Walgreens Boots Alliance Early-Settles Certain Prepaid Variable Share Forward Transactions and Sells Related Shares of Cencora For Approximately $300 Million of Proceeds

07 Février 2025 - 2:30AM

Business Wire

Transaction Highlights

- Walgreens Boots Alliance announces early settlement of certain

prepaid variable share forward transactions with respect to shares

of Cencora for delivery of an aggregate 6.1 million shares

- Concurrent with the early settlement, the Company executed a

sale of the remaining 1.3 million shares of Cencora pledged under

the early settled contracts. The Company receives approximately

$300 million from the early settlement and the concurrent sale of

shares

- Following today’s early settlement, the Company owns

approximately 12.6 million shares of Cencora pledged under the

remaining prepaid variable share forward contracts, which have the

potential to provide additional cash proceeds at maturity. These

remaining prepaid variable share forward contracts are mainly

scheduled to mature during March, June and September of calendar

year 2025.

- Use of proceeds will primarily be for debt paydown, as the

Company proactively seeks to address its debt maturities in fiscal

year 2026, and for general corporate purposes

Walgreens Boots Alliance, Inc. (Nasdaq: WBA) has agreed to the

early settlement of certain prepaid variable share forward

transactions it had previously entered into with various financial

institutions, with respect to shares of Cencora, Inc. (NYSE: COR).

Under these transactions, the Company had previously received cash

payments in an aggregate amount of approximately $1.1 billion on or

about the dates of first entering into them. The transactions were

scheduled to mature during March and June of calendar year

2026.

As part of the early settlement of the transactions prior to

their scheduled maturities, WBA will deliver to the financial

institutions an aggregate of approximately 6.1 million shares of

Cencora, while paying a net aggregate cash payment of approximately

$20 million. The transaction fulfills the Company’s obligations to

deliver shares at a future date to each financial institution

participating in the early settlement. These contracts have

accreted cash value to the Company as a result of participation in

the appreciation of Cencora’s stock since entering the transactions

in 2023. The early settlement together with the concurrent share

sale realizes the embedded cash value that exists in the prepaid

variable share forwards.

Concurrent with these early settlements, WBA today announced

that it has sold shares of Cencora common stock in an unregistered

block trade pursuant to Rule 144 for proceeds of approximately $265

million, and has sold additional shares in a share repurchase by

Cencora for additional proceeds of approximately $50 million.

Proceeds to WBA will be used primarily for debt paydown and

general corporate purposes. The proceeds from these transactions as

well as other actions, including the recent suspension of the

dividend, further help position the Company to address its upcoming

debt maturities in fiscal 2026.

Walgreens Boots Alliance’s ownership of Cencora’s common stock

has decreased from approximately 10 percent to approximately six

percent.

The sale has no impact to the long-term partnership between the

two companies. Walgreens Boots Alliance remains fully committed to

the strategic, mutually beneficial relationship with Cencora, which

has been a strong and trusted partner since 2013. Chief Operating

Officer, International of Walgreens Boots Alliance, Ornella Barra,

will continue to serve on Cencora’s Board of Directors.

About Walgreens Boots Alliance

Walgreens Boots Alliance (Nasdaq: WBA) is an integrated

healthcare, pharmacy and retail leader serving millions of

customers and patients every day, with a 175-year heritage of

caring for communities.

A trusted, global innovator in retail pharmacy with

approximately 12,500 locations across the U.S., Europe and Latin

America, WBA plays a critical role in the healthcare ecosystem.

Through dispensing medicines, improving access to pharmacy and

health services, providing high quality health and beauty products

and offering anytime, anywhere convenience across its digital

platforms, WBA is shaping the future of healthcare in the thousands

of communities it serves and beyond.

WBA employs approximately 311,000 people, with a presence in

eight countries and consumer brands including: Walgreens, Boots,

Duane Reade, No7 Beauty Company and Benavides. The Company is proud

of its contributions to healthy communities, a healthy planet, an

inclusive workplace and a sustainable marketplace. In fiscal 2024,

WBA scored 100% on the Disability Equality Index for disability

inclusion.

More Company information is available at

www.walgreensbootsalliance.com.

(WBA-GEN)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206482504/en/

WBA Media Relations USA / Jim Cohn, Jim.cohn@wba.com

WBA Investor Relations Eric Wasserstrom,

Investor.relations@wba.com

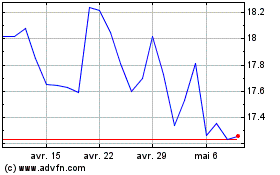

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025