Allstate Announces Fourth Quarter 2023 Catastrophe Losses, Prior Year Reserve Reestimates, and December and Fourth Quarter 2023 Implemented Rates

18 Janvier 2024 - 2:11PM

Business Wire

The Allstate Corporation (NYSE: ALL) today announced fourth

quarter estimated catastrophe losses, prior year reserve

reestimates and implemented rates.

Allstate’s estimated catastrophe losses were below the $150

million reporting threshold for December 2023. Total catastrophe

losses for the fourth quarter were $68 million, pre-tax.

Unfavorable prior year reserve reestimates, excluding

catastrophes, totaled $199 million in the fourth quarter, with

approximately $148 million related to personal auto, including

costs for claims in litigation.

During the month of December, the Allstate brand implemented

auto rate increases of 16.5% across 15 locations, resulting in

total brand premium impact of 5.0%, which includes the rate

increases approved in December by the Departments of Insurance in

California, New York and New Jersey.

“Allstate continued to make progress on our comprehensive plan

to improve profitability. In 2023, rate increases for Allstate

brand auto insurance resulted in a premium impact of 16.4%, which

are expected to raise annualized written premiums by approximately

$4.27 billion, and rate increases for Allstate brand homeowners

insurance have resulted in a premium impact of 11.3%, which are

expected to raise annualized written premiums by approximately

$1.16 billion,” said Jess Merten, Chief Financial Officer of The

Allstate Corporation. Our implemented rate exhibit for auto and

homeowners insurance has been posted on

www.allstateinvestors.com.

The company plans to file a current report on Form 8-K with the

Securities and Exchange Commission announcing quarterly results

after close of market on Wednesday, February 7.

Financial information, including material announcements about

The Allstate Corporation, is routinely posted on

www.allstateinvestors.com.

Forward-Looking Statements

This news release contains “forward-looking statements” that

anticipate results based on our estimates, assumptions and plans

that are subject to uncertainty. These statements are made subject

to the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements do not relate

strictly to historical or current facts and may be identified by

their use of words like “plans,” “seeks,” “expects,” “will,”

“should,” “anticipates,” “estimates,” “intends,” “believes,”

“likely,” “targets” and other words with similar meanings. We

believe these statements are based on reasonable estimates,

assumptions and plans. However, if the estimates, assumptions or

plans underlying the forward-looking statements prove inaccurate or

if other risks or uncertainties arise, actual results could differ

materially from those communicated in these forward-looking

statements. Factors that could cause actual results to differ

materially from those expressed in, or implied by, the

forward-looking statements may be found in our filings with the

U.S. Securities and Exchange Commission, including the “Risk

Factors” section in our most recent annual report on Form 10-K.

Forward-looking statements are as of the date on which they are

made, and we assume no obligation to update or revise any

forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117753413/en/

Al Scott Media Relations (847) 402-5600

Brent Vandermause Investor Relations (847) 402-2800

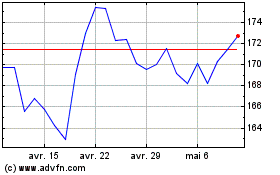

Allstate (NYSE:ALL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Allstate (NYSE:ALL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024