UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the month of |

May |

|

2024 |

Commission File Number |

001-41722 |

|

|

METALS ACQUISITION LIMITED

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ⌧

Form 40-F ¨

EXPLANATORY NOTE

On May 21, 2024, Metals Acquisition Limited

(the “Company”) issued a press release announcing the “Redemption Fair Market Value” in connection with the Company’s

previously announced redemption of all of its (i) outstanding public warrants (the “Public Warrants”) to purchase ordinary

shares of the Company, par value $0.0001 per share (the “Ordinary Shares”), that were issued under the Warrant Agreement,

dated as of July 28, 2021, between Metals Acquisition Corp (“Old MAC”) and Continental Stock Transfer & Trust

Company and (ii) outstanding private placement warrants to purchase Ordinary Shares that were issued by the Company in (a) a

private placement transaction in connection with the business combination under the Sponsor Letter Agreement, dated as of July 28,

2021, by and between Old MAC and Green Mountain Metals LLC (the “Sponsor”) and (b) the conversion of the 2022 Sponsor

Convertible Note, dated April 13, 2022, under which the Sponsor exercised its option to convert the issued and outstanding loan amount

into private placement warrants, on the same terms as the outstanding Public Warrants. A copy of the press release is furnished as Exhibit 99.1

hereto.

A copy of the Notice of Redemption Fair Market

Value delivered by the Company is furnished as Exhibit 99.2 hereto.

None of this Form 6-K, the press release attached

hereto as Exhibit 99.1 or the Notice of Redemption Fair Market Value attached hereto as Exhibit 99.2 constitutes an offer to

sell or the solicitation of an offer to buy any of the Company’s securities, and shall not constitute an offer, solicitation or

sale in any jurisdiction in which such offering, solicitation or sale would be unlawful.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

METALS ACQUISITION LIMITED |

| |

|

(Registrant) |

| |

|

|

| Date: |

May 21, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit

99.1

METALS ACQUISITION LIMITED ANNOUNCES “REDEMPTION

FAIR MARKET VALUE” IN CONNECTION WITH REDEMPTION OF PUBLIC AND PRIVATE PLACEMENT WARRANTS

ST. HELIER, Jersey – (BUSINESS WIRE) – Metals Acquisition

Limited (NYSE: MTAL; ASX: MAC)

Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC),

a private limited company incorporated under the laws of Jersey, Channel Islands (the “Company”), today announced the

“Redemption Fair Market Value” in connection with its previously announced redemption of its public warrants and private placement

warrants (the “Warrants”) to purchase ordinary shares of the Company, par value $0.0001 per share (the “Ordinary

Shares”).

On May 6, 2024, the Company announced that it will redeem all

of its Warrants that remain outstanding at 5:00 p.m. New York City time on June 5, 2024 (the “Redemption Date”)

for a redemption price of $0.10 per Warrant. Warrant holders may elect to exercise their Warrants for cash or on a “cashless basis”

before 5:00 p.m. New York City time on the Redemption Date, subject to the terms of the Company’s previously issued notice

of redemption (the “Notice of Redemption”). The “Redemption Fair Market Value” announced today is used

to determine the number of Ordinary Shares that will be issued to Warrant holders who exercise their warrants on a “cashless basis”

(a “Make-Whole Exercise”). Based on the Redemption Fair Market Value, Warrant holders who exercise their Warrants by

surrendering them pursuant to a Make-Whole Exercise prior to the Redemption Date will receive 0.3063 Ordinary Shares per Warrant.

Today, at the direction of the Company, the information agent, Georgeson

LLC (the “Information Agent”), and the warrant agent, Continental Stock Transfer & Trust Company (the “Warrant

Agent”), have delivered a notice (the “Notice of Redemption Fair Market Value”) to each of the registered

holders of the outstanding Warrants, informing them that: (i) the Redemption Fair Market Value is $13.33, and (ii) as a

result, holders of Warrants who exercise their Warrants on a “cashless basis” will receive 0.3063 Ordinary Shares per Warrant.

Deadline for Warrant Exercise

Warrant holders have until immediately prior to 5:00 p.m. New

York City time on the Redemption Date to exercise their Warrants (1) for cash, at an exercise price of $11.50 per Ordinary Share

(the “Cash Exercise Price”), or (2) on a “cashless basis” pursuant to a Make-Whole Exercise, in which

case the holder will receive 0.3063 Ordinary Shares per Warrant. If any holder of Warrants would be entitled to receive a fractional

interest in an Ordinary Share, the number of Ordinary Shares the holder will be entitled to receive will be rounded down to the nearest

whole number of Ordinary Shares.

For additional information, including information on how holders may

exercise their Warrants, please refer to the Notice of Redemption.

Exercise Procedures

Those who hold their Warrants in “street name” should immediately

contact their broker to determine their broker’s procedure for exercising their Warrants.

Persons who are holders of record of their Warrants may exercise their

Warrants by sending a properly completed and executed “Election to Purchase” (attached to the Notice of Redemption) to the

Warrant Agent’s address below or at the following link https://cstt.citrixdata.com/r-r5a49e878c1214da29db4149e1a6093fa,

indicating, among other things, the number of Warrants being exercised and that whether such Warrants are being exercised for cash or surrendered

on a cashless basis.

If holders of Warrants are exercising for cash, please send payment

in full of the Cash Exercise Price (and any and all applicable taxes) via wire transfer or other method of payment permitted by the Warrant

Agreement. If you wish to wire funds to the Warrant Agent, please contact the Warrant Agent via email at Tenders+MetalsAcqWTS@continentalstock.com

or phone 800-509-5586 for wire instructions. For certified check and bank draft payable, please send to the Warrant Agent

at:

Continental Stock Transfer & Trust Company

One State Street, 30th Floor

New York, NY 10004-1571

Attention: Compliance Department

Termination of Warrant Rights

Any Warrants that have not been exercised for cash or pursuant to a

Make-Whole Exercise immediately prior to 5:00 p.m. New York City time on the Redemption Date (being June 5, 2024) will be void

and no longer exercisable, and the holders of those Warrants will be entitled to receive only the redemption price of $0.10 per Warrant.

Prospectus

The Ordinary Shares underlying the Warrants have been registered by

the Company under the Securities Act of 1933, as amended, and are covered by a registration statement filed on Form F-1 with, and

declared effective by, the U.S. Securities and Exchange Commission (Registration No. 333-276216). The U.S. Securities and Exchange

Commission (the “SEC”) maintains an Internet website that contains a copy of the prospectus included in the registration

statement at www.sec.gov. Alternatively, you can obtain a copy of this prospectus on the Investor Relations section of the Company’s

website, at https://metalsacquisition.com/overview/default.aspx.

We understand from the New York Stock Exchange (the “NYSE”)

that June 4, 2024, the trading day prior to the Redemption Date, will be the last day on which the public warrants will be traded

on the NYSE.

Important Notice

This press release does not and will not constitute an offer to sell,

or the solicitation of an offer to buy, the Warrants, the Ordinary Shares, or any other securities, nor will there be any sale of the

Warrants, the Ordinary Shares or any such other securities, in any state or other jurisdiction in which such offer, sale or solicitation

would be unlawful.

None of the Company, its board of directors or employees has made or

is making any representation or recommendation to any holder of the Warrants as to whether to exercise or refrain from exercising any

Warrants.

Any holder of Warrants that received a Notice of Redemption should

consult with its financial adviser, tax adviser and/or legal adviser to the extent it has any questions relating to its specific circumstances.

Additional Information

Additional information regarding this announcement may be found in

a Form 6-K that will be filed with the SEC.

Any questions you may have about redemption and exercising your Warrants

may be directed to the Company’s Information Agent, at:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

U.S. toll free call center: 866-920-8291

Holders outside the U.S.: 781-262-8912

Australian call center: 1300 265 182 and 03

9415 4055

***

-ENDS-

This announcement is authorized for release by

the Board of Directors.

|

Contacts

Mick McMullen

Chief Executive Officer & Director

Metals Acquisition Limited.

investors@metalsacqcorp.com |

Morne Engelbrecht

Chief Financial Officer

Metals Acquisition Limited

|

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company focused

on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification

and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking

statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not

rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such

forward- looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control

and are difficult to predict. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as

of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement

is based.

More information on potential factors that could affect MAC’s

or CSA Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC. If any of these

risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these

forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial,

that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements

reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates

that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking

statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward-looking

statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication.

Accordingly, undue reliance should not be placed upon the forward-looking statements.

Exhibit

99.2

May 21, 2024

NOTICE OF “REDEMPTION FAIR MARKET VALUE”

TO THE HOLDERS OF

METALS ACQUISITION LIMITED’S PUBLIC WARRANTS (CUSIP G60409102) AND

PRIVATE PLACEMENT WARRANTS

Reference is made to that certain Notice of Redemption (as defined

below) under which Metals Acquisition Limited (the “Company”) committed to inform registered holders of the Company’s

Warrants (as defined below) of the following information on this date.

Background

On May 6, 2024, the Company issued a notice of redemption (the

“Notice of Redemption”) indicating that, at 5:00 p.m. New York City time on June 5, 2024 (the “Redemption

Date”), the Company will redeem all of the Company’s then remaining outstanding public warrants (the “Public

Warrants”) to purchase ordinary shares of the Company, par value $0.0001 per share (the “Ordinary Shares”),

that were issued under the Warrant Agreement, dated as of July 28, 2021, between Metals Acquisition Corp (“Old MAC”)

and Continental Stock Transfer & Trust Company (the “Warrant Agreement”), for a redemption price of $0.10

per Public Warrant (the “Redemption Price”). In addition, at 5:00 p.m. New York City time on the Redemption Date,

the Company will redeem all of its then remaining outstanding private placement warrants (the “Private Placement Warrants”

and, together with the Public Warrants, the “Warrants”) to purchase Ordinary Shares that were issued by the Company

in (i) a private placement transaction in connection with the business combination under the Sponsor Letter Agreement, dated as of

July 28, 2021, by and between Old MAC and Green Mountain Metals LLC (the “Sponsor”) and (ii) the conversion

of the 2022 Sponsor Convertible Note, dated April 13, 2022, under which the Sponsor exercised its option to convert the issued and

outstanding loan amount into private placement warrants, on the same terms as the outstanding Public Warrants. Continental Stock Transfer &

Trust Company acts as warrant agent (the “Warrant Agent”) with respect to the Warrants.

Redemption Fair Market Value

The “Redemption Fair Market Value” is determined

in accordance with Section 6.2 of the Warrant Agreement based on the volume weighted average price of the Ordinary Shares for the

ten trading days immediately following the date on which the Notice of Redemption was sent to registered holders of the Warrants.

The Redemption Fair Market Value is $13.33.

Exercise of Warrants

At any time prior to 5:00 p.m. New York City time on the Redemption

Date, Warrant holders may elect to (i) exercise their Warrants for cash, at an exercise price of $11.50 per Ordinary Share or (ii) surrender

their Warrants on a “cashless basis” (a “Make-Whole Exercise”), in which case the surrendering holder will

receive a number of Ordinary Shares determined in accordance with the terms of the Warrant Agreement and based on the Redemption Date

and the Redemption Fair Market Value. If any holder of Warrants would, after taking into account all of such holder’s Warrants exercised

at one time, be entitled to receive a fractional interest in an Ordinary Share, the number of Ordinary Shares the holder will be entitled

to receive will be rounded down to the nearest whole number of Ordinary Shares.

In particular, should a holder elect to exercise their Warrants by

surrendering them pursuant to a Make-Whole Exercise, such holder would receive a number of Ordinary Shares determined by reference to

the table set forth in Section 6.2 of the Warrant Agreement.

Based on the Redemption Fair Market Value and the number of months

to the expiration of the Warrants, the number of Ordinary Shares to be issued for each Warrant that is exercised pursuant to a Make-Whole

Exercise is 0.3063 Ordinary Shares.

Redemption of Warrants

Any Warrants that have not been exercised for cash or pursuant

to a Make-Whole Exercise by 5:00 p.m. New York City time on the Redemption Date will be void and no longer exercisable, and the

holders of those Warrants will be entitled to receive only the Redemption Price of $0.10 per Warrant. For additional information,

including information on how holders may exercise their Warrants, see the Notice of Redemption. A copy of the Notice of Redemption was

attached as Exhibit 99.2 to the Current Report on Form 6-K furnished by the Company on May 6, 2024 and is available on

the website of the U.S. Securities and Exchange Commission at www.sec.gov.

The Ordinary Shares and the Public Warrants are listed on the New York

Stock Exchange (the “NYSE”) under the symbols “MTAL” and “MTAL.WS,” respectively. We understand

from the NYSE that June 4, 2024, the trading day prior to the Redemption Date, will be the last day on which the Public Warrants

will be traded on the NYSE.

The CUSIP number appearing herein has been included solely for the

convenience of the holders of the Public Warrants. No representation is made as to the correctness or accuracy of the CUSIP number either

as printed on the Public Warrants or as contained herein. Any redemption of the Public Warrants shall not be affected by any defect in

or omission of such identification number.

Questions Regarding Redemption

Any holder of Warrants that received a Notice of Redemption should

consult with its financial adviser, tax adviser and/or legal adviser to the extent it has any questions relating to its specific circumstances.

Any questions you may have about redemption and exercising your Warrants

may be directed to the Company’s information agent, Georgeson LLC, at:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

U.S. toll free call center: 866-920-8291

Holders outside the U.S.: 781-262-8912

Australian call center: 1300 265 182 and 03

9415 4055

Sincerely,

Metals Acquisition Limited

| By: |

/s/ Michael James McMullen |

|

| |

Name: Michael James McMullen

Title: Chief Executive Officer |

|

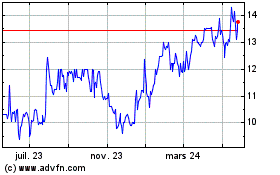

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

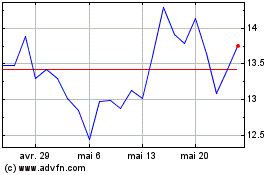

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025