Global Biopharma R&D Boasts Increased Funding, Productivity and Product Launches in 2023, says IQVIA Institute Report

23 Février 2024 - 3:00PM

Business Wire

- Clinical development productivity rose in 2023, primarily due

to an improvement in the composite success rate, a function of

phases successfully completed in the year, which rose to 10.8%.

This was the highest level since 2018.

- Industry and regulator adoption of innovative and

technology-driven enablers contributed to productivity gains. These

enablers included the use of predictive biomarkers, novel trial

design, and digital and decentralized trial methodologies.

- A total of 69 novel active substances (NASs) were launched

globally in 2023 – 6 more than the prior year – including 24

first-in-class launches in the U.S.

- Clinical development programs among larger biopharma companies

are moving toward newer modalities, including cell and gene

therapy, antibody drug conjugates, and radioligand therapies. This

is coupled with an increased focus on neurology, infectious

diseases, metabolic diseases (including obesity), and rare

diseases.

- R&D funding levels and deal activity recovered in 2023

following a steep decline in 2022 from peak levels in 2020-21.

Global biopharma R&D productivity rebounded in 2023 with

higher composite success rates enabled by industry-wide and

regulator adoption of data and technology driven innovation,

including novel trial design, optimized biomarker use, and digital

and decentralized trial methodologies. This rebound occurred while

clinical trial starts and funding returned to pre-pandemic levels,

according to the new report, “Global Trends in R&D 2024:

Activity, Productivity, and Enablers,” released by the IQVIA

Institute for Human Data Science.

“The improvement in clinical productivity and composite success

was notable across all therapy areas, particularly in Phases I and

III and in regulatory review,” said Murray Aitken, executive

director of the IQVIA Institute for Human Data Science. “This

reflects industry-wide ingenuity and regulatory acceptance of

innovative data and technology-driven enablers in trial design and

digital trial execution. Clinical trial starts have returned to

pre-pandemic levels, signaling a recognizable shift in pipelines

and clinical development programs to a focus on innovative

modalities in oncology, immunology, neurology and metabolic

diseases.”

A few key highlights of the report include:

- Clinical development productivity: Industry-wide

clinical development productivity rose primarily through better

success rates, which surged from historic lows to the highest

levels since 2018. Efforts to manage trial complexity and duration

have had more mixed results. Clinical development productivity

reached a value of 17.4 in 2023 on the Clinical Development

Productivity Index, which provides a composite metric that combines

success rates, clinical trial complexity and trial duration on an

annual basis. This is compared to the 2010 base level of 20 and

shows a continued rebound from a low of 12.8 in 2020, with the

majority of this growth driven by an increase in success

rates.

- Productivity enablers: Regulatory agencies are generally

attempting to make changes which the industry finds positive,

including greater simplication, transparency and speed, but the

pace of change differs across geographies. Large pharmaceutical

companies have shifted country utilization over the last decade by

reprioritizing and rationalizing country selection for trials.

Innovative program approaches, including use of biomarkers and

compressed trial strategies, yield significant time savings and

greater productivity. Novel trial designs were used in 18% of

trials in 2021-2023, led by oncology where more than 29% of trials

use a novel design. Decentralized methodologies peaked but remain a

stable feature of trial activity, albeit at a lower level than

2020, which was driven by COVID-19.

- New drug approvals and launches: A total of 69 novel

active substances (NASs) were launched globally in 2023 – six more

than the prior year – and representing a return to pre-COVID-19

levels. A total of 362 NASs have launched globally in the past five

years, including 113 NASs launched in the U.S. but not launched in

Europe as of the end of 2023. While the number of NAS launches in

China is rising, an increasing number are not available in other

countries, reflecting both a rising domestic industry and a mix of

reduced barriers and rising incentives for multinational NAS

launches.

- Clinical trial activity: Clinical trial starts declined

15% in 2023 from 2022, a third of which was driven by a reduction

in COVID-19 trials. This decline also reflected a shift in clinical

development programs among large biopharma companies away from

immuno-oncology to a focus on hot spots, including cell and gene

therapies, antibody-drug conjugates (ADCs), multi-specific

antibodies and obesity treatments. Emerging biopharma companies

started 416 fewer non-COVID-19 trials in 2023 than at the peak in

2021, while larger companies started 524 fewer. The top four

diseases in trial starts – oncology, metabolic/endocrinology,

immunology, and neurology – accounted for 79% of those trial starts

and declined less than other diseases. There was a notable increase

of 68% in obesity clinical trials in 2023 from 2022, nearly double

the number from five years ago. This included 124 drugs in active

development, of which 46% have oral formulations in development and

40% are GIP/GLP glucagon receptor agonists.

- R&D funding: In 2023, global funding of

biopharmaceutical research and development increased to $72Bn, up

from $61Bn in 2022. In the same period, M&A activity jumped to

$140Bn from $78Bn in 2022, while the median deal value fell for the

second year in a row. The leading deals in 2023 included 11 that

were over $5Bn and were focused on cancer, neurology and

cardiovascular diseases. The largest focus area of deals was

antibody-drug conjugates (ADCs), which had six totaling $90Bn.

About the IQVIA Institute for Human Data Science

The IQVIA Institute for Human Data Science contributes to the

advancement of human health globally through timely research,

insightful analysis and scientific expertise applied to granular

non-identified patient-level data.

Fulfilling an essential need within healthcare, the Institute

delivers objective, relevant insights and research that accelerate

understanding and innovation critical to sound decision making and

improved human outcomes. With access to IQVIA’s institutional

knowledge, advanced analytics, technology and unparalleled data,

the Institute works in tandem with a broad set of healthcare

stakeholders to drive a research agenda focused on Human Data

Science, including government agencies, academic institutions, the

life sciences industry, and payers. More information about the

IQVIA Institute can be found at www.IQVIAInstitute.org.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced

analytics, technology solutions, and clinical research services to

the life sciences industry. IQVIA creates intelligent connections

across all aspects of healthcare through its analytics,

transformative technology, big data resources and extensive domain

expertise. IQVIA Connected Intelligence™ delivers powerful insights

with speed and agility — enabling customers to accelerate the

clinical development and commercialization of innovative medical

treatments that improve healthcare outcomes for patients. With

approximately 87,000 employees, IQVIA conducts operations in more

than 100 countries.

IQVIA is a global leader in protecting individual patient

privacy. The company uses a wide variety of privacy-enhancing

technologies and safeguards to protect individual privacy while

generating and analyzing information on a scale that helps

healthcare stakeholders identify disease patterns and correlate

with the precise treatment path and therapy needed for better

outcomes. IQVIA’s insights and execution capabilities help biotech,

medical device and pharmaceutical companies, medical researchers,

government agencies, payers and other healthcare stakeholders tap

into a deeper understanding of diseases, human behaviors, and

scientific advances, in an effort to advance their path toward

cures. To learn more, visit www.iqvia.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240223378641/en/

Kerri Joseph, IQVIA Investor Relations (kerri.joseph@iqvia.com)

+1.610.244.3020 Trent Brown, IQVIA Media Relations

(trent.brown@iqvia.com) +1.919.780.3221

IQVIA (NYSE:IQV)

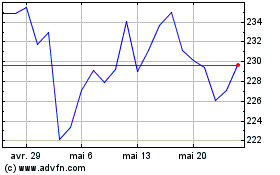

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024