As filed with the Securities and Exchange Commission

on August 12, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| GLOBAL MEDICAL

REIT INC. |

| (Exact name of registrant as specified in its

charter) |

| |

| Maryland |

|

46-4757266 |

(State or Other Jurisdiction

of Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

7373 Wisconsin Avenue,

Suite 800

Bethesda, Maryland |

|

20814 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| |

|

| Global

Medical REIT Inc. 2016 Equity Incentive Plan |

| (Full

title of the plan) |

| |

|

Jeffrey M. Busch

7373 Wisconsin Avenue, Suite 800

Bethesda, Maryland 20814 |

| (Name

and address of agent for service) |

| |

|

| (202)

524-6851 |

| (Telephone

number, including area code, of agent for service) |

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

| Large accelerated filer |

x |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

|

Smaller reporting company |

¨ |

| |

|

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933,

as amended (the “Securities Act”). ¨

INTRODUCTORY STATEMENT

Global

Medical REIT Inc., a Maryland corporation (the “Registrant”), is filing this Registration Statement on Form S-8 (the

“Registration Statement”) for the purpose of registering the offer and sale of an additional 1,650,000 shares of its common

stock, par value $0.001 per share (“Stock”), issuable pursuant to the terms of the Global Medical REIT Inc. 2016 Equity Incentive

Plan, as amended from time to time (the “Plan”).

Pursuant

to General Instruction E to Form S-8, the Registrant hereby incorporates by reference into this Registration Statement the

contents of the prior registration statements on Form S-8 filed by the Registrant with the Securities and Exchange Commission

(the “Commission”) on (i) June 30,

2016 (File No. 333-212343) relating to the Plan, (ii) June 21,

2019 (File No. 333-232279) relating to an amendment to the Plan, and (iii) March 2, 2022 (File No. 333-263219)

relating to an amendment to the Plan (collectively, the “Prior Registration Statements”), including periodic reports that

the Registrant filed after the Prior Registration Statements to maintain current information about the Registrant except to the extent

otherwise updated or modified by this Registration Statement. The additional shares of Stock that are the subject of this Registration

Statement were authorized pursuant to an amendment to the Plan that was approved by the Registrant’s stockholders on May 15,

2024, which Stock consists of shares reserved and available for delivery with respect to awards under the Plan and additional shares

that may again become available for delivery with respect to awards under the Plan pursuant to the share counting, share recycling and

other terms and conditions of the Plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

In accordance with the instructional

note to Part I of Form S-8, as promulgated by the SEC, the information specified by Part I of Form S-8 has been omitted

from this Registration Statement. The documents containing the information specified in Part I will be delivered to the participants

in the Plan covered by this Registration Statement as required by Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Bethesda, State of Maryland, on August 12, 2024.

| |

GLOBAL MEDICAL REIT INC. |

| |

|

| |

By: |

/s/

Jeffrey M. Busch |

| |

|

Name: |

Jeffrey M. Busch |

| |

|

Title: |

Chief Executive Officer (Principal Executive Officer) |

POWER OF ATTORNEY

KNOWN ALL PERSONS BY THESE

PRESENTS, pursuant to the requirements of the Securities Act, that each person whose signature appears below authorizes and appoints

Jeffrey M. Busch as such person’s true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution,

for such person and in such person’s name, place and stead in any and all capacities to sign any and all amendments (including

post-effective amendments) to this Registration Statement and any additional registration statement pursuant to Rule 462(b) under

the Securities Act, and to file the same with all exhibits thereto, and other documents in connection therewith, with the Commission,

granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary

to be done, as fully and to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all

that said attorney-in-fact and agent, or such person’s or their substitute or substitutes may lawfully do or cause to be done by

virtue hereof.

| Signature |

|

Title |

| |

|

|

| /s/

Jeffrey M. Busch |

|

Chief

Executive Officer and Director |

| Jeffrey

M. Busch |

|

(Principal

Executive Officer) |

| |

|

|

| /s/

Robert J. Kiernan |

|

Chief

Financial Officer |

| Robert

J. Kiernan |

|

(Principal

Financial and Accounting Officer) |

| |

|

|

| /s/

Henry Cole |

|

Director |

| Henry

Cole |

|

|

| |

|

|

| /s/

Paula Crowley |

|

Director |

| Paula

Crowley |

|

|

| |

|

|

| /s/

Matthew Cypher |

|

Director |

| Matthew

Cypher |

|

|

| |

|

|

| /s/

Zhang Huiqi |

|

Director |

| Zhang

Huiqi |

|

|

| |

|

|

| /s/

Ronald Marston |

|

Director |

| Ronald

Marston |

|

|

| |

|

|

| /s/

Lori Wittman |

|

Director |

| Lori

Wittman |

|

|

| |

|

|

Exhibit 5.1

August 12, 2024

Global Medical REIT Inc.

7373 Wisconsin Avenue

Suite 800

Bethesda, MD 20814

| Re: | Global Medical REIT Inc. |

Registration Statement

on Form S-8

Ladies and Gentlemen:

We have served as Maryland counsel

to Global Medical REIT Inc., a Maryland corporation (the “Company”), in connection with certain matters of Maryland law arising

out of the registration by the Company of 1,650,000 shares (the “Shares”) of common stock, par value $0.001 per share (the

“Common Stock”), of the Company, covered by the above-referenced Registration Statement, and all amendments and supplements

thereto (the “Registration Statement”), filed by the Company with the United States Securities and Exchange Commission (the

“Commission”) pursuant to the Securities Act of 1933, as amended (the “1933 Act”). The Shares will be issued pursuant

to the Company’s 2016 Equity Incentive Plan, as amended from time to time (the “Plan”).

In connection with our representation

of the Company, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified

to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1. The

Registration Statement in the form in which it was transmitted to the Commission under the 1933 Act;

2. The

charter of the Company (the “Charter”), certified by the State Department of Assessments and Taxation of Maryland (the “SDAT”);

3. The

Fourth Amended and Restated Bylaws of the Company, certified as of the date hereof by an officer of the Company;

4. A

certificate of the SDAT as to the good standing of the Company, dated as of a recent date;

5. Resolutions

(the “Resolutions”) adopted by the Board of Directors of the Company (the “Board”) relating to, among other matters,

the Plan and the issuance of the Shares, certified as of the date hereof by an officer of the Company;

6. The

Plan, certified as of the date hereof by an officer of the Company;

Global Medical REIT Inc.

August 12, 2024

Page 2

7. A

certificate executed by an officer of the Company, dated as of the date hereof; and

8. Such

other documents and matters as we have deemed necessary or appropriate to express the opinion set forth in this letter, subject to the

assumptions, limitations and qualifications stated herein.

In expressing the opinion set

forth below, we have assumed the following:

1. Each

individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so.

2. Each

individual executing any of the Documents on behalf of a party (other than the Company) is duly authorized to do so.

3. Each

of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents

to which such party is a signatory, and such party’s obligations set forth therein are legal, valid and binding and are enforceable

in accordance with all stated terms.

4. All

Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not

differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted

to us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records

reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained

in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there

has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

5. The

Shares will not be issued in violation of the restrictions on transfer and ownership contained in Article VII of the Charter.

6. Upon

issuance of any of the Shares, the total number of shares of Common Stock issued and outstanding will not exceed the total number of shares

of Common Stock that the Company is then authorized to issue under the Charter or the Plan.

7. Each

option, award, right or other security exercisable or exchangeable for a Share pursuant to the Plan (each, an “Award”) will

be duly authorized and validly granted in accordance with the Plan, and each Award will be exercised or exchanged in accordance with the

terms of the Plan and such Award, including any option or award agreement entered into in connection therewith.

Global Medical REIT Inc.

August 12, 2024

Page 3

8. Upon

the granting of any Award, the total number of Shares issuable under all then-outstanding Awards will not exceed the total number of shares

of Common Stock that the Company is then authorized to issue under the Plan (including, without limitation, if any previously issued Award

has expired, was forfeited or was terminated without having been exercised or was paid in cash without a requirement for the delivery

of Shares, the “Reallocation of Shares” provisions of the Plan).

Based upon the foregoing, and

subject to the assumptions, limitations and qualifications stated herein, it is our opinion that:

1. The

Company is a corporation duly incorporated and existing under and by virtue of the laws of the State of Maryland and is in good standing

with the SDAT.

2. The

Shares have been duly authorized and, when issued and delivered by the Company pursuant to the Registration Statement, the Plan, any applicable

Award and the Resolutions, will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited

to the laws of the State of Maryland and we do not express any opinion herein concerning United States federal law or the laws of any

other jurisdiction. We express no opinion as to the applicability or effect of federal or state securities laws, including the securities

laws of the State of Maryland, or as to federal or state laws regarding fraudulent transfers. To the extent that any matter as to which

our opinion is expressed herein would be governed by any jurisdiction other than the State of Maryland, we do not express any opinion

on such matter.

The opinion expressed herein

is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We

assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact

that might change the opinion expressed herein after the date hereof.

This opinion is being furnished

to you for submission to the Commission as an exhibit to the Registration Statement. We hereby consent to the filing of this opinion as

an exhibit to the Registration Statement and to the use of the name of our firm therein. In giving this consent, we do not admit that

we are within the category of persons whose consent is required by Section 7 of the 1933 Act.

| |

Very truly yours, |

| |

|

| |

/s/ Venable LLP |

Exhibit 23.1

CONSENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent

to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 28, 2024 relating to the financial

statements of Global Medical REIT Inc. and the effectiveness of Global Medical REIT Inc.'s internal control over financial reporting,

appearing in the Annual Report on Form 10-K of Global Medical REIT Inc. for the year ended December 31, 2023.

/s/ Deloitte

& Touche LLP

McLean, Virginia

August 12,

2024

S-8

S-8

EX-FILING FEES

0001533615

Global Medical REIT Inc.

Fees to be Paid

0001533615

2024-08-08

2024-08-08

0001533615

1

2024-08-08

2024-08-08

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

Global Medical REIT Inc.

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock, par value $0.001 per share

|

Other

|

1,650,000

|

$

9.15

|

$

15,097,500.00

|

0.0001476

|

$

2,228.39

|

|

Total Offering Amounts:

|

|

$

15,097,500.00

|

|

$

2,228.39

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

2,228.39

|

|

1

|

(1) The Form S-8 registration statement to which this Exhibit 107.1 is attached (the "Registration Statement") registers 1,650,000 shares of common stock of Global Medical REIT Inc., $0.001 par value per share (the "Common Stock"), of Global Medical REIT Inc., a Maryland corporation, that may be delivered with respect to awards under the Global Medical REIT Inc. 2016 Equity Incentive Plan (as amended from time to time, the "Plan"), which shares consist of shares of Common Stock reserved and available for delivery with respect to awards under the Plan and additional shares of Common Stock that may again become available for delivery with respect to awards under the Plan pursuant to the reallocation provisions of the Plan. (2) Pursuant to Rule 416(a) under the Securities Act, the Registration Statement shall be deemed to cover an indeterminate number of additional shares of Common Stock that may become issuable as a result of stock splits, stock dividends, or similar transactions pursuant to the adjustment or anti-dilution provisions of the Plan. (3) The proposed maximum offering price per share and proposed maximum aggregate offering price for the shares of Stock covered by this Registration Statement have been estimated solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act based upon the average of the high and low prices of a share of Common Stock as reported on the New York Stock Exchange on August 7, 2024, which was equal to $9.15.

|

|

|

v3.24.2.u1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Offerings - Offering: 1

|

Aug. 08, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, par value $0.001 per share

|

| Amount Registered | shares |

1,650,000

|

| Proposed Maximum Offering Price per Unit |

9.15

|

| Maximum Aggregate Offering Price |

$ 15,097,500.00

|

| Fee Rate |

0.01476%

|

| Amount of Registration Fee |

$ 2,228.39

|

| Offering Note |

(1) The Form S-8 registration statement to which this Exhibit 107.1 is attached (the "Registration Statement") registers 1,650,000 shares of common stock of Global Medical REIT Inc., $0.001 par value per share (the "Common Stock"), of Global Medical REIT Inc., a Maryland corporation, that may be delivered with respect to awards under the Global Medical REIT Inc. 2016 Equity Incentive Plan (as amended from time to time, the "Plan"), which shares consist of shares of Common Stock reserved and available for delivery with respect to awards under the Plan and additional shares of Common Stock that may again become available for delivery with respect to awards under the Plan pursuant to the reallocation provisions of the Plan. (2) Pursuant to Rule 416(a) under the Securities Act, the Registration Statement shall be deemed to cover an indeterminate number of additional shares of Common Stock that may become issuable as a result of stock splits, stock dividends, or similar transactions pursuant to the adjustment or anti-dilution provisions of the Plan. (3) The proposed maximum offering price per share and proposed maximum aggregate offering price for the shares of Stock covered by this Registration Statement have been estimated solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act based upon the average of the high and low prices of a share of Common Stock as reported on the New York Stock Exchange on August 7, 2024, which was equal to $9.15.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

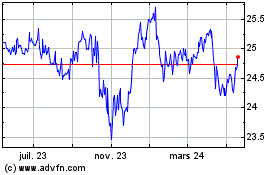

Global Med REIT (NYSE:GMRE-A)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

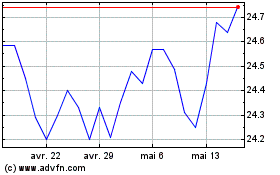

Global Med REIT (NYSE:GMRE-A)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024