Blackwells Exposes the Futility of Braemar’s May 6th Announcement

09 Mai 2024 - 2:37PM

Blackwells Capital LLC (“Blackwells”), a shareholder of Braemar

Hotels & Resorts Inc. (“Braemar” or the “Company”) (NYSE: BHR),

today released a presentation entitled “Too Little, Too Late” which

may be found at https://nomoremonty.com/letters-presentations/.

Jason Aintabi, Chief Investment Officer of

Blackwells, said:

“We have previously warned the Board against

digging an even bigger hole for themselves by enabling the

continued value destructive behaviour of Montgomery Bennett and

Braemar’s external advisor. We question the motivations that

produced a very uninspiring price for Torrey Hilton, and led to the

authorization of a suspiciously timed share buyback; this Board

must pause any and all strategic initiatives until shareholders

have their say at the ballot box.”

Blackwells encourages all shareholders to review

Blackwells’ materials, the details of its engagement with the

Company, information about Blackwells’ nominees, and other

important information at www.NoMoreMonty.com.

Shareholders are also invited to follow

Blackwells’ campaign on X at @nomoremonty and Instagram at

@no_more_monty.

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason

Aintabi, its Chief Investment Officer. Since that time, it has made

investments in public securities, engaging with management and

boards, both publicly and privately, to help unlock value for

stakeholders, including shareholders, employees and communities.

Throughout their careers, Blackwells’ principals have invested

globally on behalf of leading public and private equity firms and

have held operating roles and served on the boards of media,

energy, technology, insurance and real estate enterprises. For more

information, please visit www.blackwellscap.com.

Contacts

ShareholdersMacKenzie Partners, Inc.Toll Free: +1 (800)

322-2885proxy@mackenziepartners.com

MediaGagnier CommunicationsDan Gagnier & Riyaz

Lalani646-569-5897blackwells@gagnierfc.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason

Aintabi, Michael Cricenti, Jennifer M. Hill, Betsy L. McCoy and

Steven J. Pully (collectively, the “Participants”) are participants

in the solicitation of proxies from the shareholders of the Company

for the 2024 Annual Meeting. On April 3, 2024, the Participants

filed with the SEC their definitive proxy statement and

accompanying WHITE proxy card in connection with

their solicitation of proxies from the shareholders of the

Company.

All shareholders of the Company are

advised to read the definitive proxy statement, the accompanying

WHITE UNIVERSAL proxy card and other documents related to the

solicitation of proxies by the Participants, as they contain

important information, including additional information related to

the Participants and their direct or indirect interests in the

Company, by security holdings or otherwise.

The definitive proxy statement and an

accompanying WHITE universal proxy card will be

furnished to some or all of the Company’s shareholders and are,

along with other relevant documents, available at no charge on the

SEC’s website at http://www.sec.gov/. In addition, the Participants

will provide copies of the definitive proxy statement without

charge, upon request. Requests for copies should be directed to

Blackwells.

The Company’s board of directors has purported

to reject as invalid our nominations to elect each of Blackwells’

nominees and determined that our notice is purportedly

non-compliant with the Bylaws and defective. On March 24, 2024,

Braemar brought suit against each of the Participants, Blackwells

Holding Co. LLC, Vandewater Capital Holdings, LLC, Blackwells Asset

Management LLC and BW Coinvest Management I LLC in the United

States District Court for the Northern District of Texas, seeking

injunctive relief against solicitation of proxies by Blackwells and

a declaratory judgment that Blackwells’ nomination is invalid due

to Blackwells’ alleged violations of the Company’s Bylaws, and, as

a result, Blackwells’ slate of purported nominees is invalid and

ineligible to stand for election by the Company’s shareholders.

Ultimately, Blackwells believes the Company’s claims have no merit.

On April 11, 2024, Blackwells Capital filed a Complaint in the

District Court against the Company and the Company’s directors.

Blackwells Capital alleges, among other things, that the Company

improperly rejected Blackwells Capital’s nomination notice,

breached its bylaws, and violated Section 14(a) of the Securities

Exchange Act of 1934 by issuing false and misleading statements and

failing to disclose The Dallas Express as a proxy participant. The

action filed by the Company on March 24, 2024 and the action filed

by Blackwells Capital on April 11, 2024 have been consolidated (the

“Consolidated Litigation”). The Consolidated Litigation is

currently stayed. The outcome of the Consolidated Litigation and

any related litigation may affect our ability to deliver proxies

submitted to us on the WHITE Universal Proxy

Card.

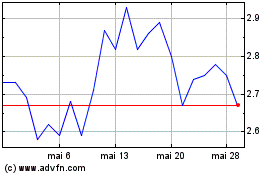

Braemar Hotels and Resorts (NYSE:BHR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Braemar Hotels and Resorts (NYSE:BHR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025