Reminds Shareholders of Similar Fact Pattern in

2021

Fully Expects Board to Move Forward with

Special Meeting After it Confirmed Receipt of Updated Material From

Shareholders

Provides Update on Engagement and Legal Due

Diligence

Buyer consortium (“the consortium”) led by Recco Control

Technology Pte. Ltd. (“Recco Control Technology”) and Dazheng Group

(Hong Kong) Investment Holdings Company Limited (“Dazheng Group”)

today issued a statement regarding Hollysys Automation Technologies

Ltd.’s (NASDAQ: HOLI) (“Hollysys”) update on its ongoing sale

process and disclosure of a supposed management-backed buyout

proposal. Members of the consortium also include TFI Asset

Management Limited, and Great Wall Capital Co., Ltd, who have

entered into a memorandum of strategic cooperation with Recco

Control Technology and Dazheng Group in connection with the

proposed acquisition of Hollysys.

The Consortium remains extremely interested in acquiring

Hollysys and is motivated to move swiftly through negotiations and

due diligence with Hollysys. The Consortium encourages an

independent and transparent sale process. In that regard, the

Consortium believes shareholders should be aware of the full

context regarding the ongoing sale process and relevant history

regarding unsolicited takeover proposals at Hollysys.

Management Buyout – An Empty Gesture

Already Used

Dating back to August 2021, Hollysys has publicly announced

multiple take private offers from its management team. Ironically,

the only two times Hollysys management has expressed apparent

interest in taking the company private have coincided with the time

periods when the Hollysys Board was evaluating proposals from

unaffiliated bidders:

- On August 24th, 2021, Hollysys announced it received a proposal

to acquire the Company for US$23.00 per share in cash from a group

that included an outside investor and the Company’s founder and

co-chief operating officers. Notably, nothing ever materialized

with this proposal, despite it being at a sizable premium at the

time. This either calls into question the Board’s willingness to

assess attractive takeover offers, or calls into question the

management group’s sincerity or its ability to secure credible

financing to back its takeover offers.

- Today, Hollysys has announced it received a proposal to acquire

the Company for US$25.00 per share in cash from the same co-chief

operating officers. At this time, this group does not consist of

any outside investors or reference any funding source, meaning this

proposal seems to be an even emptier gesture than the 2021

management takeover proposal. This announcement also draws

attention away from the fact that nearly a third of shareholders

have requested the Board to call a special meeting.

Shareholders Have Properly Resubmitted

Request to Call Special Meeting

An important aspect of any sale process is for a Board of

Directors or independent Special Committee to solicit and

internalize the views of its shareholders. This sale process is no

different. The Consortium believes it is the best course of action

for the Hollysys Board and Special Committee to listen to the views

of its shareholders. An independent Board elected by shareholders

is the best way to ensure unaffiliated shareholders’ interests are

protected during this sale process.

In its announcement today, the Board has essentially confirmed

that certain shareholders owning nearly a third of shares

outstanding have provided updated materials with the proper record

date – a date that was set by the Hollysys Board. Now that

shareholders have provided the Board with updated materials, the

Consortium fully expects the Board to fulfill its fiduciary and

legal obligation to convene a special meeting without delay.

Update on Engagement and Legal Due

Diligence

As part of an independent and transparent sale process, the

Consortium seeks to proactively provide an update to shareholders

on recent engagement between the Consortium and the Special

Committee. At this time, despite Hollysys announcing the formal

sale process over three weeks ago, the Consortium has still been

unable to access any due diligence materials from Hollysys.

The Consortium is seeking to enter good faith due diligence and

negotiations regarding its US$25 per share all-cash proposal with

the Special Committee directly. The Consortium resubmitted it’s

offer two months ago, but still the Company has not allowed the

Consortium to enter into the due diligence process yet.

The Consortium is seeking to reserve the right to make competing

offers to any bids received by the Special Committee and, only if

deemed necessary, take a proposal directly to Hollysys

shareholders. The Consortium firmly believes that this element of a

sale process – the element of fair, transparent, and open

competition amongst potential bidders – is crucial to ensuring

value is maximized for the shareholders of Hollysys.

Slowing down the legal due diligence process is contrary to the

Board’s stated goal of “conducting an expedited process to solicit

and review serious and compelling offers”. Instead, it extends the

length of the sale process. Additionally, the Consortium notes that

any engagement with regards to the sale process should not

interfere with the Board’s ability to convene a special meeting in

line with the requests of Hollysys shareholders. It is important in

this regard for all shareholders to remember that the Company has

never held any general meeting of its shareholders since it became

a public company.

Consortium Motivated to Engage

Constructively Regarding Attractive All-Cash Offer

The Consortium reiterates its interest in acquiring Hollysys and

motivation to enter due diligence and further negotiations with the

Special Committee. The Consortium is confident its all-cash offer

of US$25 per share is at an attractive premium and would see

significant support from Hollysys shareholders. The Consortium

looks forward to conducting due diligence and engaging

constructively with the Special Committee.

Advisors

UBS Investment Bank is serving as financial advisor to the

consortium and Sullivan & Cromwell LLP and DLA Piper LLP are

serving as U.S. legal advisors to the consortium. Conyers Dill

& Pearman is advising the consortium on BVI law.

About Recco

Recco Control Technology Pte. Ltd is a Singapore-incorporated

investor in the automation industry and was founded by Mr. Ke Lei,

a veteran in the automation industry in China.

About Dazheng

Dazheng Group (Hong Kong) Investment Holdings Company Limited is

a Hong Kong-incorporated financial investor founded by

sophisticated entrepreneurs and investment banking

professionals.

About TFI

TFI Asset Management Limited is a Hong Kong-based asset

management firm which is an indirect subsidiary of Tianfeng

Securities Co., Ltd. (also known as TF Securities, SH: 601162).

About Great Wall Capital

Great Wall Capital Co., Ltd. is a Beijing-based private equity

investment firm under China Great Wall Asset Management Co., Ltd.,

one of the four Chinese state-owned asset management companies.

Cautionary Statement Regarding Forward-looking

Statements

This press release contains forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements are statements that are not

historical facts. These statements include projections and

estimates and their underlying assumptions, statements regarding

plans, objectives, intentions and expectations with respect to

future financial results, events, operations, services, product

development and potential, and statements regarding future

performance. Forward-looking statements are generally identified by

the words “believe,” “envision,” “will,” “expect,” “anticipate,”

“intend,” “estimate,” “plan” and similar expressions. Although the

management of Recco, Dazheng, TFI and Great Wall Capital believe

that the expectations reflected in such forward-looking statements

are reasonable, investors are cautioned that forward-looking

information and statements are subject to various risks and

uncertainties, many of which are difficult to predict and generally

beyond the control of any of Recco, Dazheng, TFI and Great Wall

Capital, that could cause actual results and developments to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. Other than as required

by applicable law, none of Recco, Dazheng, TFI and Great Wall

Capital undertakes any obligation to update or revise any

forward-looking information or statements. The information and

opinions contained herein do not take into account the particular

investment objectives, financial situation, or needs of any

recipient and should not be construed as an offer to buy or sell or

the solicitation of an offer to buy or sell the securities

mentioned or an invitation to the public. Under no circumstances

shall the information contained herein or the opinions expressed

herein constitute a personal recommendation to anyone.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231024336313/en/

Mr. Ke LEI E-Mail: ke.lei@reccogroup.com

Investor Contact Okapi Partners LLC Chuck Garske / Bruce

Goldfarb +1 (212) 297-0720 info@okapipartners.com

Media Contact FTI Consulting

recco.dazheng.consortium@fticonsulting.com

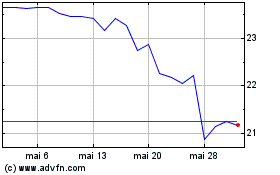

Hollysys Automation Tech... (NASDAQ:HOLI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Hollysys Automation Tech... (NASDAQ:HOLI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025