0001174922false00011749222024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 6, 2024

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 000-50028 | 46-0484987 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 3131 Las Vegas Boulevard South | | |

| Las Vegas, | Nevada | | 89109 |

| (Address of principal executive offices) | | (Zip Code) |

(702) 770-7555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | WYNN | | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 6, 2024, Wynn Resorts, Limited (the "Company") issued a press release announcing its results of operations for the quarter ended June 30, 2024. The press release is furnished herewith as Exhibit 99.1. The information furnished under Items 2.02 and 7.01 of this report, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

The information set forth under Item 2.02 of this report is incorporated herein by reference.

On August 6, 2024, the Company announced that its Board of Directors declared a quarterly cash dividend of $0.25 per share, payable on August 30, 2024 to stockholders of record as of August 19, 2024.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | WYNN RESORTS, LIMITED |

| | |

| Dated: August 6, 2024 | | By: | | /s/ Julie Cameron-Doe |

| | | | Julie Cameron-Doe |

| | | | Chief Financial Officer |

Exhibit 99.1

Wynn Resorts, Limited Reports Second Quarter 2024 Results

LAS VEGAS, August 6, 2024 — Wynn Resorts, Limited (NASDAQ: WYNN) ("Wynn Resorts" or the "Company") today reported financial results for the second quarter ended June 30, 2024.

Operating revenues were $1.73 billion for the second quarter of 2024, an increase of $137.1 million from $1.60 billion for the second quarter of 2023. Net income attributable to Wynn Resorts, Limited was $111.9 million for the second quarter of 2024, compared to net income attributable to Wynn Resorts, Limited of $105.2 million for the second quarter of 2023. Diluted net income per share was $0.91 for the second quarter of 2024, compared to diluted net income per share of $0.84 for the second quarter of 2023. Adjusted Property EBITDAR(1) was $571.7 million for the second quarter of 2024, compared to Adjusted Property EBITDAR of $524.5 million for the second quarter of 2023.

"Our second quarter results, including a new second quarter record for Adjusted Property EBITDAR, reflect continued strength throughout our business. I am incredibly proud of our teams in Las Vegas, Macau and Boston," said Craig Billings, CEO of Wynn Resorts, Limited. "Importantly, we continue to invest in growing the business, with construction on Wynn Al Marjan Island in the UAE progressing at a rapid pace. During the quarter, we also finalized a transaction to acquire our pro-rata share of the land on Al Marjan Island Three, including a sizable land bank for potential future development opportunities for Wynn Resorts or for selected third parties complementary to Wynn Al Marjan."

Consolidated Results

Operating revenues were $1.73 billion for the second quarter of 2024, an increase of $137.1 million from $1.60 billion for the second quarter of 2023. For the second quarter of 2024, operating revenues increased $79.7 million, $35.7 million, $50.6 million at Wynn Palace, Wynn Macau, and our Las Vegas Operations, respectively, and decreased $9.3 million at Encore Boston Harbor, from the second quarter of 2023.

Net income attributable to Wynn Resorts, Limited was $111.9 million for the second quarter of 2024, compared to net income attributable to Wynn Resorts, Limited of $105.2 million for the second quarter of 2023. Diluted net income per share was $0.91 for the second quarter of 2024, compared to diluted net income per share of $0.84 for the second quarter of 2023. Adjusted net income attributable to Wynn Resorts, Limited(2) was $124.5 million, or $1.12 per diluted share, for the second quarter of 2024, compared to adjusted net income attributable to Wynn Resorts, Limited of $103.3 million, or $0.91 per diluted share, for the second quarter of 2023.

Adjusted Property EBITDAR was $571.7 million for the second quarter of 2024, an increase of $47.2 million compared to Adjusted Property EBITDAR of $524.5 million for the second quarter of 2023. For the second quarter of 2024, Adjusted Property EBITDAR increased $27.9 million, $6.3 million, and $6.2 million at Wynn Palace, Wynn Macau, and our Las Vegas Operations, respectively, and decreased $7.0 million at Encore Boston Harbor, from the second quarter of 2023.

Wynn Resorts, Limited also announced today that its Board of Directors has declared a cash dividend of $0.25 per share, payable on August 30, 2024 to stockholders of record as of August 19, 2024.

Property Results

Macau Operations

Wynn Palace

Operating revenues from Wynn Palace were $548.0 million for the second quarter of 2024, an increase of $79.7 million from $468.4 million for the second quarter of 2023. Adjusted Property EBITDAR from Wynn Palace was $184.5 million for the second quarter of 2024, compared to $156.6 million for the second quarter of 2023. Table games win percentage in mass market operations was 23.6%, above the 20.3% experienced in the second quarter of 2023. VIP table games win as a percentage of turnover was 4.10%, above the property's expected range of 3.1% to 3.4% and below the 4.24% experienced in the second quarter of 2023.

Wynn Macau

Operating revenues from Wynn Macau were $337.3 million for the second quarter of 2024, an increase of $35.7 million from $301.6 million for the second quarter of 2023. Adjusted Property EBITDAR from Wynn Macau was $95.9 million for the second quarter of 2024, compared to $89.6 million for the second quarter of 2023. Table games win percentage in mass market operations was 17.5%, below the 17.7% experienced in the second quarter of 2023. VIP table games win as a percentage of turnover was 2.19%, below the property's expected range of 3.1% to 3.4% and below the 4.16% experienced in the second quarter of 2023.

Las Vegas Operations

Operating revenues from our Las Vegas Operations were $628.7 million for the second quarter of 2024, an increase of $50.6 million from $578.1 million for the second quarter of 2023. Adjusted Property EBITDAR from our Las Vegas Operations for the second quarter of 2024 was $230.3 million, compared to $224.1 million for the second quarter of 2023. Table games win percentage for the second quarter of 2024 was 21.9%, slightly below the property's expected range of 22% to 26% and below the 22.9% experienced in the second quarter of 2023.

Encore Boston Harbor

Operating revenues from Encore Boston Harbor were $212.6 million for the second quarter of 2024, a decrease of $9.3 million from $221.9 million for the second quarter of 2023. Adjusted Property EBITDAR from Encore Boston Harbor for the second quarter of 2024 was $62.1 million, compared to $69.1 million for the second quarter of 2023. Table games win percentage for the second quarter of 2024 was 19.6%, within the property's expected range of 18% to 22% and below the 22.3% experienced in the second quarter of 2023.

Wynn Al Marjan Island Development

During the second quarter of 2024, the Company contributed $356.5 million of cash into a 40%-owned joint venture that is constructing the Wynn Al Marjan Island development in the UAE, bringing our life-to-date cash contributions to the project to $514.4 million. The cash contributed in the quarter was used primarily to fund our pro rata portion of the purchase of approximately 155 acres of land underlying the integrated resort development site, including over 70 acres of land for potential future development in Ras Al Khaimah. Wynn Al Marjan Island is currently expected to open in 2027.

Balance Sheet

Our cash and cash equivalents as of June 30, 2024 totaled $2.38 billion, comprised of $1.38 billion held by Wynn Macau, Limited ("WML") and subsidiaries, $281.1 million held by Wynn Resorts Finance, LLC ("WRF") and subsidiaries excluding WML, and $715.6 million held at Corporate and other. In addition, as of June 30, 2024, we had $500.0 million in short-term investments held at WML. As of June 30, 2024, the available borrowing capacity under the WRF Revolver and the WM Cayman II Revolver was $735.3 million and $312.2 million, respectively.

Total current and long-term debt outstanding at June 30, 2024 was $11.03 billion, comprised of $6.44 billion of Macau related debt, $1.46 billion of Wynn Las Vegas debt, $2.52 billion of WRF debt, and $614.4 million of debt held by the retail joint venture which we consolidate.

During the second quarter of 2024, the Company repurchased 741,340 shares of its common stock under its publicly announced equity repurchase program at an average price of $91.72 per share, for an aggregate cost of $68.0 million. As of June 30, 2024, the Company had $365.4 million in repurchase authority remaining under the program.

Conference Call and Other Information

The Company will hold a conference call to discuss its results, including the results of Wynn Resorts Finance, LLC and Wynn Las Vegas, LLC, on August 6, 2024 at 1:30 p.m. PT (4:30 p.m. ET). Interested parties are invited to join the call by accessing a live audio webcast at http://www.wynnresorts.com. On or before August 14, 2024, the Company will make Wynn Resorts Finance, LLC and Wynn Las Vegas, LLC financial information for the quarter ended June 30, 2024 available to noteholders, prospective investors, broker-dealers and securities analysts. Please contact our investor relations office at 702-770-7555 or at investorrelations@wynnresorts.com, to obtain access to such financial information.

Forward-looking Statements

This release contains forward-looking statements regarding operating trends and future results of operations. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those we express in these forward-looking statements, including, but not limited to, reductions in discretionary consumer spending, adverse macroeconomic conditions and their impact on levels of disposable consumer income and wealth, changes in interest rates, inflation, a decline in general economic activity or recession in the U.S. and/or global economies, extensive regulation of our business, pending or future legal proceedings, ability to maintain gaming licenses and concessions, dependence on key employees, general global political conditions, adverse tourism trends, travel disruptions caused by events outside of our control, dependence on a limited number of resorts, competition in the casino/hotel and resort industries, uncertainties over the development and success of new gaming and resort properties, construction and regulatory risks associated with current and future projects (including Wynn Al Marjan Island), cybersecurity risk and our leverage and ability to meet our debt service obligations. Additional information concerning potential factors that could affect the Company's financial results is included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, as supplemented by the Company's other periodic reports filed with the Securities and Exchange Commission from time to time. The Company is under no obligation to (and expressly disclaims any such obligation to) update or revise its forward-looking statements as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures

(1) "Adjusted Property EBITDAR" is net income before interest, income taxes, depreciation and amortization, pre-opening expenses, property charges and other, triple-net operating lease rent expense related to Encore Boston Harbor, management and license fees, corporate expenses and other (including intercompany golf course, meeting and convention, and water rights leases), stock-based compensation, change in derivatives fair value, loss on debt financing transactions, and other non-operating income and expenses. Adjusted Property EBITDAR is presented exclusively as a supplemental disclosure because management believes that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Management uses Adjusted Property EBITDAR as a measure of the operating performance of its segments and to compare the operating performance of its properties with those of its competitors, as well as a basis for determining certain incentive compensation. We also present Adjusted Property EBITDAR because it is used by some investors to measure a company's ability to incur and service debt, make capital expenditures and meet working capital requirements. Gaming companies have historically reported EBITDAR as a supplement to GAAP. In order to view the operations of their casinos on a more stand-alone basis, gaming companies, including us, have historically excluded from their EBITDAR calculations pre-opening expenses, property charges, corporate expenses and stock-based compensation, that do not relate to the management of specific casino properties. However, Adjusted Property EBITDAR should not be considered as an alternative to operating income as an indicator of our performance, as an alternative to cash flows from operating activities as a measure of liquidity, or as an alternative to any other measure determined in accordance with GAAP. Unlike net income, Adjusted Property EBITDAR does not include depreciation or interest expense and therefore does not reflect current or future capital expenditures or the cost of capital. We have significant uses of cash flows, including capital expenditures, triple-net operating lease rent expense related to Encore Boston Harbor, interest payments, debt principal repayments, income taxes and other non-recurring charges, which are not reflected in Adjusted Property EBITDAR. Also, our calculation of Adjusted Property EBITDAR may be different from the calculation methods used by other companies and, therefore, comparability may be limited.

(2) "Adjusted net income attributable to Wynn Resorts, Limited" is net income attributable to Wynn Resorts, Limited before pre-opening expenses, property charges and other, change in derivatives fair value, loss on debt financing transactions, and foreign currency remeasurement and other, net of noncontrolling interests and income taxes calculated using the specific tax treatment applicable to the adjustments based on their respective jurisdictions. Adjusted net income attributable to Wynn Resorts, Limited and adjusted net income attributable to Wynn Resorts, Limited per diluted share are presented as supplemental disclosures to financial measures in accordance with GAAP because management believes that these non-GAAP financial measures are widely used to measure the performance, and as a principal basis for valuation, of gaming companies. These measures are used by management and/or evaluated by some investors, in addition to net income per share computed in accordance with GAAP, as an additional basis for assessing period-to-period results of our business. Adjusted net income attributable to Wynn Resorts, Limited and adjusted net income attributable to Wynn Resorts, Limited per diluted share may be different from the calculation methods used by other companies and, therefore, comparability may be limited.

The Company has included schedules in the tables that accompany this release that reconcile (i) net income attributable to Wynn Resorts, Limited to adjusted net income attributable to Wynn Resorts, Limited, (ii) operating income (loss) to Adjusted Property EBITDAR, and (iii) net income attributable to Wynn Resorts, Limited to Adjusted Property EBITDAR.

WYNN RESORTS, LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating revenues: | | | | | | | |

| Casino | $ | 1,008,946 | | | $ | 912,999 | | | $ | 2,130,412 | | | $ | 1,679,991 | |

| Rooms | 304,521 | | | 276,505 | | | 631,935 | | | 549,034 | |

| Food and beverage | 281,404 | | | 257,036 | | | 548,342 | | | 489,647 | |

| Entertainment, retail and other | 138,061 | | | 149,282 | | | 285,152 | | | 300,829 | |

| Total operating revenues | 1,732,932 | | | 1,595,822 | | | 3,595,841 | | | 3,019,501 | |

| Operating expenses: | | | | | | | |

| Casino | 614,518 | | | 543,643 | | | 1,289,957 | | | 1,017,028 | |

| Rooms | 80,538 | | | 73,783 | | | 162,615 | | | 146,485 | |

| Food and beverage | 221,343 | | | 203,922 | | | 427,164 | | | 384,541 | |

| Entertainment, retail and other | 62,941 | | | 85,999 | | | 133,953 | | | 178,481 | |

| General and administrative | 264,727 | | | 257,321 | | | 536,343 | | | 517,093 | |

| Provision for credit losses | 2,429 | | | (6,640) | | | 2,516 | | | (7,184) | |

| Pre-opening | 1,558 | | | 1,477 | | | 3,593 | | | 5,955 | |

| Depreciation and amortization | 176,405 | | | 169,962 | | | 351,338 | | | 338,774 | |

| Property charges and other | 38,815 | | | 16,019 | | | 55,763 | | | 18,477 | |

| Total operating expenses | 1,463,274 | | | 1,345,486 | | | 2,963,242 | | | 2,599,650 | |

| Operating income | 269,658 | | | 250,336 | | | 632,599 | | | 419,851 | |

| Other income (expense): | | | | | | | |

| Interest income | 34,884 | | | 44,127 | | | 75,056 | | | 84,320 | |

| Interest expense, net of amounts capitalized | (174,596) | | | (190,243) | | | (357,000) | | | (377,983) | |

| Change in derivatives fair value | 15,517 | | | 24,336 | | | (2,397) | | | 47,382 | |

| Loss on debt financing transactions | — | | | (3,375) | | | (1,561) | | | (15,611) | |

| Other | 8,745 | | | 6,959 | | | 4,023 | | | (23,655) | |

| Other income (expense), net | (115,450) | | | (118,196) | | | (281,879) | | | (285,547) | |

| Income before income taxes | 154,208 | | | 132,140 | | | 350,720 | | | 134,304 | |

| Provision for income taxes | (7,935) | | | (4,305) | | | (27,949) | | | (5,323) | |

| Net income | 146,273 | | | 127,835 | | | 322,771 | | | 128,981 | |

| Less: net income attributable to noncontrolling interests | (34,330) | | | (22,651) | | | (66,612) | | | (11,465) | |

| Net income attributable to Wynn Resorts, Limited | $ | 111,943 | | | $ | 105,184 | | | $ | 256,159 | | | $ | 117,516 | |

| Basic and diluted net income per common share: | | | | | | | |

| Net income attributable to Wynn Resorts, Limited: | | | | |

| Basic | $ | 1.01 | | | $ | 0.93 | | | $ | 2.31 | | | $ | 1.04 | |

| Diluted | $ | 0.91 | | | $ | 0.84 | | | $ | 2.30 | | | $ | 0.84 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 110,937 | | | 112,889 | | | 110,980 | | | 112,821 | |

| Diluted | 111,175 | | | 113,198 | | | 111,222 | | | 113,143 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to Wynn Resorts, Limited | $ | 111,943 | | | $ | 105,184 | | | $ | 256,159 | | | $ | 117,516 | |

| Pre-opening expenses | 1,558 | | | 1,477 | | | 3,593 | | | 5,955 | |

| Property charges and other | 38,815 | | | 16,019 | | | 55,763 | | | 18,477 | |

| Change in derivatives fair value | (15,517) | | | (24,336) | | | 2,397 | | | (47,382) | |

| Loss on debt financing transactions | — | | | 3,375 | | | 1,561 | | | 15,611 | |

| Foreign currency remeasurement and other | (8,745) | | | (6,959) | | | (4,023) | | | 23,655 | |

| Income tax impact on adjustments | (9,684) | | | 1,502 | | | (10,252) | | | 10 | |

| Noncontrolling interests impact on adjustments | 6,135 | | | 7,078 | | | (3,892) | | | 2,830 | |

| Adjusted net income attributable to Wynn Resorts, Limited | $ | 124,505 | | | $ | 103,340 | | | $ | 301,306 | | | $ | 136,672 | |

| Adjusted net income attributable to Wynn Resorts, Limited per diluted share | $ | 1.12 | | | $ | 0.91 | | | $ | 2.71 | | | $ | 1.21 | |

| | | | | | | |

| Weighted average common shares outstanding - diluted | 111,175 | | | 113,198 | | | 111,222 | | | 113,143 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| Wynn Palace | | Wynn Macau | | Other Macau | | Total Macau Operations | | Las Vegas Operations | | Encore Boston Harbor | | Corporate and Other | | Total |

| Operating income (loss) | $ | 108,249 | | | $ | 61,172 | | | $ | (7,486) | | | $ | 161,935 | | | $ | 124,738 | | | $ | (17,827) | | | $ | 812 | | | $ | 269,658 | |

| Pre-opening expenses | — | | | — | | | — | | | — | | | 334 | | | 515 | | | 709 | | | 1,558 | |

| Depreciation and amortization | 55,316 | | | 20,035 | | | 390 | | | 75,741 | | | 61,885 | | | 31,733 | | | 7,046 | | | 176,405 | |

| Property charges and other | 272 | | | 883 | | | 2 | | | 1,157 | | | 1,906 | | | (174) | | | 35,926 | | | 38,815 | |

| Management and license fees | 17,360 | | | 10,486 | | | — | | | 27,846 | | | 29,675 | | | 10,395 | | | (67,916) | | | — | |

| Corporate expenses and other | 2,005 | | | 1,999 | | | 5,983 | | | 9,987 | | | 7,957 | | | 1,752 | | | 14,014 | | | 33,710 | |

| Stock-based compensation | 1,257 | | | 1,336 | | | 1,111 | | | 3,704 | | | 3,838 | | | 395 | | | 8,230 | | | 16,167 | |

| Triple-net operating lease rent expense | — | | | — | | | — | | | — | | | — | | | 35,342 | | | — | | | 35,342 | |

| Adjusted Property EBITDAR | $ | 184,459 | | | $ | 95,911 | | | $ | — | | | $ | 280,370 | | | $ | 230,333 | | | $ | 62,131 | | | $ | (1,179) | | | $ | 571,655 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| Wynn Palace | | Wynn Macau | | Other Macau | | Total Macau Operations | | Las Vegas Operations | | Encore Boston Harbor | | Corporate and Other | | Total |

| Operating income (loss) | $ | 80,275 | | | $ | 47,267 | | | $ | (5,855) | | | $ | 121,687 | | | $ | 123,270 | | | $ | (11,003) | | | $ | 16,382 | | | $ | 250,336 | |

| Pre-opening expenses | — | | | — | | | — | | | — | | | — | | | 336 | | | 1,141 | | | 1,477 | |

| Depreciation and amortization | 53,908 | | | 20,527 | | | 380 | | | 74,815 | | | 57,521 | | | 30,198 | | | 7,428 | | | 169,962 | |

| Property charges and other | 1,534 | | | 6,603 | | | 12 | | | 8,149 | | | 6,938 | | | 804 | | | 128 | | | 16,019 | |

| Management and license fees | 15,074 | | | 9,487 | | | — | | | 24,561 | | | 27,441 | | | 10,746 | | | (62,748) | | | — | |

| Corporate expenses and other | 2,885 | | | 2,894 | | | 4,428 | | | 10,207 | | | 7,330 | | | 1,949 | | | 13,262 | | | 32,748 | |

| Stock-based compensation | 2,931 | | | 2,812 | | | 1,035 | | | 6,778 | | | 1,621 | | | 443 | | | 9,443 | | | 18,285 | |

| Triple-net operating lease rent expense | — | | | — | | | — | | | — | | | — | | | 35,631 | | | — | | | 35,631 | |

| Adjusted Property EBITDAR | $ | 156,607 | | | $ | 89,590 | | | $ | — | | | $ | 246,197 | | | $ | 224,121 | | | $ | 69,104 | | | $ | (14,964) | | | $ | 524,458 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| Wynn Palace | | Wynn Macau | | Other Macau | | Total Macau Operations | | Las Vegas Operations | | Encore Boston Harbor | | Corporate and Other | | Total |

| Operating income (loss) | $ | 221,841 | | | $ | 162,176 | | | $ | (16,099) | | | $ | 367,918 | | | $ | 271,187 | | | $ | (34,919) | | | $ | 28,413 | | | $ | 632,599 | |

| Pre-opening expenses | — | | | — | | | — | | | — | | | 736 | | | 647 | | | 2,210 | | | 3,593 | |

| Depreciation and amortization | 110,443 | | | 40,079 | | | 770 | | | 151,292 | | | 120,629 | | | 63,076 | | | 16,341 | | | 351,338 | |

| Property charges and other | 11,692 | | | 446 | | | 112 | | | 12,250 | | | 2,175 | | | 170 | | | 41,168 | | | 55,763 | |

| Management and license fees | 36,288 | | | 23,345 | | | — | | | 59,633 | | | 59,917 | | | 21,023 | | | (140,573) | | | — | |

| Corporate expenses and other | 4,388 | | | 4,501 | | | 13,120 | | | 22,009 | | | 15,951 | | | 3,718 | | | 31,937 | | | 73,615 | |

| Stock-based compensation | 2,177 | | | 2,550 | | | 2,097 | | | 6,824 | | | 6,000 | | | 805 | | | 16,907 | | | 30,536 | |

| Triple-net operating lease rent expense | — | | | — | | | — | | | — | | | — | | | 70,746 | | | — | | | 70,746 | |

| Adjusted Property EBITDAR | $ | 386,829 | | | $ | 233,097 | | | $ | — | | | $ | 619,926 | | | $ | 476,595 | | | $ | 125,266 | | | $ | (3,597) | | | $ | 1,218,190 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 |

| Wynn Palace | | Wynn Macau | | Other Macau | | Total Macau Operations | | Las Vegas Operations | | Encore Boston Harbor | | Corporate and Other | | Total |

| Operating income (loss) | $ | 120,143 | | | $ | 59,516 | | | $ | (10,838) | | | $ | 168,821 | | | $ | 261,772 | | | $ | (25,952) | | | $ | 15,210 | | | $ | 419,851 | |

| Pre-opening expenses | — | | | — | | | — | | | — | | | 81 | | | 1,247 | | | 4,627 | | | 5,955 | |

| Depreciation and amortization | 108,075 | | | 41,177 | | | 760 | | | 150,012 | | | 114,202 | | | 60,132 | | | 14,428 | | | 338,774 | |

| Property charges and other | 3,829 | | | 7,078 | | | 13 | | | 10,920 | | | 7,151 | | | 222 | | | 184 | | | 18,477 | |

| Management and license fees | 26,904 | | | 16,762 | | | — | | | 43,666 | | | 55,253 | | | 21,249 | | | (120,168) | | | — | |

| Corporate expenses and other | 5,111 | | | 5,219 | | | 8,052 | | | 18,382 | | | 13,886 | | | 3,813 | | | 31,157 | | | 67,238 | |

| Stock-based compensation | 3,603 | | | 4,583 | | | 2,013 | | | 10,199 | | | 3,373 | | | 893 | | | 18,530 | | | 32,995 | |

| Triple-net operating lease rent expense | — | | | — | | | — | | | — | | | — | | | 70,914 | | | — | | | 70,914 | |

| Adjusted Property EBITDAR | $ | 267,665 | | | $ | 134,335 | | | $ | — | | | $ | 402,000 | | | $ | 455,718 | | | $ | 132,518 | | | $ | (36,032) | | | $ | 954,204 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED PROPERTY EBITDAR

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to Wynn Resorts, Limited | $ | 111,943 | | | $ | 105,184 | | | $ | 256,159 | | | $ | 117,516 | |

| Net income attributable to noncontrolling interests | 34,330 | | | 22,651 | | | 66,612 | | | 11,465 | |

| Pre-opening expenses | 1,558 | | | 1,477 | | | 3,593 | | | 5,955 | |

| Depreciation and amortization | 176,405 | | | 169,962 | | | 351,338 | | | 338,774 | |

| Property charges and other | 38,815 | | | 16,019 | | | 55,763 | | | 18,477 | |

| Triple-net operating lease rent expense | 35,342 | | | 35,631 | | | 70,746 | | | 70,914 | |

| Corporate expenses and other | 33,710 | | | 32,748 | | | 73,615 | | | 67,238 | |

| Stock-based compensation | 16,167 | | | 18,285 | | | 30,536 | | | 32,995 | |

| Interest income | (34,884) | | | (44,127) | | | (75,056) | | | (84,320) | |

| Interest expense, net of amounts capitalized | 174,596 | | | 190,243 | | | 357,000 | | | 377,983 | |

| Change in derivatives fair value | (15,517) | | | (24,336) | | | 2,397 | | | (47,382) | |

| Loss on debt financing transactions | — | | | 3,375 | | | 1,561 | | | 15,611 | |

| Other | (8,745) | | | (6,959) | | | (4,023) | | | 23,655 | |

| Provision for income taxes | 7,935 | | | 4,305 | | | 27,949 | | | 5,323 | |

| Adjusted Property EBITDAR | $ | 571,655 | | | $ | 524,458 | | | $ | 1,218,190 | | | $ | 954,204 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win per unit per day, ADR and REVPAR)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2024 | | 2023 | | Percent Change | | 2024 | | 2023 | | Percent Change |

| Wynn Palace Supplemental Information | | | | | | | | | | | |

| Operating revenues | | | | | | | | | | | |

| Casino | $ | 444,964 | | $ | 365,277 | | 21.8 | | | $ | 918,745 | | $ | 635,964 | | 44.5 | |

| Rooms | 50,206 | | 50,092 | | 0.2 | | | 104,142 | | 97,002 | | 7.4 | |

| Food and beverage | 29,829 | | 25,260 | | 18.1 | | | 61,899 | | 48,813 | | 26.8 | |

| Entertainment, retail and other | 23,050 | | 27,721 | | (16.9) | | | 50,164 | | 55,934 | | (10.3) | |

| Total | $ | 548,049 | | $ | 468,350 | | 17.0 | | | $ | 1,134,950 | | $ | 837,713 | | 35.5 | |

| | | | | | | | | | | |

Adjusted Property EBITDAR (6) | $ | 184,459 | | $ | 156,607 | | 17.8 | | | $ | 386,829 | | $ | 267,665 | | 44.5 | |

| | | | | | | | | | | |

| Casino statistics: | | | | | | | | | | | |

| VIP: | | | | | | | | | | | |

| Average number of table games | 57 | | 57 | | — | | | 58 | | 54 | | 7.4 | |

| VIP turnover | $ | 2,810,016 | | $ | 3,042,338 | | (7.6) | | | $ | 6,731,100 | | $ | 5,335,696 | | 26.2 | |

VIP table games win (1) | $ | 115,297 | | $ | 129,030 | | (10.6) | | | $ | 244,712 | | $ | 191,478 | | 27.8 | |

| VIP table games win as a % of turnover | 4.10 | % | | 4.24 | % | | | | 3.64 | % | | 3.59 | % | | |

| Table games win per unit per day | $ | 22,092 | | $ | 24,728 | | (10.7) | | | $ | 23,195 | | $ | 19,697 | | 17.8 | |

| Mass market: | | | | | | | | | | | |

| Average number of table games | 243 | | 240 | | 1.3 | | | 244 | | 239 | | 2.1 | |

Table drop (2) | $ | 1,738,260 | | $ | 1,507,148 | | 15.3 | | | $ | 3,520,444 | | $ | 2,689,146 | | 30.9 | |

Table games win (1) | $ | 409,409 | | $ | 305,817 | | 33.9 | | | $ | 846,732 | | $ | 566,683 | | 49.4 | |

| Table games win % | 23.6 | % | | 20.3 | % | | | | 24.1 | % | | 21.1 | % | | |

| Table games win per unit per day | $ | 18,484 | | $ | 13,980 | | 32.2 | | | $ | 19,039 | | $ | 13,125 | | 45.1 | |

| Average number of slot machines | 607 | | 586 | | 3.6 | | | 590 | | 587 | | 0.5 | |

| Slot machine handle | $ | 642,713 | | $ | 579,626 | | 10.9 | | | $ | 1,238,334 | | $ | 1,126,224 | | 10.0 | |

Slot machine win (3) | $ | 25,590 | | $ | 27,583 | | (7.2) | | | $ | 56,560 | | $ | 53,008 | | 6.7 | |

| Slot machine win per unit per day | $ | 464 | | $ | 517 | | (10.3) | | | $ | 527 | | $ | 499 | | 5.6 | |

| Poker rake | $ | 736 | | $ | — | | NM | | $ | 736 | | $ | — | | NM |

| Room statistics: | | | | | | | | | | | |

| Occupancy | 98.9 | % | | 96.5 | % | | | | 98.9 | % | | 92.2 | % | | |

ADR (4) | $ | 316 | | $ | 318 | | (0.6) | | | $ | 326 | | $ | 319 | | 2.2 | |

REVPAR (5) | $ | 312 | | $ | 307 | | 1.6 | | | $ | 323 | | $ | 294 | | 9.9 | |

NM - Not meaningful.

WYNN RESORTS, LIMITED AND SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win per unit per day, ADR and REVPAR)

(unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2024 | | 2023 | | Percent Change | | 2024 | | 2023 | | Percent Change |

| Wynn Macau Supplemental Information | | | | | | | | | | | |

| Operating revenues | | | | | | | | | | | |

| Casino | $ | 280,717 | | $ | 242,950 | | 15.5 | | | $ | 627,070 | | $ | 419,333 | | 49.5 | |

| Rooms | 23,742 | | 26,130 | | (9.1) | | | 52,361 | | 48,101 | | 8.9 | |

| Food and beverage | 20,003 | | 14,666 | | 36.4 | | | 41,022 | | 28,968 | | 41.6 | |

| Entertainment, retail and other | 12,807 | | 17,847 | | (28.2) | | | 28,560 | | 35,917 | | (20.5) | |

| Total | $ | 337,269 | | $ | 301,593 | | 11.8 | | | $ | 749,013 | | $ | 532,319 | | 40.7 | |

| | | | | | | | | | | |

Adjusted Property EBITDAR (6) | $ | 95,911 | | $ | 89,590 | | 7.1 | | | $ | 233,097 | | $ | 134,335 | | 73.5 | |

| | | | | | | | | | | |

| Casino statistics: | | | | | | | | | | | |

| VIP: | | | | | | | | | | | |

| Average number of table games | 30 | | 48 | | (37.5) | | | 30 | | 50 | | (40.0) | |

| VIP turnover | $ | 1,164,075 | | $ | 1,390,272 | | (16.3) | | | $ | 2,753,760 | | $ | 2,534,496 | | 8.7 | |

VIP table games win (1) | $ | 25,473 | | $ | 57,828 | | (56.0) | | | $ | 79,379 | | $ | 88,579 | | (10.4) | |

| VIP table games win as a % of turnover | 2.19 | % | | 4.16 | % | | | | 2.88 | % | | 3.49 | % | | |

| Table games win per unit per day | $ | 9,449 | | $ | 13,257 | | (28.7) | | | $ | 14,629 | | $ | 9,808 | | 49.2 | |

| Mass market: | | | | | | | | | | | |

| Average number of table games | 222 | | 209 | | 6.2 | | | 222 | | 213 | | 4.2 | |

Table drop (2) | $ | 1,602,920 | | $ | 1,223,311 | | 31.0 | | | $ | 3,286,071 | | $ | 2,213,299 | | 48.5 | |

Table games win (1) | $ | 280,830 | | $ | 216,405 | | 29.8 | | | $ | 607,150 | | $ | 384,831 | | 57.8 | |

| Table games win % | 17.5 | % | | 17.7 | % | | | | 18.5 | % | | 17.4 | % | | |

| Table games win per unit per day | $ | 13,905 | | $ | 11,388 | | 22.1 | | | $ | 15,048 | | $ | 9,997 | | 50.5 | |

| Average number of slot machines | 617 | | 533 | | 15.8 | | | 600 | | 532 | | 12.8 | |

| Slot machine handle | $ | 801,813 | | $ | 519,807 | | 54.3 | | | $ | 1,532,202 | | $ | 989,576 | | 54.8 | |

Slot machine win (3) | $ | 25,978 | | $ | 15,452 | | 68.1 | | | $ | 52,170 | | $ | 31,749 | | 64.3 | |

| Slot machine win per unit per day | $ | 463 | | $ | 319 | | 45.1 | | | $ | 478 | | $ | 330 | | 44.8 | |

| Poker rake | $ | 3,607 | | $ | 5,376 | | (32.9) | | | $ | 8,626 | | $ | 9,312 | | (7.4) | |

| Room statistics: | | | | | | | | | | | |

| Occupancy | 99.4 | % | | 96.8 | % | | | | 99.4 | % | | 93.9 | % | | |

ADR (4) | $ | 236 | | $ | 269 | | (12.3) | | | $ | 260 | | $ | 256 | | 1.6 | |

REVPAR (5) | $ | 234 | | $ | 260 | | (10.0) | | | $ | 258 | | $ | 240 | | 7.5 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win per unit per day, ADR and REVPAR)

(unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2024 | | 2023 | | Percent Change | | 2024 | | 2023 | | Percent Change |

| Las Vegas Operations Supplemental Information | | | | | | | | | | | |

| Operating revenues | | | | | | | | | | | |

| Casino | $ | 129,674 | | $ | 137,946 | | (6.0) | | | $ | 264,837 | | $ | 292,476 | | (9.5) | |

| Rooms | 205,872 | | 177,765 | | 15.8 | | | 429,948 | | 362,874 | | 18.5 | |

| Food and beverage | 208,418 | | 195,146 | | 6.8 | | | 402,028 | | 367,629 | | 9.4 | |

| Entertainment, retail and other | 84,690 | | 67,215 | | 26.0 | | | 168,389 | | 141,857 | | 18.7 | |

| Total | $ | 628,654 | | $ | 578,072 | | 8.8 | | | $ | 1,265,202 | | $ | 1,164,836 | | 8.6 | |

| | | | | | | | | | | |

Adjusted Property EBITDAR (6) | $ | 230,333 | | $ | 224,121 | | 2.8 | | | $ | 476,595 | | $ | 455,718 | | 4.6 | |

| | | | | | | | | | | |

| Casino statistics: | | | | | | | | | | | |

| Average number of table games | 234 | | 235 | | (0.4) | | | 234 | | 233 | | 0.4 | |

Table drop (2) | $ | 536,461 | | $ | 559,701 | | (4.2) | | | $ | 1,140,635 | | $ | 1,160,447 | | (1.7) | |

Table games win (1) | $ | 117,496 | | $ | 128,012 | | (8.2) | | | $ | 274,107 | | $ | 274,022 | | — | |

| Table games win % | 21.9 | % | | 22.9 | % | | | | 24.0 | % | | 23.6 | % | | |

| Table games win per unit per day | $ | 5,529 | | $ | 5,997 | | (7.8) | | | $ | 6,444 | | $ | 6,490 | | (0.7) | |

| Average number of slot machines | 1,598 | | 1,651 | | (3.2) | | | 1,608 | | 1,660 | | (3.1) | |

| Slot machine handle | $ | 1,648,364 | | $ | 1,522,525 | | 8.3 | | | $ | 3,144,442 | | $ | 3,095,260 | | 1.6 | |

Slot machine win (3) | $ | 110,017 | | $ | 103,357 | | 6.4 | | | $ | 209,773 | | $ | 210,145 | | (0.2) | |

| Slot machine win per unit per day | $ | 757 | | $ | 688 | | 10.0 | | | $ | 717 | | $ | 700 | | 2.4 | |

| Poker rake | $ | 7,501 | | $ | 6,460 | | 16.1 | | | $ | 12,023 | | $ | 10,574 | | 13.7 | |

| Room statistics: | | | | | | | | | | | |

| Occupancy | 90.9 | % | | 90.6 | % | | | | 89.4 | % | | 89.7 | % | | |

ADR (4) | $ | 532 | | $ | 462 | | 15.2 | | | $ | 563 | | $ | 477 | | 18.0 | |

REVPAR (5) | $ | 484 | | $ | 418 | | 15.8 | | | $ | 504 | | $ | 428 | | 17.8 | |

WYNN RESORTS, LIMITED AND SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win per unit per day, ADR, and REVPAR)

(unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2024 | | 2023 | | Percent Change | | 2024 | | 2023 | | Percent Change |

| Encore Boston Harbor Supplemental Information | | | | | | | | | | | |

| Operating revenues | | | | | | | | | | | |

| Casino | $ | 153,591 | | $ | 166,826 | | (7.9) | | | $ | 319,760 | | $ | 332,218 | | (3.7) | |

| Rooms | 24,701 | | 22,518 | | 9.7 | | | 45,484 | | 41,057 | | 10.8 | |

| Food and beverage | 23,154 | | 21,964 | | 5.4 | | | 43,393 | | 44,237 | | (1.9) | |

| Entertainment, retail and other | 11,162 | | 10,624 | | 5.1 | | | 21,755 | | 20,726 | | 5.0 | |

| Total | $ | 212,608 | | $ | 221,932 | | (4.2) | | | $ | 430,392 | | $ | 438,238 | | (1.8) | |

| | | | | | | | | | | |

Adjusted Property EBITDAR (6) | $ | 62,131 | | $ | 69,104 | | (10.1) | | | $ | 125,266 | | $ | 132,518 | | (5.5) | |

| | | | | | | | | | | |

| Casino statistics: | | | | | | | | | | | |

| Average number of table games | 185 | | 190 | | (2.6) | | | 184 | | 194 | | (5.2) | |

Table drop (2) | $ | 358,857 | | $ | 354,365 | | 1.3 | | | $ | 725,668 | | $ | 720,406 | | 0.7 | |

Table games win (1) | $ | 70,471 | | $ | 79,072 | | (10.9) | | | $ | 153,449 | | $ | 158,615 | | (3.3) | |

| Table games win % | 19.6 | % | | 22.3 | % | | | | 21.1 | % | | 22.0 | % | | |

| Table games win per unit per day | $ | 4,186 | | $ | 4,573 | | (8.5) | | | $ | 4,576 | | $ | 4,512 | | 1.4 | |

| Average number of slot machines | 2,590 | | 2,561 | | 1.1 | | | 2,613 | | 2,540 | | 2.9 | |

| Slot machine handle | $ | 1,420,607 | | $ | 1,300,237 | | 9.3 | | | $ | 2,823,454 | | $ | 2,596,664 | | 8.7 | |

Slot machine win (3) | $ | 105,558 | | $ | 106,726 | | (1.1) | | | $ | 210,223 | | $ | 210,799 | | (0.3) | |

| Slot machine win per unit per day | $ | 448 | | $ | 458 | | (2.2) | | | $ | 442 | | $ | 459 | | (3.7) | |

| Poker rake | $ | 5,307 | | $ | 5,211 | | 1.8 | | | $ | 11,088 | | $ | 10,893 | | 1.8 | |

| Room statistics: | | | | | | | | | | | |

| Occupancy | 96.5 | % | | 92.7 | % | | | | 93.1 | % | | 91.4 | % | | |

ADR (4) | $ | 422 | | $ | 400 | | 5.5 | | | $ | 403 | | $ | 372 | | 8.3 | |

REVPAR (5) | $ | 407 | | $ | 371 | | 9.7 | | | $ | 375 | | $ | 340 | | 10.3 | |

(1)Table games win is shown before discounts, commissions and the allocation of casino revenues to rooms, food and beverage and other revenues for services provided to casino customers on a complimentary basis.

(2)In Macau, table drop is the amount of cash that is deposited in a gaming table's drop box plus cash chips purchased at the casino cage. In Las Vegas, table drop is the amount of cash and net markers issued that are deposited in a gaming table's drop box. At Encore Boston Harbor, table drop is the amount of cash and gross markers that are deposited in a gaming table's drop box.

(3)Slot machine win is calculated as gross slot machine win minus progressive accruals and free play.

(4)ADR is average daily rate and is calculated by dividing total room revenues including complimentaries (less service charges, if any) by total rooms occupied.

(5)REVPAR is revenue per available room and is calculated by dividing total room revenues including complimentaries (less service charges, if any) by total rooms available.

(6)Refer to accompanying reconciliations of Operating Income (Loss) to Adjusted Property EBITDAR and Net Income Attributable to Wynn Resorts, Limited to Adjusted Property EBITDAR.

SOURCE:

Wynn Resorts, Limited

CONTACT:

Price Karr

702-770-7555

investorrelations@wynnresorts.com

v3.24.2.u1

Document and Entity Information

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

WYNN RESORTS, LIMITED

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-50028

|

| Entity Tax Identification Number |

46-0484987

|

| Entity Address, Address Line One |

3131 Las Vegas Boulevard South

|

| Entity Address, City or Town |

Las Vegas,

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89109

|

| City Area Code |

702

|

| Local Phone Number |

770-7555

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

WYNN

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001174922

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

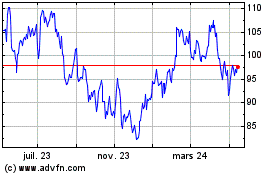

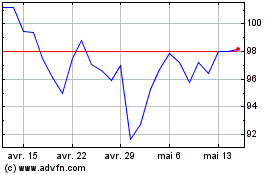

Wynn Resorts (NASDAQ:WYNN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Wynn Resorts (NASDAQ:WYNN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024