fees

785

1,084

1,194

1,254

1,004

4,317

4,351

Merger related costs

92

0

0

0

452

92

5,475

Advertising

191

435

445

431

414

1,503

1,793

Intangible amortization

914

629

630

688

578

2,861

3,434

Core processing charges

1,201

1,186

1,099

1,135

1,057

4,622

4,639

Other noninterest expenses

3,471

3,419

3,477

3,387

3,216

13,754

13,448

Total Noninterest Expense

$

26,172

$

27,075

$

26,403

$

27,039

$

26,972

$

106,691

$

111,796

Average Balance Sheets and Related Yields and Rates (Dollar

Amounts in Thousands)

Three Months Ended Three

Months Ended December 31, 2024 December 31, 2023

AVERAGE YIELD/ AVERAGE YIELD/ BALANCE INTEREST (1) RATE (1) BALANCE

INTEREST (1) RATE (1) EARNING ASSETS Loans (2)

$3,270,825

$47,286

5.78%

$3,188,581

$44,868

5.63%

Taxable securities

1,119,391

6,850

2.45

1,113,107

6,536

2.35

Tax-exempt securities (2)

379,342

2,991

3.15

411,860

3,235

3.14

Other investments

38,855

420

4.32

37,625

529

5.62

Federal funds sold and other

104,289

987

3.79

65,236

564

3.46

Total earning assets

4,912,702

58,534

4.77

4,816,409

55,732

4.63

Nonearning assets

247,199

163,905

Total assets

$5,159,901

$4,980,314

INTEREST-BEARING LIABILITIES Time deposits

$765,674

$7,463

3.90%

$712,485

$6,291

3.53%

Brokered time deposits

74,941

822

4.39

96,634

1,315

5.44

Savings deposits

1,091,547

4,056

1.49

1,068,465

2,918

1.09

Demand deposits - interest bearing

1,419,048

8,731

2.46

1,393,252

7,922

2.27

Total interest-bearing deposits

3,351,210

21,072

2.52

3,270,836

18,446

2.26

Short term borrowings

260,369

3,105

4.77

206,826

2,749

5.32

Long term borrowings

86,096

993

4.61

88,609

1,043

4.71

Total borrowed funds

346,465

4,098

4.73

295,435

3,792

5.13

Total interest-bearing liabilities

3,697,675

25,170

2.72

3,566,271

22,238

2.49

NONINTEREST-BEARING LIABILITIES AND STOCKHOLDERS' EQUITY

Demand deposits - noninterest bearing

973,788

1,035,405

Other liabilities

59,792

54,306

Stockholders' equity

428,646

324,332

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$5,159,901

$4,980,314

Net interest income and interest rate spread

$33,364

2.05%

$33,494

2.14%

Net interest margin

2.72%

2.78%

(1) Interest and yields are calculated on a tax-equivalent

basis where applicable. (2) For 2024, adjustments of $94 thousand

and $530 thousand, respectively, were made to tax equate income on

tax exempt loans and tax exempt securities. For 2023, adjustments

of $86 thousand and $577 thousand, respectively, were made to tax

equate income on tax exempt loans and tax exempt securities. These

adjustments were based on a marginal federal income tax rate of

21%, less disallowances.

Twelve Months Ended

Twelve Months Ended December 31, 2024 December 31,

2023 AVERAGE YIELD/ AVERAGE YIELD/ BALANCE INTEREST (1) RATE

(1) BALANCE INTEREST (1) RATE (1) EARNING ASSETS Loans (2)

$3,227,384

$186,032

5.76%

$3,155,858

$172,161

5.46%

Taxable securities

1,110,905

26,838

2.42

1,143,547

26,231

2.29

Tax-exempt securities (2)

386,643

12,165

3.15

419,557

13,283

3.17

Other investments

35,402

1,450

4.10

39,559

1,986

5.02

Federal funds sold and other

96,288

3,727

3.87

74,950

2,476

3.30

Total earning assets

4,856,622

230,212

4.74

4,833,471

216,137

4.47

Nonearning assets

234,297

205,683

Total assets

$5,090,919

$5,039,154

INTEREST-BEARING LIABILITIES Time deposits

$745,945

$29,329

3.93%

$654,717

$19,462

2.97%

Brokered time deposits

25,389

1,108

4.36

132,895

6,204

4.67

Savings deposits

1,095,470

16,144

1.47

1,113,561

9,899

0.89

Demand deposits - interest bearing

1,396,193

34,588

2.48

1,415,425

27,541

1.95

Total interest-bearing deposits

3,262,997

81,169

2.49

3,316,598

63,106

1.90

Short term borrowings

293,488

14,105

4.81

160,964

8,357

5.19

Long term borrowings

87,749

4,090

4.66

88,439

4,086

4.62

Total borrowed funds

381,237

18,195

4.77

249,403

12,443

4.99

Total interest-bearing liabilities

3,644,234

99,364

2.73

3,566,001

75,549

2.12

NONINTEREST-BEARING LIABILITIES AND STOCKHOLDERS' EQUITY

Demand deposits - noninterest bearing

$981,115

$1,065,389

Other liabilities

58,134

50,302

Stockholders' equity

407,436

357,462

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$5,090,919

$5,039,154

Net interest income and interest rate spread

$130,848

2.01%

$140,588

2.35%

Net interest margin

2.69%

2.91%

(1) Interest and yields are calculated on a tax-equivalent

basis where applicable. (2) For 2024, adjustments of $322 thousand

and $2.2 million, respectively, were made to tax equate income on

tax exempt loans and tax exempt securities. For 2023, adjustments

of $268 thousand and $1.9 million, respectively, were made to tax

equate income on tax exempt loans and tax exempt securities. These

adjustments were based on a marginal federal income tax rate of

21%, less disallowances.

Reconciliation of Total Assets

to Tangible Assets For the Three Months Ended For the

Twelve MonthsEnded Dec. 31, Sept. 30, June

30, March 31, Dec. 31, Dec. 31, Dec.

31,

2024

2024

2024

2024

2023

2024

2023

Total Assets

$

5,118,924

$

5,236,503

$

5,156,853

$

5,080,010

$

5,078,350

$

5,118,924

$

5,078,350

Less Goodwill and other intangibles

188,200

188,340

188,970

189,599

190,288

188,200

190,288

Tangible Assets

$

4,930,724

$

5,048,163

$

4,967,883

$

4,890,411

$

4,888,062

$

4,930,724

$

4,888,062

Average Assets

5,159,901

5,134,062

5,044,516

5,023,966

4,980,314

5,090,919

5,039,154

Less average Goodwill and other intangibles

188,256

188,755

189,382

190,040

191,108

189,105

192,306

Average Tangible Assets

$

4,971,645

$

4,945,307

$

4,855,134

$

4,833,926

$

4,789,206

$

4,901,814

$

4,846,848

Reconciliation of Common Stockholders' Equity to

Tangible Common Equity For the Three Months Ended For

the Twelve MonthsEnded Dec. 31, Sept. 30, June

30, March 31, Dec. 31, Dec. 31, Dec.

31,

2024

2024

2024

2024

2023

2024

2023

Stockholders' Equity

$

406,028

$

439,678

$

396,694

$

397,026

$

404,415

$

406,028

$

404,415

Less Goodwill and other intangibles

188,200

188,340

188,970

189,599

190,288

188,200

190,288

Tangible Common Equity

$

217,828

$

251,338

$

207,724

$

207,427

$

214,127

$

217,828

$

214,127

Average Stockholders' Equity

428,646

417,327

387,881

395,549

324,332

407,436

357,462

Less average Goodwill and other intangibles

188,256

188,755

189,382

190,040

191,108

189,105

192,306

Average Tangible Common Equity

$

240,390

$

228,572

$

198,499

$

205,509

$

133,224

$

218,331

$

165,156

Reconciliation of Net Income, Less Merger and

Certain Items For the Three Months Ended For the

Twelve MonthsEnded Dec. 31, Sept. 30, June

30, March 31, Dec. 31, Dec. 31, Dec.

31,

2024

2024

2024

2024

2023

2024

2023

Net income

$

14,391

$

8,535

$

11,783

$

11,240

$

14,577

$

45,949

$

49,932

Acquisition related costs - after tax

82

0

0

0

358

82

4,395

Acquisition related provision - after tax

0

0

0

0

0

0

6,077

Employee severence - after tax

0

0

0

0

798

0

798

Lawsuit settlement expense - after tax

0

0

0

0

0

0

620

Net (gain) on loan sale - after tax

0

0

0

0

(723

)

0

(723

)

Net loss (gain) on asset/security sales - after tax

70

(32

)

407

1,675

171

2,120

698

Net income - Adjusted

$

14,543

$

8,503

$

12,190

$

12,915

$

15,181

$

48,151

$

61,797

Diluted EPS excluding merger and certain items

$

0.39

$

0.23

$

0.33

$

0.34

$

0.41

$

1.28

$

1.65

Return on Average Assets excluding merger and certain items

(Annualized)

1.13

%

0.66

%

0.97

%

1.03

%

1.22

%

0.95

%

1.23

%

Return on Average Equity excluding merger and certain items

(Annualized)

13.57

%

8.15

%

12.57

%

13.06

%

18.72

%

11.82

%

17.29

%

Return on Average Tangible Equity excluding acquisition costs and

certain items (Annualized)

24.20

%

14.88

%

24.56

%

25.14

%

45.58

%

22.05

%

37.42

%

Efficiency ratio excluding certain items

For the Three Months Ended For the Twelve MonthsEnded

Dec. 31, Sept. 30, June 30, March 31,

Dec. 31, Dec. 31, Dec. 31,

2024

2024

2024

2024

2023

2024

2023

Net interest income, tax equated

$

33,364

$

32,483

$

32,661

$

32,341

$

33,494

$

130,848

$

140,588

Noninterest income

11,413

12,340

9,606

8,357

12,156

41,716

41,861

Net (gain) on loan sale

0

0

0

0

(915

)

0

(915

)

Net loss (gain) on asset/security sales

89

(41

)

515

2,120

217

2,684

883

Net interest income and noninterest income adjusted

44,866

44,782

42,782

42,818

44,952

175,248

182,417

Noninterest expense less intangible amortization

25,260

26,446

25,773

26,351

26,394

103,830

108,361

Legal settlement expense

0

0

0

0

0

0

785

Employee severence

0

0

0

0

1,010

0

1,010

Acquisition related costs

92

0

0

0

452

92

5,475

Noninterest expense adjusted

25,168

26,446

25,773

26,351

24,932

103,738

101,091

Efficiency ratio excluding certain items

56.10

%

59.05

%

60.24

%

61.54

%

55.46

%

59.19

%

55.42

%

Net interest margin excluding acquisition marks

and PPP interest and fees For the Three Months Ended

For the Twelve MonthsEnded Dec. 31, Sept. 30,

June 30, March 31, Dec. 31, Dec. 31,

Dec. 31,

2024

2024

2024

2024

2023

2024

2023

Net interest income, tax equated

$

33,364

$

32,483

$

32,661

$

32,341

$

33,494

$

130,848

$

140,588

Acquisition marks

1,953

2,123

2,391

2,370

2,475

8,837

10,946

PPP interest and fees

0

0

1

1

1

2

5

Adjusted and annualized net interest income

125,644

121,440

121,076

119,880

124,072

122,009

129,637

Average earning assets

4,912,702

4,890,344

4,825,532

4,796,922

4,816,409

4,856,622

4,833,471

Less PPP average balances

112

118

171

213

229

153

254

Adjusted average earning assets

4,912,590

4,890,226

4,825,361

4,796,709

4,816,180

4,856,469

4,833,217

Net interest margin excluding marks and PPP interest and fees

2.56

%

2.48

%

2.51

%

2.50

%

2.58

%

2.51

%

2.68

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127544471/en/

Kevin J. Helmick, President and CEO 20 South Broad Street, P.O.

Box 555 Canfield, OH 44406 330.533.3341 Email:

exec@farmersbankgroup.com

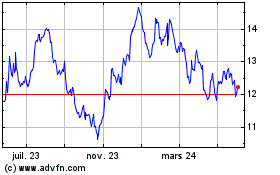

Farmers National Banc (NASDAQ:FMNB)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

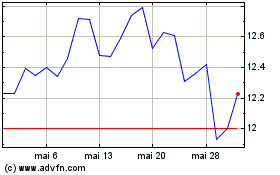

Farmers National Banc (NASDAQ:FMNB)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025