ICE Announces Plans to Launch Environmental Registry Technology Services to Bring State-of-the-Art Infrastructure to Support the Growth of Carbon Markets

28 Janvier 2025 - 1:30PM

Business Wire

Launch Partners ACR and ART will transition to

the next-generation registry platform in 2025

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, and the world’s largest operator

of environmental derivatives markets, today announced plans to

launch an environmental registry technology service to bring best

in class infrastructure to registries and registry users and

support the adoption of carbon credits as an asset class. ICE’s

service, called ICE GreenTrace™, is expected to launch in late 2025

and is designed to support registries and registry users across the

life cycle of a carbon credit.

Launch partner, Winrock International’s Environmental Resources

Trust (ERT), will use ICE’s registry technology service for its

world-leading crediting programs: ACR, the Architecture for REDD+

Transactions (ART) and the new sectoral crediting standard in

development for the Energy Transition Accelerator (ETA).

ERT launched ACR, formerly the American Carbon Registry, in 1996

as the world’s first private greenhouse gas registry. ART was

established in 2018 as the first market-based initiative to

incentivize the protection and restoration of tropical forests at

scale, also known as jurisdictional REDD+. ERT was selected in 2023

by the ETA Founding Partners to develop and pilot the carbon

crediting standard for the ETA to accelerate a clean power

transition in emerging and developing economies.

“The ICE registry platform is a leap forward for the technology

infrastructure underpinning global carbon markets, providing

powerful next-generation digital functionality to all registry

users to enhance efficiency and market integration,” said Mary

Grady, CEO of Environmental Resources Trust. “Bringing nearly 30

years of carbon market experience to our role as ICE’s launch

partner, we are excited to join forces with an industry leader to

deliver a transformational platform that supports the market growth

required to achieve global climate goals.”

“Building on more than two decades of expertise in analogue to

digital transformations across multiple asset classes, ICE now

plans to deliver mission-critical infrastructure to the carbon

credit market. We selected ERT as our launch partner based on their

reputation for excellence, longstanding support of carbon markets,

and commitment to a market infrastructure transformation,” said

Gordon Bennett, Global Head of Environmental Markets at ICE. "ICE’s

technology will bring unparalleled financial market infrastructure

to allow customers to more confidently invest in and manage carbon

assets at a time when transparency and trust are vital for scaling

carbon credit markets.”

Since its inception, ICE has built a global digital network

connecting energy and environmental market participants to the

tools needed to mitigate risk, achieve compliance, and invest, all

within a secure, highly regulated, and transparent operational

framework. Today, ICE is home to the most liquid venues in the

world to trade energy and environmental derivatives. In 2024, a

record 20.4 million environmental contracts traded on ICE,

equivalent to over $1 trillion in notional value for the fourth

consecutive year with more than $50 billion physically delivered to

multiple registries.

To find out more information about ICE’s environmental registry

services or to be kept updated on progress, please contact

GreenTrace@ICE.com.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

About Environmental Resources Trust

Environmental Resources Trust (ERT), a nonprofit

enterprise of Winrock International, offers trusted solutions to

environmental markets to catalyze transformational climate impacts.

With the mission of harnessing the power of markets to improve the

environment, ERT operates internationally recognized carbon

crediting programs, ACR and the Architecture for REDD+ Transactions

(ART). Founded in 1996 as the world’s first private carbon

registry, ACR has extensive operational experience in global

compliance and voluntary carbon markets, having issued over 300

million high-quality, verified CO2 emission reduction and removals

credits. ART is the leading global carbon market initiative

for jurisdictional REDD+, ensuring the social and environmental

integrity of climate results from protecting and restoring forests

at scale. ART’s growing pipeline of participating jurisdictions

currently includes over two dozen governments on five continents

covering 400 million hectares of tropical forests. ERT is also

developing the sectoral carbon crediting standard for the Energy

Transition Accelerator (ETA), with the goal of incentivizing

steeper and more rapid decarbonization of the electric power sector

in emerging and developing economies. The ETA is an

innovative carbon finance platform launched in 2023 by the U.S.

Department of State, Bezos Earth Fund and the Rockefeller

Foundation.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124834394/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136

ICE Investor: Katia Gonzalez katia.gonzalez@ice.com (678)

981-3882

ERT Media: Brad Kahn brad.kahn@winrock.org +1 206 419

1607

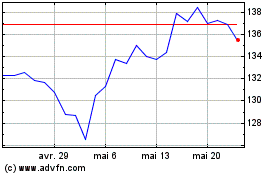

Intercontinental Exchange (NYSE:ICE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

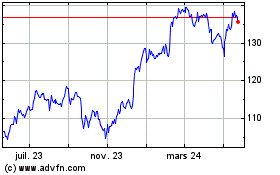

Intercontinental Exchange (NYSE:ICE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025