false

0001533615

0001533615

2024-09-17

2024-09-17

0001533615

us-gaap:CommonStockMember

2024-09-17

2024-09-17

0001533615

us-gaap:SeriesAPreferredStockMember

2024-09-17

2024-09-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): September 17, 2024

Global Medical REIT Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

001-37815 |

46-4757266 |

(State

or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S.

Employer

Identification No.) |

7373 Wisconsin Avenue, Suite 800

Bethesda, MD

20814

(Address of Principal Executive Offices)

(Zip Code)

(202) 524-6851

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading Symbols: |

|

Name

of each exchange on which registered: |

| Common Stock, par value $0.001 per share |

|

GMRE |

|

NYSE |

| Series A Preferred Stock, par value $0.001 per share |

|

GMRE PrA |

|

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act. ¨

On September 17, 2024, Global Medical REIT Inc.

(the “Company”) issued a press release announcing that (i) the Company has entered into a new, 15-year, triple-net lease with

an affiliate of CHRISTUS Health at the Company’s healthcare facility in Beaumont, Texas (the “Beaumont Facility”) and

(ii) the former tenant, Steward Health Care (“Steward”), formally requested that its lease with the Company at the Beaumont

Facility be rejected by the bankruptcy court as of September 15, 2024, as part of Steward’s Chapter 11 bankruptcy proceedings, and

a final order rejecting such lease is pending with the court. A copy of the press release is attached to this Current Report on Form 8-K

as Exhibit 99.1 and is incorporated herein by reference.

| Item

9.01 | Financial

Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Global Medical REIT Inc. |

| |

|

|

| |

By: |

/s/ Jamie A. Barber |

| |

|

Jamie A. Barber |

| |

|

Secretary and General Counsel |

Date: September 17, 2024

Exhibit 99.1

Global Medical REIT Announces Lease with CHRISTUS

Health at its Facility in Beaumont, Texas

CHRISTUS Health Lease is a triple-net lease

with a term of 15 years

Former tenant, Steward Health Care, formally

requested that its lease be rejected as of September 15, 2024, as part of its Chapter 11 bankruptcy proceedings

Bethesda, MD – September 17, 2024 –

(BUSINESS WIRE) – Global Medical REIT Inc. (NYSE: GMRE) (the “Company” or “GMRE”), a net-lease medical real

estate investment trust (REIT) that acquires healthcare facilities and leases those facilities to physician groups and regional and national

healthcare systems, today announced that it has entered into a new, 15-year, triple-net lease with an affiliate of CHRISTUS Health (“CHRISTUS”)

at its healthcare facility in Beaumont, Texas (the “Beaumont Facility”). CHRISTUS will utilize the Beaumont Facility for,

among other services, robotic surgery, orthopedic care and emergency services. The Beaumont Facility was previously tenanted by Steward

Health Care (“Steward”), which filed for Chapter 11 bankruptcy on May 6, 2024. Steward has formally requested that its

lease with us at the Beaumont Facility be rejected by the bankruptcy court as of September 15, 2024, and a final order rejecting

such lease is pending with the court.

Jeffrey M. Busch, Chairman, Chief Executive Officer

and President stated, “We are excited to begin a new relationship with CHRISTUS at our Beaumont, Texas facility. We believe the

facility is a high-quality, marketable facility, and this has been verified by our new, long-term, triple-net lease with CHRISTUS. The

situation at our Beaumont facility demonstrates the importance of underwriting both tenant and building. I’m very pleased with how

quickly our team was able to re-lease the property to a high-quality tenant, delivering an excellent outcome in this difficult situation.”

Paul Generale, Executive Vice President and Chief

Strategy Officer of CHRISTUS stated, “We look forward to our partnership with GMRE and believe the Beaumont facility will be an

essential component as we expand quality health care services to the residents of Southeast Texas.”

About CHRISTUS Health

CHRISTUS Health (S&P: A+; Fitch A+) is an international faith-based,

not-for-profit health care system based in Irving, Texas, with more than 60 hospitals in Texas, Louisiana, New Mexico, Chile, Colombia

and Mexico. CHRISTUS Health is made up of 51,000 Associates providing compassionate and individualized care at more than 600 centers,

including community hospitals, clinics, long-term care facilities and health ministries.

About the Lease

The lease is a triple-net lease that will cover

the entire Beaumont Facility, which is a two-story medical facility consisting of 84,674 leasable square feet, located at 6025 Metropolitan

Drive, Beaumont, Texas 77706. The lease term is 15 years with three, seven-year renewal options. Annual base rent for the first lease

year equals $2.9 million with 2.5% annual rent increases thereafter. Rent payments will commence three months after the delivery date

of the facility, and we expect to deliver the facility to CHRISTUS during the fourth quarter of 2024.

FORWARD-LOOKING STATEMENTS

Certain statements contained herein may be considered

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and it is the Company’s

intent that any such statements be protected by the safe harbor created thereby. These forward-looking statements are identified by their

use of terms and phrases such as "anticipate," "believe," "could," "estimate," "expect,"

"intend," "may," "should," "plan," "predict," "project," "will,"

"continue" and other similar terms and phrases, including references to assumptions and forecasts of future results. Except

for historical information, the statements set forth herein including, but not limited to, any statements regarding leases, lease rejection

and lease rejection timing, lease commencement dates, tenants and other lease terms are forward-looking statements. These forward-looking

statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties. Although

the Company believes that the expectations, estimates and assumptions reflected in its forward-looking statements are reasonable, actual

results could differ materially from those projected or assumed in any of the Company’s forward-looking statements. Additional information

concerning us and our business, including additional factors that could materially and adversely affect our financial results, include,

without limitation, the risks described under Part I, Item 1A - Risk Factors, in our Annual Report on Form 10-K, our Quarterly

Reports on Form 10-Q, and in our other filings with the SEC. You are cautioned not to place undue reliance on forward-looking statements.

The Company does not intend, and undertakes no obligation, to update any forward-looking statement.

Investor Relations Contact:

Stephen Swett

stephen.swett@icrinc.com

203.682.8377

v3.24.3

Cover

|

Sep. 17, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 17, 2024

|

| Entity File Number |

001-37815

|

| Entity Registrant Name |

Global Medical REIT Inc.

|

| Entity Central Index Key |

0001533615

|

| Entity Tax Identification Number |

46-4757266

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

7373 Wisconsin Avenue

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

202

|

| Local Phone Number |

524-6851

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

GMRE

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

GMRE PrA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

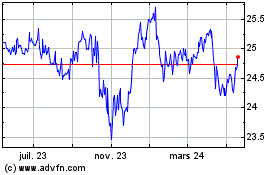

Global Med REIT (NYSE:GMRE-A)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

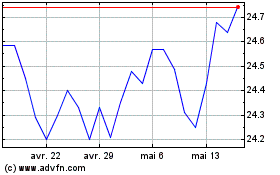

Global Med REIT (NYSE:GMRE-A)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025