Post-effective Amendment to an S-8 Filing (s-8 Pos)

03 Janvier 2022 - 11:19PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on January 3, 2022

Registration No. 333-232797

Registration No. 333-173161

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2 TO:

FORM S-8 REGISTRATION STATEMENT No. 333-232797

FORM S-8 REGISTRATION STATEMENT No. 333-173161

UNDER

THE SECURITIES ACT OF 1933

APOLLO ASSET MANAGEMENT, INC.*

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

20-8880053

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

9 West 57th Street, 43rd Floor

New York, New York 10019

(212) 515-3200

(Address of principal executive offices, including

Zip Code)

Apollo Global Management, Inc. 2019 Omnibus Equity

Incentive Plan

(Full title of the plans)

Christian Weideman, Esq.

General Counsel

Apollo Asset Management, Inc.

9 West 57th Street, 43rd Floor

New York, New York 10019

(Name and address of agent for service)

(212) 515-3200

(Telephone number, including area code, of agent

for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

|

|

Smaller reporting company

|

|

¨

|

|

|

|

|

|

Emerging growth company

|

|

¨

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

|

¨

|

|

*

|

On January 1, 2022, pursuant to the Agreement and Plan of Merger, dated as of March 8, 2021 (the “Merger Agreement”), by and among Apollo Global Management, Inc., a Delaware corporation (“AGM”), Athene Holding Ltd, a Bermuda exempted company (“AHL”), Tango Holdings, Inc., a Delaware corporation and a direct wholly owned subsidiary of AGM (“Holdings”), Blue Merger Sub, Ltd., a Bermuda exempted company and a direct wholly owned subsidiary of Holdings (“AHL Merger Sub”), and Green Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of Holdings (“AGM Merger Sub”), AGM Merger Sub merged with and into AGM with AGM as the surviving corporation and a direct subsidiary of Holdings (the “AGM Merger”), and AHL Merger Sub merged with and into AHL with AHL as the surviving corporation and a direct subsidiary of Holdings (the “AHL Merger”, and together with the AGM Merger, the “Mergers”). On January 1, 2022, upon the consummation of the Mergers, AGM was renamed Apollo Asset Management, Inc. and Holdings was renamed Apollo Global Management, Inc.

|

DEREGISTRATION OF UNSOLD SECURITIES

This Post-Effective Amendment No. 2, filed by Apollo Asset Management,

Inc., a Delaware corporation (f/k/a Apollo Global Management, Inc.) (the “Registrant”), relates to the following Registration

Statements, as amended, on Form S-8 (collectively, the “Registration Statements”), previously filed with the U.S. Securities

and Exchange Commission (the “SEC”) by the Registrant:

|

|

·

|

Registration No. 333-232797, filed with the SEC on July 25, 2019, as amended on September 5, 2019, registering 47,658,088 shares of

Class A common stock of the Registrant, par value $0.00001 per share (“Class A Shares”), under the Apollo Global Management,

Inc. 2019 Omnibus Equity Incentive Plan (the “2019 OEIP”); and

|

|

|

·

|

Registration No. 333-173161, filed with the SEC on March 30, 2011, as amended on September 5, 2019, registering 50,555,556 Class A

Shares under the 2019 OEIP

|

As a result of the Mergers, the Registrant has terminated all offerings

of its securities pursuant to existing registration statements, including the Registration Statements. In accordance with an undertaking

made by the Registrant in the Registration Statements to remove from registration, by means of a post-effective amendment, any of the

securities which remain unsold at the termination of the offering, the Registrant hereby removes from registration all of the securities

registered under the Registration Statements which remain unsold as of January 1, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the

Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8, and has duly

caused this Post-Effective Amendment No. 2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New

York, State of New York, on January 3, 2022.

|

|

APOLLO ASSET MANAGEMENT, INC.

|

|

|

|

|

|

|

|

|

By

|

/s/ CHRISTIAN WEIDEMAN

|

|

|

|

|

Christian Weideman

|

|

|

|

|

General Counsel

|

|

Note: No other person is required to sign this Post-Effective Amendment

in reliance upon Rule 478 under the Securities Act of 1933.

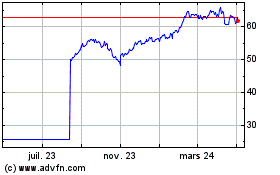

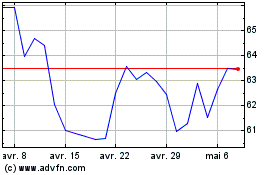

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024