Blackwells Calls out More of Mr. Bennett’s Fictions

11 Juin 2024 - 10:00PM

Blackwells Capital LLC (“Blackwells”), a shareholder of Braemar

Hotels & Resorts Inc. (“Braemar” or the “Company”) (NYSE: BHR),

responded to a press release issued by Braemar today.

Jason Aintabi, Chief Investment Officer of Blackwells, said:

“If Mr. Bennett really ‘takes his responsibility to protect the

best interests of shareholders seriously’ as he stated earlier

today, he would look at the share price declines of every

REIT he has touched and acknowledge that he is among the

worst managers in the history of US listed REITs. Mr. Bennett’s

primary expertise rather appears to be in the field of ‘shareholder

value extraction’-- where we award him a gold medal.”

Blackwells calls out Mr. Bennett’s fictions.. (again..):

- Mr. Bennett said Blackwells’ campaign “from the start has been

defined by smear tactics and personal attacks.” Mr. Bennett has a

pattern of smearing and suing shareholders who bring attention to

his shady external advisory agreement with Ashford Inc. (or

otherwise call out his unique skillsets), including the smear

tactics and personal attacks against Blackwells in a series of

articles published in a ‘newspaper’ he controls, in a manner we

believe violates securities laws.

- Mr. Bennett labels the Blackwells nominees as “handpicked”. The

Blackwells nominees are all independent,

all highly qualified, all

outraged at the governance of the Company and are

all willing to step in and defend shareholders.

Just a quick glance at the ever-increasing fee stream paid to

Ashford Inc. will enlighten even the most uninformed shareholder as

to why Mr. Bennett is fighting desperately to keep skilled,

independent directors out of his boardroom.

- Mr. Bennett claims that Blackwells’ intention is “taking over

the Braemar Board of Directors without paying a control premium”.

Either Mr. Bennett does not understand how proxy contests work, or

he is deliberately misleading shareholders. We believe it is the

latter. Blackwells wants independent directors to examine the shady

‘Advisory Agreement’ and understand how Mr. Bennett has

increased his fee stream by 600% while shareholders have suffered a

90% decline in share price. The current Board members are

clearly not interested in figuring that magic trick out.

- Mr. Bennett said that Blackwells has a “history of running

misguided, unsuccessful efforts.” Blackwells has created tens of

billions of dollars in value for fellow shareholders in its public

campaigns, while Mr. Bennett has turned every REIT he has

ever gotten his fingers on into illiquid, mismanaged and

debt-ridden disasters.

Blackwells urges all Braemar shareholders to vote their

proxy on the WHITE universal proxy card “FOR” each of the

Blackwells nominees and the Blackwells proposals. Blackwells

recommends shareholders vote “AGAINST” Braemar’s executive

compensation resolution.

If you have any questions about voting your proxy

or need replacement proxy materials, contact:MacKenzie Partners,

Inc.+1 (800) 322-2885 (toll free for

shareholders)proxy@mackenziepartners.com

Blackwells also encourages shareholders to

review Blackwells’ materials, the details of its engagement with

the Company, information about Blackwells’ nominees, and other

important information at www.NoMoreMonty.com. Shareholders are also

invited to follow Blackwells’ campaign on X at @nomoremonty and

Instagram at @no_more_monty.

About Blackwells Capital

Blackwells is a multi-strategy alternative asset management firm

that invests in public and private markets globally. Our public

markets portfolio focuses on currencies, equities, credit and

commodities. When necessary, we engage with public company boards

to drive value for all stakeholders. Our private markets portfolio

includes investments in space, clean energy, infrastructure, real

estate and technology. Further information is available

at www.blackwellscap.com.

Contacts

StockholdersMacKenzie Partners, Inc.Toll Free:

+1 (800) 322-2885proxy@mackenziepartners.com

MediaGagnier CommunicationsDan Gagnier &

Riyaz Lalani646-569-5897blackwells@gagnierfc.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason Aintabi, Michael

Cricenti, Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully

(collectively, the “Participants”) are participants in the

solicitation of proxies from the stockholders of the Company for

the Company’s 2024 annual meeting of stockholders. On April 3,

2024, the Participants filed with the Securities and Exchange

Commission (the “SEC”) their definitive proxy statement and

accompanying WHITE universal proxy card in connection with their

solicitation of proxies from the stockholders of the Company.

ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE

DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY

CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY

THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING

ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT

OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR

OTHERWISE.

The definitive proxy statement and an accompanying WHITE

universal proxy card will be furnished to some or all of the

Company’s stockholders and are, along with other relevant

documents, available at no charge on the SEC’s website

at http://www.sec.gov/. In addition, the Participants will

provide copies of the definitive proxy statement without charge,

upon request. Requests for copies should be directed to

Blackwells.

The Company’s board of directors has purported to reject as

invalid our nominations to elect each of Blackwells’ nominees and

determined that our notice is purportedly non-compliant with the

Company’s Fifth Amended and Restated Bylaws, as amended (the

“Bylaws”) and defective. On March 24, 2024, the Company brought

suit against each of the Participants, Blackwells Holding Co. LLC,

Vandewater Capital Holdings, LLC, Blackwells Asset Management LLC

and BW Coinvest Management I LLC in the United States District

Court for the Northern District of Texas (the “District Court”),

seeking injunctive relief against solicitation of proxies by

Blackwells and a declaratory judgment that Blackwells’ nomination

is invalid due to Blackwells’ alleged violations of the Bylaws,

and, as a result, Blackwells’ slate of purported nominees is

invalid and ineligible to stand for election by the Company’s

stockholders. Ultimately, Blackwells believes the Company’s claims

have no merit. On April 11, 2024, Blackwells filed a Complaint in

the District Court against the Company and the Company’s directors.

Blackwells alleges, among other things, that the Company improperly

rejected Blackwells’ nomination notice, breached the Bylaws, and

violated Section 14(a) of the Securities Exchange Act of 1934 by

issuing false and misleading statements and failing to disclose The

Dallas Express as a proxy participant. The action filed by the

Company on March 24, 2024 and the action filed by Blackwells on

April 11, 2024 have been consolidated (the “Consolidated

Litigation”). The Consolidated Litigation is currently stayed. The

outcome of the Consolidated Litigation and any related litigation

may affect our ability to deliver proxies submitted to us on the

WHITE universal proxy card.

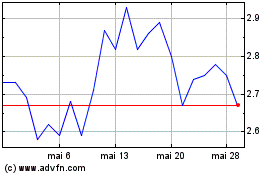

Braemar Hotels and Resorts (NYSE:BHR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Braemar Hotels and Resorts (NYSE:BHR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025