Amplify Energy Corp. (NYSE: AMPY) (“Amplify,” the “Company,” “us,”

or “our”) announced today its operating and financial results for

the second quarter of 2024.

Key Highlights

-

During the second quarter of 2024, the Company:

-

Achieved average total production of 20.3 MBoepd

-

Generated net cash provided by operating activities of $15.4

million and net income of $7.1 million

-

Delivered Adjusted EBITDA of $30.7 million

-

Generated $9.2 million of free cash flow

-

Drilled and completed the A50 development well at Beta. The A50

well, which came on-line in early June, achieved a peak IP30 oil

rate of approximately 730 Bopd (gross) and exceeded Company

projections. Amplify expects the well to pay out in approximately 4

months.

-

The Company is updating its 2024 guidance primarily as the result

of better than expected second quarter results and the Company’s

election to participate in non-operated development wells in East

Texas and the Eagle Ford

-

Amplify received multiple bids for both an outright sale and

partial monetization of its Bairoil asset in Wyoming. The Company,

working with its advisors, continues to evaluate these proposals

and will provide updates as they become available

-

As of June 30, 2024, net debt was $117.5 million, consisting of

$118.0 million outstanding under the revolving credit facility and

$0.5 million of cash and cash equivalents

-

Net Debt to Last Twelve Months (“LTM”) Adjusted EBITDA of

1.2x1

(1) Net debt as of June 30,

2024, and LTM Adjusted EBITDA as of the second quarter of

2024Martyn Willsher, Amplify’s President and Chief Executive

Officer, commented, “Amplify again delivered strong operating and

financial results for the second quarter, while also continuing the

tremendous progress on our key strategic initiatives. At Beta, we

successfully drilled and completed the A50 well on time and under

budget. The 30-day peak IP rate of 730 barrels of oil per day

exceeded our expectations, and based on early results and current

commodity prices, we anticipate the A50 will pay out in

approximately four months. The performance of the A50 is a

testament to the team’s exceptional planning and execution, which

we intend to capitalize on for our future development wells. We are

scheduled to drill two wells in the third quarter on the Eureka

platform before returning to the Ellen platform later this year. We

believe a successful development program at Beta has the potential

to materially increase cash flows and improve the long-term value

of the asset.”

Mr. Willsher further stated, “We continue to

evaluate proposals and options regarding the monetization of our

Wyoming assets. While we are encouraged by the interest received to

date, the Company is committed to pursuing the path it believes

will maximize shareholder value.”

Mr. Willsher concluded, “As I have indicated

previously, I am confident that the initiatives Amplify is actively

pursuing this year can be transformative for the Company. The

progress we have made through the first half of 2024 has reinforced

our confidence in our ability to execute on these initiatives and

drive increased shareholder value.”

Key Financial Results

During the second quarter of 2024, the Company

reported net income of approximately $7.1 million compared to a net

loss of $9.4 million in the prior quarter. The increase was

primarily attributable to lower non-cash unrealized losses on

commodity derivatives during the period compared to the prior

period.

Amplify generated $30.7 million of Adjusted

EBITDA for the second quarter, an increase of approximately $5.8

million from $24.9 million in the prior quarter. Second quarter

Adjusted EBITDA benefited from a one-time $7.0 million accounting

adjustment related to the release of suspense from prior quarters.

Further detail on the adjustment can be found at the end of this

release and in our quarterly report on Form 10-Q.

Free cash flow was $9.2 million for the second

quarter, an increase of $6.9 million versus the prior quarter.

Amplify has now generated positive free cash flow in 16 of the last

17 fiscal quarters.

| |

|

|

|

| |

|

Second

Quarter |

First

Quarter |

|

$ in millions |

|

2024 |

2024 |

|

Net income (loss) |

|

$7.1 |

($9.4 |

) |

|

Net cash provided by operating activities |

|

$15.4 |

$7.7 |

|

|

Average daily production (MBoe/d) |

|

|

20.3 |

|

20.2 |

|

|

Total revenues excluding hedges |

|

$79.5 |

$76.3 |

|

|

Adjusted EBITDA (a non-GAAP financial measure) |

$30.7 |

$24.9 |

|

|

Total capital |

|

$18.0 |

$19.1 |

|

|

Free Cash Flow (a non-GAAP financial measure) |

$9.2 |

$2.3 |

|

| |

|

|

|

Revolving Credit Facility

As of June 30, 2024, Amplify had net debt of

$117.5 million, consisting of $118.0 million outstanding under its

revolving credit facility and $0.5 million of cash and cash

equivalents. Net debt to LTM Adjusted EBITDA was 1.2x (net debt as

of June 30, 2024 and 2Q24 LTM Adjusted EBITDA). Second quarter net

debt increased slightly from the prior quarter due to expected

changes in working capital and increased activity (primarily at

Beta). The next regularly scheduled borrowing base redetermination

is expected to occur in the fourth quarter of 2024.

Corporate Production and

Pricing

During the second quarter of 2024, average daily

production was approximately 20.3 Mboepd, which was in-line with

the previous quarter. The Company benefitted from a one-time

prior-period accounting adjustment that added approximately 1.2

Mboepd, which was offset by multiple flooding events in East Texas

that limited access to wells and resulted in prolonged shut-ins.

The Company’s product mix for the quarter was 41% crude oil, 19%

NGLs, and 40% natural gas, excluding the impact from the one-time

accounting adjustment.

| |

|

|

|

|

|

|

|

| |

|

|

|

Three

Months |

|

Three

Months |

|

| |

|

|

|

Ended |

|

Ended |

|

| |

|

|

|

June 30, 2024 |

|

March 31, 2024 |

|

| |

|

|

|

|

|

|

|

|

Production volumes - MBOE: |

|

|

|

|

|

|

|

Bairoil |

|

301 |

|

|

293 |

|

|

| |

Beta |

|

277 |

|

|

281 |

|

|

| |

Oklahoma |

|

492 |

|

|

488 |

|

|

| |

East Texas / North Louisiana |

|

709 |

|

|

676 |

|

|

| |

Eagle Ford (Non-op) |

|

64 |

|

|

104 |

|

|

| |

Total - MBoe |

|

1,843 |

|

|

1,842 |

|

|

| |

Total - MBoe/d |

|

20.3 |

|

|

20.2 |

|

|

| |

% - Liquids |

|

60 |

% |

|

61 |

% |

|

| |

|

|

|

|

|

|

|

Total oil, natural gas and NGL revenues for the

second quarter of 2024 were approximately $72.3 million, before the

impact of derivatives. The Company realized a gain on commodity

derivatives of $3.7 million during the second quarter. Oil, natural

gas and NGL revenues, net of realized hedges, decreased $3.6

million for the second quarter compared to the prior quarter.

The following table sets forth information

regarding average realized sales prices for the periods

indicated:

|

|

|

Crude Oil ($/Bbl) |

NGLs ($/Bbl) |

Natural Gas ($/Mcf) |

|

|

|

|

Three Months Ended June 30, 2024 |

|

Three Months Ended March 31, 2024 |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended March 31, 2024 |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average sales price exclusive of realized derivatives and certain

deductions from revenue |

|

$ |

76.51 |

|

|

$ |

72.98 |

|

|

$ |

20.05 |

|

|

$ |

24.07 |

|

|

$ |

1.78 |

|

$ |

2.39 |

|

|

Realized derivatives |

|

|

(3.17 |

) |

|

|

(1.17 |

) |

|

|

- |

|

|

|

- |

|

|

|

1.36 |

|

|

1.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average sales price with realized derivatives exclusive of certain

deductions from revenue |

|

$ |

73.34 |

|

|

$ |

71.81 |

|

|

$ |

20.05 |

|

|

$ |

24.07 |

|

|

$ |

3.14 |

|

$ |

3.59 |

|

|

Certain deductions from revenue |

|

|

- |

|

|

|

- |

|

|

|

(1.06 |

) |

|

|

(1.46 |

) |

|

|

0.02 |

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average sales price inclusive of realized derivatives and certain

deductions from revenue |

|

$ |

73.34 |

|

|

$ |

71.81 |

|

|

$ |

18.99 |

|

|

$ |

22.61 |

|

|

$ |

3.16 |

|

$ |

3.60 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

Lease operating expenses in the second quarter

of 2024 were approximately $36.3 million, or $19.70 per Boe, a $2.0

million decrease compared to the prior quarter. This decrease was

primarily due to increased costs related to scheduled maintenance

and other routine annual expenses in the first quarter. Lease

operating expenses also do not reflect $0.9 million of income

generated by Magnify Energy Services.

Severance and Ad Valorem taxes in the second

quarter were approximately $4.6 million, a decrease of $0.3 million

compared to $4.9 million in the prior quarter. Severance and Ad

Valorem taxes as a percentage of revenue were approximately 6.4%

this quarter compared to 6.5% in the prior quarter.

Amplify incurred $4.9 million, or $2.66 per Boe,

of gathering, processing and transportation expenses in the second

quarter, compared to $4.8 million, or $2.59 per Boe, in the prior

quarter.

Second quarter cash G&A expenses were $6.6

million, a decrease of $1.3 million from the prior quarter and

in-line with expectations. This decrease was primarily due to

year-end processes that impacted various cost drivers annually in

the first quarter and a one-time cost associated with the early

termination of our Tulsa office lease. The Company anticipates that

quarterly cash G&A expenses will remain at approximately this

same level throughout the remainder of 2024.

Depreciation, depletion and amortization expense

for the second quarter totaled $7.8 million, or $4.25 per Boe,

compared to $8.2 million, or $4.47 per Boe, in the prior

quarter.

Net interest expense was $3.6 million for the

second quarter, an increase of $0.1 million from $3.5 million in

the prior quarter.

Amplify recorded current income tax expense of

$0.6 million for the second quarter.

Capital Investments

Cash capital investment during the second

quarter of 2024 was approximately $18.0 million. During the second

quarter, the Company’s capital allocation was approximately 90% for

Beta facility projects and development drilling, with the remainder

distributed across the Company’s other assets.

The following table details Amplify’s capital

invested during the second quarter 2024:

| |

|

Second

Quarter |

|

Year to

Date |

|

| |

|

2024

Capital |

|

2024

Capital |

|

| |

|

($ MM) |

|

($ MM) |

|

|

Bairoil |

|

$ |

0.0 |

|

$ |

1.5 |

|

| Beta |

|

$ |

16.0 |

|

$ |

31.7 |

|

|

Oklahoma |

|

$ |

0.8 |

|

$ |

1.6 |

|

| East Texas /

North Louisiana |

|

$ |

0.5 |

|

$ |

0.6 |

|

| Eagle Ford

(Non-op) |

|

$ |

0.4 |

|

$ |

0.8 |

|

| Magnify

Energy Services |

|

$ |

0.3 |

|

$ |

1.0 |

|

|

Total Capital Invested |

|

$ |

18.0 |

|

$ |

37.1 |

|

| |

|

|

|

|

|

The majority of the Company’s capital

investments for the remainder of 2024 will be allocated to Beta to

continue the development program and complete the electrification

and emissions reduction infrastructure project, which are currently

underway. Additionally, the Company has elected to participate in

several non-operated drilling opportunities comprised of 14 gross

(0.7 net) new development wells and 2 gross (0.4 net) recompletion

projects in the Eagle Ford and 4 gross (1.0 net) wells in East

Texas. In total, Amplify expects to invest $7 – 9 million in these

non-operated opportunities. As a result, the Company is updating

guidance to reflect these elections and now expects to invest $60 –

65 million in 2024. These non-operated development projects are

expected to provide additional volumes and cash flow in early

2025.

Beta Development and Facility Upgrade

Update

In the second quarter, the Company successfully

drilled and completed the A50 well from the Ellen platform in less

than 30 days and brought it on-line in early June. The A50 was

completed laterally in the prolific D-Sand and achieved a peak

IP-30 oil rate of approximately 730 Bopd. Rates from the well after

approximately 2 months of production were in excess of 650 Bopd.

Total capital costs for the well were approximately $4.2 million.

At current oil prices, we are projecting a 4-month payback on this

investment.

For the third quarter, the Company is moving its

drilling operations to the Eureka platform. Amplify will first

drill the C59 well (also targeting the D-Sand), which is expected

to be online in the third quarter. The Company intends to drill a

second well from Eureka platform before returning to platform Ellen

late in the fourth quarter. Amplify then anticipates finishing the

A45 well, which was deferred earlier in the year.

During the second quarter, the Company continued

the third and final phase of the electrification and emissions

reduction project at Beta, which involves installing selective

catalytic reducers on the platform generators and rig engines. This

multi-year facility project is scheduled to be completed in the

fourth quarter of 2024, within the compliance deadline as

prescribed by district air quality regulations.

Updated Full-Year 2024

Guidance

Based on better than expected results in the

first half of the year and our decision to participate in

non-operated drilling opportunities in East Texas and the Eagle

Ford, the Company is providing updated guidance for 2024. The

following guidance is subject to the cautionary statements and

limitations described under the "Forward-Looking Statements"

caption at the end of this press release. Amplify's updated 2024

guidance is based on its current expectations regarding capital

investment and full-year 2024 commodity prices for crude oil of

$76/Bbl (WTI) and natural gas of $2.25/MMBtu (Henry Hub), and on

the assumption that market demand and prices for oil and natural

gas will continue at levels that allow for economic production of

these products. Additionally, the Company expects to invest 85% to

95% of its capital in the first three quarters of the year

primarily in connection with the Beta development program and the

one-time electrification and emissions reduction facility

project.

A summary of the guidance is presented

below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous

Guidance |

|

Updated

Guidance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FY

2024E |

|

FY

2024E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Low |

|

High |

|

Low |

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Average Daily Production |

|

|

|

|

|

|

|

|

|

|

|

Oil (MBbls/d) |

8.0 |

- |

8.9 |

|

8.1 |

- |

8.9 |

|

|

|

|

|

NGL (MBbls/d) |

3.1 |

- |

3.5 |

|

3.1 |

- |

3.5 |

|

|

|

|

|

Natural Gas (MMcf/d) |

44.0 |

- |

50.0 |

|

44.0 |

- |

50.0 |

|

|

|

|

|

Total (MBoe/d) |

19.0 |

- |

21.0 |

|

19.0 |

- |

21.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity Price Differential / Realizations

(Unhedged) |

|

|

|

|

|

|

|

|

|

|

|

Oil Differential ($ / Bbl) |

($3.00) |

- |

($4.00) |

|

($3.50) |

- |

($4.00) |

|

|

|

|

|

NGL Realized Price (% of WTI NYMEX) |

27% |

- |

30% |

|

27% |

- |

30% |

|

|

|

|

|

Natural Gas Realized Price (% of Henry Hub) |

88% |

- |

94% |

|

90% |

- |

95% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Revenue |

|

|

|

|

|

|

|

|

|

|

|

Magnify Energy Services ($ MM) |

$2 |

- |

$4 |

|

$2 |

- |

$4 |

|

|

|

|

|

Other ($ MM) |

$2 |

- |

$3 |

|

$7 |

- |

$8 |

|

|

|

|

|

Total ($ MM) |

$4 |

- |

$7 |

|

$9 |

- |

$12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gathering, Processing and Transportation

Costs |

|

|

|

|

|

|

|

|

|

|

|

Oil ($ / Bbl) |

$0.70 |

- |

$0.90 |

|

$0.75 |

- |

$0.95 |

|

|

|

|

|

NGL ($ / Bbl) |

$2.75 |

- |

$3.75 |

|

$2.60 |

- |

$3.10 |

|

|

|

|

|

Natural Gas ($ / Mcf) |

$0.55 |

- |

$0.75 |

|

$0.60 |

- |

$0.80 |

|

|

|

|

|

Total ($ / Boe) |

$2.30 |

- |

$2.90 |

|

$2.25 |

- |

$2.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Costs |

|

|

|

|

|

|

|

|

|

|

|

Lease Operating ($ / Boe) |

$18.50 |

- |

$20.50 |

|

$18.50 |

- |

$20.50 |

|

|

|

|

|

Taxes (% of Revenue) (1) |

6.5% |

- |

7.5% |

|

6.0% |

- |

7.0% |

|

|

|

|

|

Cash General and Administrative ($ / Boe) (2)(3) |

$3.30 |

- |

$3.80 |

|

$3.40 |

- |

$3.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA ($ MM)

(2)(3) |

$95 |

- |

$115 |

|

$100 |

- |

$120 |

|

|

|

|

|

Cash Interest Expense ($ MM) |

$10 |

- |

$15 |

|

$10 |

- |

$15 |

|

|

|

|

|

Capital Expenditures ($ MM) |

$50 |

- |

$60 |

|

$60 |

- |

$65 |

|

|

|

|

|

Free

Cash Flow ($ MM) (2)(3) |

$25 |

- |

$45 |

|

$30 |

- |

$40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes production, ad valorem and franchise

taxes(2) Refer to “Use of Non-GAAP Financial Measures” for

Amplify’s definition and use of cash G&A, Adjusted EBITDA and

free cash flow, non-GAAP measures (cash income taxes, which are not

included in free cash flow, are expected to range between $4 - $8

million for the year)(3) Amplify believes that a quantitative

reconciliation of such forward-looking information to the most

comparable financial measure calculated and presented in accordance

with GAAP cannot be made available without unreasonable efforts. A

reconciliation of these non-GAAP financial measures would require

Amplify to predict the timing and likelihood of future transactions

and other items that are difficult to accurately predict. Neither

of these forward-looking measures, nor their probable significance,

can be quantified with a reasonable degree of accuracy.

Accordingly, a reconciliation of the most directly comparable

forward-looking GAAP measures is not provided.

Hedging

In the second quarter, Amplify added oil and

natural gas hedges. Amplify executed 2026 natural gas swaps at a

weighted-average price of $3.88 per MMBtu and natural gas collars

with a floor of $3.62 per MMBtu and a ceiling of $4.27 per MMBtu.

Amplify also executed crude oil swaps for 2025 at a

weighted-average price of $74.10 per barrel.

The following table reflects the hedged volumes

under Amplify’s commodity derivative contracts and the average

fixed, floor and ceiling prices at which production is hedged for

July 2024 through December 2026, as of August 7, 2024:

| |

|

|

|

|

|

|

|

| |

|

|

2024 |

|

2025 |

|

2026 |

| |

|

|

|

|

|

|

|

| |

Natural Gas Swaps: |

|

|

|

|

|

|

|

|

Average Monthly Volume (MMBtu) |

|

|

775,000 |

|

|

675,000 |

|

|

500,000 |

| |

Weighted

Average Fixed Price ($) |

|

$ |

3.73 |

|

$ |

3.74 |

|

$ |

3.79 |

| |

|

|

|

|

|

|

|

| |

Natural Gas Collars: |

|

|

|

|

|

|

| |

Two-way

collars |

|

|

|

|

|

|

| |

Average Monthly Volume (MMBtu) |

|

|

500,000 |

|

|

500,000 |

|

|

500,000 |

| |

Weighted Average Ceiling Price ($) |

|

$ |

4.10 |

|

$ |

4.10 |

|

$ |

4.17 |

| |

Weighted Average Floor Price ($) |

|

$ |

3.50 |

|

$ |

3.50 |

|

$ |

3.55 |

| |

|

|

|

|

|

|

|

| |

Oil

Swaps: |

|

|

|

|

|

|

| |

Average

Monthly Volume (Bbls) |

|

|

83,000 |

|

|

78,583 |

|

|

30,917 |

| |

Weighted

Average Fixed Price ($) |

|

$ |

74.34 |

|

$ |

71.79 |

|

$ |

70.68 |

| |

|

|

|

|

|

|

|

| |

Oil

Collars: |

|

|

|

|

|

|

| |

Two-way

collars |

|

|

|

|

|

|

| |

Average Monthly Volume (Bbls) |

|

|

102,000 |

|

|

59,500 |

|

|

| |

Weighted Average Ceiling Price ($) |

|

$ |

80.20 |

|

$ |

80.20 |

|

|

| |

Weighted Average Floor Price ($) |

|

$ |

70.00 |

|

$ |

70.00 |

|

|

| |

|

|

|

|

|

|

|

Amplify posted an updated investor presentation

containing additional hedging information on its website,

www.amplifyenergy.com, under the Investor Relations section.

Quarterly Report on Form

10-Q

Amplify’s financial statements and related

footnotes will be available in its Quarterly Report on Form 10-Q

for the quarter ended June 30, 2024, which Amplify expects to file

with the SEC on August 7, 2024.

About Amplify Energy

Amplify Energy Corp. is an independent oil and

natural gas company engaged in the acquisition, development,

exploitation and production of oil and natural gas properties.

Amplify’s operations are focused in Oklahoma, the Rockies

(Bairoil), federal waters offshore Southern California (Beta), East

Texas / North Louisiana, and the Eagle Ford (Non-op). For more

information, visit www.amplifyenergy.com.

Conference Call

Amplify will host an investor teleconference

tomorrow at 10:00 a.m. Central Time to discuss these operating and

financial results. Interested parties may join the call by dialing

(800) 245-3047 at least 15 minutes before the call begins and

providing the Conference ID: AEC2Q24. A telephonic replay will be

available for fourteen days following the call by dialing (800)

654-1563 and providing the Conference ID: 71724901.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical fact, included in this press release that address

activities, events or developments that the Company expects,

believes or anticipates will or may occur in the future are

forward-looking statements. Terminology such as “may,” “will,”

“would,” “should,” “expect,” “plan,” “project,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “outlook,” “continue,” the negative of such

terms or other comparable terminology are intended to identify

forward-looking statements. These statements include, but are not

limited to, statements about the Company’s expectations of plans,

goals, strategies (including measures to implement strategies),

objectives and anticipated results with respect thereto. These

statements address activities, events or developments that we

expect or anticipate will or may occur in the future, including

things such as projections of results of operations, plans for

growth, goals, future capital expenditures, competitive strengths,

references to future intentions and other such references. These

forward-looking statements involve risks and uncertainties and

other factors that could cause the Company’s actual results or

financial condition to differ materially from those expressed or

implied by forward-looking statements. These include risks and

uncertainties relating to, among other things: the ongoing impact

of the oil incident that occurred off the coast of Southern

California resulting from the Company’s pipeline operations at the

Beta field; the Company’s evaluation and implementation of

strategic alternatives; risks related to the redetermination of the

borrowing base under the Company’s revolving credit facility; the

Company’s ability to satisfy debt obligations; the Company’s need

to make accretive acquisitions or substantial capital expenditures

to maintain its declining asset base, including the existence of

unanticipated liabilities or problems relating to acquired or

divested business or properties; volatility in the prices for oil,

natural gas and NGLs; the Company’s ability to access funds on

acceptable terms, if at all, because of the terms and conditions

governing the Company’s indebtedness, including financial

covenants; general political and economic conditions, globally and

in the jurisdictions in which we operate, including the Russian

invasion of Ukraine, the Israel-Hamas war and the potential

destabilizing effect such conflicts may pose for the global oil and

natural gas markets; expectations regarding general economic

conditions, including inflation; and the impact of local, state and

federal governmental regulations, including those related to

climate change and hydraulic fracturing. Please read the Company’s

filings with the SEC, including “Risk Factors” in the Company’s

Annual Report on Form 10-K, and if applicable, the Company’s

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

which are available on the Company’s Investor Relations website at

https://www.amplifyenergy.com/investor-relations/sec-filings/default.aspx

or on the SEC’s website at http://www.sec.gov, for a discussion of

risks and uncertainties that could cause actual results to differ

from those in such forward-looking statements. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements in this press release are qualified in

their entirety by these cautionary statements. Except as required

by law, the Company undertakes no obligation and does not intend to

update or revise any forward-looking statements, whether as a

result of new information, future results or otherwise.

Use of Non-GAAP Financial

Measures

This press release and accompanying schedules

include the non-GAAP financial measures of Adjusted EBITDA, free

cash flow, net debt, and cash G&A. The accompanying schedules

provide a reconciliation of these non-GAAP financial measures to

their most directly comparable financial measures calculated and

presented in accordance with GAAP. Amplify’s non-GAAP financial

measures should not be considered as alternatives to GAAP measures

such as net income, operating income, net cash flows provided by

operating activities, standardized measure of discounted future net

cash flows, or any other measure of financial performance

calculated and presented in accordance with GAAP. Amplify’s

non-GAAP financial measures may not be comparable to similarly

titled measures of other companies because they may not calculate

such measures in the same manner as Amplify does.

Adjusted EBITDA. Amplify

defines Adjusted EBITDA as net income (loss) plus Interest expense;

Income tax expense (benefit); DD&A; Impairment of goodwill and

long-lived assets (including oil and natural gas properties);

Accretion of AROs; Loss or (gain) on commodity derivative

instruments; Cash settlements received or (paid) on expired

commodity derivative instruments; Amortization of gain associated

with terminated commodity derivatives; Losses or (gains) on sale of

assets and other, net; Share-based compensation expenses;

Exploration costs; Acquisition and divestiture related expenses;

Reorganization items, net; Severance payments; and Other

non-routine items that we deem appropriate. Adjusted EBITDA is

commonly used as a supplemental financial measure by management and

external users of Amplify’s financial statements, such as

investors, research analysts and rating agencies, to assess: (1)

its operating performance as compared to other companies in

Amplify’s industry without regard to financing methods, capital

structures or historical cost basis; (2) the ability of its assets

to generate cash sufficient to pay interest and support Amplify’s

indebtedness; and (3) the viability of projects and the overall

rates of return on alternative investment opportunities. Since

Adjusted EBITDA excludes some, but not all, items that affect net

income or loss and because these measures may vary among other

companies, the Adjusted EBITDA data presented in this press release

may not be comparable to similarly titled measures of other

companies. The GAAP measures most directly comparable to Adjusted

EBITDA are net income and net cash provided by operating

activities.

Free cash flow. Amplify defines

free cash flow as Adjusted EBITDA, less cash interest expense and

capital expenditures. Free cash flow is an important non-GAAP

financial measure for Amplify’s investors since it serves as an

indicator of the Company’s success in providing a cash return on

investment. The GAAP measures most directly comparable to free cash

flow are net income and net cash provided by operating

activities.

Net debt. Amplify defines net

debt as the total principal amount drawn on the revolving credit

facility less cash and cash equivalents. The Company uses net debt

as a measure of financial position and believes this measure

provides useful additional information to investors to evaluate the

Company's capital structure and financial leverage.

Cash G&A. Amplify defines

cash G&A as general and administrative expense, less

share-based compensation expense; acquisition and divestiture

costs; bad debt expense; and severance payments. Cash G&A is an

important non-GAAP financial measure for Amplify’s investors since

it allows for analysis of G&A spend without regard to

share-based compensation and other non-recurring expenses which can

vary substantially from company to company. The GAAP measures most

directly comparable to cash G&A is total G&A expenses.

Contacts

Jim Frew -- Senior Vice President and Chief

Financial Officer(832) 219-9044jim.frew@amplifyenergy.com

Michael Jordan -- Director, Finance and

Treasurer(832) 219-9051michael.jordan@amplifyenergy.com

Selected Operating and Financial Data

(Tables)

|

Amplify Energy Corp. |

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Statements of Operations Data |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s, except per share data) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

Oil and natural gas sales |

|

$ |

72,346 |

|

|

$ |

75,322 |

|

| |

Other

revenues |

|

|

7,157 |

|

|

|

977 |

|

| |

Total revenues |

|

|

79,503 |

|

|

|

76,299 |

|

| |

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

| |

Lease

operating expense |

|

|

36,311 |

|

|

|

38,284 |

|

| |

Pipeline

incident loss |

|

|

500 |

|

|

|

707 |

|

| |

Gathering,

processing and transportation |

|

|

4,895 |

|

|

|

4,774 |

|

| |

Exploration |

|

|

10 |

|

|

|

41 |

|

| |

Taxes other

than income |

|

|

4,631 |

|

|

|

4,911 |

|

| |

Depreciation, depletion and amortization |

|

|

7,827 |

|

|

|

8,239 |

|

| |

General and

administrative expense |

|

|

8,358 |

|

|

|

9,800 |

|

| |

Accretion of

asset retirement obligations |

|

|

2,096 |

|

|

|

2,061 |

|

| |

Realized (gain) loss on commodity derivatives |

|

(3,680 |

) |

|

|

(4,303 |

) |

| |

Unrealized (gain) loss on commodity derivatives |

|

4,905 |

|

|

|

20,867 |

|

| |

Other,

net |

|

|

98 |

|

|

|

- |

|

| |

Total costs and expenses |

|

|

65,951 |

|

|

|

85,381 |

|

| |

|

|

|

|

|

|

Operating Income (loss) |

|

|

13,552 |

|

|

|

(9,082 |

) |

| |

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

| |

Interest

expense, net |

|

|

(3,632 |

) |

|

|

(3,527 |

) |

| |

Other income

(expense) |

|

|

(109 |

) |

|

|

(95 |

) |

| |

Total Other

Income (Expense) |

|

|

(3,741 |

) |

|

|

(3,622 |

) |

| |

|

|

|

|

|

| |

Income (loss) before reorganization items, net and income

taxes |

|

9,811 |

|

|

|

(12,704 |

) |

| |

|

|

|

|

|

|

Income tax benefit (expense) - current |

|

|

(557 |

) |

|

|

(1,395 |

) |

|

Income tax benefit (expense) - deferred |

|

|

(2,135 |

) |

|

|

4,703 |

|

| |

|

|

|

|

|

| |

Net income

(loss) |

|

$ |

7,119 |

|

|

$ |

(9,396 |

) |

| |

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

| |

Basic and

diluted earnings (loss) per share |

|

$ |

0.17 |

|

|

$ |

(0.24 |

) |

| |

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Operating Statistics |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s, except per unit data) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

Oil and natural gas revenue: |

|

|

|

|

|

|

Oil Sales |

|

$ |

57,789 |

|

$ |

57,422 |

| |

NGL

Sales |

|

|

6,565 |

|

|

7,525 |

| |

Natural Gas

Sales |

|

|

7,992 |

|

|

10,375 |

| |

Total oil and natural gas sales - Unhedged |

$ |

72,346 |

|

$ |

75,322 |

| |

|

|

|

|

|

|

Production volumes: |

|

|

|

|

| |

Oil Sales -

MBbls |

|

|

756 |

|

|

786 |

| |

NGL Sales -

MBbls |

|

|

345 |

|

|

333 |

| |

Natural Gas

Sales - MMcf |

|

|

4,453 |

|

|

4,335 |

| |

Total -

MBoe |

|

|

1,843 |

|

|

1,842 |

| |

Total -

MBoe/d |

|

|

20.3 |

|

|

20.2 |

| |

|

|

|

|

|

|

Average sales price (excluding commodity

derivatives): |

|

|

|

| |

Oil - per

Bbl |

|

$ |

76.51 |

|

$ |

72.98 |

| |

NGL - per

Bbl |

|

$ |

18.99 |

|

$ |

22.61 |

| |

Natural gas

- per Mcf |

|

$ |

1.79 |

|

$ |

2.39 |

| |

Total - per

Boe |

|

$ |

39.25 |

|

$ |

40.89 |

| |

|

|

|

|

|

|

Average unit costs per Boe: |

|

|

|

|

| |

Lease

operating expense |

|

$ |

19.70 |

|

$ |

20.78 |

| |

Gathering,

processing and transportation |

|

$ |

2.66 |

|

$ |

2.59 |

| |

Taxes other

than income |

|

$ |

2.51 |

|

$ |

2.67 |

| |

General and

administrative expense |

|

$ |

4.53 |

|

$ |

5.32 |

| |

Depletion,

depreciation, and amortization |

|

$ |

4.25 |

|

$ |

4.47 |

| |

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Asset Operating Statistics |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

| |

|

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

Production volumes - MBOE: |

|

|

|

|

|

|

Bairoil |

|

|

301 |

|

|

|

293 |

|

| |

Beta |

|

|

277 |

|

|

|

281 |

|

| |

Oklahoma |

|

|

492 |

|

|

|

488 |

|

| |

East Texas /

North Louisiana |

|

|

709 |

|

|

|

676 |

|

| |

Eagle Ford

(Non-op) |

|

|

64 |

|

|

|

104 |

|

| |

Total - MBoe |

|

|

1,843 |

|

|

|

1,842 |

|

| |

Total - MBoe/d |

|

|

20.3 |

|

|

|

20.2 |

|

| |

%

- Liquids |

|

|

60 |

% |

|

|

61 |

% |

| |

|

|

|

|

|

|

Lease operating expense - $M: |

|

|

|

|

| |

Bairoil |

|

$ |

13,423 |

|

|

$ |

14,451 |

|

| |

Beta |

|

|

11,889 |

|

|

|

12,011 |

|

| |

Oklahoma |

|

|

3,896 |

|

|

|

4,463 |

|

| |

East Texas /

North Louisiana |

|

|

5,386 |

|

|

|

5,744 |

|

| |

Eagle Ford

(Non-op) |

|

|

1,717 |

|

|

|

1,615 |

|

| |

Total Lease operating expense: |

|

$ |

36,311 |

|

|

$ |

38,284 |

|

| |

|

|

|

|

|

|

Capital expenditures - $M: |

|

|

|

|

| |

Bairoil |

|

$ |

3 |

|

|

$ |

1,461 |

|

| |

Beta |

|

|

15,991 |

|

|

|

15,681 |

|

| |

Oklahoma |

|

|

788 |

|

|

|

768 |

|

| |

East Texas /

North Louisiana |

|

|

472 |

|

|

|

93 |

|

| |

Eagle Ford

(Non-op) |

|

|

436 |

|

|

|

410 |

|

| |

Magnify

Energy Services |

|

|

314 |

|

|

|

679 |

|

| |

Total Capital expenditures: |

|

$ |

18,004 |

|

|

$ |

19,092 |

|

| |

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(Amounts in $000s) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

| |

Cash and Cash Equivalents |

|

$ 502 |

|

$

2,989 |

| |

Accounts Receivable |

|

36,306 |

|

36,540 |

| |

Other Current Assets |

|

25,210 |

|

22,795 |

| |

|

Total

Current Assets |

|

$ 62,018 |

|

$ 62,324 |

| |

|

|

|

|

|

|

| |

Net Oil and Gas Properties |

|

$

368,802 |

|

$

358,251 |

| |

Other Long-Term Assets |

|

289,555 |

|

291,629 |

| |

|

Total

Assets |

|

$ 720,375 |

|

$ 712,204 |

| |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

| |

Accounts Payable |

|

$

25,056 |

|

$

21,723 |

| |

Accrued Liabilities |

|

35,831 |

|

36,776 |

| |

Other Current Liabilities |

|

12,629 |

|

20,809 |

| |

|

Total

Current Liabilities |

|

$ 73,516 |

|

$ 79,308 |

| |

|

|

|

|

|

|

| |

Long-Term Debt |

|

$

118,000 |

|

$

115,000 |

| |

Asset Retirement Obligation |

|

125,739 |

|

124,062 |

| |

Other Long-Term Liabilities |

|

12,831 |

|

12,819 |

| |

|

Total

Liabilities |

|

$ 330,086 |

|

$ 331,189 |

| |

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

| |

Common Stock & APIC |

|

$

436,980 |

|

$

434,863 |

| |

Accumulated Earnings (Deficit) |

|

(46,691) |

|

(53,848) |

| |

|

Total

Shareholders' Equity |

|

$ 390,289 |

|

$ 381,015 |

| |

|

|

|

|

|

|

|

Selected Financial Data - Unaudited |

|

|

|

|

|

Statements of Cash Flows Data |

|

|

|

|

| |

|

|

|

|

| |

|

Three

Months |

|

Three

Months |

| |

|

Ended |

|

Ended |

| (Amounts in

$000s) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

| |

|

|

|

|

|

Net cash provided by (used in) operating activities |

$ |

15,389 |

|

|

$ |

7,712 |

|

|

Net cash provided by (used in) investing activities |

|

(20,853 |

) |

|

|

(23,724 |

) |

|

Net cash provided by (used in) financing activities |

|

2,977 |

|

|

|

(1,745 |

) |

| |

|

|

|

|

|

Selected Operating and Financial Data (Tables) |

| Reconciliation of

Unaudited GAAP Financial Measures to Non-GAAP Financial

Measures |

|

Adjusted EBITDA1 and Free Cash Flow |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Three

Months |

|

Three

Months |

| |

|

|

Ended |

|

Ended |

|

(Amounts in $000s) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

Reconciliation of Adjusted

EBITDA1 to Net Cash Provided from

Operating Activities: |

|

|

|

|

Net cash provided by operating activities |

|

$ |

15,389 |

|

|

$ |

7,712 |

|

| |

Changes in

working capital |

|

|

10,348 |

|

|

|

11,217 |

|

| |

Interest

expense, net |

|

|

3,632 |

|

|

|

3,527 |

|

| |

Amortization and write-off of deferred financing fees |

|

(304 |

) |

|

|

(304 |

) |

| |

Exploration

costs |

|

|

10 |

|

|

|

41 |

|

| |

Acquisition

and divestiture related costs |

|

|

9 |

|

|

|

14 |

|

| |

Plugging and

abandonment cost |

|

|

514 |

|

|

|

- |

|

| |

Current

income tax expense (benefit) |

|

|

557 |

|

|

|

1,395 |

|

| |

Pipeline

incident loss |

|

|

500 |

|

|

|

707 |

|

| |

Other |

|

|

94 |

|

|

|

592 |

|

|

Adjusted EBITDA1: |

|

$ |

30,749 |

|

|

$ |

24,901 |

|

| |

|

|

|

|

|

|

Reconciliation of Free Cash Flow to Net Cash Provided from

Operating Activities: |

|

|

|

Adjusted EBITDA1: |

|

$ |

30,749 |

|

|

$ |

24,901 |

|

| |

Less: Cash

interest expense |

|

|

3,594 |

|

|

|

3,526 |

|

| |

Less:

Capital expenditures |

|

|

18,004 |

|

|

|

19,092 |

|

|

Free Cash Flow: |

|

$ |

9,151 |

|

|

$ |

2,283 |

|

| |

|

|

|

|

|

(1) Adjusted EBITDA includes a non-cash revenue

suspense release of $7.0 million for the three months ended June

30, 2024 and $1.4 million for the three months ended March 31,

2024. See “Revenue Payables in Suspense” table for additional

information.

| |

Selected Operating and Financial Data (Tables) |

|

|

|

|

| |

Reconciliation of Unaudited GAAP Financial Measures to Non-GAAP

Financial Measures |

|

|

| |

Adjusted EBITDA1 and Free Cash Flow |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

Three

Months |

|

Three

Months |

| |

|

|

|

|

Ended |

|

Ended |

| |

(Amounts in $000s) |

|

June 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

|

|

|

| |

Reconciliation of Adjusted

EBITDA1 to Net Income

(Loss): |

|

|

|

| |

|

Net income (loss) |

|

$ |

7,119 |

|

$ |

(9,396 |

) |

| |

|

Interest expense, net |

|

|

3,632 |

|

|

3,527 |

|

| |

|

Income tax expense (benefit) - current |

|

|

557 |

|

|

1,395 |

|

| |

|

Income tax expense (benefit) - deferred |

|

|

2,135 |

|

|

(4,703 |

) |

| |

|

Depreciation, depletion and amortization |

|

|

7,827 |

|

|

8,239 |

|

| |

|

Accretion of asset retirement obligations |

|

|

2,096 |

|

|

2,061 |

|

| |

|

(Gains) losses on commodity derivatives |

|

|

1,225 |

|

|

16,564 |

|

| |

|

Cash settlements received (paid) on expired commodity derivative

instruments |

|

|

3,680 |

|

|

4,303 |

|

| |

|

Acquisition and divestiture related costs |

|

|

9 |

|

|

14 |

|

| |

|

Share-based compensation expense |

|

|

1,767 |

|

|

1,531 |

|

| |

|

Exploration costs |

|

|

10 |

|

|

41 |

|

| |

|

Loss on settlement of AROs |

|

|

98 |

|

|

- |

|

| |

|

Bad debt expense |

|

|

- |

|

|

26 |

|

| |

|

Pipeline incident loss |

|

|

500 |

|

|

707 |

|

| |

|

Other |

|

|

94 |

|

|

592 |

|

| |

|

Adjusted EBITDA1: |

|

$ |

30,749 |

|

$ |

24,901 |

|

| |

|

|

|

|

|

|

|

| |

|

Reconciliation of Free Cash Flow to Net Income

(Loss): |

|

|

|

| |

|

Adjusted EBITDA1: |

|

$ |

30,749 |

|

$ |

24,901 |

|

| |

|

|

Less: Cash interest expense |

|

|

3,594 |

|

|

3,526 |

|

| |

|

|

Less:

Capital expenditures |

|

|

18,004 |

|

|

19,092 |

|

| |

|

Free Cash Flow: |

|

$ |

9,151 |

|

$ |

2,283 |

|

| |

|

|

|

|

|

|

|

(1) Adjusted EBITDA includes a non-cash revenue

suspense release of $7.0 million for the three months ended June

30, 2024 and $1.4 million for the three months ended March 31,

2024. See “Revenue Payables in Suspense” table for additional

information.

|

Selected Operating and Financial Data (Tables) |

|

|

|

|

|

|

|

|

Reconciliation of Unaudited GAAP Financial Measures to Non-GAAP

Financial Measures |

|

|

|

|

|

Cash General and Administrative Expenses |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Three

Months |

|

Three

Months |

|

| |

|

Ended |

|

Ended |

|

| (Amounts in

$000s) |

|

June 30, 2024 |

|

March 31, 2024 |

|

| |

|

|

|

|

|

|

|

| General and

administrative expense |

|

$ |

8,358 |

|

$ |

9,800 |

|

| Less:

Share-based compensation expense |

|

|

1,767 |

|

|

1,531 |

|

| Less:

Acquisition and divestiture costs |

|

|

9 |

|

|

14 |

|

| Less: Bad

debt expense |

|

|

— |

|

|

26 |

|

| Less:

Severance payments |

|

|

— |

|

|

344 |

|

|

Total Cash General and Administrative Expense |

|

$ |

6,582 |

|

$ |

7,885 |

|

| |

|

|

|

|

|

|

|

|

Selected Operating and Financial Data (Tables) |

|

|

|

|

|

|

|

Reconciliation of Unaudited GAAP Financial Measures to Non-GAAP

Financial Measures |

|

|

|

|

Revenue Payables in Suspense |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three

Months |

|

Six

Months |

| |

|

Ended |

|

Ended |

| (Amounts in

$000s) |

|

June 30, 2024 |

|

June 30, 2024 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Oil and natural gas sales |

|

|

$ |

2,579 |

|

|

|

$ |

4,023 |

|

| Other

revenues |

|

|

|

4,829 |

|

|

|

|

4,829 |

|

| Severance

tax and other deducts |

|

|

|

(361 |

) |

|

|

|

(433 |

) |

|

Total net revenue |

|

|

$ |

7,047 |

|

|

|

$ |

8,419 |

|

| |

|

|

|

|

|

|

|

Production volumes: |

|

|

|

|

|

|

| Oil

(MBbls) |

|

|

|

10 |

|

|

|

|

33 |

|

| NGLs

(MBbls) |

|

|

|

27 |

|

|

|

|

31 |

|

| Natural gas

(MMcf) |

|

|

|

421 |

|

|

|

|

441 |

|

|

Total (Mboe) |

|

|

|

107 |

|

|

|

|

138 |

|

|

Total (Mboe/d) |

|

|

|

1.18 |

|

|

|

|

0.76 |

|

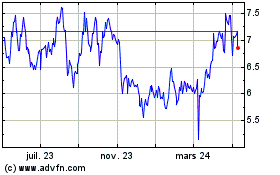

Amplify Energy (NYSE:AMPY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

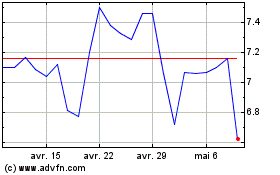

Amplify Energy (NYSE:AMPY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024