Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

03 Septembre 2024 - 11:10PM

Edgar (US Regulatory)

|

|

|

| Free Writing Prospectus (To the

Preliminary Prospectus Supplement dated September 3, 2024) |

|

Filed pursuant to Rule 433 under the Securities Act

Registration Statement No. 333-277326 |

$850,000,000

Term Sheet

6.125% Senior Notes due 2029

Pricing Term Sheet dated September 3, 2024 to the Preliminary Prospectus Supplement of MGM Resorts International dated September 3,

2024. This Pricing Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Pricing Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information therein to

the extent it is inconsistent. Financial information presented in the Preliminary Prospectus Supplement is deemed to have changed to the extent affected by changes described herein, and the use of proceeds with respect to the increased amount

referred to herein will be as described herein. Capitalized terms used in this Pricing Term Sheet but not defined have the meanings given to them in the Preliminary Prospectus Supplement.

|

|

|

| Issuer: |

|

MGM Resorts International (the “Issuer”) |

|

|

| Offering Size: |

|

$850,000,000 aggregate principal amount, which constitutes an increase of $175,000,000 from the

Preliminary Prospectus Supplement |

|

|

| Title of Securities: |

|

6.125% Senior Notes due 2029 (the “Notes”) |

|

|

| Maturity: |

|

September 15, 2029 |

|

|

| Offering Price: |

|

100.000%, plus accrued interest, if any, from September 17, 2024 |

|

|

| Coupon: |

|

6.125% |

|

|

| Yield to Maturity: |

|

6.125% |

|

|

| Gross Proceeds: |

|

$850,000,000 |

|

|

| Net Proceeds to Issuer before Estimated Expenses: |

|

$841,619,000 |

|

|

| Interest Payment Dates: |

|

March 15 and September 15, commencing March 15, 2025 |

|

|

| Record Dates: |

|

March 1 and September 1 |

|

|

| Optional Redemption: |

|

On and after September 15, 2026, the Issuer may on any one or more occasions redeem the Notes,

in whole or in part, at the redemption prices (expressed as a percentage of the principal amount of

the Notes to be

redeemed) set forth below, plus accrued and unpaid interest on the Notes, if |

|

|

|

| |

|

any, to the applicable date of redemption, if redeemed during the twelve-month period beginning

on September 15 of each of the years indicated below: |

|

|

|

|

|

| |

|

Year |

|

Price |

|

|

2026 |

|

103.063% |

|

|

2027 |

|

101.531% |

|

|

2028 and thereafter |

|

100.000%

|

|

|

|

|

|

In addition, the Issuer may redeem the Notes at its election, in whole or in part, at any time prior to September 15, 2026, at a redemption price equal to the greater of: |

|

|

|

|

• 100% of the principal amount of the Notes to be redeemed; or |

|

|

|

|

• (a) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date (assuming the Notes matured on September 15, 2026) on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 50 basis points less (b) interest accrued to the date of redemption. |

|

|

| |

|

plus, in either of the above cases, accrued and unpaid interest to the date of redemption on the

Notes to be redeemed. |

|

|

| |

|

Prior to September 15, 2026, the Issuer may also on any one or more occasions redeem in the

aggregate up to 40% of the aggregate principal amount of the Notes (calculated after giving effect

to any issuance of

additional notes under the Indenture) with the net cash proceeds of one or more

Equity Offerings, at a redemption price equal to 106.125% of the principal amount of the Notes to

be redeemed, plus accrued and unpaid interest, if any, to the

applicable date of redemption;

provided that: (1) at least 50% of the original aggregate principal amount of the Notes remains

outstanding after each such redemption; and (2) such redemption occurs within 120 days after

the

closing of such Equity Offering. |

|

|

| Use of Proceeds: |

|

We intend to use the net proceeds from this offering to (i) repay indebtedness, including our

outstanding 5.75% senior notes due 2025, and (ii) pay transaction-related fees and expenses, with

the remainder for

general corporate purposes. This Pricing Term Sheet shall not constitute a notice

of redemption with respect to the 5.75% senior notes due 2025. Any such notice of redemption

will be delivered in accordance with the indenture governing the

5.75% senior notes due 2025. |

|

|

| |

|

Pending such use, we may invest the net proceeds in short-term interest-bearing accounts,

securities or similar investments. |

|

|

Joint Book-Running

Managers: |

|

BofA Securities, Inc. |

| |

|

J.P. Morgan Securities LLC |

| |

|

Barclays Capital Inc. |

| |

|

BNP Paribas Securities Corp. |

| |

|

Citigroup Global Markets Inc. |

-2-

|

|

|

|

|

Citizens JMP Securities, LLC |

|

|

Deutsche Bank Securities Inc. |

|

|

Fifth Third Securities, Inc. |

|

|

Morgan Stanley & Co. LLC |

|

|

Scotia Capital (USA) Inc. |

|

|

SMBC Nikko Securities America, Inc. |

|

|

Truist Securities, Inc. |

|

|

| Co-Managers: |

|

Goldman Sachs & Co. LLC |

|

|

PNC Capital Markets LLC |

|

|

U.S. Bancorp Investments, Inc. |

|

|

Wells Fargo Securities, LLC |

|

|

CBRE Capital Advisors, Inc. |

|

|

Valtus Capital Group, LLC |

|

|

| Trade Date: |

|

September 3, 2024 |

|

|

| Settlement Date: |

|

September 17, 2024 (T+10) |

|

|

|

|

The settlement date of the Notes is expected to be September 17, 2024, the tenth business day following the trade date (such settlement date being referred to as “T+10”). Under Rule

15c6-1 of the SEC under the Exchange Act, trades in the secondary market generally are required to settle in one business day, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers

who wish to trade the Notes prior to the initial T+10 settlement may be required, by virtue of the fact that the Notes initially will settle on a delayed basis, to specify an alternate settlement, and such purchasers should consult their own

advisor. |

|

|

| Distribution: |

|

SEC Registered Offering |

|

|

| CUSIP Number: |

|

552953 CK5 |

|

|

| ISIN Number: |

|

US552953CK50 |

The Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange

Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the Preliminary Prospectus Supplement and other documents the Issuer has filed

with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting the Next-Generation EDGAR System on the SEC web site at www.sec.gov. Alternatively, the Issuer or any underwriter

will arrange to send you the prospectus if you request it from BofA Securities, Inc. at dg.prospectus_requests@bofa.com or by calling

1-800-294-1322 (toll-free).

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers

or other notices were automatically generated as a result of this communication being sent via Bloomberg email or another communication system.

-3-

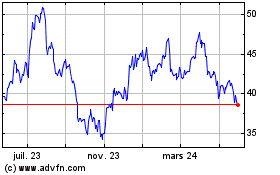

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

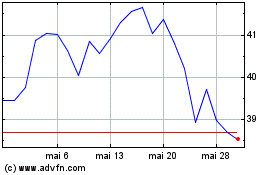

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024