- More than 35 billion illicit cigarettes were consumed across

the 27 EU member states in 2023, close to 2022 figures.

- France continues to be the largest illicit market in the EU,

and now accounts for 47.7% of total illicit cigarette consumption

in the region.

- Illicit consumption has grown for the fifth consecutive year in

Europe, reaching 52.2 billion cigarettes across the 38 countries

included in this study. Nearly one in 10 cigarettes in the

continent are illicit.

- More than 110 clandestine cigarette factories were dismantled

in 2023, as illegal manufacturing sites are being set up nearer

large end markets.

Philip Morris International Inc. (PMI) (NYSE: PM) today warns

about the high levels of contraband and counterfeit cigarettes in

the European Union (EU) year over year, with 35.2 billion illicit

cigarettes consumed in the region in 2023, accounting for 8.3% of

total consumption in the EU, an increase of 0.1 percentage point

compared to 2022.

PMI praises European law enforcement agencies for their

continued crackdown on criminal networks that profit from the

illicit tobacco trade, and calls on regulators to advance a

sensible, data-driven policy approach that puts consumers—and

public health—front and center and that effectively addresses the

challenges posed by the millions of adult smokers who are turning

to the black market rather than quitting or, for those who do not

quit, switching to smoke-free products.

The results of the 2023 KPMG annual study on illicit cigarette

consumption, commissioned by Philip Morris Products SA, revealed

that the illicit market in the EU continues to be a major threat

for public health, public security, and states’ economies.

Counterfeit cigarettes remain one of the main sources of illicit

consumption in the region, with 12.7 billion (36%) cigarettes

consumed—as criminal networks increasingly target higher-taxed and

higher-priced markets. Overall, governments in the EU lost an

estimated €11.6 billion in tax revenue, up from €11.3 billion in

2022. France is still leading the ranking as the country with the

largest illicit consumption in all of Europe, with 16.8 billion

illicit cigarettes and an estimated €7.3 billion in tax revenues

lost.

“We are witnessing an evolution of organized crime groups in

Europe, as they are increasingly locating production facilities

nearer Western European countries. We consider this phenomenon to

be a direct consequence of failed policy approaches that have not

done enough to curb illicit trade and reduce smoking prevalence,

and it is putting consumers, governments, legitimate businesses,

and society alike at risk,” said Christos Harpantidis, Senior Vice

President of External Affairs, PMI. “Law enforcement agencies have

played an instrumental role in disrupting crime rings dealing in

clandestine cigarette production across Europe, as well as

cross-border contraband operations. However, if we want to curb

illicit trade in the region altogether, we need a holistic approach

that complements tough penalties and strong law enforcement with

awareness and education campaigns about the real-life impact of

illicit trade, a predictable fiscal and regulatory environment

where adult smokers are not being driven to the black market, and

coordinated and committed public-private partnerships.”

Interviews with law enforcement agencies included in the KPMG

report shed light onto transnational organized crime’s

professionalization of their role in the supply chain of illicit

cigarettes. According to information from law enforcement agencies,

publicly available media articles, and PMI estimates, criminals

have expanded the setup of illegal cigarette factories; in 2023

alone, law enforcement data shows that at least 113 clandestine

cigarette manufacturing sites in 22 European countries were

disrupted by regional and local authorities.

The steady increase of counterfeit cigarette consumption for the

fourth consecutive year across Europe—mainly driven by the U.K. and

Ukraine—is now coupled with the rise of all other illicit trade

categories, including illicit whites and contraband. Combined with

the continued recovery of cross-border legal volumes, after

COVID-related travel restrictions ended in 2022, total non-domestic

consumption across the 38 European countries in the study has also

reached its highest level ever (15.5%), equal to more than one

cigarette out of six.

Despite this scenario, KPMG revealed that in 26 European

countries illicit consumption share was less than 10% of total

consumption. Of these, 16 markets had an illicit consumption share

of less than 5%. And in 25 of the 38 European countries included in

the study, the share of illicit cigarette consumption was either

stable or declining, compared to 2022.

“It’s truly encouraging to see a decrease in illicit consumption

in countries like Italy, Poland, Romania, and Spain. We need to

continue working together with law enforcement agencies and

governments to ensure that illicit trade does not become an even

larger problem across the EU,” stated Massimo Andolina, President

Europe Region, PMI. “Illicit trade undermines efforts to reduce

smoking prevalence; it’s bad for public health and consumers and

creates financial damage for governments and lawful operators.

Regulators must make this fight a top priority, while at the same

time enabling smoke-free products to be available and affordable

for all adult smokers who don’t quit cigarettes.”

“If we want to tackle illicit trade, governments must deploy

relentless law enforcement action against criminals profiting from

the black market. This has proven successful over excessive

taxation on consumer goods, or even prohibition,” added

Harpantidis. “In order to end smoking overall, traditional tobacco

control policies must be complemented with innovative approaches.

Governments must recognize that embracing alternatives to

cigarettes for those adults who would otherwise continue to smoke

will reduce smoking-related harm much faster than existing measures

alone.”

The KPMG report has expanded to 38 European countries

For the first time since its publication in 2006, the KPMG

annual research study has broadened its scope and incorporated all

Balkan countries. Now, the research covers 38 countries: the 27 EU

member states, as well as Albania, Bosnia and Herzegovina, Kosovo,

Moldova, Montenegro, North Macedonia, Norway, Serbia, Switzerland,

Ukraine, and the U.K.

The Balkan region has shown lower presence of illicit cigarettes

compared to some of the Western European countries, such as France

or the U.K. Ukraine, on the other hand, remains the country with

the second highest volume of illicit cigarettes consumed, at 8.4

billion.

This is the 18th consecutive year that KPMG has estimated

illicit cigarette consumption across Europe.

What are Europeans saying?

Illicit trade has a direct impact on people’s lives across

Europe. It makes unlawful and inferior-quality tobacco products

easily accessible—discouraging smoking cessation efforts,

undermining youth access prevention measures, and preventing adult

smokers from considering better alternatives to cigarettes. It has

serious consequences for consumers, as these illegal goods are

produced in substandard conditions, in complete disregard of the

rule of law and applicable tobacco control regulations.

To better understand societal views regarding illicit trade, PMI

commissioned independent public opinion research firm Povaddo to

conduct a survey among adults in 14 European countries. The survey,

which was executed in January 2024, found that:

- More than half (60%) believe their country (and the EU as a

whole) has a problem with illicit tobacco and illicit

nicotine-containing products.

- Almost three quarters (74%) agree that governments must

consider illicit trade as an unintended consequence when deciding

how to regulate and tax tobacco and nicotine-containing

products.

- 77% agree that illicit trade robs governments of significant

tax revenue.

Illicit trade fuels ruthless criminal gangs, often impacting the

most vulnerable communities and populations. It deprives

governments of tax revenue needed to provide public services,

including security. The proceeds from illicit trade often help

facilitate other serious crimes such as human trafficking,

corruption, and money laundering.

For PMI, eliminating the illicit tobacco trade has been a

long-standing priority. We implement preventive and protective

measures to fight illicit trade and work with public and private

sectors to advance efforts against this global issue.

As we advance on our journey toward delivering a smoke-free

future, we are increasing our efforts to secure both our supply

chain and the products we sell and to protect consumers and our

brands from smugglers and counterfeiters. We collaborate with law

enforcement agencies and other organizations all over the world to

root out and shut down illegal activities, including counterfeiting

and smuggling operations. PMI also continues to support relevant

European regulations, such as the EU Tobacco Products Directives’

tracking-and-tracing provisions.

A detailed overview of the results and methodology of the KPMG

report is available here.

For more information about PMI’s illicit trade prevention

efforts, visit PMI.com.

Note to editors

Definitions of illicit cigarette categories, as detailed in the

KPMG report

- Counterfeit: Illegally manufactured and sold by a party other

than the original trademark owner. In the KPMG report, counterfeit

volumes are reported from the participating manufacturers of BAT,

IB, JTI, and PMI.

- Illicit whites: Usually manufactured legally in one

country/market, but which the evidence suggests have been smuggled

across borders during their transit to the destination market under

review, where they have limited or no legal distribution and are

sold without payment of tax.

- Other C&C: Mainly contraband, i.e., genuine products that

have been either bought in a lower-tax country and that exceed

indicative quantities/limits or acquired without taxes for export

purposes to be illegally resold (for financial profit) in a

higher-priced market. This category may also contain counterfeits

of brands that are not trademark-owned by empty pack survey

participant manufacturers.

Povaddo survey methodology

PMI commissioned Povaddo LLC to field the survey in the

following countries: Belgium, Bulgaria, Croatia, Czech Republic,

France, Greece, Italy, Lithuania, Poland, Portugal, Romania,

Slovakia, Spain, and Ukraine. A total of 14,119 interviews were

conducted among legal age, general population adults (approximately

1,000 per country) between Dec. 29, 2023, and Jan. 31, 2024. The

data has been weighted at a country level by age, gender, and

tobacco/nicotine product consumption to reflect national population

statistics. The survey carries an overall margin of error of +/- 1%

at the 95% confidence interval. Results are available both at an

overall level (14 countries) and at an individual country level.

Country-level results carry a margin of error of +/- 3.2% at the

95% confidence interval.

Philip Morris International: Delivering a Smoke-Free

Future

Philip Morris International (PMI) is a leading international

tobacco company, actively delivering a smoke-free future and

evolving its portfolio for the long term to include products

outside of the tobacco and nicotine sector. The company’s current

product portfolio primarily consists of cigarettes and smoke-free

products. Since 2008, PMI has invested over $12.5 billion to

develop, scientifically substantiate and commercialize innovative

smoke-free products for adults who would otherwise continue to

smoke, with the goal of completely ending the sale of cigarettes.

This includes the building of world-class scientific assessment

capabilities, notably in the areas of pre-clinical systems

toxicology, clinical and behavioral research, as well as

post-market studies. In 2022, PMI acquired Swedish Match – a leader

in oral nicotine delivery – creating a global smoke-free champion

led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug

Administration has authorized versions of PMI’s IQOS devices and

consumables and Swedish Match’s General snus as Modified Risk

Tobacco Products and renewal applications for these products are

presently pending before the FDA. As of June 30, 2024, PMI's

smoke-free products were available for sale in 90 markets, and PMI

estimates that 36.5 million adults around the world use PMI's

smoke-free products. Smoke-free business accounted for

approximately 38% of PMI’s total first-half 2024 net revenues. With

a strong foundation and significant expertise in life sciences, PMI

announced in February 2021 its ambition to expand into wellness and

healthcare areas and, through its Vectura Fertin Pharma business,

aims to enhance life through the delivery of seamless health

experiences. "PMI" refers to Philip Morris International Inc. and

its subsidiaries. For more information, please visit www.pmi.com

and www.pmiscience.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909118299/en/

Philip Morris International David Fraser T. +41 (0)58 242 4500

E. david.fraser@pmi.com

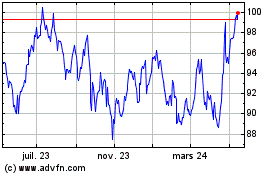

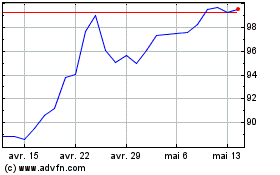

Philip Morris (NYSE:PM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Philip Morris (NYSE:PM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024