We are offering to a single institutional

investor 2,250,000 shares of our common stock, par value $0.001 per share (“Common Stock”), pre-funded warrants to purchase

up to 3,464,286 shares of Common Stock (the “Pre-Funded Warrants”) and the shares of Common Stock underlying the Pre-Funded

Warrants in this offering through this prospectus supplement and the accompanying prospectus.

In a concurrent private placement, we are

issuing to the same institutional investor warrants to purchase up to an aggregate of 5,714,286 shares of Common Stock (the “Purchase

Warrants”). Each Purchase Warrant will have an exercise price of $0.70 per share and will be immediately exercisable on the date

of issuance (the “Initial Exercise Date”) for a period of five (5) years from the Initial Exercise Date. The Purchase Warrants

and the shares of our Common Stock issuable upon the exercise of the Purchase Warrants are being offered pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act of 1933, as amended, or the Securities Act and Rule 506(b) promulgated thereunder, and they

are not being offered pursuant to this prospectus supplement and the accompanying prospectus. The Purchase Warrants issued in the concurrent

private placement will not be listed for trading on any national securities exchange.

There is no established trading market for

the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for the Pre-Funded Warrants

on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded

Warrants will be limited.

Our Common Stock is listed on the Nasdaq Stock

Market LLC (“Nasdaq”) under the symbol “PRSO.” The last reported sale price of our Common Stock on May 30, 2023

was $0.90 per share.

As of May 30, 2023, the aggregate market

value of our outstanding Common Stock held by non-affiliates was approximately $19,570,982, based on 17,932,237 shares of Common

Stock (which excludes 502,567 shares held in escrow) and 4,781,734 exchangeable shares (which are exchangeable for shares of Common

Stock on a 1:1 basis and excludes 1,312,878 shares held in escrow) of which approximately 21,745,535 shares were held by non-affiliates, and a price of $0.90 per share, which

was the last reported sale price of our Common Stock on the Nasdaq Capital Market on May 30, 2023. Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell the securities described in this prospectus in a public primary offering with a value

exceeding more than one-third (1/3) of the aggregate market value of our Common Stock held by non-affiliates in any twelve

(12)-month period, so long as the aggregate market value of our outstanding Common Stock held by non-affiliates remains below

$75,000,000. During the 12 calendar months prior to and including the date of this prospectus supplement, we sold $2,450,000 in

securities pursuant to General Instruction I.B.6 of Form S-3.

We have retained The Benchmark Company, LLC

to act as our sole placement agent in connection with this offering. The placement agent has agreed to use its best efforts to place the

securities offered by this prospectus supplement. We have agreed to pay the placement agent the fee set forth in the table above.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus

supplement and the accompanying prospectus and the documents incorporated by reference constitute forward-looking statements. These statements

involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of

activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements

expressed or implied by such forward-looking statements. These factors include, among others, those incorporated by reference under “Risk

Factors” below.

In some cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue” or similar

terms.

Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

Our actual results could differ materially from those expressed or implied by these forward-looking statements as a result of various

factors, including the risk factors under the section titled “Risk Factors” and a variety of other factors, including, without

limitation, statements about our future business operations and results, the market for our technology, our strategy and competition.

Moreover, neither we nor any other person

assumes responsibility for the accuracy and completeness of these statements. We undertake no obligation to update or revise any of the

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of

these risks, uncertainties and assumptions, the forward-looking events discussed or incorporated by reference in this prospectus supplement

and the accompanying prospectus may not occur.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary highlights selected information

related to our business. Since it is a summary, this section may not contain all the information that you should consider before investing

in our Common Stock. You should carefully read the entire prospectus supplement, the accompanying prospectus and the documents incorporated

by reference in each one, including the “Risk Factors” section.

Our Business

Overview

We were formerly

known as MoSys, Inc. (MoSys) and were incorporated in California in 1991 and reincorporated in 2000 in Delaware. On

September 14, 2021, we and our subsidiaries, 2864552 Ontario Inc. and 2864555 Ontario Inc., entered into an Arrangement Agreement (the

Arrangement Agreement) with Peraso Technologies Inc. (Peraso Tech), a corporation existing under the laws of the province of Ontario,

to acquire all of the issued and outstanding common shares of Peraso Tech (the Peraso Shares), including those Peraso Shares to be issued

in connection with the conversion or exchange of secured convertible debentures and common share purchase warrants of Peraso Tech, as

applicable, by way of a statutory plan of arrangement (the Arrangement) under the Business Corporations Act (Ontario). On December

17, 2021, following the satisfaction of the closing conditions set forth in the Arrangement Agreement, the Arrangement was completed and

we changed our name to “Peraso Inc.” and began trading on the Nasdaq Stock Market (the Nasdaq) under the symbol “PRSO.”

For accounting

purposes, the legal subsidiary, Peraso Tech, was treated as the accounting acquirer and we, the legal parent, have been treated as the

accounting acquiree. The transaction was accounted for as a reverse acquisition in accordance with Financial Accounting Standards Board

(FASB) Accounting Standards Codification (ASC) 805, Business Combinations (ASC 805). Accordingly, the financial condition and results

of operations discussed herein are a continuation of Peraso Tech’s financial results prior to December 17, 2021 and exclude the

financial results of us prior to December 17, 2021. See Note 2 to the consolidated financial statements for additional disclosure.

Our strategy

and primary business objective is to be a profitable, IP-rich fabless semiconductor company offering integrated circuits, or ICs, modules

and related non-recurring engineering services. We specialize in the development of mmWave semiconductors, primarily in the 60 GHz spectrum

band for 802.11ad/ay compliant devices and in the 28/39 GHz spectrum bands for 5G-compliant devices. We derive our revenue from selling

semiconductor devices, as well as modules based on using those mmWave semiconductor devices. We have pioneered a high-volume mmWave

production test methodology using standard low cost production test equipment. It has taken us several years to refine performance of

this production test methodology, and we believe this places us in a leadership position in addressing operational challenges of delivering

mmWave products into high-volume markets. During 2021, we augmented our business model by selling complete mmWave modules. The primary

advantage provided by a module is the silicon and the antenna are integrated into a single device. A differentiating characteristic of

mmWave technology is that the RF amplifiers must be as close as possible to the antenna to minimize loss, and by providing a module, we

can guarantee the performance of the amplifier/antenna interface.

We also acquired

a memory product line marketed under the Accelerator Engine name. This memory product line comprises our Bandwidth Engine and Quad Partition

Rate IC products, which integrate our proprietary, 1T-SRAM high-density embedded memory and a highly-efficient serial interface protocol

resulting in a monolithic memory IC solution optimized for memory bandwidth and transaction access performance.

We incurred net losses of approximately $32.4 million

and $10.9 million for the years ended December 31, 2022 and 2021, respectively, and had an accumulated deficit of approximately $149.6

million as of December 31, 2022. These and prior year losses have resulted in significant negative cash flows for almost a decade and

have necessitated that we raise substantial amounts of additional capital during this period.

We will need to

increase revenues substantially beyond levels that we have attained in the past in order to generate sustainable operating profit and

sufficient cash flows to continue doing business without raising additional capital from time to time.

Recent Developments

Amendment to November 2022 Warrants

In connection

with this offering, on May 31, 2023, we entered into an amendment with the institutional investor in this offering (the “Amendment”)

to amend that certain common stock purchase warrant previously issued by us on November 30, 2022 to the institutional investor to purchase

up to 3,675,000 shares of Common Stock (the “Prior Warrant”). Pursuant to the terms of the Amendment, the Prior Warrant was

amended to reduce the exercise price per share from $1.36 to $1.00, effective as of the closing date of this offering.

Memory IC Product End-of-Life

Taiwan Semiconductor

Manufacturing Corporation, or TSMC, is the sole foundry that manufactures the wafers used to produce our memory IC products. TSMC recently

informed us that it would be discontinuing the foundry process used to produce wafers, in turn, necessary to manufacture our memory ICs.

As a result, we have informed our memory IC customers that we are initiating an end-of-life, or EOL, of our memory IC products. We have

notified our customers to provide purchase orders during 2023 that we expect to fulfill during 2024. We are requiring customers to pay

a deposit upon purchase order placement to reserve supply and provide funding for our required inventory purchases. Under our EOL plan,

we intend to complete all shipments of our memory products during 2024, and, as a result, we do not anticipate any shipments of our memory

products after December 31, 2024. However, the timing of EOL shipments will be dependent on deliveries from our suppliers, as well as

the delivery schedules requested by our customers.

Available Information

We were founded

in 1991 and reincorporated in Delaware in 2000. Our website address is www.peraso.com. The information in our website is not incorporated

by reference into this report. Through a link on the Investor section of our website, we make available our annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section

13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after they are filed with, or furnished to, the Securities and Exchange

Commission, or SEC. You can also read any materials submitted electronically by us to the SEC on its website (www.sec.gov), which contains

reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

THE OFFERING

| Issuer: |

|

Peraso Inc. |

| |

|

|

| Common Stock offered: |

|

2,250,000 shares. |

| |

|

|

| Pre-Funded Warrants offered: |

|

We are also offering the Pre-Funded Warrants to purchase up to 3,464,286 shares of Common Stock in lieu of shares of Common Stock because the purchase of shares of Common Stock in this offering would otherwise result in the investor, together with its affiliates, beneficially owning more than 9.99% of our outstanding Common Stock immediately following the consummation of this offering. Each Pre-Funded Warrant is exercisable for one share of our Common Stock at an exercise price of $0.01 per share. The Pre-Funded Warrants are exercisable immediately upon issuance and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This prospectus supplement and the accompanying base prospectus also relate to the offering of the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants. |

| |

|

|

| Shares of Common Stock outstanding after the offering: |

|

20,684,804 shares (assuming no exercise of the Pre-Funded Warrants). Assuming all of the Pre-Funded Warrants were immediately exercised, there would be 24,149,090 shares of our Common Stock outstanding after this offering. |

| |

|

|

| Trading symbol: |

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “PRSO.” There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| |

|

|

| Use of proceeds: |

|

We estimate that we will receive net proceeds of approximately $4 million from this offering, after deducting placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, including working capital. |

| |

|

|

| Concurrent Private Placement: |

|

In a concurrent private placement, we are issuing to the purchaser Purchase Warrants to purchase 5,714,286 of our common shares at an exercise price of $0.70 per share. We will receive gross proceeds from the concurrent private placement transaction solely to the extent such warrants are exercised for cash. The Purchase Warrants and the shares of Common Stock issuable upon the exercise of the Purchase Warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus. See “Private Placement Transaction” below. |

| |

|

|

| Risk factors: |

|

Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus supplement beginning on page S-4 and page 4 of the accompanying prospectus, and the other information in this prospectus supplement for a discussion of the factors you should consider before you decide to invest in this offering. |

The number of shares of Common Stock

to be outstanding immediately before and after this offering is based on 18,434,804 shares of Common Stock outstanding as of May 30,

2023, and excludes, as of such date:

| ● | 6,094,612

shares of Common Stock issuable upon the exchange of exchangeable shares; |

| ● | 1,473,758

shares of Common Stock issuable upon exercise of outstanding stock options; |

| ● | 1,152,232

shares of Common Stock issuable upon vesting of restricted stock units; |

| ● | 1,458,174

shares of Common Stock available for future issuance under the Company’s 2019 Stock Incentive Plan; |

| ● | 3,675,000

shares of Common Stock issuable upon exercise of warrants dated November 30, 2022 at $1.36 per share; and |

| ● | 100,771

shares of Common Stock issuable upon exercise of warrants dated October 4, 2018 at $2.40 per share. |

Additionally,

unless otherwise stated, all information in this prospectus supplement:

| ● | assumes

no exercise of the Pre-Funded Warrants or the Purchase Warrants; |

| ● | assumes

no exercise of outstanding options and warrants to purchase Common Stock, and no issuance of shares available for future issuance under

our equity compensation plans; and |

| ● | reflects

all currency in United States dollars. |

RISK FACTORS

An investment in our Common Stock is risky.

Prior to making a decision about investing in our Common Stock, you should carefully consider the risks discussed below, together with

all of the other information contained in this prospectus supplement and the accompanying prospectus, or otherwise incorporated by reference

in this prospectus supplement and the accompanying prospectus. The risks and uncertainties described below are not the only ones facing

us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business.

If any of the risks or uncertainties described below or in our filings with the SEC or any such additional risks and uncertainties actually

occur, our business, results of operations, cash flows and financial condition could be materially and adversely affected. In that case,

the trading price of our Common Stock could decline, and you might lose all or part of your investment.

Risks Relating to this Offering and our Securities

You will experience immediate and substantial dilution as a result

of this offering as well as immediate dilution in the net tangible book value per share of the common stock purchased in the offering.

Since the offering price of our Common Stock in this offering is substantially

higher than the net tangible book value per share of our outstanding Common Stock outstanding prior to this offering, you will suffer

dilution in the book value of the Common Stock you purchase in this offering or obtain upon exercise of the Pre-Funded Warrants. The exercise

of outstanding stock options and warrants, including Purchase Warrants sold in in a private placement concurrently with this offering,

or the conversion or exchange of other securities, may result in further dilution of your investment. See the section titled “Dilution”

for a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

Management will have broad discretion as to the use of the proceeds

from this offering, and may not use the proceeds effectively.

We cannot specify with certainty the particular uses of the net proceeds

we will receive from this offering, and these uses may vary from our current plans. Our management will have discretion in the application

of the net proceeds, including for working capital and general corporate purposes as described in “Use of Proceeds.” Accordingly,

you will have to rely upon the judgment of our management with respect to the use of the proceeds. Our management may spend a portion

or all of the net proceeds from this offering in ways that holders of our Common Stock may not desire or that may not yield a significant

return or any return at all. The failure by our management to apply these funds effectively could harm our business. Pending their use,

we may also invest the net proceeds from this offering in a manner that does not produce income or that loses value.

There is no public market for the Pre-Funded Warrants being sold

in this offering or the Purchase Warrants being sold in a private offering concurrently with this offering.

There is no established public trading market for the Pre-Funded Warrants

being offered in this offering or the Purchase Warrants being offered in a private placement concurrently with this offering, and we do

not expect a market to develop. In addition, we do not intend to apply for listing of the Pre-Funded Warrants or the Purchase Warrants

on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the Pre-Funded

Warrants and the Purchase Warrants will be limited.

Any holder of the Pre-Funded Warrants and Purchase Warrants will

have no rights as a common stockholder until such holder exercises its Pre-Funded Warrant and/or Purchase Warrants and acquires our Common

Stock.

Until the holder of each Pre-Funded Warrant and Purchase Warrant exercises

its Pre-Funded Warrant and/or Purchase Warrant and acquires shares of our Common Stock, such holder will have no rights with respect to

the shares of our Common Stock underlying such Pre-Funded Warrants or Purchase Warrants except as expressly set forth in such warrants.

Upon exercise of their respective Pre-Funded Warrants or Purchase Warrants, the holder will be entitled to exercise the rights of a common

stockholder only as to matters for which the record date occurs after the exercise date.

A significant holder or beneficial holder of our Common Stock

may not be permitted to exercise the Pre-Funded Warrants or Purchase Warrants that it holds.

A holder of Pre-Funded Warrants and/or Purchase Warrants will not be

entitled to exercise any portion of the Pre-Funded Warrants or Purchase Warrants that, upon giving effect to such exercise, would cause

the aggregate number of shares of our Common Stock beneficially owned by such holder (together with its affiliates and any other persons

whose beneficial ownership of Common Stock would be aggregated with the holder for purposes of Section 13(d) of the Exchange Act) to exceed

4.99% of the total number of then issued and outstanding shares of Common Stock, as such percentage ownership is determined in accordance

with the terms of the Pre-Funded Warrants or Purchase Warrants and subject to such holder’s rights under the Pre-Funded Warrants

and Purchase Warrants to increase or decrease such percentage to any other percentage not in excess of 9.99% upon at least 61 days’

prior notice from such holder to us; provided that the investor has elected to use a beneficial ownership limitation equal to 9.99%

already in connection with the Pre-Funded Warrants. As a result, an investor may not be able to exercise Pre-Funded Warrants or Purchase

Warrants for shares of our Common Stock at a time when it would be financially beneficial to do so. In such a circumstance, a holder could

look to sell the Pre-Funded Warrants or Purchase Warrants to realize value, but a holder may be unable to do so in the absence of an established

trading market.

There is no established public trading

market for the Pre-Funded Warrants being offered in this offering or Purchase Warrants being sold in a private offering concurrently with

this offering.

There is no established public trading market

for the Pre-Funded Warrants being offered in this offering or Purchase Warrants being sold in a private offering concurrently with this

offering, and we do not expect a market to develop. In addition, we do not intend to apply to list such warrants on any national securities

exchange or other nationally recognized trading system, including the Nasdaq Capital Market. Without an active market, the liquidity of

the warrants will be limited.

Resales of our Common Stock in the public market may cause the

market price of our Common Stock to fall.

Sales of a substantial number of shares of our Common Stock could occur

at any time. The issuance of new shares of our Common Stock could result in resales of our Common Stock by our current stockholders concerned

about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing the market price

for our Common Stock.

This offering may cause the trading price of our Common Stock

to decrease.

The price per share, together with the number of shares of Common Stock

and Pre-Funded Warrants we propose to issue and ultimately will issue if this offering is completed and/or the number of Purchase Warrants

being sold concurrently herewith, may result in an immediate decrease in the market price of our Common Stock. This decrease may continue

after the completion of this offering.

If we do not maintain a current and effective prospectus relating

to the Common Stock issuable upon exercise of the Purchase Warrants, holders may exercise such Purchase Warrants on a “cashless

basis.”

If we do not maintain a current and effective prospectus relating to

the shares of Common Stock issuable upon exercise of the Purchase Warrants at the time that holders wish to exercise such warrants, they

will be able to exercise them on a “cashless basis”. As a result, the number of shares of Common Stock that holders will receive

upon exercise of the Purchase Warrants will be fewer than it would have been had such holders exercised their Purchase Warrants for cash.

Under the terms of the Purchase Agreement, we have agreed to file a registration statement to register the Warrant Shares, as soon as

practicable (and in any event within 15 calendar days of the date of the Purchase Agreement), and cause such registration statement to

become effective within a certain period of time following the closing date of this offering and to keep such registration statement effective

until the investor holds no Purchase Warrants or shares of Common Stock issuable upon exercise thereof. However, we cannot assure you

that we will be able to do so. If the Purchase Warrants are exercised on a “cashless” basis, we will not receive any consideration

from such exercises.

Provisions of the Purchase Warrants could discourage an acquisition

of us by a third party.

Certain provisions of the Purchase Warrants being sold in a private

offering concurrently with this offering could make it more difficult or expensive for a third party to acquire us. The Purchase Warrants

prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the

surviving entity assumes our obligations under the Purchase Warrants. Further, the Purchase Warrants provide that, in the event of certain

transactions constituting “fundamental transactions,” with some exception, holders of such warrants will have the right, at

their option, to require us to repurchase such warrants at a price described in such warrants. These and other provisions of the Purchase

Warrants could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

There may be future sales of our Common Stock, which could adversely

affect the market price of our Common Stock and dilute a stockholder’s ownership of Common Stock.

The exercise of (a) any options granted to executive officers and other

employees under our equity compensation plans and (b) of any warrants, and other issuances of our Common Stock could have an adverse effect

on the market price of the shares of our Common Stock. Other than the restrictions set forth in the section titled “Plan of Distribution,”

we are not restricted from issuing additional shares of Common Stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive shares of Common Stock, provided that we are subject to the requirements of the Nasdaq Capital

Market (which generally requires stockholder approval for any transactions which would result in the issuance of more than 20% of our

then outstanding shares of Common Stock or voting rights representing over 20% of our then outstanding shares of stock). Sales of a substantial

number of shares of our Common Stock in the public market or the perception that such sales might occur could materially adversely affect

the market price of the shares of our Common Stock. Because our decision to issue securities in any future offering will depend on market

conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Accordingly,

our stockholders bear the risk that our future offerings will reduce the market price of our Common Stock and dilute their stock holdings

in us.

You may experience future dilution as a result of future equity

offerings.

In order to raise additional capital, we may in the future offer additional

shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock. We cannot assure you that we will

be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share

paid by investors in this offering, and investors purchasing our shares or other securities in the future could have rights superior to

existing stockholders. The price per share at which we sell additional shares of our Common Stock or other securities convertible into

or exchangeable for our Common Stock in future transactions may be higher or lower than the price per share in this offering.

A substantial number of shares of our Common Stock may be sold

in this offering, which could cause the price of our Common Stock to decline.

In this offering, we are offering shares of Common Stock, which represent

approximately 23.7% of our outstanding Common Stock as of May 30, 2023 after giving effect to the sale of the shares of Common Stock and

Pre-Funded Warrants, excluding our exchangeable shares, and assuming the full exercise of such Pre-Funded Warrants, and when including

the Purchase Warrants being sold in a private offering concurrently with this offering, and the shares of Common Stock issuable upon exercise

thereof, that number increases to approximately 38.3% of our outstanding Common Stock as of May 30, 2023, excluding our exchangeable shares.

These sales and any future sales of a substantial number of shares of our Common Stock in the public market, or the perception that such

sales may occur, could adversely affect the price of our Common Stock on the Nasdaq Capital Market. We cannot predict the effect, if any,

that market sales of those shares of Common Stock or the availability of those shares of Common Stock for sale will have on the market

price of our Common Stock.

Future sales of our Common Stock could cause our stock price

to decline.

If our stockholders sell substantial amounts of our Common Stock in

the public market, the market price of our Common Stock could decrease significantly. The perception in the public market that our stockholders

might sell shares of our Common Stock could also depress the market price of our Common Stock. Up to $100,000,000 in total aggregate value

of securities have been registered by us on a “shelf” registration statement on Form S-3 (File No. 333-258386) that we filed

with the Securities and Exchange Commission on August 2, 2021, and which was declared effective on August 9, 2021. After taking into account

securities sold in this offering, there is an aggregate of over $93 million in securities which will be eligible for sale in the public

markets from time to time, subject to the requirements of Form S-3, which limits us, until such time, if ever, as our public float exceeds

$75 million, from selling securities in a public primary offering under Form S-3 with a value exceeding more than one-third of the aggregate

market value of the Common Stock held by non-affiliates of the Company every twelve months. Additionally, if our existing stockholders

sell, or indicate an intention to sell, substantial amounts of our Common Stock in the public market, the trading price of our Common

Stock could decline significantly. The market price for shares of our Common Stock may drop significantly when such securities are sold

in the public markets. A decline in the price of shares of our Common Stock might impede our ability to raise capital through the issuance

of additional shares of our Common Stock or other equity securities.

Potential volatility of the price of our Common Stock could negatively

affect your investment.

We cannot assure you that there will continue to be an active trading

market for our Common Stock. Historically, the stock market, as well as our Common Stock, has experienced significant price and volume

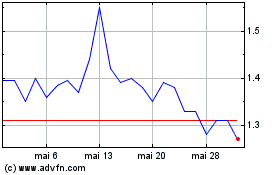

fluctuations. The closing market price for our Common Stock has varied between a high of $2.57 on August 9, 2022, and a low of $0.25 on

May 19, 2023, in the twelve-month period ended May 30, 2023. During this time, the price per share of Common Stock has ranged from an

intra-day low of $0.20 per share to an intra-day high of $2.69 per share. Market prices of securities of technology companies can be highly

volatile and frequently reach levels that bear no relationship to the operating performance of such companies. These market prices generally

are not sustainable and are subject to wide variations. If our Common Stock trades to unsustainably high levels, it is likely that the

market price of our Common Stock will thereafter experience a material decline. As a result of fluctuations in the price of our Common

Stock, you may be unable to sell your shares at or above the price you paid for them. In addition, if we seek additional financing, including

through the sale of equity or convertible securities, such sales could cause our stock price to decline and result in dilution to existing

stockholders.

In addition, the stock markets in general, and the markets for semiconductor

stocks in particular, have experienced significant volatility that has often been unrelated to the financial condition or results of operations

of particular companies. These broad market fluctuations may adversely affect the trading price of our Common Stock and, consequently,

adversely affect the price at which you could sell the shares that you purchase in this offering. In the past, following periods of volatility

in the market or significant price declines, securities class-action litigation has often been instituted against companies. Such litigation,

if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially

and adversely affect our business, financial condition, results of operations and growth prospects.

Certain of our

Common Stock warrants are accounted for as a warrant liability and recorded at fair value with changes in fair value each period reported

in earnings, which may have an adverse effect on the market price of our Common Stock.

In accordance with generally accepted accounting

principles in the United States, we are required to evaluate our Common Stock warrants to determine whether they should be accounted for

as a warrant liability or as equity. At each reporting period (1) the warrants will be reevaluated for proper accounting treatment as

a liability or equity and (2) the fair value of the liability of the warrants will be re-measured. The change in the fair value of the

liability will be recorded as other income (expense) in our statement of operations and comprehensive loss. This accounting treatment

may adversely affect the market price of our securities, as we may incur additional expense. In addition, changes in the inputs and assumptions

for the valuation model we use to determine the fair value of such liability may have a material impact on the estimated fair value of

the warrant liability. As a result, our financial statements and results of operations will fluctuate quarterly, based on various factors,

many of which are outside of our control, including the share price of our Common Stock. We expect that we will recognize non-cash gains

or losses on our warrants or any other similar derivative instruments in each reporting period and that the amount of such gains or losses

could be material. We expect that the Purchase Warrants to be issued in this transaction will be accounted for as a liability rather than

equity. The impact of changes in fair value on earnings may have an adverse effect on the market price of our Common Stock.

Provisions of our certificate of incorporation and bylaws or

Delaware law might delay or prevent a change-of-control transaction and depress the market price of our stock.

Various provisions of our certificate of incorporation and bylaws might

have the effect of making it more difficult for a third party to acquire, or discouraging a third party from attempting to acquire, control

of our company. These provisions could limit the price that certain investors might be willing to pay in the future for shares of our

Common Stock. Certain of these provisions eliminate cumulative voting in the election of directors, limit the right of stockholders to

call special meetings and establish specific procedures for director nominations by stockholders and the submission of other proposals

for consideration at stockholder meetings.

We are also subject to provisions of Delaware law which could delay

or make more difficult a merger, tender offer or proxy contest involving our company. In particular, Section 203 of the Delaware General

Corporation Law prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period

of three years unless specific conditions are met. Any of these provisions could have the effect of delaying, deferring or preventing

a change in control, including without limitation, discouraging a proxy contest or making more difficult the acquisition of a substantial

block of our Common Stock.

Under our certificate of incorporation, our board of directors may

issue up to a maximum of 20,000,000 shares of preferred stock without stockholder approval on such terms as the board might determine.

The rights of the holders of Common Stock will be subject to, and might be adversely affected by, the rights of the holders of any preferred

stock that might be issued in the future.

If we are unable to satisfy the continued

listing requirements of The Nasdaq Stock Market, our Common Stock could be delisted and the price and liquidity of our Common Stock may

be adversely affected.

Our Common Stock may lose

value and our Common Stock could be delisted from Nasdaq due to several factors or a combination of such factors. While our Common Stock

is currently listed on Nasdaq, there can be no assurance that we will be able to maintain such listing. To maintain the listing of our

Common Stock on Nasdaq, we are required to meet certain listing requirements, including, among others, a requirement to maintain a minimum

closing bid price of $1.00 per share. If our Common Stock trades below the $1.00 minimum closing bid price requirement for 30 consecutive

business days or if we do not meet other listing requirements, we may be notified by Nasdaq of non-compliance. On February 1, 2023, we

received a notice from Nasdaq, indicating that, based upon the closing bid price of our Common Stock for the previous 30 business days,

we no longer meet the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2) (the

“Notice”).

In accordance with Nasdaq

Listing Rule 5810(c)(3)(A), we have been provided a period of 180 calendar days, or until July 31, 2023, in which to regain compliance.

In order to regain compliance with the minimum bid price requirement, the closing bid price of our Common Stock must be at least $1 per

share for a minimum of ten consecutive business days during this 180-day period. In the event that we do not regain compliance within

this 180-day period, we may be eligible to seek an additional compliance period of 180 calendar days if we meet the continued listing

requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception

of the bid price requirement, and provide written notice to Nasdaq of our intent to cure the deficiency during this second compliance

period, by effecting a reverse stock split, if necessary. However, if it appears to the Nasdaq Staff that we will not be able to cure

the deficiency, or if we are otherwise not eligible, Nasdaq will provide notice to us that our common stock will be subject to delisting.

The above mentioned notice

does not result in the immediate delisting of our Common Stock from the Nasdaq Capital Market. We intend to monitor the closing bid price

of our Common Stock and consider our available options in the event that the closing bid price of our Common Stock remains below $1 per

share. There can be no assurance that we will be able to regain compliance with the minimum bid price requirement or maintain compliance

with the other listing requirements. As of the date of this prospectus, we have not regained compliance. There can be no assurance that

we would pursue a reverse stock split or be able to obtain the approvals necessary to effect a reverse stock split. In addition, there

can be no assurance that, following any reverse stock split, the per share trading price of our Common Stock would remain above $1.00

per share or that we would be able to continue to meet other listing requirements. If we were to be delisted, we would expect our Common

Stock to be traded in the over-the-counter market which could adversely affect the liquidity of our Common Stock. Additionally, we could

face significant material adverse consequences, including:

| |

● |

a limited availability of market quotations for our Common Stock; |

| |

● |

a reduced amount of analyst coverage; |

| |

● |

a decreased ability to issue additional securities or obtain additional financing in the future; |

| |

● |

reduced liquidity for our stockholders; |

| |

● |

potential loss of confidence by customers, collaboration partners and employees; and |

| |

● |

loss of institutional investor interest. |

USE OF PROCEEDS

We estimate that we will receive net proceeds

of approximately $4 million from this offering, after deducting placement agent fees and estimated offering expenses payable by us.

We intend to use the net proceeds from this

offering for our operations, including the development of our 5G products, and working capital and general corporate purposes. We may

also use the net proceeds from this offering to acquire and invest in complementary products, technologies or businesses; however, we

currently have no agreements or commitments to complete any such transaction.

CAPITALIZATION

The following table sets forth our capitalization

as March 31, 2023:

| ● | on an as adjusted basis to give

effect to (a) the issuance and sale by us of 2,250,000 shares of Common Stock and Pre-Funded Warrants to purchase up to 3,464,286 shares

of Common Stock, after deducting the estimated private placement fee and commissions and estimated offering expenses payable by us,

and assuming the full exercise of the Pre-Funded Warrants for cash; and (b) the issuance and sale by us

of Purchase Warrants exercisable for 5,714,286 shares of Common Stock in the concurrent private placement. |

You should read this table together with our financial

statements and the related notes, and our most recent “Management’s Discussion and Analysis of Financial Condition and Results

of Operations,” which have been incorporated by reference into this prospectus supplement.

| | |

March 31, 2023 | |

| | |

(unaudited) | |

| | |

Actual | | |

As Adjusted | |

| Cash and cash equivalents | |

$ | 1,392 | | |

$ | 4,945 | |

| Total liabilities | |

| 5,378 | | |

| 5,378 | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.01 par value; 20,000 shares authorized, actual and as adjusted | |

| | | |

| | |

| Series A special voting preferred stock, $0.01 par value; one share authorized;

one share issued and outstanding, actual and as adjusted | |

| — | | |

| — | |

| Common Stock, $0.001 par value; 120,000 shares authorized; 14,580 shares and 16,830 shares issued and outstanding, actual and as adjusted | |

| 15 | | |

| 17 | |

| Exchangeable shares, no par value; unlimited shares authorized; 8,797 shares and 8,797 shares

outstanding, actual and as adjusted | |

| — | | |

| — | |

| Additional paid-in capital | |

| 166,171 | | |

| 169,722 | |

| Accumulated other comprehensive loss | |

| (11 | ) | |

| (11 | ) |

| Accumulated deficit | |

| (152,745 | ) | |

| (152,745 | ) |

| Total stockholders’ equity | |

| 13,430 | | |

| 16,983 | |

The table and discussion above are based on 23,376,466

shares of Common Stock outstanding as of March 31, 2023, and excludes, as of such

date:

| ● | 8,796,791

shares of Common Stock issuable upon the exchange of exchangeable shares; |

| ● | 1,482,000

shares of Common Stock issuable upon exercise of outstanding stock options; |

| ● | 1,086,492

shares of Common Stock issuable upon vesting of restricted stock units; |

| ● | 1,526,864

shares of Common Stock available for future issuance under the Company’s 2019 Stock

Incentive Plan; |

| ● | 3,675,000

shares of Common Stock issuable upon exercise of warrants dated November 30, 2022 at 1.36

per share; and |

| ● | 100,771

shares of Common Stock issuable upon exercise of warrants dated October 4, 2018 at $2.40

per share. |

DILUTION

Our unaudited net tangible book value as of

March 31, 2023 was approximately ($7.7) million, or ($0.33) per share. We calculate net tangible book value per share by dividing our

net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares of our Common Stock. Dilution

in net tangible book value per share represents the difference between the amount per share paid by the purchasers of Common Stock in

this offering and the pro forma net tangible book value per share of common stock immediately after giving effect to this offering.

After giving effect to the sale by us of (i)

2,250,000 shares of Common Stock at an offering price of $0.70 per share of Common Stock and (ii) Pre-Funded Warrants to purchase up to

3,464,286 shares of Common Stock at an offering price of $0.69 per Pre-Funded Warrant, for aggregate gross proceeds of approximately $4.0

million in this offering, after deducting the placement agent’s fees and expenses, and assuming the full exercise of the Pre-Funded

Warrants for cash, resulting in the issuance of 3,464,286 shares of our Common Stock, but excluding the exercise of the Purchase Warrants,

our pro forma net tangible book value as of March 31, 2023 would have been approximately $11.4 million, or $0.45 per share. This represents

an immediate increase in pro forma net tangible book value of $0.12 per share to existing stockholders and an immediate dilution of $0.45

per share to new investors purchasing our shares in this offering.

The following table illustrates this per share

dilution to the new investor purchasing the securities in this offering:

| Public offering price per share | |

| | | |

$ | 0.70 | |

| Historical net tangible book value per share as of March 31, 2023 | |

$ | 0.33 | | |

| | |

| Increase in pro forma net tangible book value per share attributable to the investors purchasing shares in this offering | |

$ | 0.12 | | |

| | |

| Pro forma net tangible book value per share as of March 31, 2023, after giving effect to this offering | |

| | | |

$ | 0.45 | |

| Dilution per share to the investors in this offering | |

| | | |

$ | 0.25 | |

The table and discussion

above are based on 23,376,466 shares of Common Stock outstanding as of March 31, 2023, which,

for purposes of this table, includes 8,796,791 shares of Common Stock issuable

upon the exchange of exchangeable shares, and excludes, as of such date:

| ● | 1,482,000

shares of Common Stock issuable upon exercise of outstanding stock options; |

| ● | 1,086,492

shares of Common Stock issuable upon vesting of restricted stock units; |

| ● | 1,526,864

shares of Common Stock available for future issuance under the Company’s 2019 Stock

Incentive Plan; |

| ● | 3,675,000

shares of Common Stock issuable upon exercise of warrants dated November 30, 2022 at 1.36

per share; and |

| ● | 100,771

shares of Common Stock issuable upon exercise of warrants dated October 4, 2018 at $2.40

per share. |

DESCRIPTION OF SECURITIES

WE ARE OFFERING

In this offering, we are offering 2,250,000 shares

of our Common Stock and Pre-Funded Warrants to purchase up to 3,464,286 shares of Common Stock.

Common Stock

The material terms and provisions of our Common

Stock are described under the caption “General Description of Securities That We May Sell - Description of Capital Stock - Common

Stock” starting on page 5 of the accompanying base prospectus.

Pre-Funded Warrants

The following summary of certain terms and provisions

of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions

of the Pre-Funded Warrant, the form of which will be filed as an exhibit to our Current Report on Form 8-K. Prospective investors should

carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of

the Pre-Funded Warrants.

The term “pre-funded” refers to the

fact that the purchase price of our Common Stock in this offering includes almost the entire exercise price that will be paid under the

Pre-Funded Warrants, except for a nominal remaining exercise price of $0.01. The purpose of the Pre-Funded Warrants is to enable investors

that may have restrictions on their ability to beneficially own more than 9.99% of our outstanding Common Stock following the consummation

of this offering the opportunity to make an investment in the Company without triggering their ownership restrictions, by receiving Pre-Funded

Warrants in lieu of our Common Stock which would result in such ownership of more than 9.99%, and receive the ability to exercise their

option to purchase the shares underlying the Pre-Funded Warrants at such nominal price at a later date.

Duration and Exercise Price. Each Pre-Funded

Warrant offered hereby has an initial exercise price per share equal to $0.01. The Pre-Funded Warrants are immediately exercisable and

may be exercised at any time until the Pre-Funded Warrants are exercised in full. The exercise price and number of shares of Common Stock

issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar

events affecting our Common Stock and the exercise price.

Exercisability. The Pre-Funded Warrants

are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by

payment in full for the number of shares of our Common Stock purchased upon such exercise (except in the case of a cashless exercise as

discussed below). Purchasers of the Pre-Funded Warrants in this offering may elect to deliver their exercise notice following the pricing

of the offering and prior to the issuance of the Pre-Funded Warrants at closing to have their Pre-Funded Warrants exercised immediately

upon issuance and receive shares of Common Stock underlying the Pre-Funded Warrants upon closing of this offering. A holder (together

with its affiliates) may not exercise any portion of the Pre-Funded Warrant to the extent that the holder would own more than 9.99% of

the outstanding Common Stock. No fractional shares of Common Stock will be issued in connection with the exercise of a Pre-Funded Warrant.

In lieu of fractional shares, we will either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction

multiplied by the exercise price or round up to the next whole share.

Cashless Exercise. In lieu of making the

cash payment otherwise contemplated to be made to us upon exercise of a Pre-Funded Warrant in payment of the aggregate exercise price,

the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined

according to a formula set forth in the Pre-Funded Warrants.

Transferability. Subject to applicable

laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with

the appropriate instruments of transfer.

Exchange Listing. There is no trading market

available for the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the

Pre-Funded Warrants on any securities exchange or nationally recognized trading system.

Right as a Stockholder. Except as otherwise

provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our Common Stock, the holders of the Pre-Funded

Warrants do not have the rights or privileges of holders of our Common Stock, including any voting rights, until they exercise their Pre-Funded

Warrants.

Fundamental Transaction. In the case of

certain fundamental transactions affecting the Company, a holder of Pre-Funded Warrants, upon exercise of such Pre-Funded Warrants after

such fundamental transaction, will have the right to receive, in lieu of shares of the Company’s Common Stock, the same amount and

kind of securities, cash or property that such holder would have been entitled to receive upon the occurrence of the fundamental transaction,

had the Pre-Funded Warrants been exercised immediately prior to such fundamental transaction.

PRIVATE PLACEMENT TRANSACTION

In a concurrent private placement (the “Private

Placement Transaction”), we are selling to the single institutional investor in this offering the Purchase Warrants to purchase

an aggregate of 5,714,286 shares of our Common Stock.

The Purchase Warrants and the shares of our

Common Stock issuable upon the exercise of the Purchase Warrants are not being registered under the Securities Act, are not being offered

pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section

4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. Accordingly, a holder may only sell shares of Common Stock issued

upon exercise of the Purchase Warrants pursuant to an effective registration statement under the Securities Act covering the resale of

those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Description of Purchase Warrants. The

Purchase Warrants are immediately exercisable for a five-year period after the date of issuance, at which time any unexercised Purchase

Warrants will expire and cease to be exercisable. The Purchase Warrants will be exercisable, at the option of each holder, in whole or

in part by delivering to us a duly executed exercise notice and by payment in full in immediately available funds for the number of shares

of Common Stock purchased upon such exercise. If a registration statement registering the issuance of the shares of Common Stock underlying

the Purchase Warrants under the Securities Act is not then effective or available, the holder may exercise the warrant through a cashless

exercise, in whole or in part, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined

according to the formula set forth in the Purchase Warrant. No fractional shares of Common Stock will be issued in connection with the

exercise of a Purchase Warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional

amount multiplied by the exercise price or round up to the next whole share.

A holder will not have the right to exercise

any portion of the Purchase Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or on election

of the holder, 9.99%) of the number of shares of our stock outstanding immediately after giving effect to the exercise, as such percentage

ownership is determined in accordance with the terms of the Purchase Warrants. However, any holder may increase or decrease such percentage

to any other percentage not in excess of 9.99% upon notice to us, provided that any increase in such percentage shall not be effective

until 61 days after such notice to us.

The initial exercise price per share of Common

Stock purchasable upon exercise of the Purchase Warrants is $0.70 per share of Common Stock. The exercise price is subject to appropriate

adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events

affecting our Common Stock.

In the case of certain fundamental transactions affecting the Company,

a holder of Purchase Warrants, upon exercise of such Purchase Warrants after such fundamental transaction, will have the right to receive,

in lieu of shares of the Company’s Common Stock, the same amount and kind of securities, cash or property that such holder would

have been entitled to receive upon the occurrence of the fundamental transaction, had the Purchase Warrants been exercised immediately

prior to such fundamental transaction. In lieu of such consideration, a holder of Purchase Warrants may instead elect to receive a cash

payment based upon the Black-Scholes value of their Purchase Warrants.

PLAN OF DISTRIBUTION

Pursuant to an engagement letter, we have engaged The Benchmark Company,

LLC, or Benchmark, as our exclusive placement agent for this offering. Benchmark is not purchasing or selling any shares, nor are they

required to arrange for the purchase and sale of any specific number or dollar amount of shares other than the use their “best efforts”

to arrange for the sale of securities by us. Therefore, we may not sell the entire amount of securities being offered. Benchmark may engage

one or more sub-agents or selected dealers to assist with the offering.

We have entered into a securities purchase agreement, or the Purchase

Agreement, directly with the investor in connection with this offering, and we will only sell to investors who have entered into the Purchase

Agreement.

We expect to deliver the securities being offered pursuant to this

prospectus supplement on or about June 2, 2023.

Upon the closing of this offering, we will pay Benchmark a cash transaction

fee equal to 7.0% of the gross proceeds to us from the sale of the shares of Common Stock and Pre-Funded Warrants in the offering. We

have also agreed to pay Benchmark up to $75,000 of fees and expenses of its legal counsel. We estimate the total expenses of this offering,

which will be payable by us, excluding the placement agent fees and expenses, will be approximately $413,000.

We have agreed to issue to Benchmark five-year warrants to purchase

up to 285,714 shares of our Common Stock at an exercise price of $0.70 per share, which are immediately exercisable (the “Placement

Agent Warrants”), provided that the number of shares underlying the Placement Agent Warrants represents 5.0% of the aggregate number

of shares of our Common Stock and shares underlying the Pre-Funded Warrants sold in this offering. The Placement Agent Warrant will also

be exercisable on a cashless basis.

We have agreed to indemnify Benchmark and specified other persons against

certain liabilities relating to or arising out of Benchmark’s activities under the engagement letter and to contribute to payments

that Benchmark may be required to make in respect of such liabilities.

Benchmark may be deemed to be an underwriter within the meaning of

Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the securities sold

by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter,

Benchmark would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation,

Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit

the timing of purchases and sales of shares of common stock by Benchmark acting as principal. Under these rules and regulations, Benchmark:

| ● | may not engage in any stabilization

activity in connection with our securities; and |

| ● | may not bid for or purchase any

of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act,

until it has completed its participation in the distribution. |

From the date of the Purchase Agreement until

90 days after the closing of this offering, the provisions of the

Purchase Agreement generally prohibit us from

issuing or agreeing to issue shares of Common Stock or common stock equivalents other than under equity compensation plans, outstanding

rights to acquire Common Stock or common stock equivalent, or in connection with certain strategic transactions.

Pursuant to the terms of the Purchase Agreement,

we are also prohibited from (i) entering into an at-the-market, or ATM, offering, that is an offering of Common Stock into its existing

trading market for the Common Stock at a price or prices related to the then-market price of the Common Stock, within six months after

the date of the Purchase Agreement and (ii) issuing or agreeing to issue shares of Common Stock or common stock equivalents that are variable

until the earlier of 12 months after the date of the Purchase Agreement or the date the investor no longer holds any Pre-Funded Warrants

or Purchase Warrants.

From time to time, Benchmark may provide in

the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which

they may receive customary fees and commissions.

However, we have no present arrangements with

Benchmark for any further services.

The transfer agent for our shares of Common

Stock is Equiniti Trust Company.

Our Common Stock is listed on the Nasdaq Capital

Market under the symbol “PRSO.”

Lock-Up Agreements

Each of our executive officers and directors

have agreed, subject to certain exceptions, not to dispose of or hedge any shares of Common Stock or securities convertible into or exchangeable

for shares of Common Stock during the period from the date of the lock-up agreement continuing through the 90 days after the closing of

this offering, except with Benchmark’s prior written consent. Each executive officer and director shall be immediately and automatically

released from all restrictions and obligations under the lock up agreement in the event that he or she ceases to be a director or officer

of our company and has no further reporting obligations under Section 16 of the Exchange Act.

LEGAL MATTERS

The validity of the issuance of shares of

Common Stock offered hereby will be passed upon for us by Mitchell Silberberg & Knupp, LLP, New York, New York. Arent Fox Schiff,

LLP, Washington, DC, is acting as counsel for the placement agent in connection with this offering.

EXPERTS

The consolidated financial statements of Peraso,

Inc. as of December 31, 2022 and 2021 and for each of the two years in the period ended December 31, 2021, incorporated in this prospectus

supplement by reference to Peraso Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, have been so incorporated

in reliance on the report of Weinberg & Company, P.A., an independent registered public accounting firm, given on the authority of

said firm as experts in auditing and accounting.

WHERE YOU CAN FIND

MORE INFORMATION

We file annual, quarterly and special reports

and other information with the SEC. In addition, we have filed with the SEC a Registration Statement on Form S-3, of which this prospectus

supplement and the accompanying prospectus is a part, under the Securities Act, with respect to the shares of Common Stock offered hereby.

You may read and obtain copies at prescribed rates of any document that we file with the SEC at its Public Reference Room at 100 F Street,

N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

Our SEC filings are also available to you free of charge at the SEC’s web site at http://www.sec.gov, which contains reports, proxy and

information statements and other information regarding issuers that file electronically with the SEC.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by

reference” the information we file with them, which means that we can disclose important information by referring you to those documents.

The information incorporated by reference is considered to be part of the accompanying prospectus, and information that we file later

with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below (other than

information deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K):

| (a) | our Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, filed with the SEC on March 29, 2023; |

| (b) | our Current Report on Form 8-K filed with the SEC on February 3, 2023; |

| (c) | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, filed with the SEC on May 15, 2023; and |

| (d) | the description of our Common

Stock contained in the “Description of Securities” filed as Exhibit 4.6 to our Annual Report on Form 10-K for the year ended

December 31, 2022, filed with the SEC on March 29, 2023. |

In addition, all filed information contained

in reports and documents filed with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date

of filing the registration statement that includes the accompanying prospectus and prior to the filing of a post-effective amendment to

the registration statement containing the accompanying prospectus, which indicates that all securities offered have been sold or which

deregisters all of such securities then remaining unsold, shall be deemed to be incorporated by reference in this prospectus supplement

and the accompanying prospectus and to be a part thereof from the respective dates of filing of such documents.

You may request a copy of these filings, at

no cost, by writing or telephoning us at the following address or telephone number:

Peraso Inc.

2309 Bering Dr.

San Jose, CA 95131

(408) 418-7500

Attention: Chief Financial Officer

In addition, you may obtain a copy of these

filings from the SEC as described above in the section entitled “Where You Can Find More Information.”

MoSys,

Inc.

$100,000,000

Common Stock

Preferred Stock

Warrants

Units

Subscription Rights

We may offer

from time to time:

| ● | Shares

of our common stock; |

| ● | Shares

of our preferred stock; |

| ● | Warrants

to purchase our common stock or preferred stock; |

We may offer

from time to time to sell the securities described in this prospectus separately or together in any combination, in one or more classes

or series, in amounts, at prices and on terms that we will determine at the time of any such offering.

The securities we offer will have an aggregate public offering price

of up to $100,000,000. We will provide specific terms of any offering in supplements to this prospectus. The securities may be offered

separately or together in any combination and as separate series. You should read this prospectus and any prospectus supplement carefully

before you invest.

We may sell these securities on a continuous or delayed basis directly,

through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. We reserve the sole

right to accept, and together with any agents, dealers and underwriters, reserve the right to reject, in whole or in part, any proposed

purchase of securities. If any agents, dealers or underwriters are involved in the sale of any securities, the applicable prospectus supplement

will set forth any applicable commissions or discounts. Our net proceeds from the sale of securities also will be set forth in the applicable

prospectus supplement.

Our common stock is listed on the Nasdaq Capital Market, or Nasdaq,

under the symbol “MOSY.” The last reported sales price of our shares of common stock on July 28, 2021 was $4.73 per share.

Investing in any of our securities involves a high degree of risk.

Please read carefully the section entitled “Risk Factors” on page 4 of this prospectus and the “Risk Factors”

section contained in any applicable prospectus supplement and in the documents incorporated by reference in this prospectus before investing

in our securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is August 9, 2021.

TABLE OF CONTENTS

In this prospectus, “MoSys,” “we,” “us”

and “our” refer to MoSys, Inc. and its subsidiaries.

You should rely only on information contained or incorporated by reference

in this prospectus. We have not authorized any person to provide you with information that differs from what is contained or incorporated

by reference in this prospectus. If any person does provide you with information that differs from what is contained or incorporated by

reference in this prospectus, you should not rely on it. This prospectus is not an offer to sell or the solicitation of an offer to buy

any securities other than the securities to which it relates, or an offer of solicitation in any jurisdiction where offers or sales are

not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, even though this prospectus

may be delivered or shares may be sold under this prospectus on a later date.

About This Prospectus

This prospectus is part of a registration statement that we filed with

the Securities and Exchange Commission, or the SEC or the Commission, using a “shelf” registration process. Under the shelf

process, we may, from time to time, issue and sell to the public any or all of the securities described in the registration statement

in one or more offerings.

This prospectus provides you with a general description of the securities

we may offer. Each time we offer securities, we will provide a prospectus supplement that will describe the specific amounts, prices,

and terms of the securities we offer. The prospectus supplement also may add, update, or change information contained in this prospectus.

This prospectus, together with applicable prospectus supplements, includes all material information relating to this offering. If there

is any inconsistency between the information in this prospectus and the information in the accompanying prospectus supplement, you should

rely on the information in the prospectus supplement. Please carefully read both this prospectus and any prospectus supplement together

with the additional information described below under the section entitled “Where You Can Find More Information.”

We may sell the securities to or through underwriters, dealers, or

agents or directly to purchasers. We and our agents reserve the sole right to accept and to reject in whole or in part any proposed purchase

of securities. A prospectus supplement, which we will provide each time we offer securities, will provide the names of any underwriters,

dealers or agents involved in the sale of the securities, and any applicable fee, commission, or discount arrangements with them.

Special Note Regarding Forward-Looking Statements

Some of the statements in this prospectus constitute forward-looking

statements. These statements involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s

actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity,

performance, or achievements expressed or implied by such forward-looking statements. These factors include, among others, those incorporated

by reference under “Risk Factors” below.

In some cases, you can identify forward-looking statements by terms

such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue” or similar

terms.

Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Our actual results could

differ materially from those expressed or implied by these forward-looking statements as a result of various factors, including the risk

factors incorporated by reference under the heading “Risk Factors” below and a variety of other factors, including, without

limitation, statements about our future business operations and results, the market for our technology, our strategy and competition and

the widespread outbreak of contagious diseases, including the outbreak in 2020 of a respiratory illness caused by a novel coronavirus

known as COVID-19.

Moreover, neither we nor any other person assumes responsibility for

the accuracy and completeness of these statements. We undertake no obligation to update or revise any of the forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties

and assumptions, the forward-looking events discussed or incorporated by reference in this prospectus may not occur.

Our Company

We are a fabless semiconductor company focused on the development and

sale of integrated circuits, or ICs, for the high-speed cloud networking, communications, security appliance, video, monitor and test,

data center and computing markets. Our solutions deliver time-to-market, performance, power, area and economic benefits for system original

equipment manufacturers, or OEMs. Our primary product line is marketed under the Accelerator Engine name and comprises our Bandwidth Engine

and Programmable HyperSpeed Engine IC products, which integrate our proprietary, 1T-SRAM high-density embedded memory and a highly-efficient

serial interface protocol resulting in a monolithic memory IC solution optimized for memory bandwidth and transaction access performance.

Further performance benefits can be achieved to offload statistical, search or other custom functions using our optional integrated logic

and processor elements.

As data rates and the amount of high-speed processing increase, critical

memory access bottlenecks occur. Our Accelerator Engine ICs dramatically increase memory accesses per second, removing these bottlenecks.

In addition, the serial interface and high-memory capacity reduce the board footprint, number of pins and complexity, while using less