0000004962false00000049622024-07-262024-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2024

AMERICAN EXPRESS COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| New York | | 1-7657 | | 13-4922250 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

200 Vesey Street,

New York, New York 10285

(Address of principal executive offices and zip code)

(212) 640-2000

(Registrant's telephone number, including area code)

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares (par value $0.20 per Share) | | AXP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Exhibits are filed herewith in connection with the issuance by American Express Company (the “Company”), on July 26, 2024, of $1,200,000,000 aggregate principal amount of 5.043% Fixed-to-Floating Rate Notes due July 26, 2028 (the “2028 Fixed-to-Floating Rate Notes”), $1,700,000,000 aggregate principal amount of 5.284% Fixed-to-Floating Rate Notes due July 26, 2035 (the “2035 Fixed-to-Floating Rate Notes”) and $500,000,000 aggregate principal amount of Floating Rate Notes due July 26, 2028 (the “Floating Rate Notes” and, together with the 2028 Fixed-to-Floating Rate Notes and the 2035 Fixed-to-Floating Rate Notes, the “Notes”) pursuant to a Prospectus Supplement dated July 22, 2024 to the Prospectus dated February 9, 2024, filed as part of the Company’s Registration Statement on Form S-3 (No. 333-276975). The Notes were issued under a senior indenture, dated as of August 1, 2007, between the Company and The Bank of New York Mellon, as trustee (the “Trustee”), as supplemented by the first supplemental indenture thereto, dated as of February 12, 2021, and the second supplemental indenture thereto, dated as of May 1, 2023, each between the Company and the Trustee.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits are incorporated by reference into the Registration Statement as exhibits thereto and are filed as part of this Current Report:

| | | | | |

| Exhibit | Description |

| 5 | |

| 23 | |

| 104 | The cover page of this Current Report on Form 8-K, formatted as inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AMERICAN EXPRESS COMPANY |

| | (REGISTRANT) |

| | | |

| | By: | /s/ James J. Killerlane III |

| | | Name: James J. Killerlane III |

| | | Title: Corporate Secretary |

Date: July 26, 2024

Exhibit 5

| | | | | | | | | | | | | | |

| |

| American Express Company |

| | | | General Counsel’s Organization |

| | | | 200 Vesey Street |

| | | | New York, NY 10285 |

July 26, 2024

American Express Company

200 Vesey Street

New York, New York 10285

Ladies and Gentlemen:

I am Director and Counsel of American Express Company (the “Company”), a New York corporation, and I have represented the Company in connection with the offering by the Company pursuant to a registration statement on Form S-3 (No. 333-276975) of $1,200,000,000 aggregate principal amount of the Company’s 5.043% Fixed-to-Floating Rate Notes due July 26, 2028 (the “2028 Fixed-to-Floating Rate Notes”), $1,700,000,000 aggregate principal amount of the Company’s 5.284% Fixed-to-Floating Rate Notes due July 26, 2035 (the “2035 Fixed-to-Floating Rate Notes”) and $500,000,000 aggregate principal amount of the Company’s Floating Rate Notes due July 26, 2028 (the “Floating Rate Notes” and, together with the 2028 Fixed-to-Floating Rate Notes and the 2035 Fixed-to-Floating Rate Notes, the “Notes”). The Notes are being issued pursuant to a senior indenture dated as of August 1, 2007 between the Company and The Bank of New York Mellon, as trustee (the “Trustee”), as supplemented by the first supplemental indenture thereto dated as of February 12, 2021 and the second supplemental indenture thereto dated as of May 1, 2023, each between the Company and the Trustee (as so supplemented, the “Indenture”).

I, or members of the staff of the General Counsel’s Organization of the Company, have reviewed the originals, or copies certified or otherwise identified to our satisfaction, of such corporate records and documents relating to the Company and have made such other investigations of law and fact as we have deemed appropriate as the basis for the opinions expressed below. In such examination, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, I have assumed the due authorization, execution, delivery and, where appropriate, authentication of the documents by all parties thereto other than the Company.

American Express Company, page 2

I am admitted to the practice of law only in the State of New York and do not purport to be expert in the laws of any jurisdictions other than the federal law of the United States of America and the law of the State of New York.

Based on the foregoing, and subject to the further assumptions and qualifications set forth below, it is my opinion that:

The issuance and sale of the Notes have been authorized by the Company. The Notes have been duly executed and delivered by the Company and constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

Insofar as the foregoing opinions relate to the validity, binding effect or enforceability of any agreement or obligation of the Company, (a) I have assumed that each other party to such agreement or obligation has satisfied those legal requirements that are applicable to it to the extent necessary to make such agreement or obligation enforceable against it (except that no such assumption is made as to the Company regarding matters of the federal law of the United States of America or the law of the State of New York), and (b) such opinions are subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally and to general principles of equity. The foregoing opinions are limited to the law of the State of New York.

As to certain factual matters, I have relied upon certificates of officers of the Company and certificates of public officials and other sources believed by me to be responsible; and I have assumed that the Indenture has been duly authorized, executed and delivered by the Trustee, that the Trustee’s certificates of authentication of the Notes have been signed by one of the Trustee’s authorized officers, that the Notes have been delivered against payment as contemplated in the prospectus and the prospectus supplement and that the signatures on all documents examined by me or members of the staff of the General Counsel’s Organization of the Company are genuine (assumptions that I have not independently verified).

I hereby consent to the use of my name in each of the prospectus and the prospectus supplement constituting a part of the Registration Statement under the heading “Legal Matters,” as counsel for the Company who has passed on the validity of the Notes, and to the use of this opinion as an exhibit to the Company’s Current Report on Form 8-K, dated July 26, 2024, which will be incorporated by reference in the Registration Statement. In giving such consent, I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the Securities and Exchange Commission thereunder.

[Signature Page Follows]

American Express Company, page 3

Very truly yours,

/s/ Benjamin L. Kuder

Benjamin L. Kuder

Director and Counsel

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

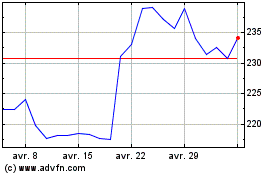

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024