false

N-2

0000845379

0000845379

2022-11-01

2023-10-31

0000845379

chn:PoiliticalEconomicAndOtherFactorsMember

2022-11-01

2023-10-31

0000845379

chn:InvestmentAndRepatriationRestrictionsMember

2022-11-01

2023-10-31

0000845379

chn:ChineseCorporateAndSecuritiesLawsMember

2022-11-01

2023-10-31

0000845379

chn:MarketCharacteristicsMember

2022-11-01

2023-10-31

0000845379

chn:ForeignExchangeControlMember

2022-11-01

2023-10-31

0000845379

chn:ForeignCurrencyAndHedgingConsiderationsMember

2022-11-01

2023-10-31

0000845379

chn:AShareRiskMember

2022-11-01

2023-10-31

0000845379

chn:DirectInvestmentsMember

2022-11-01

2023-10-31

0000845379

chn:NetAssetValueDiscountMember

2022-11-01

2023-10-31

0000845379

chn:NonDiversificationMember

2022-11-01

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment

Company Act file number: 811-05749

THE

CHINA FUND, INC.

(Exact

name of registrant as specified in charter)

C/O

BROWN BROTHERS HARRIMAN & CO.

50

POST OFFICE SQ.

BOSTON,

MA 02110

ATTENTION

SUZAN BARRON

(Address

of principal executive offices)(Zip code)

Copy

to:

Suzan

Barron

Brown

Brothers Harriman & Co.

50

Post Office Sq.

Boston,

MA 02110 |

Laura

E. Flores, Esq.

Morgan,

Lewis & Bockius LLP

1111

Pennsylvania Avenue, NW

Washington,

DC 20004-2541 |

| |

|

| (Name

and Address of Agent for Service) |

|

Registrant’s

telephone number, including area code: (888) 246-2255

Date

of fiscal year end: October 31

Date

of reporting period: October 31, 2023

Item

1. Report to Stockholders.

ANNUAL REPORT

October 31, 2023

The China Fund, Inc.

Table of Contents

| |

Page |

Key Highlights |

1 |

Asset Allocation |

2 |

Industry Allocation |

3 |

Chairman’s Statement |

4 |

Investment Manager’s Statement |

7 |

Performance |

9 |

Portfolio Management |

10 |

Schedule of Investments |

11 |

Financial Statements |

16 |

Notes to Financial Statements |

21 |

Report of Independent Registered Public Accounting Firm |

30 |

Other Information |

31 |

Dividends and Distributions: Summary of Dividend Reinvestment and Cash Purchase Plan |

33 |

Investment Objective and Policies |

36 |

Risk Factors and Special Considerations |

40 |

Directors and Officers |

48 |

THE CHINA FUND, INC.

Key Highlights (unaudited)

FUND DATA |

NYSE Stock Symbol |

CHN |

Listing Date |

July 10, 1992 |

Shares Outstanding |

10,029,955 |

Total Net Assets (10/31/23) |

$119,149,099 |

Net Asset Value Per Share (10/31/23) |

$11.88 |

Market Price Per Share (10/31/23) |

$9.74 |

TOTAL RETURN(1) |

Performance as of 10/31/23: |

Net Asset Value(2) |

Market Price |

MSCI China All-Shares Index |

1-Year Cumulative |

7.35% |

3.91% |

11.86% |

3-Year Cumulative |

-40.69% |

-45.13% |

-35.95% |

3-Year Annualized |

-15.98% |

-18.13% |

-13.80% |

5-Year Cumulative |

7.88% |

-1.14% |

1.03% |

5-Year Annualized |

1.53% |

-0.23% |

0.20% |

10-Year Cumulative |

28.59% |

19.89% |

22.57% |

10-Year Annualized |

2.55% |

1.83% |

2.06% |

DIVIDEND HISTORY |

Record Date |

Income |

Capital Gains |

12/28/22 |

|

|

— |

|

|

$ |

0.6748 |

|

12/28/21 |

|

$ |

0.0421 |

|

|

$ |

7.2248 |

|

12/28/20 |

|

$ |

0.1502 |

|

|

$ |

2.1621 |

|

12/30/19 |

|

$ |

0.1320 |

|

|

$ |

1.2523 |

|

12/21/18 |

|

$ |

0.1689 |

|

|

$ |

0.3712 |

|

12/19/17 |

|

$ |

0.5493 |

|

|

|

— |

|

12/19/16 |

|

$ |

0.4678 |

|

|

|

— |

|

12/28/15 |

|

$ |

0.2133 |

|

|

$ |

1.2825 |

|

12/22/14 |

|

$ |

0.2982 |

|

|

$ |

3.4669 |

|

12/23/13 |

|

$ |

0.4387 |

|

|

$ |

2.8753 |

|

(1) Total investment returns reflect changes in net asset value or market price, as the case may be, during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The net asset value returns are not an indication of the performance of a stockholder’s investment in the Fund, which is based on market price. Total investment returns do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Total investment returns are historical and do not guarantee future results. Market price returns do not reflect broker commissions in connection with the purchase or sale of Fund shares.

(2) Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from what is reported in the Financial Highlights.

1

THE CHINA FUND, INC.

Asset Allocation AS OF October 31, 2023 (unaudited)

Ten Largest Listed Equity Investments* |

Tencent Holdings, Ltd. |

|

|

8.6 |

% |

Alibaba Group Holding, Ltd. |

|

|

7.8 |

% |

PDD Holdings, Inc. |

|

|

6.3 |

% |

Meituan |

|

|

5.2 |

% |

China Merchants Bank Co., Ltd. |

|

|

4.4 |

% |

JD.com, Inc. |

|

|

4.1 |

% |

KE Holdings, Inc. |

|

|

3.6 |

% |

China International Capital Corp., Ltd. |

|

|

3.5 |

% |

CITIC Securities Co., Ltd. |

|

|

2.9 |

% |

Wuxi Biologics Cayman, Inc. |

|

|

2.3 |

% |

* Percentages based on net assets.

2

Industry Allocation (unaudited) |

Fund holdings are subject to change and percentages shown above are based on net assets at October 31, 2023. A complete list of holdings at October 31, 2023 is contained in the Schedule of Investments included in this report. The most current available data regarding portfolio holdings can be found on our website, www.chinafundinc.com. You may also obtain holdings by calling 1-888-246-2255.

3

THE CHINA FUND, INC.

Chairman’s Statement (unaudited)

Dear fellow Stockholders,

I have the pleasure to provide the annual report for The China Fund, Inc. (the “Fund”) covering its full fiscal year from November 1, 2022 to October 31, 2023, otherwise referred to herein as the “Period”.

The China Market

In my past two annual letters to Stockholders, I wrote of the pressures facing the Chinese economy which resulted in the near 33.47% decline in the stock market through the 24 months period of annual 2021 and 2022. I suggested a brighter market at the end of last year which, in turn, led to a 11.06% recovery in our Fund’s benchmark, the MSCI China All Shares Index. Regrettably this recovery failed early in 2023, as much on continuing Covid-related issues and the Chinese government’s reluctance to provide any financial impetus, particularly in the way of debt financing to both certain State governments and the corporate property sector, resulting in a 13.31% stock market decline through 2023 to time of writing (December 11, 2023). These recent market moves have totally reversed China’s position as having been amongst the best performing of stock markets in the period up to 2021 and subsequently placing it amongst the very worst performers globally.

So, 2023 has proven a further tough year for China’s economy and investors as much on the back of a seriously cash-strapped property sector and some State provinces. The concerns of the property sector are well highlighted in the fact that annual apartment sales are running at some one third of the levels achieved in 2020. Leadership from central government is urgently needed to set out the levels of financial assistance that may be forthcoming in these times. Such concern has been increased by President Xi’s recent postponement of the Third Plenum, held each five years at which such levels of aid have traditionally been announced. Further caution has been indicated by Pan Gongsheng, Governor of the People’s Bank of China (“PBOC”), who very recently forecast a ‘long and difficult journey’ for the economy suggesting it need diversify away from its traditional emphasis on property and infrastructure.

On a more optimistic note, in October the Peoples Bank of China pledged to resolve default risks for the larger property groups in the hope, in their own words, to “stabilize expectations” for the sector whilst in November PBOC urged State lenders to assist in financing needs.

These domestic challenges unfolded alongside lingering geopolitical tensions between the US and China, which have undoubtedly contributed to the souring of global investor sentiment. Whilst it is expected that China still will achieve an estimated 5% GDP in 2023, greater doubts exist on the expectation for 2024 which, without additional government policy support to enhance the confidence of corporate and individual investors alike, increases the uncertainties.

Only this week has Moody’s Investor Service, a leading credit rating agency, downgraded China’s Sovereign credit standing to negative, citing growing risks of persistently lower medium-term economic growth and the continuing overhang of a property sector crisis.

Whilst China’s short-term outlook appears less opportune as a major world economy its domestic market itself offers constant opportunity particularly amongst, inter alia, areas of renewable energy, electrification of its auto industry, artificial intelligence, drone development and healthcare.

4

THE CHINA FUND, INC.

Chairman’s Statement (unaudited) (continued)

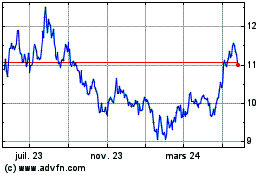

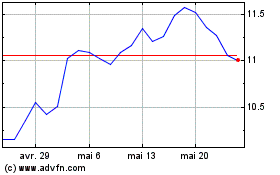

Fund Performance

In this environment, your Fund achieved a 7.35% gain in Net Asset Value (“NAV”) for the year despite a decline of 14.41% in the second half. These figures compare with 11.86% increase for the Fund’s benchmark for the fiscal year and a 12.17% depreciation in the second half.

These figures whilst disappointing reflect particularly your investment manager’s continued measurable overweight in the consumer discretionary sector – and the ‘platform’ stocks in particular. Several of those IT-based companies boasted improving revenue growth and expanding profit margins; however, amid decidedly (and extended) negative sentiment, particularly amongst global investors, these names suffered from contracting valuation multiples over the course of calendar 2023 and largely explain the underperformance of the Fund relative to benchmark, despite our investment manager largely avoiding the worst of the real estate pressures.

Accordingly, the Fund’s performance over the initial measurement period of the Tender Policy adopted earlier this year and extending over 5 years is behind the MSCI All China benchmark by nearly 800 basis points. As discouraging as this may appear, our manager’s conviction on retaining the overweight to these platform companies remains unbowed, and the positive underlying fundamentals of these names should prompt meaningful outperformance when deeply negative sentiment towards China abates.

Share Price Discount Management

Through calendar year 2023 the discounts of the vast majority of worldwide investment companies have widened as buyers in the sector appear to have stood aside. In the case of the Fund, its discount through 2023 has widened from some 7.60 to 18.53 percent against its net asset value but has narrowed marginally to 13.82% at time of writing. I would add that whilst these levels are totally unacceptable to your board, they have been by no means the largest discounts within NYSE listed investment companies. In this environment your board has continued its policy of making opportune buy backs of stock from the market and through the full fiscal period has purchased 228,640 shares, at an average price of $12.44 per share, for a total consideration of $2,843,434. The average discount to the purchase price, including commission, was 13.43% and which has resulted in a 0.04 accretion to the NAV.

Expenses

Your board is forever conscious of the expenses of the Fund and their bearing on the total expense ratio (“TER”). Costs are monitored constantly to ensure best value for stockholders and the ongoing management of the Fund. Whilst the trend of total expenses has been downwards over the recent 5 years, the market-driven decline in assets under management has, particularly over the past three years, unavoidably forced the TER higher from the 1% level in fiscal year end 2021 to 1.56% in fiscal 2023. Your board will continue to monitor all costs closely.

5

THE CHINA FUND, INC.

Chairman’s Statement (unaudited) (continued)

May we thank all stockholders for your support and indeed patience over the past Period.

Yours very sincerely

For and on behalf of The China Fund Inc.

Julian Reid

Chair

6

THE CHINA FUND, INC.

Investment Manager’s Statement (unaudited)

Market Environment

Chinese equities started the fiscal year weak and choppy with continued worry of an economic growth slowdown in the country, ADR delisting pricing pressures and investor worries that Russia-like sanctions could be implemented upon select Chinese companies. However, the quarter that ended January 31, 2023 saw a reversal as Chinese equities posted some of the strongest results within global markets with a rebound in sentiment stemming from the government’s statements and actions which support the easing of COVID-related restrictions in favor of ‘living with COVID’ policies. The roll-back of COVID restrictions gained momentum during the quarter spurring speculation of a forthcoming increase in consumer discretionary activity and overall mobility.

Unfortunately, the overall environment for China remained challenging in the second quarter with limited policy support and continued negative headlines related to U.S. – China relations as tensions escalated with speculation of “spy balloons” before partially recovering in March as the government showed strong support for gaming and internet sectors along with announcing state-owned enterprise (SOE) reforms and additional fiscal stimulus. U.S. – China bilateral relations also remained strained as China restricted its companies from buying chips from Micron, a U.S. company, citing national security risks.

In July, China equities rebounded due to a flurry of government policy announcements after the Politburo meeting on July 24. Some of the policy announcements included the relaxation of platform company regulation, incentives to lift household consumption, loan support for property developers and measures to stabilize the Chinese currency. The cadence of policy announcements aimed at supporting China’s property market and domestic consumption seems to make it clear that the government is intent on getting the economy moving again. That said, policy easing was met with weak consumer sentiment and fragile business confidence which resulted in still weak equity market performance most of the second half of 2023.

Post “balloon-gate,” tensions between the two countries subsided thanks in part to a series of visits to China by high-profile U.S. government officials to advance talks between the superpowers on topics with a focus on re-opening lines of communication between the two countries to resolve problematic issues surrounding trade and intellectual property. In addition, President Biden is expected to host a bilateral meeting with Xi Jinping during the November Asia Pacific Economic Cooperation (APEC) meetings in San Francisco.

Performance Contributors and Detractors

For the 12-months ending October 31, 2023, China Fund, Inc. returned 7.35% while its benchmark, the MSCI China All Shares Index, returned 11.86%. From a sector perspective, allocation and stock selection within materials, health care and financials contributed the most to relative performance, while the Fund’s under allocation to communication services and stock selection within industrials detracted the most.

On the other hand, the top contributor to relative performance was PDD Holdings, Inc. (PDD), one of China’s largest e-commerce platforms that started its businesses with a focus on lower-tier city, price sensitive consumers directly through its interactive shopping experience, was the top contributor to performance. PDD continued to deliver strong results during the quarter in what has been a weaker e-commerce market in China and has also successfully gained

7

THE CHINA FUND, INC.

Investment Manager’s Statement (unaudited) (continued)

growth momentum overseas. Gross merchandise value (GMV) growth and monetization for PDD has remained on track. Alibaba, the largest e-commerce platform in China was another contributor to performance. The company did well given its relative defensiveness owing to cheap valuations and continued shareholder return plans.

On the other hand, property developer CIFI was among the top detractors to performance. CIFI recently resumed trading after a long suspension and its negative share price performance, in our view, is an accumulated impact from the period when the stock was suspended. Consumer internet giant Tencent Holdings was another detractor given the strategy’s underweight to the name. While we think that Tencent’s growth has been resilient, valuations were likely on the richer side which led to our underweight in the name. Lastly, e-commerce and logistics company JD.com also detracted given a still weak earnings profile.

Outlook:

China continues to be grinding its way through a slow economic recovery with continued challenges including a weak property market, weak global demand and weak business confidence. While the government has not offered any bazooka stimulus, more support for the property market was seen over the past few months. We believe the government continues to be in a position to support its economy further if needed.

Looking into the final couple of months of 2023, it is hard to see a major recovery in economic growth, although comparables will be more favorable. We will look for the bottoming of the property market and increased efforts to boost business confidence. All in, things are not collapsing, but we are mindful that major catalysts for recovery remain at bay given all of the above, and a still challenging geopolitical environment.

8

THE CHINA FUND, INC.

Performance (unaudited)

Average Annual Total Returns(1) as of 10/31/23

| |

1-Year |

5-Year |

10-Year |

Net Asset Value (“NAV”) |

7.35% |

1.53% |

2.55% |

Market Price |

3.91% |

-0.23% |

1.83% |

MSCI China All-Shares Index |

11.86% |

0.20% |

2.06% |

Growth of a Hypothetical $10,000 Investment(2)

|

(1)

|

Past performance is not indicative of future returns. Investment returns are historical and do not guarantee future results. Investment returns reflect changes in NAV and market price per share during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The NAV percentages are not an indication of the performance of a shareholders investment in the Fund, which is based on market price. NAV performance includes the deduction of management fees and other expenses. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from what is reported in the Financial Highlights. Market price performance does not include the deduction of brokerage commissions and other expenses of trading shares and would be lower had such commissions and expenses been deducted. Indexes are unmanaged and it is not possible to invest directly in an index. The MSCI China All Shares Index captures large and mid-cap representation across China A shares, B shares, H shares, Red Chips, P chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China.

|

|

(2)

|

The graph represents historical performance of a hypothetical investment of $10,000 in the Fund over ten years. This graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

|

Matthews International Capital Management was appointed as Investment Manager January 1, 2019. Prior to that date the Fund had different Investment Management arrangements.

9

THE CHINA FUND, INC.

Portfolio Management (unaudited)

Matthews International Capital Management, LLC (“Matthews Asia”), the largest dedicated Asia investment specialist in the United States, is an independent, privately owned firm with a focus on long-term investment performance.

Andrew Mattock serves as the Lead Manager for the Fund’s portfolio of listed securities. Prior to joining Matthews Asia in 2015, he was a Fund Manager at Henderson Global Investors for 15 years, first in London and then in Singapore, managing Asia Pacific equities. Andrew holds a Bachelor of Business majoring in Accounting from ACU. He began his career at PricewaterhouseCoopers and qualified as a Chartered Accountant.

Winnie Chwang serves as the co-manager for the Fund’s portfolio of listed securities. Ms. Chwang joined Matthews Asia in 2004 and has built her investment career at the firm. Ms. Chwang is U.S. based and has over 19 years of experience investing in Asia.

10

THE CHINA FUND, INC.

Schedule of Investments

October 31, 2023

Name of Issuer and Title of Issue |

|

Shares |

|

|

|

|

|

|

Value (Note A) |

|

COMMON STOCK |

|

|

|

|

|

|

|

|

|

|

|

|

CHINA — “A” SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

Banks — 4.4% |

|

|

|

|

|

|

|

|

|

|

|

|

China Merchants Bank Co., Ltd. — A |

|

|

1,248,447 |

|

|

|

|

|

|

$ |

5,231,827 |

|

Beverages — 3.2% |

|

|

|

|

|

|

|

|

|

|

|

|

Shanxi Xinghuacun Fen Wine Factory Co., Ltd. — A |

|

|

50,300 |

|

|

|

|

|

|

|

1,696,448 |

|

Wuliangye Yibin Co., Ltd. — A |

|

|

101,096 |

|

|

|

|

|

|

|

2,149,008 |

|

| |

|

|

|

|

|

|

|

|

|

|

3,845,456 |

|

Capital Markets — 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

East Money Information Co., Ltd. — A |

|

|

435,480 |

|

|

|

|

|

|

|

904,768 |

|

Electrical Equipment — 3.5% |

|

|

|

|

|

|

|

|

|

|

|

|

Contemporary Amperex Technology Co., Ltd. — A |

|

|

88,040 |

|

|

|

|

|

|

|

2,231,541 |

|

Sungrow Power Supply Co., Ltd. — A |

|

|

172,500 |

|

|

|

|

|

|

|

1,978,436 |

|

| |

|

|

|

|

|

|

|

|

|

|

4,209,977 |

|

Electronic Equipment, Instruments & Components — 2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Wingtech Technology Co., Ltd. — A* |

|

|

178,054 |

|

|

|

|

|

|

|

1,208,383 |

|

Zhejiang Supcon Technology Co., Ltd. — A |

|

|

196,380 |

|

|

|

|

|

|

|

1,168,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

2,376,768 |

|

Food Products — 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

Guangdong Haid Group Co., Ltd. — A |

|

|

209,100 |

|

|

|

|

|

|

|

1,283,658 |

|

Health Care Equipment & Supplies — 1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. — A |

|

|

56,300 |

|

|

|

|

|

|

|

2,199,525 |

|

Household Durables — 1.6% |

|

|

|

|

|

|

|

|

|

|

|

|

Midea Group Co., Ltd. — A |

|

|

258,829 |

|

|

|

|

|

|

|

1,867,642 |

|

Machinery — 2.1% |

|

|

|

|

|

|

|

|

|

|

|

|

Estun Automation Co., Ltd. — A |

|

|

377,100 |

|

|

|

|

|

|

|

966,946 |

|

Shenzhen Inovance Technology Co., Ltd. — A |

|

|

181,104 |

|

|

|

|

|

|

|

1,492,885 |

|

| |

|

|

|

|

|

|

|

|

|

|

2,459,831 |

|

Media — 2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Focus Media Information Technology Co., Ltd. — A |

|

|

2,579,200 |

|

|

|

|

|

|

|

2,435,741 |

|

See notes to financial statements.

11

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

October 31, 2023

Name of Issuer and Title of Issue |

|

Shares |

|

|

|

|

|

|

Value (Note A) |

|

COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

CHINA — “A” SHARES (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment — 1.6% |

|

|

|

|

|

|

|

|

|

|

|

|

NAURA Technology Group Co., Ltd. — A |

|

|

34,702 |

|

|

|

|

|

|

$ |

1,212,507 |

|

Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. — A |

|

|

116,200 |

|

|

|

|

|

|

|

689,733 |

|

| |

|

|

|

|

|

|

|

|

|

|

1,902,240 |

|

Software — 1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

Shanghai Baosight Software Co., Ltd. — A |

|

|

275,796 |

|

|

|

|

|

|

|

1,603,734 |

|

Specialty Retail — 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

China Tourism Group Duty Free Corp., Ltd. — A |

|

|

70,900 |

|

|

|

|

|

|

|

914,157 |

|

Transportation Infrastructure — 1.2% |

|

|

|

|

|

|

|

|

|

|

|

|

Shanghai International Airport Co., Ltd. — A* |

|

|

272,100 |

|

|

|

|

|

|

|

1,381,423 |

|

TOTAL CHINA — “A” SHARES — (Cost $40,782,154) |

|

|

|

|

|

|

27.4 |

% |

|

|

32,616,747 |

|

HONG KONG |

|

|

|

|

|

|

|

|

|

|

|

|

Automobiles — 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

Yadea Group Holdings, Ltd. 144A |

|

|

528,000 |

|

|

|

|

|

|

|

966,564 |

|

Broadline Retail — 18.2% |

|

|

|

|

|

|

|

|

|

|

|

|

Alibaba Group Holding, Ltd.* |

|

|

912,308 |

|

|

|

|

|

|

|

9,394,150 |

|

JD.com, Inc. |

|

|

379,754 |

|

|

|

|

|

|

|

4,827,103 |

|

PDD Holdings, Inc. ADR* |

|

|

73,620 |

|

|

|

|

|

|

|

7,466,540 |

|

| |

|

|

|

|

|

|

|

|

|

|

21,687,793 |

|

Capital Markets — 1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Hong Kong Exchanges & Clearing, Ltd. |

|

|

34,000 |

|

|

|

|

|

|

|

1,196,434 |

|

Consumer Staples Distribution & Retail — 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

JD Health International, Inc. 144A* |

|

|

295,700 |

|

|

|

|

|

|

|

1,341,275 |

|

Diversified Consumer Services — 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

China Education Group Holdings, Ltd. |

|

|

1,598,000 |

|

|

|

|

|

|

|

1,327,524 |

|

Entertainment — 2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Tencent Music Entertainment Group ADR* |

|

|

335,968 |

|

|

|

|

|

|

|

2,439,128 |

|

Gas Utilities — 1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

ENN Energy Holdings, Ltd. |

|

|

150,400 |

|

|

|

|

|

|

|

1,147,164 |

|

See notes to financial statements.

12

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

October 31, 2023

Name of Issuer and Title of Issue |

|

Shares |

|

|

|

|

|

|

Value (Note A) |

|

COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

HONG KONG (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure — 10.1% |

|

|

|

|

|

|

|

|

|

|

|

|

Galaxy Entertainment Group, Ltd. |

|

|

352,000 |

|

|

|

|

|

|

$ |

1,978,217 |

|

Luckin Coffee, Inc. ADR* |

|

|

40,381 |

|

|

|

|

|

|

|

1,303,902 |

|

Meituan 144A* |

|

|

438,250 |

|

|

|

|

|

|

|

6,213,245 |

|

Trip.com Group, Ltd. ADR* |

|

|

37,231 |

|

|

|

|

|

|

|

1,265,854 |

|

Yum China Holdings, Inc. |

|

|

24,837 |

|

|

|

|

|

|

|

1,305,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

12,066,651 |

|

Household Durables — 1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

Man Wah Holdings, Ltd. |

|

|

2,395,600 |

|

|

|

|

|

|

|

1,492,651 |

|

Interactive Media & Services — 11.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Baidu, Inc.* |

|

|

82,150 |

|

|

|

|

|

|

|

1,081,553 |

|

Kuaishou Technology Co., Ltd. 144A* |

|

|

275,600 |

|

|

|

|

|

|

|

1,775,484 |

|

Tencent Holdings, Ltd. |

|

|

275,600 |

|

|

|

|

|

|

|

10,212,522 |

|

| |

|

|

|

|

|

|

|

|

|

|

13,069,559 |

|

Life Sciences Tools & Services — 2.3% |

|

|

|

|

|

|

|

|

|

|

|

|

Wuxi Biologics Cayman, Inc. 144A* |

|

|

445,500 |

|

|

|

|

|

|

|

2,766,423 |

|

Real Estate Management & Development — 5.3% |

|

|

|

|

|

|

|

|

|

|

|

|

CIFI Holdings Group Co., Ltd.* |

|

|

21,016,968 |

|

|

|

|

|

|

|

521,013 |

|

Country Garden Services Holdings Co., Ltd. |

|

|

1,238,000 |

|

|

|

|

|

|

|

1,083,264 |

|

KE Holdings, Inc. ADR |

|

|

292,893 |

|

|

|

|

|

|

|

4,308,456 |

|

Times China Holdings, Ltd.(1)* |

|

|

8,477,000 |

|

|

|

|

|

|

|

390,088 |

|

| |

|

|

|

|

|

|

|

|

|

|

6,302,821 |

|

TOTAL HONG KONG — (Cost $91,358,673) |

|

|

|

|

|

|

55.2 |

% |

|

|

65,803,987 |

|

HONG KONG — “H” SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

Banks — 2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

China Construction Bank Corp. |

|

|

4,265,000 |

|

|

|

|

|

|

|

2,419,698 |

|

Beverages — 0.9% |

|

|

|

|

|

|

|

|

|

|

|

|

Tsingtao Brewery Co., Ltd. |

|

|

134,000 |

|

|

|

|

|

|

|

1,016,323 |

|

Capital Markets — 8.0% |

|

|

|

|

|

|

|

|

|

|

|

|

China International Capital Corp., Ltd. 144A |

|

|

2,654,800 |

|

|

|

|

|

|

|

4,228,240 |

|

China Merchants Securities Co., Ltd. 144A |

|

|

2,194,600 |

|

|

|

|

|

|

|

1,816,051 |

|

CITIC Securities Co., Ltd. |

|

|

1,790,125 |

|

|

|

|

|

|

|

3,484,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

9,528,933 |

|

See notes to financial statements.

13

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

October 31, 2023

Name of Issuer and Title of Issue |

|

Shares |

|

|

|

|

|

|

Value (Note A) |

|

COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

HONG KONG — “H” SHARES (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services — 0.9% |

|

|

|

|

|

|

|

|

|

|

|

|

Sinopharm Group Co., Ltd. |

|

|

452,800 |

|

|

|

|

|

|

$ |

1,081,798 |

|

Insurance — 3.2% |

|

|

|

|

|

|

|

|

|

|

|

|

PICC Property & Casualty Co., Ltd. |

|

|

1,552,000 |

|

|

|

|

|

|

|

1,772,125 |

|

Ping An Insurance Group Co., of China Ltd. |

|

|

410,500 |

|

|

|

|

|

|

|

2,100,207 |

|

| |

|

|

|

|

|

|

|

|

|

|

3,872,332 |

|

Oil, Gas & Consumable Fuels — 1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

PetroChina Co., Ltd. |

|

|

3,238,000 |

|

|

|

|

|

|

|

2,110,370 |

|

TOTAL HONG KONG — “H” SHARES — (Cost $23,492,725) |

|

|

|

|

|

|

16.8 |

% |

|

|

20,029,454 |

|

TOTAL HONG KONG (INCLUDING “H” SHARES) — (Cost $114,851,398) |

|

|

|

|

|

|

72.0 |

% |

|

|

85,833,441 |

|

TOTAL COMMON STOCK — (Cost $155,633,552) |

|

|

|

|

|

|

99.4 |

% |

|

|

118,450,188 |

|

COLLATERAL FOR SECURITIES ON LOAN |

|

|

|

|

|

|

|

|

|

|

|

|

Money Market Funds — 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

Fidelity Investments Money Market Government Portfolio, 5.28%∞ (Cost $66,800) |

|

|

66,800 |

|

|

|

|

|

|

|

66,800 |

|

TOTAL COLLATERAL FOR SECURITIES ON LOAN — (Cost $66,800) |

|

|

|

|

|

|

0.1 |

% |

|

|

66,800 |

|

See notes to financial statements.

14

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

October 31, 2023

Name of Issuer and Title of Issue |

|

Principal

Amount |

|

|

|

|

|

|

Value (Note A) |

|

SHORT TERM INVESTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

Time Deposits — 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

BNP Paribas - Paris, 2.87%, 11/1/2023 |

|

HKD |

667,586 |

|

|

|

|

|

|

$ |

85,311 |

|

JPMorgan Chase & Co. - New York, 4.68%, 11/1/2023 |

|

USD |

80,818 |

|

|

|

|

|

|

|

80,818 |

|

TOTAL SHORT TERM INVESTMENTS — (Cost $166,129) |

|

|

|

|

|

|

0.1 |

% |

|

|

166,129 |

|

TOTAL INVESTMENTS — (Cost $155,866,481) |

|

|

|

|

|

|

99.6 |

% |

|

|

118,683,117 |

|

OTHER ASSETS AND LIABILITIES |

|

|

|

|

|

|

0.4 |

% |

|

|

465,982 |

|

NET ASSETS |

|

|

|

|

|

|

100.0 |

% |

|

$ |

119,149,099 |

|

Footnotes to Schedule of Investments

|

*

|

Denotes non-income producing security.

|

|

∞

|

Rate shown is the 7-day yield as of October 31, 2023.

|

|

(1)

|

A security (or a portion of the security) is on loan. As of October 31, 2023, the market value of securities loaned was $61,479. The loaned securities were secured with cash collateral of $66,800. Collateral is calculated based on prior day’s prices.

|

144A Securities exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2023, these restricted securities amounted to $ 19,107,282, which represented 16.04% of net assets.

ADR — American Depositary Receipt

HKD — Hong Kong dollar

USD — United States dollar

See notes to financial statements.

15

THE CHINA FUND, INC.

Statement of Assets and Liabilities

October 31, 2023

ASSETS |

|

|

|

|

Investments in securities, at value (cost $155,866,481) (including securities on loan, at value, $61,479) (Note A) |

|

$ |

118,683,117 |

|

Cash |

|

|

1,110 |

|

Foreign currency, at value (cost $501) |

|

|

501 |

|

Receivable for investments sold |

|

|

769,948 |

|

Prepaid expenses |

|

|

61,438 |

|

TOTAL ASSETS |

|

|

119,516,114 |

|

| |

|

|

|

|

LIABILITIES |

|

|

|

|

Payable upon return of collateral for securities on loan |

|

|

66,800 |

|

Payable for shares redeemed |

|

|

45,038 |

|

Investment management fee payable (Note B) |

|

|

83,504 |

|

Administration and custodian fees payable (Note B) |

|

|

22,196 |

|

Directors’ fees payable |

|

|

7,750 |

|

Chief Compliance Officer fees payable |

|

|

5,500 |

|

Other accrued expenses |

|

|

136,227 |

|

TOTAL LIABILITIES |

|

|

367,015 |

|

TOTAL NET ASSETS |

|

$ |

119,149,099 |

|

| |

|

|

|

|

COMPOSITION OF NET ASSETS: |

|

|

|

|

Par value, 100,000,000 shares authorized, 10,029,955 shares outstanding (Note C) |

|

|

100,299 |

|

Paid in capital in excess of par |

|

|

176,272,525 |

|

Distributable earnings |

|

|

(57,223,725 |

) |

TOTAL NET ASSETS |

|

$ |

119,149,099 |

|

| |

|

|

|

|

NET ASSET VALUE PER SHARE |

|

|

|

|

($119,149,099/10,029,955 shares of common stock outstanding) |

|

$ |

11.88 |

|

See notes to financial statements.

16

THE CHINA FUND, INC.

Statement of Operations

Year Ended October 31, 2023

INVESTMENT INCOME: |

|

|

|

|

Dividend income (net of tax withheld of $187,534) |

|

$ |

2,241,204 |

|

Securities lending income |

|

|

135,248 |

|

Interest income |

|

|

52,255 |

|

TOTAL INVESTMENT INCOME |

|

|

2,428,707 |

|

| |

|

|

|

|

EXPENSES |

|

|

|

|

Investment Management fees (Note B) |

|

|

1,099,459 |

|

Directors’ fees and expenses |

|

|

268,477 |

|

Insurance |

|

|

156,998 |

|

Legal fees (Note B) |

|

|

136,193 |

|

Custodian fees (Note B) |

|

|

97,963 |

|

Administration fees (Note B) |

|

|

72,840 |

|

Principal Financial Officer fee |

|

|

63,591 |

|

Chief Compliance Officer fee |

|

|

63,500 |

|

Audit and tax service fees |

|

|

54,999 |

|

Shareholder service fees |

|

|

32,099 |

|

Stock exchange listing fee |

|

|

29,243 |

|

Transfer agent fees |

|

|

26,361 |

|

Fund accounting fees |

|

|

23,091 |

|

Printing and postage |

|

|

20,410 |

|

Fund Secretary fee |

|

|

10,000 |

|

Miscellaneous expenses |

|

|

59,740 |

|

TOTAL EXPENSES |

|

|

2,214,964 |

|

| |

|

|

|

|

NET INVESTMENT INCOME |

|

|

213,743 |

|

| |

|

|

|

|

See notes to financial statements.

17

THE CHINA FUND, INC.

Statement of Operations (continued)

Year Ended October 31, 2023

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

|

|

|

|

Net realized loss on investments |

|

$ |

(17,395,864 |

) |

Net realized loss on foreign currency transactions |

|

|

(28,594 |

) |

| |

|

|

(17,424,458 |

) |

Net change in unrealized appreciation/(depreciation) on investments |

|

|

27,313,223 |

|

Net change in unrealized appreciation/(depreciation) on foreign currency translations |

|

|

107 |

|

| |

|

|

27,313,330 |

|

| |

|

|

|

|

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

|

|

9,888,872 |

|

| |

|

|

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS |

|

$ |

10,102,615 |

|

See notes to financial statements.

18

THE CHINA FUND, INC.

Statements of Changes In Net Assets

| |

|

Year Ended

October 31, 2023 |

|

|

Year Ended

October 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS |

|

|

|

|

|

|

|

|

Net investment income (loss) |

|

$ |

213,743 |

|

|

$ |

(570,162 |

) |

Net realized gain (loss) on investments and foreign currency transactions |

|

|

(17,424,458 |

) |

|

|

4,671,794 |

|

Net change in unrealized appreciation (depreciation) on investments and foreign currency translations |

|

|

27,313,330 |

|

|

|

(122,574,950 |

) |

Net increase (decrease) in net assets from operations |

|

|

10,102,615 |

|

|

|

(118,473,318 |

) |

| |

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS FROM: |

|

|

|

|

|

|

|

|

Distributable earnings |

|

|

(6,875,397 |

) |

|

|

(75,077,381 |

) |

Total distributions to shareholders |

|

|

(6,875,397 |

) |

|

|

(75,077,381 |

) |

| |

|

|

|

|

|

|

|

|

CAPITAL SHARE TRANSACTIONS: |

|

|

|

|

|

|

|

|

Cost of shares repurchased (Note D) |

|

|

(2,843,434 |

) |

|

|

(1,986,437 |

) |

Net increase (decrease) in net assets from capital share transactions |

|

|

(2,843,434 |

) |

|

|

(1,986,437 |

) |

NET INCREASE (DECREASE) IN NET ASSETS |

|

|

383,784 |

|

|

|

(195,537,136 |

) |

| |

|

|

|

|

|

|

|

|

NET ASSETS: |

|

|

|

|

|

|

|

|

Beginning of Year |

|

|

118,765,315 |

|

|

|

314,302,451 |

|

End of Year |

|

$ |

119,149,099 |

|

|

$ |

118,765,315 |

|

See notes to financial statements.

19

THE CHINA FUND, INC.

Financial Highlights

Selected data for a share of common stock outstanding for the years indicated

| |

|

Year Ended October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019(1) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Operating Performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year |

|

$ |

11.58 |

|

|

$ |

30.32 |

|

|

$ |

31.52 |

|

|

$ |

22.80 |

|

|

$ |

18.98 |

|

Net investment income (loss)* |

|

|

0.02 |

|

|

|

(0.06 |

) |

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.13 |

|

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

|

|

0.91 |

|

|

|

(11.43 |

)(2) |

|

|

1.02 |

|

|

|

9.98 |

|

|

|

4.09 |

|

Total from investment operations |

|

|

0.93 |

|

|

|

(11.49 |

) |

|

|

1.08 |

|

|

|

10.04 |

|

|

|

4.22 |

|

Less dividends and distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from net investment income |

|

|

— |

|

|

|

(0.04 |

) |

|

|

(0.15 |

) |

|

|

(0.13 |

) |

|

|

(0.17 |

) |

Distributions from net realized gains |

|

|

(0.67 |

) |

|

|

(7.23 |

) |

|

|

(2.16 |

) |

|

|

(1.25 |

) |

|

|

(0.37 |

) |

Total dividends and distributions |

|

|

(0.67 |

) |

|

|

(7.27 |

) |

|

|

(2.31 |

) |

|

|

(1.38 |

) |

|

|

(0.54 |

) |

Capital Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accretion (Dilution) to net asset value resulting from share repurchase program, tender offer or issuance of shares in stock dividend |

|

|

0.04 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.06 |

|

|

|

0.14 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year |

|

$ |

11.88 |

|

|

$ |

11.58 |

|

|

$ |

30.32 |

|

|

$ |

31.52 |

|

|

$ |

22.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market price, end of year |

|

$ |

9.74 |

|

|

$ |

9.80 |

|

|

$ |

26.06 |

|

|

$ |

27.93 |

|

|

$ |

20.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Return (Based on Market Price)(3) |

|

|

3.91 |

% |

|

|

(47.48 |

)% |

|

|

0.54 |

% |

|

|

47.84 |

% |

|

|

21.86 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Return (Based on Net Asset Value)(4) |

|

|

7.26 |

% |

|

|

(46.66 |

)%(2) |

|

|

3.65 |

% |

|

|

46.94 |

% |

|

|

23.79 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (000’s) |

|

$ |

119,149 |

|

|

$ |

118,765 |

|

|

$ |

314,302 |

|

|

$ |

329,412 |

|

|

$ |

242,937 |

|

Ratio of gross expenses to average net assets |

|

|

1.56 |

% |

|

|

1.25 |

% |

|

|

1.00 |

% |

|

|

1.08 |

% |

|

|

1.41 |

% |

Ratio of net expenses to average net assets |

|

|

1.56 |

% |

|

|

1.25 |

% |

|

|

1.00 |

% |

|

|

1.08 |

% |

|

|

1.41 |

% |

Ratio of net investment income to average net assets |

|

|

0.15 |

% |

|

|

(0.30 |

)% |

|

|

0.20 |

% |

|

|

0.25 |

% |

|

|

0.61 |

% |

Portfolio turnover rate |

|

|

51 |

% |

|

|

74 |

% |

|

|

76 |

% |

|

|

60 |

% |

|

|

132 |

% |

|

*

|

Per share amounts have been calculated using the average share method.

|

|

(1)

|

Effective January 1, 2019, Matthews International Capital Management, LLC became the investment manager. Prior to January 1, 2019, the Fund’s investment manager was Allianz Global Investors.

|

|

(2)

|

Includes proceeds from a class action settlement payment related to foreign exchange transactions from prior years. Without this, net realized and unrealized gain (loss) on investments and foreign currency transactions would have been $(11.44) and the Total Investment Return (Based on Net Asset Value) would have been (46.70)%.

|

|

(3)

|

Based on changes in the share market price and assumes that dividend and capital gain distributions, if any, were reinvested in accordance with the Dividend Reinvestment and Cash Purchase Plan.

|

|

(4)

|

Based on changes in the share net asset value and assumes that dividend and capital gain distributions, if any, were reinvested in accordance with the Dividend Reinvestment and Cash Purchase Plan.

|

See notes to financial statements.

20

THE CHINA FUND, INC.

Notes to Financial Statements

October 31, 2023

NOTE A — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The China Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on April 28, 1992, and is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in equity securities (i) of companies for which the principal securities trading market is in the People’s Republic of China (“China”), (ii) of companies for which the principal securities trading market is outside of China, or constituting direct equity investments in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets, in China and (iii) constituting direct equity investments in companies organized in China (“Direct Investments”). The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund’s investment manager is Matthews International Capital Management, LLC (“Matthews Asia” or the “Investment Manager”).

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation: Portfolio securities listed on recognized U.S. or foreign security exchanges are valued at the last quoted sales price in the principal market where they are traded. Listed securities with no such sales price and unlisted securities are valued at the mean between the current bid and asked prices, if any, from brokers. Short-term investments having maturities of sixty days or less are valued at amortized cost (original purchase cost as adjusted for amortization of premium or accretion of discount) which when combined with accrued interest approximates market value. Securities for which market quotations are not readily available or are deemed unreliable are valued at fair value in good faith by or at the direction of the Board of Directors (the “Board”) considering relevant factors, data and information including, if relevant, the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded. For securities listed on non-North American exchanges, the Fund fair values those securities daily using fair value factors provided by a third-party pricing service if certain thresholds determined by the Board are met. Direct Investments and derivatives investments, if any, are valued at fair value as determined by or at the direction of the Board based on financial and other information supplied by the Direct Investment Manager or a third-party pricing service.

Factors used in determining fair value may include, but are not limited to, the type of security, the size of the holding, the initial cost of the security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies, the availability of quotations from broker-dealers, the availability of values of third parties other than the Investment Manager, information obtained from the issuer, analysts, and/or the appropriate stock exchange (if available), an analysis of the company’s financial

21

Notes To Financial Statements (continued)

statements, an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which they trade.

Securities Lending: The Fund may lend up to 33 1/3% of the Fund’s total assets held by Brown Brothers Harriman & Co. (“BBH”) as custodian to certain qualified brokers, except those securities which the Fund specifically identifies as not being available. By lending its investment securities, the Fund attempts to increase its net investment income through the receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Upon entering into a securities lending transaction, the Fund receives cash as collateral in an amount equal to or exceeding 100% of the current market value of the loaned securities with respect to securities of the U.S. government or its agencies, 102% of the current market value of the loaned securities with respect to U.S. securities and 105% of the current market value of the loaned securities with respect to foreign securities. Any cash received as collateral is generally invested by BBH, acting in its capacity as securities lending agent (the “Agent”), in the Fidelity Investments Money Market Government Portfolio. A portion of the dividends received on the collateral may be rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

| |

|

Remaining Contractual Maturity of the Agreements

As of October 31, 2023 |

|

| |

|

Overnight and

Continuous |

|

|

<30 days |

|

|

Between

30 & 90 days |

|

|

>90 days |

|

|

Total |

|

Securities Lending Transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money Market Fund |

|

$ |

66,800 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

66,800 |

|

Total Borrowings |

|

$ |

66,800 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

66,800 |

|

Gross amount of recognized liabilities for securities lending transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

66,800 |

|

As of October 31, 2023, the Fund had loaned securities which were collateralized by cash. The value of the securities on loan and the value of the related collateral were as follows:

| |

Value of

Securities |

|

|

Value of Cash

Collateral |

|

|

Value of

Non-Cash

Collateral* |

|

|

Total

Collateral |

|

| |

|

$61,479 |

|

|

|

$66,800 |

|

|

|

$— |

|

|

|

$66,800 |

|

* Fund cannot repledge or dispose of this collateral, nor does the Fund earn any income or receive dividends with respect to this collateral.

22

Notes To Financial Statements (continued)

| |

Gross Amounts Not Offset in the Statement of Assets and Liabilities |

|

| |

Gross Asset Amounts

Presented in Statement of

Assets and Liabilities |

|

|

Financial

Instrument |

|

|

Collateral

Received |

|

|

Net Amount |

|

| |

|

$66,800 |

|

|

|

$— |

|

|

|

$(66,800) |

|

|

|

$0 |

|

Time Deposits: The Fund places excess cash balances into overnight time deposits with one or more eligible deposit institutions that meet credit and risk standards approved by the Fund. These are classified as short-term investments in the Schedule of Investments.

Foreign Currency Translations: The records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included in realized and unrealized gain or loss on investments. Net unrealized foreign currency gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates.

Forward Foreign Currency Contracts: The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risks. A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the U.S. dollar. The U.S. dollar value of forward currency contracts is determined using forward exchange rates provided by quotation services. Daily fluctuations in the value of such contracts are recorded as unrealized gain or loss and included in the distributable earnings in the Statement of Assets and Liabilities. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. Such gain or loss is disclosed in the realized and unrealized gain or loss on foreign currency transactions in the Fund’s accompanying Statement of Operations. On October 31, 2023, the Fund did not hold forward foreign currency transactions contracts.

Option Contracts: The Fund may purchase and write (sell) call options and put options provided the transactions are for hedging purposes and the initial margin and premiums do not exceed 5% of total assets. Option contracts are valued daily and unrealized gains or losses are recorded on the Statement of Assets and Liabilities based upon the last sales price on the principal exchange on which the options are traded. The Fund will realize a gain or loss upon the expiration or closing of the option contract. Such gain or loss is disclosed in the realized and unrealized gain or loss on options in the Fund’s accompanying Statement of Operations. When an option is exercised, the proceeds on sales of the underlying security for a written call option, the purchase cost of the security for a written put option, or the cost of the security for a purchased put or call option is adjusted by the amount of premium received or paid.

23

Notes To Financial Statements (continued)

The risk in writing a call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of a counterparty to meet the terms of the contract. At October 31, 2023, the Fund did not hold any option contracts.

Equity-Linked Securities: The Fund may invest in equity-linked securities such as linked participation notes, equity swaps and zero-strike options and securities warrants. Equity-linked securities may be used by the Fund to gain exposure to countries that place restrictions on investments by foreigners. To the extent that the Fund invests in equity-linked securities whose return corresponds to the performance of a foreign securities index or one or more foreign stocks, investing in equity-linked securities will involve risks similar to the risks of investing in foreign securities. In addition, the Fund bears the risk that the issuer of any equity-linked securities may default on its obligation under the terms of the arrangement with the counterparty. Equity-linked securities are often used for many of the same purposes as, and share many of the same risks with, derivative instruments. In addition, equity-linked securities may be considered illiquid. At October 31, 2023, the Fund did not hold equity-linked securities.

Direct Investments: The Fund may invest up to 25% of the net proceeds from its offering of its outstanding common stock in Direct Investments; however, the Board of the Fund has suspended additional investments in Direct Investments. Direct Investments are generally restricted and do not have a readily available resale market. Because of the absence of any public trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices on these sales could be less than those originally paid by the Fund. Issuers whose securities are not publicly traded may not be subject to public disclosure and other investor protections requirements applicable to publicly traded securities. At October 31, 2023, the Fund did not hold Direct Investments.

Indemnification Obligations: Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

Security Transactions and Investment Income: Security transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, or, in the case of dividend income on foreign securities, on the ex-dividend date or when the Fund becomes aware of its declaration. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for both financial reporting and federal income tax purposes.

Dividends and Distributions: The Fund intends to distribute to its stockholders, at least annually, substantially all of its net investment income and any net realized capital gains. Distributions to stockholders are recorded on the ex-dividend date. Income and capital gains distributions are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no

24

Notes To Financial Statements (continued)

impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Unless the Board elects to make distributions in shares of the Fund’s common stock, the distributions will be paid in cash, except with respect to stockholders who have elected to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan.

Federal Taxes: It is the Fund’s policy to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended (“Code”) and to distribute to stockholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2023, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. For the previous three years the Fund remains subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the State of Maryland. The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

The tax character of distributions the Fund made during the year ended October 31, 2023 were $888 from ordinary income and $6,874,509 from net long-term capital gains. The tax character of distributions the Fund made during the year ended October 31, 2022 was $8,950,865 from ordinary income and $66,126,517 from net long-term capital gains.

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. As of October 31, 2023, no reclassifications were made between distributable earnings and paid in capital.

As of October 31, 2023, the components of distributable earnings on tax basis were $184,261 of undistributed ordinary income, $17,413,722 (LT: 14,885,002 and ST: 2,528,720) of capital loss carryforward (capital loss carryforward do not expire) and $39,994,264 of net unrealized depreciation on investments and currency, resulting in total accumulated losses of $57,223,725.