E2open Ocean Shipping Index Shows Geopolitical Tensions, Labor Shortages and Port Congestion Driving Significant Increases in Global Transit Times

31 Janvier 2025 - 1:15PM

Business Wire

Latest report highlights ripple effects of ongoing turmoil at

key ports as primary cause of extended transit times and booking

delays

E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply

chain SaaS platform with the largest multi-enterprise network, has

published the latest edition of its Ocean Shipping Index, a

quarterly benchmark report that provides insight for

decision-making around global ocean shipments. The report reveals

that the global average time for ocean shipments in Q4 2024

averaged 68 days, up eight days compared to Q4 2023. The most

significant contributor to the year-over-year (YoY) increase is

actual transit time, alongside extraordinary volatility that has

created a complex landscape for businesses dependent on ocean

freight.

The e2open Ocean Shipping Index empowers shippers with

data-driven insights to proactively navigate supply chain

challenges. The quarterly report is based on ocean shipping

activity in e2open’s vast network of over 480,000 connected

enterprises and managing billions of transactions and more than 70

million containers annually. Providing details down to booking

date, e2open’s Ocean Shipping Index arms the market with unique and

timely insights for proactive and optimal decision-making.

"Economic headwinds, geopolitical turbulence and uncertain trade

routes are creating unprecedented disruptions within the ocean

shipping industry. From continued Red Sea diversions to port

congestion and labor unrest, businesses face a complex landscape of

obstacles, all while grappling with possibility of new U.S.

tariffs," says Pawan Joshi, chief strategy officer (CSO) at e2open.

"We can expect these ongoing issues will be exacerbated by the

Lunar New Year holiday, as businesses relying on Asian suppliers

often rush to place orders, adding strain to their supply chains.

Companies that prioritize resilience and agility will be best

positioned to navigate anticipated and unexpected disruptions,

while helping ensure goods move smoothly through an increasingly

volatile system."

Key takeaways from the latest e2open Ocean Shipping Index report

covering the fourth quarter of 2024 include:

- Actual transit times contributed heavily to YoY duration

increases, with Asia to Europe (+12 days) and South America to

North America (+11 days) routes showing the largest impact.

- South America to North America showed significant YoY duration

increases, exhibiting the highest YoY increase (+19 days) YoY. This

is attributed to prolonged booking processes alongside lengthy

transit times, which present major difficulties for shippers. North

America to South America total time was up five days from the last

quarter and 11 days YoY.

- Europe to Asia averaged 83 days overall, an increase of 11 days

from the comparable quarter last year, with actual transit time of

nine being the most significant contributor to the increase YoY.

Asia to Europe averaged 80 days overall, an increase of 16 days

YoY, the most significant contributor being actual transit time (12

days).

- Shipping routes between Asia and South America saw an extended

average of 85-86 days, among the longest durations globally, with

longer transit and booking times as primary drivers.

- North America to Asia shows mixed trends, averaging 85 days

from booking to clearing the gate at the final port – down by one

day compared to last quarter, but up seven days YoY.

- Overall, global ocean shipments averaged 68 days from initial

booking to clearing the gate at the final port, an increase of

eight days from the duration in Q4 2023 (60 days).

Read the full e2open Ocean Shipping Index for additional data

points and insights; view and subscribe at e2open.com. This report

is one of several benchmark reports available from e2open to help

companies manage increasingly complex and rapidly shifting global

supply chains.

About e2open

E2open is the connected supply chain software platform that

enables the world’s largest companies to transform the way they

make, move, and sell goods and services. With the broadest

cloud-native global platform purpose-built for modern supply

chains, e2open connects more than 480,000 manufacturing, logistics,

channel, and distribution partners as one multi-enterprise network

tracking over 16 billion transactions annually. Our SaaS platform

anticipates disruptions and opportunities to help companies improve

efficiency, reduce waste, and operate sustainably. Moving as one.™

Learn More: www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of

E2open, LLC. All other trademarks, registered trademarks and

service marks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131176447/en/

Media Contact: 5W PR for e2open e2open@5wpr.com

408-504-7707

Investor Relations Contact: Russell Johnson

russell.johnson@e2open.com investor.relations@e2open.com

Corporate Contact: Kristin Seigworth VP Communications,

e2open kristin.seigworth@e2open.com pr@e2open.com

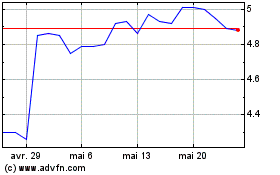

E2open Parent (NYSE:ETWO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

E2open Parent (NYSE:ETWO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025