Current Report Filing (8-k)

04 Mai 2023 - 7:48PM

Edgar (US Regulatory)

0001127703false00011277032023-05-042023-05-04

| | | | | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM | 8-K |

CURRENT REPORT |

| |

| Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

|

Date of Report (Date of earliest event reported): May 4, 2023 |

|

| ProAssurance Corporation |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-16533 | 63-1261433 |

(State of Incorporation) | (Commission File No.) | (IRS Employer I.D. No.) |

| | | | | | | | | | | |

| 100 Brookwood Place, | Birmingham, | AL | 35209 |

| (Address of Principal Executive Office ) | (Zip code) |

| | | | | | | | |

Registrant’s telephone number, including area code: | (205) | 877-4400 |

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act

(17CFR 240.13e-(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | PRA | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

We are describing an amendment of our Revolving Credit Agreement, initiation of a Term Loan, and initiation of two swap agreements under “Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.” These descriptions are hereby incorporated by reference into this Item 1.01.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

On April 28, 2023, ProAssurance Corporation amended and restated its Revolving Credit Agreement to extend its expiration to April 2028. This amendment modifies the terms of the original facility that was originally entered into on April 15, 2011 and subsequently amended on November 7, 2019 and April 19, 2021. The Revolving Credit Agreement permits borrowings up to $250 million, and has available a $50 million accordion feature which, if successfully subscribed, would expand the permitted borrowings to a maximum of $300 million. As of March 31, 2023 and December 31, 2022, there were no outstanding borrowings on the Revolving Credit Agreement. The Revolving Credit Agreement may be used for general corporate purposes, including, but not limited to, use as short-term working capital, funding for share repurchases as authorized by our Board, and for support of other activities we enter into in the normal course of business including mergers and acquisitions. The Agreement contains customary representations, covenants and events in the event of default.

In concert with the Revolving Credit Agreement amendment, ProAssurance agreed to a Term Loan of $125 million as of April 28, 2023. We plan to draw on the Term Loan and the Revolving Credit Agreement in November 2023 to refinance our senior notes that are due at that time. The Term Loan will be due April 2028. The Agreement contains customary representations, covenants and events in the event of default.

We also entered into certain swap agreements with US Bank on May 2, 2023. These are intended to hedge the interest rate movements inherent in the Revolving Credit Agreement and Term Loan by effectively offsetting changes in the short term interest rate indices that partially determine the rates of these loans. The portion of the interest rate we pay that is based upon our Consolidated Total Leverage Ratio will remain variable. The swaps are for $125 million each, beginning December 29, 2023 and ending March 31, 2028. Payment dates will be on the quarters beginning March 29, 2024. The swap related to the Term Loan will amortize on a schedule similar to the Term Loan, beginning June 2024 and quarterly thereafter. ProAssurance may be required to deposit collateral with US Bank from time to time in order to secure the net present value of future cash flows as measured quarterly into the future.

We qualify the preceding description of the Revolving Credit Agreement, Term Loan, and related swaps in their entirety by reference to the complete terms and conditions of the Agreement, which will be filed with our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 4, 2023

| | |

| PROASSURANCE CORPORATION |

| by: /s/ Jeffrey P. Lisenby |

| ----------------------------------------------------- |

Jeffrey P. Lisenby

General Counsel |

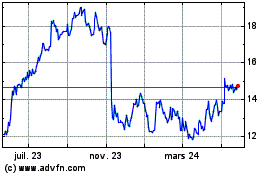

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

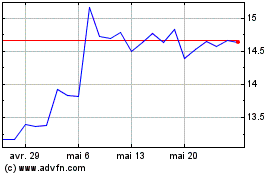

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025