Statement of Changes in Beneficial Ownership (4)

03 Décembre 2021 - 11:04PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Suydam John J |

2. Issuer Name and Ticker or Trading Symbol

Apollo Global Management, Inc.

[

APO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Legal Officer |

|

(Last)

(First)

(Middle)

C/O APOLLO GLOBAL MANAGEMENT, INC., 9 WEST 57TH STREET, 43RD FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/1/2021 |

|

(Street)

NEW YORK, NY 10019

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 12/1/2021 | | A | | 129310 (1) | A | $00.00 | 421752 (2) | D | |

| Class A Common Stock | | | | | | | | 4515 | I | Kalmia Investments LLC - Series A (3) |

| Class A Common Stock | | | | | | | | 64260 | I | Suydam 2012 Family Trust (4) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Consists of fully vested restricted stock units ("RSUs") that were granted under the Apollo Global Management, Inc. 2019 Omnibus Equity Incentive Plan (the "Plan"). Each such RSU represents the contingent right to receive one share of Class A common stock of the Issuer (the "Class A shares") in January 2027, provided that the reporting person honors his restrictive covenants until that date. |

| (2) | Reported amount includes 196,613 vested and unvested RSUs granted under the Plan. Each RSU represents the contingent right to receive, in accordance with the issuance schedule set forth in the applicable RSU award agreement, one share of Class A common stock of the Issuer for each vested RSU. The unvested RSUs vest in installments in accordance with the terms of the applicable RSU award agreement, provided the reporting person remains in service through the applicable vesting date. |

| (3) | These Class A shares are held by Kalmia Investments LLC - Series A ("Kalmia"). The reporting person owns 30% of Kalmia, and the remaining 70% of Kalmia is owned by the Suydam GST Exempt Trust for the benefit of reporting person's grandchildren for which the reporting person's spouse is the trustee (the "GST Trust"). The reporting person disclaims beneficial ownership of 70% of the securities owned by Kalmia, as they will ultimately be distributed to the GST Trust. |

| (4) | These Class A shares are held in the Suydam 2012 Family Trust for the benefit of the reporting person's spouse and children for which the reporting person's spouse is the trustee (the "2012 Trust"). The reporting person disclaims beneficial ownership of all securities held by the 2012 Trust except to the extent of the reporting person's pecuniary interest therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Suydam John J

C/O APOLLO GLOBAL MANAGEMENT, INC.

9 WEST 57TH STREET, 43RD FLOOR

NEW YORK, NY 10019 |

|

| Chief Legal Officer |

|

Signatures

|

| /s/ John J. Suydam | | 12/3/2021 |

| **Signature of Reporting Person | Date |

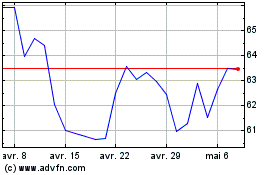

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

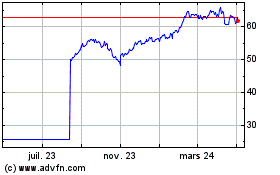

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Apollo Global Management Inc (New York Stock Exchange): 0 recent articles

Plus d'articles sur Apollo Global Management, Inc.