false000163411700016341172024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

| | | | | | | | | | | | | | | | | |

| BARNES & NOBLE EDUCATION, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware | | 1-37499 | | 46-0599018 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | |

120 Mountainview Blvd., Basking Ridge, NJ 07920 |

| (Address of principal executive offices)(Zip Code) |

| |

| Registrant’s telephone number, including area code: | | (908) 991-2665 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Exchange on which registered |

| Common Stock, $0.01 par value per share | | BNED | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Barnes & Noble Education, Inc. (the “Company”) issued a press release announcing its preliminary unaudited financial results for the second quarter ended October 26, 2024 (the “Press Release”). A copy of the Press Release and the financial statements and Non-GAAP reconciliation tables are attached hereto as Exhibit 99.1.

The information in this Form 8-K and the Exhibit attached hereto pertaining to the Company’s financial results shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | BARNES & NOBLE EDUCATION, INC. |

| | | | |

| Date: November 7, 2024 | | | By: | /s/ Jonathan Shar |

| | | Name: | Jonathan Shar |

| | | Title: | Chief Executive Officer |

| | | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Description |

| |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document). |

Exhibit 99.1

Barnes & Noble Education Reports Second Quarter Preliminary Fiscal Year 2025 Unaudited Financial Results

2Q BNC First Day® Program Revenues Increased 18% YOY to $235 million

2Q Net Income From Continuing Operations Expected to Increase by mid-70% to mid-90% YoY

BASKING RIDGE, N.J., Nov. 7, 2024 (GLOBE NEWSWIRE) -- Barnes & Noble Education, Inc. (NYSE: BNED), a leading solutions provider for the education industry, today announced preliminary, unaudited results for the second quarter ended October 26, 2024. These unaudited GAAP results are from continuing operations on a consolidated basis, unless noted otherwise, with Adjusted EBITDA presented as a non-GAAP measure.

As BNED’s most significant quarter from a revenue perspective, the second quarter includes the majority of the Fall back-to-school period. Preliminary, unaudited results suggest that second quarter fiscal year 2025 revenue is expected to be approximately flat year over year (YoY), while operating 109 fewer physical and virtual stores. Net Income for the quarter is expected to be in the mid to high $40 million range, an anticipated increase by mid-70% to mid-90% YoY, driven by comparable store top-line growth and continued improvements in cost management. Adjusted EBITDA is also expected to increase in the mid to high $10 million range to the mid to high $60 million range.

Jonathan Shar, CEO, commented, “We are pleased with the preliminary second quarter results during the important Fall back to school period and the progress we have made to date executing against our key strategic initiatives. From strong growth in our First Day® affordable access programs, to outstanding retail execution supporting our client institutions, and a disciplined approach to cost management, we are excited about the momentum we are building in our business transformation.”

The company is expecting to share final, unaudited second quarter fiscal year 2025 financial results in the beginning of December 2024 and will provide more detail and commentary at that time, inclusive of full financial tables and a reconciliation of non-GAAP measures.

The table below reflects the reconciliation of Adjusted EBITDA to the most comparable GAAP financial metric, Net Income from Continuing Operations:

| | | | | | | | | | | |

| $ in thousands | 13 weeks ended - Q2 |

| October 26, 2024 | | October 28, 2023 |

| Net income from continuing operations | $44,000-$49,000 | | $ | 24,854 | |

| Add: | | | |

| Depreciation and amortization expense | 8,000 | | | 10,175 | |

Interest expense, net | 5,000 | | | 10,664 | |

| Income tax expense | 1,000-2,000 | | 314 | |

| Restructuring and other charges | 1,000 | | | 4,274 | |

| Stock-based compensation expense (non-cash) | 2,000 | | | 799 | |

Adjusted EBITDA (Non-GAAP)- Continuing Operations | $61,000-$69,000 | | $ | 51,080 | |

| | | |

ABOUT BARNES & NOBLE EDUCATION, INC.

Barnes & Noble Education, Inc. (NYSE: BNED) is a leading solutions provider for the education industry, driving affordability, access and achievement at hundreds of academic institutions nationwide and ensuring millions of students are equipped for success in the classroom and beyond. Through its family of brands, BNED offers campus retail services and academic solutions, wholesale capabilities and more. BNED is a company serving all who work to elevate their lives through education, supporting students, faculty and institutions as they make tomorrow a better and smarter world. For more information, visit www.bned.com.

| | |

| Media & Investor Contact: |

| Judith Buckingham |

| Manager, Corporate Communications |

| jbuckingham@bned.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Use of Non-GAAP Financial Information - Adjusted EBITDA | |

| | | | | | | | | | | |

| To supplement the Company’s condensed consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”) the Company has presented the financial measure of Adjusted EBITDA, which is a non-GAAP financial measure under Securities and Exchange Commission (the "SEC") regulations. We define Adjusted EBITDA as net income (loss) plus (1) depreciation and amortization; (2) interest expense and (3) income taxes, (4) as adjusted for items that are subtracted from or added to net income (loss). | |

| | | | | | | | | | | |

| This non-GAAP measure has been reconciled to the most comparable financial measure presented in accordance with GAAP as follows: the reconciliation of consolidated Adjusted EBITDA to consolidated net income (loss). All of the items included in the reconciliation are either (i) non-cash items or (ii) items that management does not consider in assessing our on-going operating performance. | | | | |

| | | | | | | | | | | |

| This non-GAAP financial measure is not intended as substitutes for and should not be considered superior to measures of financial performance prepared in accordance with GAAP. In addition, the Company's use of this non-GAAP financial measure may be different from similarly named measures used by other companies, limiting their usefulness for comparison purposes. | |

| | | | | | | | | | | |

| We review this non-GAAP financial measure as an internal measure to evaluate our performance at a consolidated level to manage our operations. We believe that this measure is a useful performance measure which is used by us to facilitate a comparison of our on-going operating performance on a consistent basis from period-to-period. We believe that this non-GAAP financial measure provides for a more complete understanding of factors and trends affecting our business than measures under GAAP can provide alone, as they exclude certain items that management believes do not reflect the ordinary performance of our operations in a particular period. Our Board of Directors and management also use Adjusted EBITDA at a consolidated level as one of the primary methods for planning and forecasting expected performance, for evaluating on a quarterly and annual basis actual results against such expectations, and as a measure for performance incentive plans. We believe that the inclusion of Adjusted EBITDA results provides investors useful and important information regarding our operating results, in a manner that is consistent with management’s evaluation of business performance. | |

| | | | | | | | | | | |

| The Company urges investors to carefully review the GAAP financial information included as part of the Company’s Form 10-K dated April 27, 2024 filed with the SEC on July 1, 2024, which includes consolidated financial statements for each of the three years for the period ended April 27, 2024, April 29, 2023, and April 30, 2022 (Fiscal 2024, Fiscal 2023, and Fiscal 2022, respectively). The Company also urges investors to carefully review the financial information included as part of the Company’s Quarterly Report on Form 10-Q for the period ended July 27, 2024, filed with the SEC on September 10, 2024. | |

| |

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and information relating to us and our business that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this communication, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “will,” “forecasts,” “projections,” and similar expressions, as they relate to us or our management, identify forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements, which include but are not limited to the anticipated financial results for second quarter fiscal 2025 and the timing of the Company full release of financial results for second quarter fiscal 2025. We caution you not to place undue reliance on these forward-looking statements. Such statements

reflect our current views with respect to future events, the outcome of which is subject to certain risks, including, but not limited to: the completion of our quarterly review process for our financial results for the second fiscal quarter of 2025, which could cause the preliminary results reflect in this press release to change; the amount of our indebtedness and ability to comply with covenants contained in our credit agreement; and our ability to maintain adequate liquidity levels to support ongoing inventory purchases and related vendor payments in a timely manner. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. For a more detailed discussion of these factors, and other factors that could cause actual results to vary materially, interested parties should review the risk factors listed in the Company’s Annual Report on Form 10-K for the year ended April 27, 2024 as filed with the SEC. Any forward-looking statements made by us in this press release speak only as of the date of this press release, and we do not intend to update these forward-looking statements after the date of this press release, except as required by law.

v3.24.3

Cover

|

Nov. 07, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

BARNES & NOBLE EDUCATION, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-37499

|

| Entity Tax Identification Number |

46-0599018

|

| Entity Address, Address Line One |

NJ

|

| Entity Address, Address Line One |

120 Mountainview Blvd.,

|

| Entity Address, City or Town |

Basking Ridge,

|

| Entity Address, Postal Zip Code |

07920

|

| City Area Code |

(908)

|

| Local Phone Number |

991-2665

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

BNED

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001634117

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

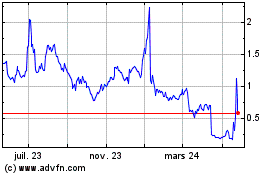

Barnes and Noble Education (NYSE:BNED)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

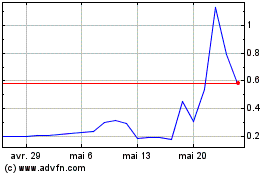

Barnes and Noble Education (NYSE:BNED)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025