Medallion Bank (the “Bank”) recently released its 4Q24 earnings.

Medallion Financial Corp (“MFIN” or the “Company”) will be

releasing consolidated earnings shortly, along with important

updates on a possible SEC settlement involving fraud and touting

charges against Andrew Murstein, President and Board Member of

MFIN, that has cost shareholders an estimated $8 million in legal

fees to defend.

The Bank represents approximately 95%i of MFIN’s consolidated

revenues. On almost all metrics, financial performance is down.

Frustratingly, MFIN has lagged in areas that ZimCal Asset

Management LLC (“ZimCal”, “We”, “Our”) predicted almost 16 months

ago.

ZimCal remains one of MFIN’s largest investors and has been

invested for 4 years. Had MFIN and its board listened to us in 2023

and taken proactive steps to mitigate risk, enhance its operations,

resolve the SEC complaint and numerous other detailed suggestions

ZimCal offered to increase enterprise value, we believe MFIN would

be trading at a substantial premium to its current

value.

Against the backdrop of healthy consumer data, and booming stock

and credit markets, we ask MFIN stockholders - are you happy with

such glaring underperformance or do you think the Company can do

better? Are you satisfied with MFIN’s President being sued by the

SEC for alleged fraud and yet earning tens of millions in

compensation even as MFIN’s stock is down, and its unadjusted and

core returns are at their worst in over 4 yearsii?

We will withhold our full analysis until MFIN’s earnings are

released, but we note a few key points about the Bank’s earnings -

divided into positives and negatives.

Full analysis with graphs can be accessed

here.

POSITIVES IN 4Q24 MEDALLION BANK EARNINGS

1. Asset growth is flatIf this is driven by a

reluctance on the Bank’s part to lower underwriting standards

simply to increase growth this is positive. Chasing returns by

recklessly opening the credit box would be a mistake. If this is

driven by constraints on lending because the Bank’s capital ratio

of 15.6% is just above the 15% mandatory minimum, then this is

problematic. For similar reasons, we support a robust loan

origination and sale or securitization strategy to augment interest

income, but we think the 1Q25 loan sales are problematic if they

are driven by an effort to juice near-term earnings and avoid

breaching the Bank’s minimum leverage ratio.

2. Allowance for credit losses (ACL) has been increased

to cover future losses, driven by Recreation ACLACL for

Recreation loans specifically increased to 5.00% at 4Q24 from 4.31%

at 4Q23. Since 2024, charge-offs have also increased, indicating an

effort by the Bank to better recognize the threats of future

charge-offs and provision accordingly. We felt that the Bank

under-provisioned in the last crisis to artificially boost

earnings; we are supportive of their decision to avoid doing so

now.

NEGATIVES IN 4Q24 MEDALLION BANK EARNINGS

1. Consumer credit quality continues to decline, driven

by RecreationRecreation loans made up ~65% of total loans

at 4Q24. Subprime Recreation was an estimated 35% of Recreation

loans or ~$550 million at 4Q24. This borrower demographic will be

more stressed by higher for longer rates, inflation and a

potentially softening labor market. Despite the Bank’s increased

loss allowances, we remain concerned about quarterly consumer

charge-offs, which are now at their highest since 2010 and well

above the most recent peak in 2019 (Figure 1 below or

here). We are concerned that this could get worse.

We have beaten our head against the wall for 16 months urging MFIN

to proactively mitigate these risks (see letter here from October

2023) but without success.

2. Net Interest Margin (NIM) continues to be pressured

by expensive funding costsQuarterly NIM declined to 8.28%

at 4Q24 from 8.75% a year ago at 4Q23. This is the lowest quarterly

NIM since 2019 when we started tracking this for the Bank. This was

mainly driven by higher funding costs and an inability to

materially raise loan yields. As predicted, the Bank’s cost of

funds (almost entirely CD deposits) continued to trend higher and

reached an estimated 3.95% at 4Q24iii. We have noted that a Bank CD

portfolio with a 1.8 year weighted average maturity and 36% of CDs

maturing in 2024 as of 12/31/23iv, would have rates that would lag

benchmark rate increases on the way up (boosting NIM) but would

also lag benchmarks on the way down (hurting NIM). We have tracked

brokered CD rates through one of the largest platforms since

September 2024 and note that while short-term CD (less than 1-year)

rates are down, 1, 2 and 5-year CD rates are UP

since 09/30/24 and 12/31/24. (See Figure 2 below or

here). This shows that NIM pressure will

persist.

3. Earnings have declined YoY despite being boosted by a

“noisy” allowance releaseCore net earnings available to

common stockholders were $10.3 million in 4Q24 after eliminating

$3.9 million in provision reversals and $900,000 in non-core Taxi

Medallion recoveries (adjustment to earnings is after taxes).

Unadjusted earnings were $14 million. If the Bank were a standalone

entity, this would be mediocre but manageable. But when you pile on

high holding company expenses and debt service, this is

unsustainable. The Bank paid a dividend of $6MM to the holding

company in 4Q24 leaving only $4.3MM in core earnings to boost

capital levels and fund future loan growth. As we noted in our last

earnings commentary, quarterly earnings for MFIN in 2024 are the

lowest they have been on an unadjusted and adjusted basis since the

last stages of the Taxi Medallion implosion in 2020. Bank ROAA and

core ROAA (excluding non-core Taxi Medallion recoveries) we

calculated at 2.50% and 1.65% respectively at 4Q24. This core ROAA

is dangerously low for a consumer lender and leaves little room for

error. Lowered earnings are one of the reasons the Bank’s parent

company (MFIN) had to borrow $10 million in 2024 to pay $9.5

million in dividends and share buybacks through 3Q24. The Bank

continues to “carry” the weight of its parent, which is reliant on

the Bank for upstreamed dividends to fund its expenses and pay its

expensive debt.

We believe that Medallion Bank (and MFIN) have tremendous upside

but only with the right Board and leadership. We encourage

investors to review www.restoretheshine.com for details on the 2024

proxy contest to replace 2 incumbent directors, where, despite

insider ownership that gave MFIN a 44% leadv, ZimCal still earned

22% of stockholder votes with over 1 in 4

stockholders voting against MFIN’s compensation plan. We

believe that MFIN’s board of directors (the “Board”) has shown weak

governance and is beholden to the Murstein family rather than to

all stockholdersvi. We also believe that MFIN’s management team is

overpaid and must be improvedvii. We believe that it is ludicrous

to pay MFIN’s President $6.5 million or 19% of MFIN’s core

earningsviii at FYE23, significantly higher than all but one of

MFIN’s self-selected peersix and comparable to the highest paid

Wall Street hedge fund managers. Until we see positive

changes, we will work to hold MFIN’s Board and management team

accountable and believe the potential for the Company is

extraordinary.

Visit www.restoretheshine.com for more information or read our 5

Steps to Improvement.ZimCal will issue ongoing press releases with

updates and details on its plan to “Restore the Shine” to Medallion

Financial Corp.

About ZimCal Asset Management, LLCZimCal Asset

Management is an alternative investment firm focused primarily on

niche, illiquid and complex credit investment opportunities.

ZimCal Asset Management partners with both healthy and

distressed borrowers or issuers and provides customized solutions

that meet their unique needs and circumstances. Over the last 15

years, the founder of ZimCal Asset Management has developed a

specialization investing in FDIC-insured institutions and has

partnered with over 120 bank lenders through investments on both

sides of the balance sheet.

ZimCal usually works in collaboration with bank leadership teams

if required, but on very rare occasions, must insert itself more

forcefully if it believes that leadership is underwhelming and

threatens to undermine stakeholder investments. ZimCal prides

itself on performing extensive, rigorous financial analysis and

research to fully understand the risks of any investment.

Important Information and

DisclaimerZimCal Asset Management, LLC, and its affiliates

BIMIZCI Fund, LLC, Warnke Investments LLC and Stephen Hodges

(collectively, “ZimCal” or “we”), are, directly or indirectly,

owners of securities of Medallion Financial Corp. (the “Company”).

ZimCal currently has combined investment exposure of $15,604,000

million to the Company, comprised of $15 million par value of Trust

Preferred Securities (backed by the Company’s issued debt), and

76,122 shares of the Company. We are not currently engaged in any

solicitation of proxies from stockholders of the Company. ZimCal

intends to monitor the performance and corporate governance of the

Company, as well as the actions of the Company’s management and

board. As ZimCal deems necessary, ZimCal will assert its

stockholder rights.

Except as otherwise set forth herein, the views

expressed reflect ZimCal’s opinions and are based on publicly

available information with respect to the Company. We recognize

that there may be confidential information in the possession of the

Company that could lead it or others to disagree with our

conclusions. ZimCal reserves the right to change any of its

opinions expressed herein at any time as it deems appropriate and

disclaims any obligation to notify the market or any other party of

any such change, except as required by law. We disclaim any

obligation to update the information or opinions contained

herein.

The information herein is being provided merely

as information and is not intended to be, nor should it be

construed as, an offer to sell or a solicitation of an offer to buy

any security.

Some of the information herein may contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that depend on future

events are forward-looking. The words “anticipate,” “believe,”

“expect,” “potential,” “could,” “opportunity,” “estimate,” “plan,”

and similar expressions are generally intended to identify

forward-looking statements. There can be no assurance that any

forward-looking statements will prove to be accurate and therefore

actual results could differ materially from those set forth in,

contemplated by, or underlying these forward-looking statements. In

light of the significant uncertainties inherent in forward-looking

statements, the inclusion of such information should not be

regarded as a representation as to future results or that the

objectives and strategic initiatives expressed or implied by such

forward-looking statements will be achieved.

i Source: MFIN 10K/Qsii See www.restoretheshine.com and MFIN

10K/10Qsiii Source: Medallion Bank 4Q24 8K. This is based on the

Bank’s annual average CD rate of 3.57% at 4Q24.iv Source; MFIN 2024

10Kv Source: MFIN DEF14A. Insider ownership derived from recent

disclosures by MFIN. Insiders owned ~7 million shares and total

votes cast were 16 million. We have assumed that all insiders voted

and voted against ZimCal. See here for full SEC filing on

stockholder meeting voting results.vi See www.restoretheshine.com

for why we believe the Board is not fulfilling its fiduciary

responsibilities to stockholders. Also see Section 1 and Section 2

of the plan for further examples.vii See www.restoretheshine.com

for why we believe Management, specifically Andrew Murstein, is

overpaid relative to bank peers, proxy peers and in terms of

absolute performance. Also see Section 1 of the plan for further

examples.viii See www.restoretheshine.com for comparisons to

larger, top performing banks and proxy peers selected by MFINix See

viii above.

Media contact: nicole@nh-consult.com

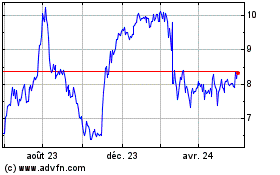

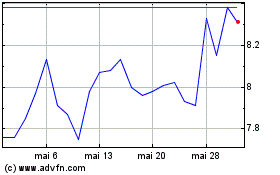

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025