Raises FY24 Earnings & Free Cash Flow

Guidance Following Improved Margin Outlook

Maximus (NYSE: MMS), a leading provider of government services

worldwide, reported financial results for the three months ended

December 31, 2023.

Highlights for the first quarter of fiscal year 2024

include:

- Revenue increased 6.2% to $1.33 billion, compared to $1.25

billion for the prior year period. Organic growth was 6.9% and

driven by expanded programs as well as resumed programs tied to

Medicaid redeterminations.

- Diluted earnings per share were $1.04 and adjusted diluted

earnings per share were $1.34, compared to $0.65 and $0.94,

respectively, for the prior year period.

- The company is raising earnings and free cash flow guidance for

fiscal year 2024. Adjusted operating income guidance is increasing

by $15 million, adjusted diluted earnings per share by $0.15, and

free cash flow by $10 million.

- A quarterly cash dividend of $0.30 per share is payable on

February 29, 2024, to shareholders of record on February 15,

2024.

"Our operational performance was excellent this quarter as we

focused on delivery of programs critical to the wellbeing of

individuals and families, including veteran exams, redeterminations

for Medicaid, return to repayment for millions of borrowers, and

recently-completed open enrollment," said Bruce Caswell, President

and Chief Executive Officer. "The improved outlook for fiscal 2024

signifies the business is in great health and benefiting from

scale. We continue to focus on creating growth opportunities for

our employees while using technology to improve the citizen

experience and deliver on our customers' missions."

Caswell continued, "More broadly, we believe the current

economic climate will continue to favor Maximus, given our current

base underpinned by essential work and a strategy squarely aligned

to prioritized areas of government spend."

First Quarter Results

Revenue for the first quarter of fiscal year 2024 increased 6.2%

to $1.33 billion, compared to $1.25 billion for the prior year

period. Organic growth was 6.9% from expanded programs in the

domestic segments as well as resumed programs in the U.S. Services

Segment tied to the restart of Medicaid redeterminations.

For the first quarter of fiscal year 2024, operating margin was

8.1% and the adjusted operating margin was 9.9%. This compares to

margins of 6.0% and 7.9%, respectively, for the prior year period.

Diluted earnings per share were $1.04 and adjusted diluted earnings

per share were $1.34. This compares to $0.65 and $0.94,

respectively, for the prior-year period. The margin improvement is

attributable to higher transactional volumes across both expanded

and resumed programs.

U.S. Federal Services Segment

U.S. Federal Services Segment revenue for the first quarter of

fiscal year 2024 increased 9.5% to $677.1 million, compared to

$618.2 million reported for the prior year period. All growth was

organic and driven primarily by volume growth on expanded programs,

including the VA's Medical Disability Exam (MDE) contracts.

The segment operating margin for the first quarter of fiscal

year 2024 was 10.2%. This compares to 8.3% reported for the prior

year, which reflected the hiring of resources in anticipation of

the higher volumes. The anticipated profile for the U.S. Federal

Services Segment is an increasing margin across the year with a

full-year margin expected to range between 11% and 12%.

U.S. Services Segment

U.S. Services Segment revenue for the first quarter of fiscal

year 2024 increased 11.5% to $489.8 million, compared to $439.5

million reported in the prior year period. All growth was organic

and driven by the resumption of Medicaid redetermination activities

and expanded programs in eligibility support and clinical

services.

The segment operating margin for the first quarter of fiscal

year 2024 was 13.5%. This compares to 8.6% reported for the prior

year period when redetermination activities were paused. Since

resumed, beneficiary engagement drove the highest margin expected

for the segment in fiscal year 2024, with slight moderation

expected in subsequent quarters as engagement levels normalize. The

full-year fiscal 2024 margin for the U.S. Services Segment is

expected to range between 11% and 12%.

Outside the U.S. Segment

Outside the U.S. Segment revenue for the first quarter of fiscal

year 2024 decreased 16.4% to $160.1 million, compared to $191.6

million reported in the prior year period. Approximately 7% of

decline was attributable to disposal of businesses and the

remaining decline was due to both lower employment services volumes

and currency impacts.

The segment broke even in the first quarter of fiscal year 2024.

This compares to an operating margin of 5.3% in the prior year

period which benefited from higher employment services volumes. The

Outside the U.S. Segment is expected to be slightly above breakeven

for the full-year fiscal 2024. Continued shaping of the segment to

reduce volatility and deliver consistent profitability is a

management priority this year.

Sales and Pipeline

Year-to-date signed contract awards at December 31, 2023,

totaled $422 million, and contracts pending (awarded but unsigned)

totaled $802 million. The book-to-bill ratio at December 31, 2023,

was 1.2x calculated on a trailing twelve-month basis.

The sales pipeline at December 31, 2023, totaled $37.7 billion,

comprised of approximately $933 million in proposals pending, $1.01

billion in proposals in preparation, and $35.7 billion in

opportunities tracking. New work opportunities represent

approximately 77% of the total sales pipeline.

Balance Sheet and Cash Flows

At December 31, 2023, cash and cash equivalents totaled $104.2

million, and gross debt was $1.32 billion. The ratio of debt, net

of allowed cash, to adjusted EBITDA for the quarter ended December

31, 2023, as calculated in accordance with our credit agreement,

was 2.1x. This compares to 2.2x at September 30, 2023.

For the first quarter of fiscal year 2024, cash provided

operating activities totaled $21.6 million and free cash flow was

an outflow of approximately $1 million. Days sales outstanding

(DSO) were 59 days as of December 31, 2023, reflecting good

collections and offset by seasonality from the timing of payments

that were expected this quarter. Free cash flow guidance is

increasing for the full fiscal year 2024.

On January 5, 2024, our Board of Directors declared a quarterly

cash dividend of $0.30 for each share of our common stock

outstanding. The dividend is payable on February 29, 2024, to

shareholders of record on February 15, 2024.

Raising FY24 Earnings and Free Cash Flow Guidance

Maximus is raising fiscal year 2024 earnings and free cash flow

guidance following first quarter results and improved margin

outlook for the rest of the fiscal year. Revenue guidance is

maintained between $5.05 billion and $5.20 billion.

Adjusted operating income is now expected to range between $503

million and $528 million, representing an increase of $15 million

from prior guidance. Adjusted operating income excludes an

estimated $88 million of expense for amortization of intangible

assets and $1 million of divestiture-related charges incurred this

quarter.

Adjusted diluted earnings per share is now expected to range

between $5.20 and $5.50 per share, representing an increase of

$0.15 per share from prior guidance.

Free cash flow is now expected to range between $300 million and

$350 million as a result of the increased earnings guidance. Other

estimates include interest expense of approximately $73 million, an

effective income tax rate between 24.5% and 25.5%, and weighted

average shares outstanding between 62.0 million and 62.2 million

shares for fiscal year 2024.

Conference Call and Webcast Information

Maximus will host a conference call tomorrow, February 8, 2024,

at 9:00 a.m. ET. Shareholders are invited to submit questions for

management’s consideration by emailing IR@maximus.com up to one

hour prior to the call.

The call is open to the public and available by webcast or by

phone at:

877.407.8289 (Domestic) / +1.201.689.8341 (International)

For those unable to listen to the live call, a recording of the

webcast will be available on investor.maximus.com.

About Maximus

As a leading strategic partner to governments across the globe,

Maximus helps improve the delivery of public services amid complex

technology, health, economic, environmental, and social challenges.

With a deep understanding of program service delivery, acute

insights that achieve operational excellence, and an extensive

awareness of the needs of the people being served, our employees

advance the critical missions of our partners. Maximus delivers

innovative business process management, impactful consulting

services, and technology solutions that provide improved outcomes

for the public and higher levels of productivity and efficiency of

government-sponsored programs. For more information, visit

maximus.com.

Non-GAAP Measures and Risk Factors

This release refers to non-GAAP measures and other indicators,

including organic growth, free cash flow, operating income and EPS

adjusted for amortization of intangible assets and

divestiture-related charges, adjusted EBITDA, and other non-GAAP

measures.

A description of these non-GAAP measures, the reasons why we use

and present them, and details as to how they are calculated are

included in our earnings presentation and forthcoming Form

10-Q.

The presentation of these non-GAAP numbers is not meant to be

considered in isolation, nor as alternatives to cash flows from

operations, revenue growth, or net income as measures of

performance. These non-GAAP financial measures, as determined and

presented by us, may not be comparable to related or similarly

titled measures presented by other companies.

Statements that are not historical facts, including statements

about the company’s confidence and strategies, and the company’s

expectations about revenues, results of operations, profitability,

future contracts, market opportunities, market demand, or

acceptance of the company’s products are forward-looking statements

that involve risks and uncertainties.

These risks could cause the Company’s actual results to differ

materially from those indicated by such forward-looking statements.

A summary of risk factors can be found in Item 1A, "Risk Factors"

in our Annual Report on Form 10-K for the year ended September 30,

2023, which was filed with the Securities and Exchange Commission

(SEC) on November 16, 2023. The Company's SEC reports are

accessible on maximus.com.

Maximus, Inc.

Consolidated Statements of

Operations

(Unaudited)

For the Three Months Ended

December 31, 2023

December 31, 2022

(in thousands, except per share

amounts)

Revenue

$

1,327,041

$

1,249,246

Cost of revenue

1,026,987

1,004,499

Gross profit

300,054

244,747

Selling, general, and administrative

expenses

169,195

146,452

Amortization of intangible assets

23,349

23,518

Operating income

107,510

74,777

Interest expense

21,507

21,606

Other expense/(income), net

488

(266

)

Income before income taxes

85,515

53,437

Provision for income taxes

21,367

13,442

Net income

$

64,148

$

39,995

Earnings per share:

Basic

$

1.05

$

0.65

Diluted

$

1.04

$

0.65

Weighted average shares outstanding:

Basic

61,322

61,117

Diluted

61,535

61,196

Dividends declared per share

$

0.30

$

0.28

Maximus, Inc.

Consolidated Balance

Sheets

December 31, 2023

September 30, 2023

(unaudited)

(in thousands)

Assets:

Cash and cash equivalents

$

104,186

$

65,405

Accounts receivable, net

860,409

826,873

Income taxes receivable

15,850

16,556

Prepaid expenses and other current

assets

129,174

146,632

Total current assets

1,109,619

1,055,466

Property and equipment, net

34,976

38,831

Capitalized software, net

125,383

107,811

Operating lease right-of-use assets

154,929

163,929

Goodwill

1,781,092

1,779,215

Intangible assets, net

680,309

703,648

Deferred contract costs, net

46,439

45,372

Deferred compensation plan assets

47,273

42,919

Deferred income taxes

2,204

2,459

Other assets

34,637

46,147

Total assets

$

4,016,861

$

3,985,797

Liabilities and Shareholders' Equity:

Liabilities:

Accounts payable and accrued

liabilities

$

267,623

$

282,081

Accrued compensation and benefits

115,864

194,251

Deferred revenue, current portion

63,032

60,477

Income taxes payable

23,717

451

Long-term debt, current portion

90,443

86,844

Operating lease liabilities, current

portion

48,490

49,852

Other current liabilities

49,197

49,058

Total current liabilities

658,366

723,014

Deferred revenue, non-current portion

37,221

38,849

Deferred income taxes

198,317

203,898

Long-term debt, non-current portion

1,222,243

1,163,149

Deferred compensation plan liabilities,

non-current portion

51,507

46,432

Operating lease liabilities, non-current

portion

118,594

129,367

Other liabilities

12,807

13,253

Total liabilities

2,299,055

2,317,962

Shareholders' equity:

Common stock, no par value; 100,000 shares

authorized; 61,031 and 60,998 shares issued and outstanding as of

December 31, 2023 and September 30 2023, respectively

585,278

577,898

Accumulated other comprehensive loss

(30,588

)

(27,615

)

Retained earnings

1,163,116

1,117,552

Total shareholders' equity

1,717,806

1,667,835

Total liabilities and shareholders'

equity

$

4,016,861

$

3,985,797

Maximus, Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

For the Three Months Ended

December 31, 2023

December 31, 2022

(in thousands)

Cash flows from operating activities:

Net income

$

64,148

$

39,995

Adjustments to reconcile net income to

cash flows from operations:

Depreciation and amortization of property,

equipment, and capitalized software

8,411

12,280

Amortization of intangible assets

23,349

23,518

Amortization of debt issuance costs and

debt discount

601

1,034

Deferred income taxes

(2,165

)

(1,331

)

Stock compensation expense

9,427

4,403

Loss on sale of a businesses

1,018

—

Change in assets and liabilities, net of

effects of business combinations:

Accounts receivable

(35,379

)

(200,749

)

Prepaid expenses and other current

assets

10,056

10,624

Deferred contract costs

(888

)

(1,013

)

Accounts payable and accrued

liabilities

(15,543

)

3,642

Accrued compensation and benefits

(67,392

)

(53,271

)

Deferred revenue

877

14,764

Income taxes

22,250

9,465

Operating lease right-of-use assets and

liabilities

(1,088

)

(948

)

Other assets and liabilities

3,926

2,928

Net cash provided by/(used in) operating

activities

21,608

(134,659

)

Cash flows from investing activities:

Purchases of property and equipment and

capitalized software

(22,247

)

(15,697

)

Proceeds from divestitures

1,815

—

Net cash used in investing activities

(20,432

)

(15,697

)

Cash flows from financing activities:

Cash dividends paid to Maximus

shareholders

(18,299

)

(17,017

)

Tax withholding related to RSU vesting

(13,455

)

(8,475

)

Payments for contingent consideration

(2,819

)

(1,415

)

Proceeds from borrowings

228,409

268,702

Principal payments for debt

(166,658

)

(61,355

)

Cash-collateralized escrow liabilities

1,204

(9,473

)

Net cash provided by financing

activities

28,382

170,967

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

1,846

2,421

Net change in cash, cash equivalents, and

restricted cash

31,404

23,032

Cash, cash equivalents, and restricted

cash, beginning of period

122,091

136,795

Cash, cash equivalents, and restricted

cash, end of period

$

153,495

$

159,827

Maximus, Inc.

Consolidated Results of

Operations by Segment

(Unaudited)

For the Three Months Ended

December 31, 2023

December 31, 2022

Amount

% (1)

Amount

% (1)

(dollars in thousands)

Revenue:

U.S. Federal Services

$

677,078

$

618,167

U.S. Services

489,845

439,478

Outside the U.S.

160,118

191,601

Revenue

$

1,327,041

$

1,249,246

Gross

profit:

U.S. Federal Services

$

156,662

23.1

%

$

122,694

19.8

%

U.S. Services

118,363

24.2

%

83,598

19.0

%

Outside the U.S.

25,029

15.6

%

38,455

20.1

%

Gross profit

$

300,054

22.6

%

$

244,747

19.6

%

Selling, general,

and administrative expenses:

U.S. Federal Services

$

87,855

13.0

%

$

71,649

11.6

%

U.S. Services

52,300

10.7

%

45,842

10.4

%

Outside the U.S.

25,141

15.7

%

28,389

14.8

%

Divestiture-related charges (2)

1,018

NM

—

NM

Other (3)

2,881

NM

572

NM

Selling, general, and administrative

expenses

$

169,195

12.7

%

$

146,452

11.7

%

Operating

income:

U.S. Federal Services

$

68,807

10.2

%

$

51,045

8.3

%

U.S. Services

66,063

13.5

%

37,756

8.6

%

Outside the U.S.

(112

)

(0.1

)%

10,066

5.3

%

Amortization of intangible assets

(23,349

)

NM

(23,518

)

NM

Divestiture-related charges (2)

(1,018

)

NM

—

NM

Other (3)

(2,881

)

NM

(572

)

NM

Operating income

$

107,510

8.1

%

$

74,777

6.0

%

(1)

Percentage of respective segment revenue.

Percentages not considered meaningful are marked "NM."

(2)

In November 2023, we sold our businesses

in Italy and Singapore, as well as our employment services business

in Canada, recording a loss of $1.0 million. We previously recorded

an impairment charge of $2.9 million related to these assets.

(3)

Other expenses includes credits and costs

that are not allocated to a particular segment. This includes

expenses incurred as part of our acquisitions, as well as potential

acquisitions which have not been or may not be completed.

Maximus, Inc.

Consolidated Free Cash Flows -

Non-GAAP

(Unaudited)

For the Three Months Ended

December 31, 2023

December 31, 2022

(in thousands)

Net cash provided by/(used in) operating

activities

21,608

(134,659

)

Purchases of property and equipment and

capitalized software

(22,247

)

(15,697

)

Free cash flow (Non-GAAP)

$

(639

)

$

(150,356

)

Maximus, Inc.

Non-GAAP Adjusted Results

Excluding Amortization of Intangible Assets

(Unaudited)

For the Three Months Ended

December 31, 2023

December 31, 2022

(dollars in thousands, except per

share data)

Operating income

$

107,510

$

74,777

Add back: Amortization of intangible

assets

23,349

23,518

Add back: Divestiture-related charges

1,018

—

Adjusted operating income excluding

amortization of intangible assets and divestiture-related charges

(Non-GAAP)

$

131,877

$

98,295

Adjusted operating income margin excluding

amortization of intangible assets and divestiture-related charges

(Non-GAAP)

9.9

%

7.9

%

Net income

$

64,148

$

39,995

Add back: Amortization of intangible

assets, net of tax

17,208

17,360

Add back: Divestiture-related charges

1,018

—

Adjusted net income excluding amortization

of intangible assets and divestiture-related charges (Non-GAAP)

$

82,374

$

57,355

Diluted earnings per share

$

1.04

$

0.65

Add back: Effect of amortization of

intangible assets on diluted earnings per share

0.28

0.29

Add back: Effect of divestiture-related

charges on diluted earnings per share

0.02

—

Adjusted diluted earnings per share

excluding amortization of intangible assets and divestiture-related

charges (Non-GAAP)

$

1.34

$

0.94

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240207818524/en/

James Francis, VP - IR Jessica Batt, VP - IR & ESG

IR@maximus.com

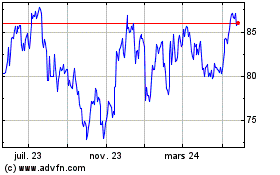

MAXIMUS (NYSE:MMS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

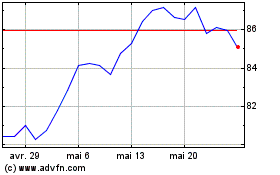

MAXIMUS (NYSE:MMS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024