UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of July 2024

SKEENA RESOURCES LIMITED

(Translation of Registrant's Name into English)

001-40961

(Commission File Number)

1133 Melville Street, Suite 2600, Vancouver, British Columbia, V6E 4E5, Canada

(Address

of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

EXHIBIT

INDEX

Exhibit 99.1 of this Report on Form 6-K is incorporated by reference

into the Registration Statement on Form F-10 of the Registrant, which was originally filed with the Securities and Exchange Commission

(the “SEC”) on January 31, 2023, and the Registration Statement on Form S-8 of the Registrant, which was originally

filed with the SEC on April 1, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 8, 2024

| |

SKEENA RESOURCES LIMITED |

| |

|

| |

By: |

/s/

Andrew MacRitchie |

| |

|

Andrew MacRitchie |

| |

|

Chief Financial Officer |

Exhibit 99.1

Form 51-102F3

MATERIAL CHANGE REPORT

| Item 1. | Name and Address of Reporting Issuer |

Skeena Resources Limited (“Skeena”

or the “Company”)

Suite 2600-1133 Melville Street.

Vancouver, British Columbia

V6E 4E5

| Item 2. | Date of Material Change |

June 24, 2024

A news release describing the material

change was disseminated by the Corporation on June 25, 2024 through Accesswire and a copy was subsequently filed on SEDAR+.

| Item 4. | Summary of Material Change |

On June 25, 2024, the Company announced

it secured a financing package totaling US$750 million (equivalent to over C$1 billion) with Orion Resource Partners (“Orion”)

for the development, construction, and general working capital required to advance the Company’s 100%-owned Eskay Creek Gold-Silver

Project (“Eskay” or the “Project”).

| Item 5. | Full Description of Material Change |

| 5.1 | Full Description of Material Change |

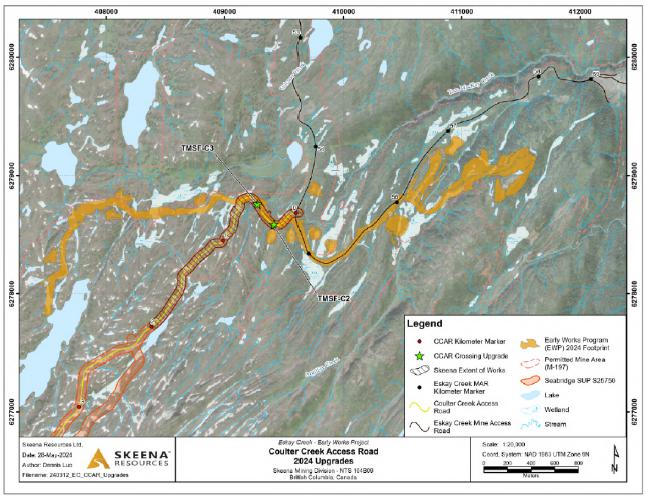

On June 25, 2024, the Company announced

it secured a financing package totaling US$750 million (equivalent to over C$1 billion) with Orion for the development, construction,

and general working capital required to advance the Project. This complete funding package significantly derisks the Project and provides

Skeena with optionality, flexibility and stakeholder alignment as the Company progresses Eskay towards production in the first half of

2027. The package provides a significant portion of financing prior to Skeena’s receipt of required permits in respect to the Eskay

project and therefore, allows the Company to advance the project on the most efficient and expedient schedule to production.

Financing Package Highlights:

The total financing package of US$750

million is comprised of an equity investment, gold stream, senior secured loan, and a cost over-run facility:

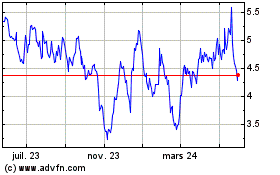

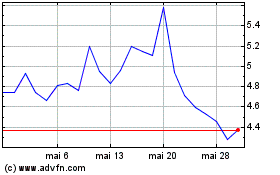

| · | US$100 million equity investment priced at a

meaningful premium to the Company’s five-day volume weighted average share price. |

| · | US$200 million gold stream with option to buy

back up to 66.7% for 12-month period after start of commercial production (the “Gold Stream”). |

| · | US$350 million of committed capital available

from a senior secured loan with 1% standby fee and no break fee (the “Senior Secured Loan”). |

| | | |

| · | US$100 million cost over-run facility in the

form of an additional gold stream subject to the same standby terms as the Senior Secured Loan (the “Cost Contingency”). |

Equity Investment - US$100,000,000

| · | Orion committed to purchase US$100 million of

Skeena’s common shares with a portion of the equity commitment priced and closing immediately and the balance (US$25 million) closing

at a later date. |

| o | Orion was the back-end buyer of a C$100 million development flow-through private placement transaction

in which Skeena issued 12,021,977 shares at a price of C$8.32 per share, which closed on June 24, 2024. |

| o | Orion also purchased 3,418,702 common shares priced at C$6.65 per share (C$22.75 million / US$16.6 million)

which closed on June 24, 2024. |

| o | The balance of Orion’s equity investment commitment into Skeena is expected to close later this

year with pricing to be set at the time of the investment. |

| · | Upon completion of the full US$100 million equity

investment, Orion will own less than 20% of the issued and outstanding shares of the Company. |

| · | Orion will have the right to participate in any

future equity or equity-linked offerings by Skeena up to the level of its ownership at the time of the offering provided that Orion continues

to own at least 5% of the basic shares outstanding of the Company. |

| · | The shares of Skeena issued in connection with

the equity investment are subject to customary 4-month hold period under applicable securities law in Canada. In addition, until the earlier

of (i) 12 months after the Closing Date; or (ii) the termination of the Senior Secured Loan or Gold Stream, Orion agreed to not transfer

its Skeena common shares without approval from Skeena’s board of directors. |

Gold Stream - US$200,000,000

| · | Gold Stream agreement to be drawn in five tranches |

| o | The initial tranche of US$5 million, initially anticipated to close on June 26, 2024, is now expected

to close on or about July 5, 2024. |

| o | The second tranche of US$45 million will be available after receipt of the Technical Sample permit. |

| o | The next three tranches of US$50 million are available as needed to support the project construction schedule. |

| · | Once the stream is fully drawn, Orion will be

entitled to receive 10.55% of payable gold produced from the mine (“Stream Percentage”) at a price equal to 10% of

the LBMA AM gold fixing price three days prior to the delivery day for the life of mine of the Project. |

| · | The silver production is not subject to the stream

agreement. |

| · | For a period of 12 months following the project

completion date, Skeena may, at any time, reduce the Stream Percentage by 66.67% by repaying Orion the proportional deposit plus an imputed

18% IRR. |

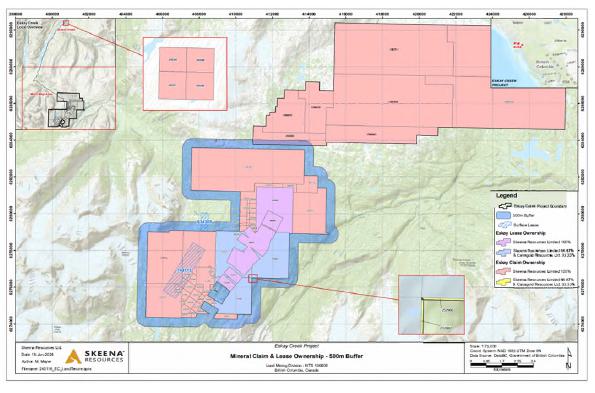

| · | The area of interest for the stream is constrained

to 500 meters around the existing mineral reserves and resources currently delineated at the Project. |

Senior Secured Loan - US$350,000,000

| · | Term: 5.75 years from the first drawdown. |

| · | Availability period: Drawdowns will be in four

equal tranches of US$87,500,000. |

| · | Availability fee: 1.0% per year on the undrawn

portion. |

| · | Coupon: 3-month US$ SOFR (subject to a minimum

of 1.5%) plus 7.75% margin, calculated based on the number of days elapsed in the quarter divided by 360 days. In the case of default,

the margin will increase by 2%. |

| · | Interest and principal repayment: Interest to

be paid quarterly until the maturity date. Commencing 3 months following the planned project completion, the principal shall amortize

and be payable in 15 quarterly installments. Skeena may prepay the loan and any accrued unpaid interest in full or in part at any time

without any penalty. |

| · | Original issue discount: 2.0% of the Senior Secured

Loan Amount, which shall be paid pro-rata upon the funding of each tranche. |

| · | No break fee: Skeena may terminate the Senior

Secured Loan at any time without incurring penalties. |

Cost Over-run Facility - US$100,000,000

| · | Skeena may request an additional $100,000,000

deposit with the same pro-rata terms as the Gold Stream other than being subject to a 2% original issue discount and a 1% availability

fee. |

Conclusion: Fully

Funded

The

Company’s definitive feasibility study released in November 2023 estimated Eskay’s preproduction capital expenditures to be

US$528 million (C$713 million), including a US$36 million (C$49 million) contingency.

The total financing

package of US$750 million, combined with US$44 million (C$59 million) of cash and cash equivalents as of March 31, 2024, provides Skeena

with approximately US$794 million of available capital towards the Project, which is substantially more than the remaining estimated capital

expenditures required to bring Eskay back into production. With no precious metals hedging or concentrate off-take requirements, the Company

retains excellent upside to increasing metals prices.

| 5.2 | Disclosure for Restructuring Transaction |

Not applicable.

| Item 6. | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7. | Omitted Information |

No information has been omitted on the

basis that it is confidential information.

The name and business number of the executive

officer of the Company who is knowledgeable of the material change and this report is:

Andrew MacRitchie

Chief Financial Officer

Tel: (604)-558-7687

July 4, 2024

Exhibit 99.2

FILING VERSION

CREDIT AGREEMENT

BETWEEN

Skeena Resources Limited

as Borrower

-and-

The

Guarantors party hereto from time to time

as Guarantors

-and-

THE LENDERS PARTY HERETO FROM TIME TO TIME

as Lenders

June 24, 2024

Table

of Contents

Page

| Article 1 INTERPRETATION |

2 |

| |

|

| 1.1 |

Definitions |

2 |

| 1.2 |

Certain Rules of Interpretation |

31 |

| 1.3 |

Currency |

31 |

| 1.4 |

Time of Essence |

31 |

| 1.5 |

Knowledge |

32 |

| 1.6 |

This Agreement to Govern |

32 |

| 1.7 |

Interest Act |

32 |

| 1.8 |

No Subordination |

32 |

| 1.9 |

Paramountcy |

32 |

| 1.10 |

Schedules, etc. |

33 |

| |

|

|

| Article 2 TERM facilitY |

34 |

| |

|

| 2.1 |

Establishment of Facility |

34 |

| 2.2 |

Availment |

34 |

| 2.3 |

Calculation and Payment of Interest |

34 |

| 2.4 |

Prepayment and Repayment of Loans |

35 |

| 2.5 |

Availability Fee |

35 |

| 2.6 |

Cancellation of the Facility |

35 |

| |

|

|

| Article 3 other provisions relating to the Facility |

36 |

| |

|

| 3.1 |

Several Obligations |

36 |

| 3.2 |

Default Interest |

36 |

| 3.3 |

Application of Payments |

36 |

| 3.4 |

Payments Generally |

36 |

| 3.5 |

Status of Lenders |

36 |

| 3.6 |

Payments – No Deduction |

37 |

| 3.7 |

Illegality |

38 |

| 3.8 |

Change in Circumstances |

38 |

| 3.9 |

Payment of Costs and Expenses |

39 |

| 3.10 |

Indemnities |

40 |

| 3.11 |

Maximum Rate of Interest |

42 |

| 3.12 |

Net Insurance Proceeds |

42 |

| 3.13 |

Defaulting Lenders |

43 |

| 3.14 |

Benchmark Replacement |

43 |

| |

|

|

| Article 4 REPRESENTATIONS AND WARRANTIES |

49 |

| |

|

| 4.1 |

Representations and Warranties of the Borrower and the Guarantors |

49 |

| 4.2 |

Survival of Representations and Warranties |

61 |

| |

|

|

| Article 5 SECURITY |

61 |

| |

|

| 5.1 |

Security |

61 |

| 5.2 |

Additional Security from New Subsidiaries |

62 |

| 5.3 |

Further Assurances - Security |

62 |

| 5.4 |

Security Effective Notwithstanding Date of Advance |

62 |

Table

of Contents

(continued)

Page

| 5.5 |

No Merger |

62 |

| 5.6 |

Release of Security |

62 |

| |

|

|

| Article 6 COVENANTS |

63 |

| |

|

| 6.1 |

Affirmative Covenants |

63 |

| 6.2 |

Notifications to the Lenders |

65 |

| 6.3 |

Corporate Documents |

68 |

| 6.4 |

Other Reports |

68 |

| 6.5 |

Material Contracts, Material Project Authorizations |

68 |

| 6.6 |

Monthly Reporting |

69 |

| 6.7 |

Quarterly Reporting |

69 |

| 6.8 |

Annual Reporting |

69 |

| 6.9 |

Anti-Corruption |

70 |

| 6.10 |

ESIA |

70 |

| 6.11 |

Changes to Accounting Policies |

70 |

| 6.12 |

Negative Covenants |

70 |

| 6.13 |

Financial Covenants |

74 |

| 6.14 |

Liquidity |

74 |

| 6.15 |

Know Your Customer Checks |

74 |

| 6.16 |

Environmental and Social Matters |

75 |

| 6.17 |

E&S Non-Compliance Dispute Mechanism |

77 |

| 6.18 |

Transparency |

78 |

| |

|

|

| Article 7 Technical Committee |

79 |

| |

|

| 7.1 |

Establishment of Technical Committee |

79 |

| 7.2 |

Responsibilities |

80 |

| 7.3 |

Meeting Procedures |

80 |

| |

|

|

| Article 8 CONDITIONS PRECEDENT |

81 |

| |

|

| 8.1 |

Conditions Precedent to Effective Date |

81 |

| 8.2 |

Conditions Precedent to Advances |

82 |

| |

|

|

| Article 9 EVENTS OF DEFAULT AND REMEDIES |

85 |

| |

|

| 9.1 |

Events of Default |

85 |

| 9.2 |

Remedies Upon Default |

88 |

| 9.3 |

Set-Off |

88 |

| 9.4 |

Application of Proceeds |

88 |

| |

|

|

| Article 10 ADMINISTRATIVE AGENT |

89 |

| |

|

| 10.1 |

Agency |

89 |

| |

|

|

| Article 11 COLLATERAL AGENT |

92 |

| |

|

| 11.1 |

Appointment of Collateral Agent |

92 |

| 11.2 |

Limitation of Duties |

93 |

| 11.3 |

Delegation or Employment of Agents |

93 |

Table

of Contents

(continued)

Page

| 11.4 |

Knowledge of Events of Default; Actions; Permitted Encumbrances and Dispositions |

94 |

| 11.5 |

Requests for Instructions |

94 |

| 11.6 |

Reliance |

94 |

| 11.7 |

Restrictions on Actions |

95 |

| 11.8 |

Right of the Collateral Agent |

95 |

| 11.9 |

Indemnification by the Obligors |

96 |

| 11.10 |

Indemnification by the Lenders |

97 |

| 11.11 |

Waiver of Consequential Damages |

97 |

| 11.12 |

No Obligation to Act |

97 |

| 11.13 |

Force Majeure |

97 |

| 11.14 |

Collateral Agent Resignation |

98 |

| 11.15 |

Compliance with AML Legislation |

98 |

| 11.16 |

Conflict of Interest |

98 |

| |

|

|

| Article 12 GENERAL |

98 |

| |

|

| 12.1 |

Reliance and Non-Merger |

98 |

| 12.2 |

Amendment and Waiver |

99 |

| 12.3 |

Notices |

100 |

| 12.4 |

Further Assurances |

101 |

| 12.5 |

Assignment |

101 |

| 12.6 |

Severability |

102 |

| 12.7 |

Entire Agreement |

102 |

| 12.8 |

Confidentiality |

102 |

| 12.9 |

Press Releases and Public Disclosure |

104 |

| 12.10 |

Governing Law |

104 |

| 12.11 |

Submission to Jurisdictions |

104 |

| 12.12 |

Liability Limit |

104 |

| 12.13 |

Counterparts |

104 |

| 12.14 |

Acknowledgement and Consent to Bail-In Action |

104 |

| 12.15 |

Erroneous Payments |

106 |

| 12.16 |

QFC Provisions |

111 |

CREDIT AGREEMENT

THIS

CREDIT AGREEMENT is made as of the 24th day of June, 2024,

B E T W E E N:

SKEENA

RESOURCES LIMITED, a company incorporated under the laws of British Columbia (the “Borrower”)

- and -

the guarantors party hereto from time

to time (the “Guarantors”)

-and-

the lenders party hereto from time to

time (the “Lenders”)

-and-

upon its joinder hereto, a trust company

existing under the laws of Canada in its capacity as collateral agent (the “Collateral Agent”)

-and-

upon its joinder hereto, [xx]

a trust company existing under the laws of Canada in its capacity as administrative agent (the “Administrative Agent”)

RECITALS:

| A. | The Borrower has requested that the Lenders make available the Facility for the purpose of financing the

exploration, development, construction and working capital requirements of the Project, and for general corporate and administrative expenses

of the Obligors related to the Project, all in accordance with the Planning Documents. |

| B. | The Lenders have agreed to make the Facility available to the Borrower on the terms and conditions set

forth herein. |

NOW

THEREFORE THIS AGREEMENT WITNESSES that, in consideration of the covenants and agreements herein contained and for other good

and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

Article 1

INTERPRETATION

For the purposes of this Agreement:

| 1.1.1 | “Acquisition” means, with respect to any Person, any purchase or other acquisition

by such Person, regardless of how accomplished or effected (including any such purchase or other acquisition effected by way of amalgamation,

merger, arrangement, business combination or other form of corporate reorganization or by way of purchase, lease or other acquisition

arrangements), of: (a) any other Person (including any purchase or acquisition of such number of the issued and outstanding securities

of, or such portion of an Equity Interest in, such other Person so that such other Person becomes a Subsidiary of the purchaser or of

any of its Affiliates) or of all or substantially all of the property of any other Person, or (b) any division, business, project,

operation or undertaking of any other Person or of all or substantially all of the property of any division, business, project, operation

or undertaking of any other Person. |

| 1.1.2 | “Additional Amounts” has the meaning ascribed to such term in Section 3.6. |

| 1.1.3 | “Administrative Agent” means [xx], in its capacity as administrative agent for the

Lenders hereunder, or any successor Administrative Agent appointed pursuant to Section 10.1. |

| 1.1.4 | “Advance” means an advance by the Lenders to the Borrower of any portion of the Facility. |

| 1.1.5 | “Advance Date” means the date on which an Advance is made to the Borrower pursuant

to the provisions hereof and which will be a Business Day. |

| 1.1.6 | “Advance Notice” means a notice signed by a Borrower substantially in the form of Schedule

1.1.6. |

| 1.1.7 | “Affected Persons” means any community or worker located in the area of influence of

the Project and who are affected by the Project. |

| 1.1.8 | “Affiliate” means, with respect to any Person, any other Person which directly or indirectly,

through one or more intermediaries, Controls, or is Controlled by, or is under common Control with, such Person. |

| 1.1.9 | “Agency Fee Letters” means the agency fee letter or agreements providing for the compensation

payable to the Administrative Agent and the Collateral Agent. |

| 1.1.10 | “Agreement” means this credit agreement and all Schedules attached hereto, and the

expressions “hereof”, “herein”, “hereto”, “hereunder”, “hereby”

and similar expressions refer to this Agreement as a whole and not to any particular Article, Section, Schedule, or other portion hereof

or thereof. |

| 1.1.11 | “AML Legislation” means any Applicable Law concerning or relating to terrorism or money

laundering, including, without limitation, United States Executive Order No. 13224, the Patriot Act, the laws comprising or implementing

the Bank Secrecy Act (United States), the laws administered by OFAC and the U.S. State Department, the Criminal Code (Canada), the Proceeds

of Crime (Money Laundering) and Terrorist Financing Act (Canada), the Regulations Implementing the United Nations Resolutions on the Suppression

of Terrorism (Canada), the United Nations Al-Qaida and Taliban Regulations (Canada), the Anti-terrorism Act (Canada), and any similar

or analogous legislation in any other applicable country, including as may be applicable to the Obligors, the Project or any Lender, as

any of the foregoing laws may from time to time be amended, renewed, extended, or replaced. |

| 1.1.12 | “Annual Forecast Report” means a written report in relation to a Fiscal Year with respect

to the Project, to be prepared by or on behalf of the Borrower, the form of Schedule 1.1.12. |

| 1.1.13 | “Anti-Corruption Laws” means any Applicable Law concerning or relating to bribery or

corruption, including, without limitation, the Corruption of Foreign Public Officials Act (1999) (Canada), the Foreign Corrupt Practices

Act of 1977 (United States) and the Bribery Act 2010 (United Kingdom), and any analogous or similar law of any other applicable country,

including as may be applicable to the Obligors, the Project or any Lender, as any of the foregoing laws may from time to time be amended,

renewed, extended, or replaced. |

| 1.1.14 | “Anti-Corruption Policy” means the anti-bribery and anti-corruption policy of the Group

Members adopted by the Board, as the same may be amended, revised, supplemented or replaced from time to time in accordance with Section 6.9,

a copy of which has been provided to the Lenders prior to the Effective Date. |

| 1.1.15 | “Applicable Law” or “Law” means the common law and any law, any

international or other treaty, any domestic or foreign constitution or any multinational, federal, provincial, territorial, state, municipal,

county, local or other statute, law, ordinance, code, rule, regulation, Order (including any securities laws or requirements of stock

exchanges and any consent, decree or administrative Order), or Authorization of a Governmental Body in any case applicable to the Project

or any specified Person (including any Obligor or Lender), property, transaction or event, or any such Person’s property or assets

(and, in the case of Section 3.8, whether or not having the force of law). |

| 1.1.16 | “Applicable Percentage” means with respect to any Lender, the percentage of the total

Commitments represented by such Lender’s Commitment. If all Advances available under the Facility have been made or if the Commitments

have been terminated or expired, the Applicable Percentage shall be the percentage of the total outstanding Loans represented by such

Lender’s outstanding Loans. |

| 1.1.17 | “Associate” has the meaning ascribed to such term in the Securities Act (Ontario),

as in effect on the date of this Agreement. |

| 1.1.18 | “Authorization” means any authorization, approval, consent, mineral claim, exemption,

license, lease, grant, permit, franchise, right, privilege or no-action letter from any Governmental Body having jurisdiction with respect

to the Project or any specified Person, property, transaction or event, or with respect to any of such Person’s property or business

and affairs (including any zoning approval, mining permit, development permit or building permit) or from any Person in connection with

any easements, contractual rights or other matters. |

| 1.1.19 | “BCFM” means the Borrower’s life of mine base case financial model for the Project

based as included in the Definitive Feasibility Study, and as further updated as provided for herein, and which details, on a Fiscal Quarter

basis: |

| (a) | Project physicals including (i) gold tonnes mined; (ii) grade of ore mined; (iii) ore tonnes

and grade processed; (iv) metallurgical recoveries and gold produced; |

| (b) | Project-level expenses including (i) net working capital; (ii) operating and capital costs (including

any estimated contingency amounts); (iii) administration costs; (iv) Taxes payable, government charges and royalties; |

| (c) | Project general and administrative expenses; |

| (e) | sustainability for Eskay Creek general and administrative expenses; |

| (f) | payments to Indigenous Groups; |

| (g) | corporate general and administrative expenses; |

| (h) | Project Revenue and cash flows; |

| (i) | expenses, including (i) the Stream Agreement; (ii) administration costs; and (iii) Taxes

payable; |

| (j) | cash flows, including (i) drawdown requirements; (ii) interest and principal repayments; and |

| (k) | calculation of the financial covenants set forth in Section 6.13.1. |

| 1.1.20 | “Blocked Account Agreement” means a blocked accounts control agreement in respect of

any bank accounts of any Obligor. |

| 1.1.21 | “Board” means the board of directors of the Borrower. |

| 1.1.22 | “Borrower” means Skeena Resources Limited, a company incorporated under the laws of

the Province of British Columbia, and its permitted successors and assigns. |

| 1.1.23 | “Business” means the business of the Obligors, taken as a whole, as described

in the Public Disclosure Documents, including, without limitation, the development, construction, and operation of, and extraction of

mineral resources from, the Project. |

| 1.1.24 | “Business Day” means any day, other than a Saturday, Sunday or statutory holiday in

any one of Vancouver, British Columbia or New York City, New York, or a day on which banks are generally closed in any one of those cities. |

| 1.1.25 | “Canadian Securities Authorities” means any of the securities commissions or similar

securities regulatory authorities in each of the provinces and territories of Canada in which the Borrower is a reporting issuer (or analogous

status). |

| 1.1.26 | “Canadian Securities Laws” means all applicable Canadian securities Laws, the respective

regulations, rules and orders made thereunder, and all applicable policies and notices issued by the Canadian Securities Authorities

in the applicable jurisdictions in Canada. |

| 1.1.27 | “Capital Expenditures” means, for any period, any expenditure made by the Obligors

for the purchase, lease, license, acquisition, erection, development, improvement or construction of capital assets, including any such

expenditure financed by way of Capitalized Lease Obligations or any other expenditure required to be capitalized, all as determined on

a consolidated basis in accordance with IFRS. |

| 1.1.28 | “Capitalized Lease Obligation” means, for any Person, any payment obligation of such

Person under an agreement for the lease, license or rental of, or providing such Person with the right to use, property that, in accordance

with IFRS, is required to be capitalized. |

| 1.1.29 | “Cash Flow Available for Debt Service” or “CFADS” means, in respect

of a period, the amount determined by deducting from the Revenue for that period, the aggregate of the following amounts (without double-counting)

actually paid by the Borrower on a consolidated basis during that period: |

| (b) | corporate overhead costs and administrative costs; |

| (c) | net amounts required to be paid under or in relation to any hedging arrangements; |

| (d) | any Taxes paid or required to be paid, including without limitation (i) income tax, provincial or

territorial sales tax, goods and services tax or harmonized sales tax (or similar value-added taxes), and whether paid directly to a Governmental

Body or to third parties which are ultimately required to be remitted to Governmental Bodies, (ii) any Tax deduction, and (iii) any

royalties paid to a Governmental Body in respect of Minerals; |

| (e) | cost of Minerals purchased in the market to deliver under the Stream Agreement or any Permitted Prepay,

if applicable; |

| (f) | amounts paid in such period in respect of Debt referred to in paragraph (i) of the definition thereof; |

| (g) | amounts deposited in such period as cash collateral to any Person other than the Collateral Agent; |

| (h) | cash on hand used to fund a Permitted Acquisition; |

| (i) | the aggregate amount of financing charges (including original issue discount), fees, commissions and other

expenses (other than interest and principal payments) paid in cash on account of such period with respect to Debt, other than in respect

of Capitalized Lease Obligations or Purchase Money Obligations; |

| (j) | Capital Expenditures, other than Capital Expenditures funded with the proceeds of: |

| (k) | all other costs and expenses paid in cash in such period. |

| 1.1.30 | “Change of Control” means: |

| (i) | any Person or Persons acting jointly or in concert (within the meaning of the Securities Act (Ontario))

acquires, together with all other voting shares held by such Person or Persons, control or direction over 50% of the outstanding voting

shares of any Obligor, or otherwise acquires the ability to elect a majority of the Board of such Obligor; or |

| (ii) | with respect to any Obligor, the occupation of a majority of the seats (other than vacant seats) on its

Board by Persons who were neither (a) nominated by its Board nor (b) appointed by directors so nominated; or |

| (iii) | the acquisition of direct or indirect Control of any Obligor by any Person or group of Persons acting

jointly or otherwise in concert; or |

| (iv) | the Disposition of all or substantially all or any substantial portion of the assets of the Obligors,

taken as a whole, except to another Obligor; or |

| (v) | any Subsidiary of the Borrower which is an Obligor ceases to be a wholly-owned Subsidiary of the Borrower; |

or Borrower, or any of its Subsidiaries,

as applicable, takes any actions to effect any of the foregoing.

| 1.1.31 | “Claim” has the meaning defined in Section 3.10.2. |

| 1.1.32 | “Collateral” means the Project Property and all the presently held and future acquired

undertaking, property and assets of each Obligor, including for certainty the equity interests of each Guarantor, but excluding the Excluded

Assets. |

| 1.1.33 | “Collateral Agent” means [xx] in its capacity as collateral agent for the Lenders. |

| 1.1.34 | “Commitment” means, in respect of each Lender, the amount specified with respect to

such Lender in Schedule A (which will be amended and distributed to all parties by the Administrative Agent from time to time to

reflect any changes thereto), as such amount may be reduced from time to time by such Lender’s Applicable Percentage of the amount

of any prepayments or repayments required or made hereunder or by the cancellation of any unused portion of the Facility. |

| 1.1.35 | “Common Shares” means the common shares in the capital of the Borrower which the Borrower

is authorized to issue. |

| 1.1.36 | “Completion” means, in relation to the Project, the satisfaction or fulfillment of

each of the conditions set forth in Schedule 1.1.36: |

| 1.1.37 | “Completion Date” means the date on which Completion occurs. |

| 1.1.38 | “Completion Outside Date” means the earlier of (i) June 30, 2029 and (ii) 30

months after the Obligors receive the final Material Project Authorization needed for the development, construction and operation of the

Project, except for those Material Project Authorizations agreed not to be required by the First Advance pursuant to Section 8.2.9. |

| 1.1.39 | “Compliance Certificate” means a certificate of the Chief Executive Officer or the

Chief Financial Officer of the Borrower in the form set out in Schedule 1.1.39. |

| 1.1.40 | “Consolidated Basis” means, in respect of any calculations or determinations hereunder

in respect of a Person, the consolidated financial position or results of operations, as the case may be, of such Person and all of its

Subsidiaries determined on a consolidated basis in accordance with IFRS. |

| 1.1.41 | “Contract” means any agreement, contract, lease, license, mineral claim, option, indenture,

mortgage, deed of trust, debenture, note or other instrument, arrangement, understanding or commitment. |

| 1.1.42 | “Control” means, in respect of a particular Person, the possession, directly or indirectly,

of the power to direct or cause the direction of the management or policies of such Person, whether through the ability to exercise voting

power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto. |

| 1.1.43 | “Copper Exploration Concessions” means the mining concessions relating to the exploration

of copper set forth in Schedule 1.1.43. |

| 1.1.44 | “Corrective Action Plan” means a written plan from the Borrower to correct and remedy

all damage and adverse consequences caused by any material failure by the Project to comply with any applicable Environmental and Social

Requirements, including a time schedule, for implementing such proposed action to remedy the identified damage and adverse consequences,

which comprises the start date, the end date and (if any) the key milestones. |

| 1.1.45 | “Cost to Complete Certificate” means a certificate in the form of Schedule 1.1.45. |

| 1.1.46 | “Debt” means, at any time, with respect to any Person on a Consolidated Basis, without

duplication and without regard to any interest component thereof (whether actual or imputed) that is not due and payable, the aggregate

of all indebtedness of that Person at that time that according to IFRS are required to appear in that Person’s financial statements

as such including without limitation the following amounts, each calculated in accordance with IFRS: |

| (a) | all obligations, including by way of overdraft and drafts or orders accepted representing extensions of

credit, that would be considered to be indebtedness for borrowed money, and all obligations, whether or not with respect to the borrowing

of money, that are evidenced by bonds, debentures, notes or other similar instruments; |

| (b) | the face amount of all bankers’ acceptances and similar instruments; |

| (c) | all liabilities upon which interest charges are customarily paid by that Person, other than liabilities

for Taxes; |

| (d) | any capital stock of that Person, or of any Subsidiary of that Person, which capital stock, by its terms

or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder, or upon the

happening of any event, matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise, or is redeemable at

the option of the holder thereof, in whole or in part; |

| (e) | all Capitalized Lease Obligations, synthetic lease obligations, obligations under Sale-Leasebacks and

Purchase Money Obligations; |

| (f) | letters of credit and similar instruments; |

| (g) | accounts payable and accruals that are over ninety (90) days past due; |

| (h) | the mark-to-market amount (to the extent “under water” from the perspective of such Person)

of any hedging, swap, forward or other derivative transaction where such amount has been accelerated or has otherwise become due and payable; |

| (i) | contingent liabilities in respect of performance bonds, surety bonds and product warranties, and any other

contingent liability, in each case only to the extent that the contingent liability is required by IFRS to be treated as a liability on

a balance sheet of the Person contingently liable; and |

| (j) | the amount of the contingent liability under any Guarantee in any manner of any part or all of an obligation

of another Person of the type included in items (a) through (i) above. |

| 1.1.47 | “Debt Service” for a period means, on a consolidated basis, the sum of: |

| (a) | Interest and fees (including original issue discount and Availability Fees) paid or payable in respect

of the Loans or Commitments for a period, |

| (b) | all scheduled principal payments in respect of the Loans for a period, |

| (c) | all payments required to be made in such period in respect of Capitalized Lease Obligations or Purchase

Money Obligations. |

Where a payment identified above would

be payable on a date within a period (the “calculation period”) that is not a Business Day (the “original date”)

and as a result becomes payable on a date that is no longer within such calculation period, Debt Service for such calculation period shall

be calculated as if such payment was payable on the original date.

| 1.1.48 | “Debt Service Coverage Ratio” for a period, means the ratio of CFADS for such period

to Debt Service for such period. |

| 1.1.49 | “Default” means any event or condition which, upon notice, lapse of time, or both,

would constitute an Event of Default. |

| 1.1.50 | “Default Rate” means [REDACTED – Commercially Sensitive Information.]. |

| 1.1.51 | “Defaulting Lender” means any Lender or, in the case of paragraph (c) below,

a Lender’s parent (being any Person that directly or indirectly Controls a Lender): |

| (a) | that has failed to fund its portion of any Advances required to be made by it hereunder within two (2) Business

Days; |

| (b) | that has notified the Administrative Agent or the Borrower (verbally or in writing) that it does not intend

to or is unable to comply with any of its funding obligations under this Agreement or has made a public statement to that effect or to

the effect that it does not intend to or is unable to fund advances generally under credit arrangements to which it is a party; or |

| (c) | that becomes insolvent, has been deemed insolvent by a court of competent jurisdiction, or becomes the

subject of bankruptcy or insolvency proceedings. |

| 1.1.52 | “Defined Benefit Provision” has the same meaning ascribed that term in subsection 147.1(1) of

the Tax Act. |

| 1.1.53 | “Development Plan” means a comprehensive plan for the construction and development

of the Project consistent with the Definitive Feasibility Study, to be delivered to and agreed upon by the Lenders in accordance with

the term of this Agreement, and including the Integrated Master Schedule, definitive construction and operating budgets, the source and

application of funds required to achieve Completion and to thereafter operate and maintain the Project in accordance with the Mine Plan,

as such plan may be amended from time to time in accordance with this Agreement. |

| 1.1.54 | “Definitive Feasibility Study” means the Definitive Feasibility Study in respect of

the Project prepared in accordance with NI 43-101 and approved and adopted by the Board in respect of the development of the Project and

dated January ¨, 2024 provided to the Majority Lenders, except that the financial model

set out in such Definitive Feasibility Study (i) is superseded and will be deemed replaced by the Project Financing Rebaseline, and

(ii) will be disregarded for all purposes of this Agreement as the same may be amended in accordance

with Section 6.12.17. |

| 1.1.55 | “Delivery Parties” (i) while there are three or fewer Lenders, means all of the

Lenders, and (ii) if there are more than three Lenders, means the Administrative Agent. |

| 1.1.56 | “Disposition” means any sale, assignment, transfer, conveyance, lease, license, granting

of an option or other disposition (or agreement to dispose) of any nature or kind whatsoever of any property or of any right, title or

interest in or to any property in accordance with this Agreement, but does not include the payment of a dividend, and the verb “Dispose”

has a correlative meaning. |

| 1.1.57 | “Effective Date” means the date on which all of the conditions precedent set forth

in Section 8.1 are satisfied by the Borrower or waived by the Lenders. |

| 1.1.58 | “Employee Benefit Plans” means all employee benefit plans of any kind or nature, but

excluding statutory plans including, for the avoidance of doubt, the Canada Pension Plan. |

| 1.1.59 | “Encumbrance” means any mortgage, debenture, pledge, hypothec, lien, charge, assignment

by way of security, contractual right of set-off, consignment, lease, hypothecation, security interest, including a purchase money security

interest, or other security agreement, trust or arrangement having the effect of security for the payment of any debt, liability or obligation,

and “Encumbrances”, “Encumbrancer”, “Encumber” and “Encumbered”

shall have corresponding meanings. |

| 1.1.60 | “Environmental and Social Impact Assessment” or “ESIA” means a comprehensive

document of the Project’s potential environmental and social risks and impacts, which may be amended, revised, supplemented or replaced

from time to time in accordance with Section 8.1.2. The ESIA includes the draft Environmental Assessment (“EA”)

to be submitted to the applicable regulatory agency by the Fiscal Quarter ending September 30, 2024 and to be replaced by the EA

approved by such regulatory agency. |

| 1.1.61 | “Environmental and Social Management Plan” or “ESMP” means plans

that summarize the Borrower’s commitments to address and mitigate risks and impacts identified as part of the ESIA, through avoidance,

minimization, and compensation and offset, which may be supplemented, amended or modified from time to time in accordance with the frameworks

set out in such plans and this Agreement. |

| 1.1.62 | “Environmental and Social Laws” means, to the extent binding on the Project or the

Borrower, all applicable statutes, laws, regulations, orders, by-laws, decrees or orders of any applicable Governmental Body, any international

treaty, convention or rule applicable to the Project and any administrative or judicial decisions, judgements or orders and in each

case having the force of law at the time and relating to pollution, the protection of the environment, preservation or reclamation of

natural resources, human health and safety, Hazardous Substances, the assessment of environmental and social impacts of, or the rehabilitation

or reclamation and closure of lands used in connection with the Project or Business, or the management, Release or threat of Release of

any harmful or deleterious substances. |

| 1.1.63 | “Environmental and Social Management System” or “ESMS” means the

overarching environmental, social, health and safety management system in place for the Project for the implementation of the environmental

and social management and monitoring requirements of this Agreement and as set out in the ESMPs. |

| 1.1.64 | “Environmental and Social Requirements” means: all Environmental and Social Laws, all

environmental Authorizations, conformance with the Equator Principles, and the Canadian Dam Association (“CDA”) tailings

standards and dam safety reviews consistent with Good Industry Practice, in each case as applicable to the then current phase of the Project. |

| 1.1.65 | “Environmental Laws” means all Applicable Laws relating to pollution, the protection

of the environment, preservation or reclamation of natural resources, human health and safety, Hazardous Substances, the assessment of

environmental and social impacts or the rehabilitation, reclamation and closure of lands used in connection with the Project or Business,

or the management, Release or threat of Release of any harmful or deleterious substances. |

| 1.1.66 | “Environmental Liability” means any liability, fixed or contingent, (including any

liability for damages, costs of environmental remediation, fines, penalties or indemnities) resulting from or based upon (a) violation

of any Environmental Law, (b) the generation, use, handling, transportation, storage or treatment of any Hazardous Substances, (c) exposure

to any Hazardous Substances, (d) the imposition of any environmental Encumbrances, (e) the Release or threatened Release of

any Hazardous Substances or (f) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or

imposed with respect to any of the foregoing. |

| 1.1.67 | “Equity Financings” has the meaning ascribed to it in Section 8.2.10. |

| 1.1.68 | “Equator Principles” means those principles so entitled and described in “The

‘Equator Principles – July 2020’ - A financial industry benchmark for determining, assessing and managing social

and environmental risk in Projects” and available at: http://equator-principles.com/about/, as adopted as at the date of this Agreement,

and including all applicable IFC EHS guidelines required therein. |

| 1.1.69 | “Environmental and Social Action Plan” or “ESAP” means a plan that

describes and prioritizes the actions needed to address any gaps in the ESMPs, the ESMS, or Stakeholder Engagement process documentation

to bring the Project in line with applicable standards as defined in the Equator Principles and in accordance with Section 6.15. |

| 1.1.70 | “Equity Interests” means, with respect to any Person, shares in the capital of (or

other ownership or profit interests in) such Person, warrants, options or other rights for the purchase or acquisition from such Person

of shares in the capital of (or other ownership or profit interests in) such Person, securities convertible into or exchangeable for shares

in the capital of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition

from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including,

without limitation, partnership, member or trust interests therein), whether voting or non-voting, and whether or not such shares, warrants,

options, rights or other interests are outstanding on any date of determination; |

| 1.1.71 | “Event of Default” has the meaning ascribed to it in Section 9.1. |

| 1.1.72 | “Exchanges” means, together, the TSX and NYSE. |

| 1.1.73 | “Excluded Assets” means (i) the Snip Project, (ii) any Copper Exploration

Concessions which are not Project Real Property, (iii) any assets located in Mexico, and (iv) the Excluded Subsidiaries and

their property and assets from time to time provided that such property and assets shall at no time include any Project Property. |

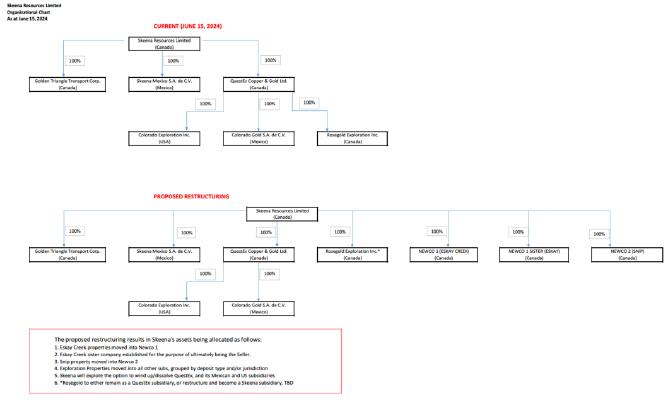

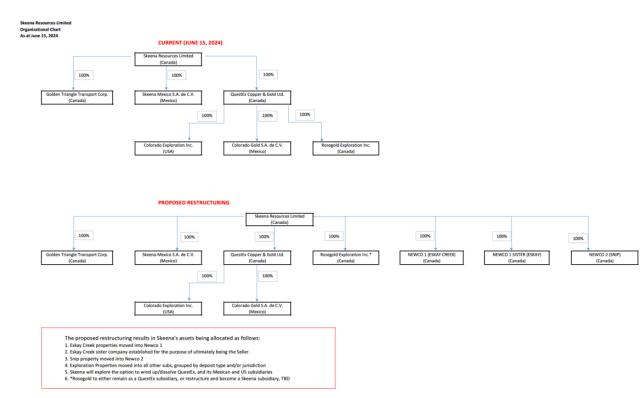

| 1.1.74 | “Excluded Subsidiaries” means (i) Golden Triangle Transport Corp., Skeena Mexico

S.A. de C.V., QuestEx Copper & Gold Ltd., Colorado Exploration Inc., Colorado Gold S.A. de C.V. and Rosegold Exploration Inc.,

(ii) any Subsidiary formed after the date hereof that is not a Project Subsidiary and that the Majority Lenders agree is an Excluded

Subsidiary, and (iii) any Subsidiary acquired pursuant to a Permitted Acquisition that is deemed pursuant to the definition thereof

to be an Excluded Subsidiary. |

| 1.1.75 | “Excluded Taxes” means any of the following Taxes solely imposed on or with respect

to a Lender or required to be withheld or deducted from a payment to a Lender: (a) Taxes imposed on or measured by net income (however

denominated), franchise Taxes, and branch profits Taxes, in each case (i) imposed as a result of a Lender being organized under the

laws of, or having its principal office or its applicable lending office located in, the jurisdiction imposing such Tax (or any political

subdivision thereof) or (ii) that are Other Connection Taxes; and (b) any Taxes imposed under FATCA; (c) Taxes attributable

to such Lender’s failure to comply with Section 3.5, and (d) any Canadian withholding Taxes arising as a result of (i) a

Lender not dealing at arm’s length (within the meaning of the Tax Act) with an Obligor (ii) a Lender being a “specified

non-resident shareholder” as defined in Subsection 18(5) of the Tax Act) of an Obligor or not dealing at arm’s length

(for the purposes of the Tax Act) with a “specified shareholder” (as defined in subsection 18(5) of the Tax Act) of an

Obligor, or (iii) a Lender being a “specified entity” (as defined in Subsection 18.4(1) of the Tax Act) in respect

of an Obligor. |

| 1.1.76 | “Expropriation Event” means an expropriatory act or series of expropriatory acts, comprising

confiscation, nationalization, requisition, deprivation, sequestration and/or similar acts, by law, order, executive or administrative

action or otherwise of any Governmental Body, the result of which expropriatory act or series of expropriatory acts is that (i) all

or substantially all of the rights, privileges and benefits pertaining to or associated with all or any material part of the Project cease

being for the benefit or entitlement of the Project Entities, whether as a result of ceasing to own such part of the Project or otherwise;

or (ii) condemns, nationalizes, seizes, confiscates, or otherwise expropriates, all or any material portion of the share capital

of any of the Project Entities, or assumes custody or control of all or any material portion of the share capital of any of the Project

Entities owned, directly or indirectly, by any of the other Project Entities. |

| 1.1.77 | “Facility” means the $350,000,000 multi-draw senior secured term facility provided

by the Lenders hereunder, as may be increased or reduced pursuant to the terms hereof. |

| 1.1.78 | “FATCA” means Sections 1471 through 1474 of the United States Internal Revenue

Code (“IRC”) as of the Effective Date (or any amended or successor version that is substantively comparable and

not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreement

entered into pursuant to Section 1471(b)(i) of the IRC, or any fiscal or regulatory legislation, treaty, rules or

practices adopted pursuant to any intergovernmental agreement entered into in connection with the implementation of such Sections

of the IRC; |

| 1.1.79 | “Federal Funds Effective Rate” for any day, means the rate on overnight federal funds

transactions calculated by the Federal Reserve Bank of New York as the federal funds effective rate, as published on the next succeeding

Business Day by the Federal Reserve Bank of New York, or, if such rate is not so published for any day that is a Business Day, the average

of the quotations for that day on overnight federal funds transactions received by the Lenders from three depository institutions of recognized

standing selected by the Lenders, in each case calculated on the basis of a 360-day year and for the actual number of days elapsed. |

| 1.1.80 | “Financial Assistance” given by any Person (the “Financial Assistance Provider”)

to or for the account or benefit of any other Person (the “Financial Assistance Recipient”) means any direct or indirect

financial assistance of any nature, kind or description whatsoever (by means of loan, Guarantee or otherwise) of or from such Financial

Assistance Provider, or of or from any other Person with recourse against such Financial Assistance Provider or any of its property, to

or for the account or benefit of the Financial Assistance Recipient (including Investments in a Financial Assistance Recipient, Acquisitions

from a Financial Assistance Recipient, and gifts or gratuities to or for the account or benefit of a Financial Assistance Recipient). |

| 1.1.81 | “Financial Statements” means the audited consolidated financial statements of the Borrower

as at and for the year ended December 31, 2023, including the notes thereto, together with the auditor’s report thereon, and

the unaudited consolidated interim financial statements of the Borrower for the period ending March 31, 2024, and each subsequent

set of audited annual financial statements (including the notes thereto, together with the auditor’s report thereon) and unaudited

interim financial statement of the Borrower which are delivered to the Administrative Agent or the Lenders or which form part of the Public

Disclosure Documents. |

| 1.1.82 | “First Advance” means the first Advance under the Facility to be made by the Lenders

in favour of the Borrower. |

| 1.1.83 | “First Advance Date” means the date on which all of the conditions precedent in respect

of the First Advance set forth in 8.2 are satisfied by the Borrower or waived by the Lenders. |

| 1.1.84 | “First Payment Date” has the meaning ascribed to such term in Section 2.4.1. |

| 1.1.85 | “Fiscal Quarter” means each calendar quarter ending on the last day of March, June,

September and December of each year. |

| 1.1.86 | “Fiscal Year” means the period of January 1 to December 31 of each year. |

| 1.1.87 | “FN Convertible Debenture” means the $25,000,000 unsecured convertible debenture dated

December 18, 2023 by Franco-Nevada Corporation, as holder, the Borrower, as the corporation, as amended and supplemented to the date

hereof and as otherwise amended and supplemented with the consent of the Majority Lenders. |

| 1.1.88 | “Framework Documents” means the HSEC Policy, the ESMS, ESMPs and any applicable Corrective

Action Plan. |

| 1.1.89 | “Good Industry Practice” means, in relation to any decision or undertaking, the exercise

of that degree of diligence, skill, care, prudence, oversight, economy and stewardship which is commonly observed or would reasonably

be expected to be observed by skilled and experienced professionals in the Canadian mining industry engaged in the same type of undertaking

under the same or similar circumstances. |

| 1.1.90 | “Governmental Body” means any domestic or foreign federal, provincial, territorial,

regional, state, municipal or other government, governmental department, agency, authority or body (whether administrative, legislative,

executive or otherwise), court, tribunal, commission or commissioner, bureau, minister or ministry, board or agency, or other regulatory

authority, including any securities regulatory authorities or stock exchange. |

| 1.1.91 | “Group Members” means, collectively, Borrower and the Subsidiaries, and “Group

Member” means any one of them. |

| 1.1.92 | “Guarantee” means, with respect to any Person, any direct or indirect liability, contingent

or otherwise, of such Person with respect to any indebtedness, letter of credit, lease, dividend or other obligation of another, including

any such obligation directly or indirectly guaranteed, endorsed (otherwise than for collection or deposit in the ordinary course of business)

or discounted or sold with recourse by such Person, or in respect of which such Person is otherwise directly or indirectly liable, including

any such obligation in effect guaranteed by such Person through any agreement (contingent or otherwise) to purchase, repurchase or otherwise

acquire such obligation or any security therefor, or to provide funds for the payment or discharge of such obligation (whether in the

form of loans, advances, stock purchases, capital contributions or otherwise), or to maintain the solvency or any balance sheet or other

financial condition of the obligor of such obligation (including keep-well covenants), or to make payment for any products, materials

or supplies or for any transportation or services regardless of the non-delivery or non-furnishing thereof, in any such case if the purpose

or intent of such agreement is to provide assurance that such obligation will be paid or discharged, or that any agreements relating thereto

will be complied with, or that the lender of such obligation will be protected against loss in respect thereof. The amount of any guarantee

shall be equal to the outstanding principal amount of the obligation guaranteed or such lesser amount to which the maximum exposure of

the guarantor shall have been specifically limited. |

| 1.1.93 | “Guarantors” means, collectively, all Project Subsidiaries and any other Person that

holds or acquires a direct or indirect interest in any of the Project Property, or Equity Interests or Subordinated Intercompany Debt

of any Project Subsidiary other than any holder of Equity Interests of the Borrower, and “Guarantor” means any one

of them, as the context may require. |

| 1.1.94 | “Hazardous Substances” means any substance, material or waste defined, regulated, listed

or prohibited by Environmental Laws, including pollutants, contaminants, chemicals, deleterious substances, dangerous goods, hazardous

or industrial toxic wastes or substances, tailings, wasterock, radioactive materials, flammable substances, explosives, petroleum and

petroleum products, polychlorinated biphenyls, chlorinated solvents and asbestos. |

| 1.1.95 | “HSEC Policy” means the integrated health, safety, environmental and community policies

and operating guidelines for the Project adopted by the Borrower’s board of directors and delivered to the Administrative Agent,

and if applicable, the IESC, pursuant to this Agreement, as amended from time to time in accordance with this Agreement. |

| 1.1.96 | “IFRS” means the International Financial Reporting Standards adopted by the International

Accounting Standards Board from time to time. |

| 1.1.97 | “Inchoate Lien” means, with respect to any property or asset of any Person, the following

liens: |

| (a) | any lien for Taxes, assessments or governmental charges not yet due or being contested in good faith by

appropriate proceedings and for which a reasonable reserve has been made in accordance with IFRS; and |

| (b) | undetermined or inchoate liens, privileges or charges incidental to current operations which have not

been filed (or are not required to be filed) pursuant to law against such Person’s property or assets or which relate to obligations

not due or delinquent. |

| 1.1.98 | “Indemnified Taxes” means Taxes, other than Excluded Taxes, imposed on or with respect

to any payment by or on account of any obligation of the Borrower under any Loan Documents. |

| 1.1.99 | “Independent Engineer” means an internationally recognized mine engineering firm nominated

by the Borrower and acceptable to the Majority Lenders, acting reasonably. |

| 1.1.100 | “Independent Environmental and Social Consultant” or “IESC” means

a qualified independent firm or consultant (not directly tied to the client), nominated by the Borrower and acceptable to the Majority

Lenders, acting reasonably. |

| 1.1.101 | “Indigenous Group” means any First Nation, Métis or Inuit indigenous and/or

aboriginal band, group, band council, tribal council or other governing body of indigenous peoples of Canada, or any similar indigenous,

aboriginal or tribal group of the United States with asserted or established rights in Canada |

| 1.1.102 | “Indigenous Group’s Claims” means any written claims, assertions or demands,

whether proven or unproven, made by any Indigenous Group to the Obligors or a Governmental Body, or any representatives thereof, in respect

of asserted or proven aboriginal rights, aboriginal title, treaty rights or any other aboriginal or indigenous interest in or to all or

any portion of the Project or the Project Real Property. |

| 1.1.103 | “Indigenous Group’s Information” means any and all written and material communications

and documentation of which the Obligors have knowledge (or, assuming due and reasonable inquiry, ought to know) and in their possession,

including electronic or other form related to any (i) Indigenous Group’s Claims; (ii) Indigenous Group making any Indigenous

Group’s Claims; (iii) Indigenous Group agreement, or (iv) any Governmental Body, or representatives thereof (including

the issuance of required permits, licences and other governmental authorizations) involving any Indigenous Group’s Claims or Indigenous

Group in relation to the Project or the Project Real Property. |

| 1.1.104 | “Initial Lender” means OMF Fund IV SPV G LLC. |

| 1.1.105 | “Initial Equity Financing” means the common share equity financing of the Borrower

to be completed on or prior to the First Advance Date for the purchase of 3,418,702 Common Shares of the Borrower by the Subscriber pursuant

to the Subscription Agreement plus 12,021,977 common shares of the Borrower pursuant to the Purchase Agreement. |

| 1.1.106 | “Insurance Consultant” means an insurance consultant engaged by the Initial Lender

in consultation with the Borrower. |

| 1.1.107 | “Insurance Requirements” means the requirements set forth in the report of the Insurance

Consultant. |

| 1.1.108 | “Integrated Master Schedule” means the comprehensive Level 3 development, construction

and commissioning schedule for the Project, to be delivered to and agreed upon by the Lenders in accordance with the terms of this Agreement,

as the same may be amended, revised, supplemented or replaced from time to time in accordance with the terms of this Agreement. |

| 1.1.109 | “Intercreditor Agreement” means the intercreditor agreement to be entered into among

the Administrative Agent, on behalf of the Lenders under this Agreement, the Collateral Agent, the collateral agent under the Stream Agreement,

the Borrower and the Guarantors, as the same may be amended, modified, supplemented or replaced from time to time. |

| 1.1.110 | “Interest Period” means the period commencing on (and including) the date of the First

Advance, to (but excluding) the first Quarterly Date, and thereafter each period from (and including) each Quarterly Date, to (but excluding)

the earlier of (x) the next Quarterly Date, and (y) the Maturity Date, provided that if the Administrative Agent reasonably

determines that the Benchmark is not available or not ascertainable for such period, then Interest Period shall mean the period from (and

including) the last day of each calendar month, to (but excluding) the first day of the following calendar month, and provided further

that if the Administrative Agent reasonably determines that the Benchmark is not available or not ascertainable for such period, then

Interest Period shall mean the period from (and including) each Quarterly Date, to (but excluding) the second following Quarterly Date. |

| 1.1.111 | “Interest Rate” means [REDACTED – Commercially Sensitive Information.]. |

| 1.1.112 | “Investment” means, with respect to any Person, the making by such Person of: (a) any

direct or indirect investment in or purchase or other acquisition of the securities of or an Equity Interest in any other Person, (b) any

loan or advance to, or arrangement for the purpose of providing funds or credit to (excluding extensions of trade credit in the ordinary

course of business in accordance with customary commercial terms), any other Person, or (c) any capital contribution to (whether

by means of a transfer of cash or other property or any payment for property or services for the account or use of) any other Person;

provided that, for greater certainty, an Acquisition shall not be treated as an Investment. |

| 1.1.113 | “Key Transaction Agreements” means, collectively, each Loan Document, the Stream Agreement

and the Subscription Agreement. |

| 1.1.114 | “Lenders” means the lenders party hereto from time to time, and their respective permitted

successors and assigns. |

| 1.1.115 | “Liquidity” means the sum of unencumbered (other than in favour of the Collateral Agent

and the collateral agent under the Stream Agreement) and unrestricted cash and cash equivalents of the Obligors that are subject to the

Security and deposited in accounts over which the Collateral Agent has a blocked account agreement or control agreement. |

| 1.1.116 | “Loan” means any extension of credit by the Lenders under this Agreement. |

| 1.1.117 | “Loan Documents” means, collectively, this Agreement, the Security Documents, the Intercreditor

Agreement and all other agreements, instruments and documents from time to time (both before and after the date of this Agreement) delivered

to the Lenders, the Administrative Agent for the benefit of the Lenders in connection with this Agreement or the other Loan Documents

or the Collateral Agent for the benefit of the Lenders in connection with this Agreement or the other Loan Documents. |

| 1.1.118 | “Majority Lenders” means one or more Lenders holding greater than 50.1 % of the Commitments

or, if all Advances under the Facility have been made or the Commitments have otherwise been terminated or expired, of the Principal Amount

of the Loans, and further provided that if there are only two Lender it shall mean both Lenders. |

| 1.1.119 | “Material Adverse Effect” means, individually or in the aggregate, any event, change

or effect that would reasonably be expected to have a materially adverse effect on (i) the business, affairs, capitalization, assets,

liabilities, results of operations, condition (financial or otherwise) or prospects of the Borrower and its Subsidiaries, taken as a whole,

(ii) the development, construction or operation of the Project, (iii) the ability of any Obligor to consummate the transactions

contemplated by the Key Transaction Agreements or to perform their respective obligations under the Key Transaction Agreements, subject

to any replacement rights with respect to Material Contracts as set out herein, or (iv) the rights and remedies, taken as a whole,

of the Administrative Agent, the Collateral Agent or Lenders under the Key Transaction Agreements. |

| 1.1.120 | “Material Contracts” means (i) the Contracts listed on Schedule 1.1.120, (ii) any

Contract involving the payment or receipt by the Obligors in excess of C$25,000,000, (iii) any impact benefit agreement, (iv) any

Indigenous Group Royalty Interest, and (v) any other Contract the breach, loss or termination of which would reasonably be expected

to result in a Material Adverse Effect. |

| 1.1.121 | “Material Project Authorization” means the Project Authorizations listed on Part 1

and Part 2 of Schedule 1.1.121, and any other Project Authorization, the breach, loss or termination of which would be, or would

reasonably be expected to be, materially adverse to the development of the Project or the commencement and ongoing operation of commercial

production. |

| 1.1.122 | “Maturity Date” means September 30, 2031, provided that if such date is not a

Business Day, the Maturity Date shall be the next following Business Day. |

| 1.1.123 | “Monthly Report” means the monthly report in the form of Schedule 1.1.123. |

| 1.1.124 | “Mine Plan” means the proposed operating plan for the Project consistent with the Project

Financing Rebaseline, including without limitation the design throughput of the processing facilities, to be delivered to and agreed upon

by the Lenders in accordance with the terms of this Agreement, as the same may be amended, revised supplemented or replaced from time

to time in accordance with the terms of this Agreement. |

| 1.1.125 | “Minerals” means any and all marketable metal bearing material in whatever form or

state that is mined, produced, extracted or otherwise recovered from the Real Property, and including any such material derived from any

processing or reprocessing of any tailings, waste rock or other waste products originally derived from the Real Property, and including

ore and any other products resulting from the further milling, processing or other beneficiation of Minerals, including doré. |

| 1.1.126 | “Mining Rights” means mineral claims, prospecting licences, exploration licenses, mining

or mineral licenses or leases, mineral concessions and other forms of tenure or other rights to minerals or to work upon land for the

purpose of exploring for, developing or extracting minerals under any form of title recognized under the Applicable Laws, whether contractual,

statutory or otherwise, or any interest therein. |

| 1.1.127 | “Multi-Employer Plan” means a “multi-employer plan” within the meaning

of subsection 147.1(1) of the Income Tax Act, subsection 1(1) of the Pension Benefits Act (Ontario) or as such

similar terms are defined in similar pension standards legislation of Canada or a province. |

| 1.1.128 | “National Instrument 43-101” National Instrument 43-101 Standards of Disclosure

for Mineral Projects of the Canadian Securities Administrators and the companion policy thereto in effect from time to time. |

| 1.1.129 | “Net Asset Disposition Proceeds” means, in respect of items listed in (a) or (b) of

the definition of Permitted Asset Disposition, the aggregate net cash proceeds received by an Obligor therefrom after payment of reasonable

expenses, commissions and the like (including brokerage, legal, accounting and investment banking fees and commissions) incurred in connection

therewith. |

| 1.1.130 | “Net Insurance Proceeds” means the aggregate net cash proceeds of insurance received

by any Obligor after payment of reasonable expenses (including legal and accounting fees) incurred in connection therewith, and for certainty,

shall not include any insurance proceeds received on account of business interruption insurance or any substantially similar policy of

any Obligor. |

| 1.1.131 | “Net Liquidated Damages Proceeds” means the aggregate net cash proceeds of liquidated

damages received by an Obligor, net of (i) payment of reasonable expenses (including legal and accounting fees) incurred in connection

therewith, and (ii) reinvestment (or a contractual commitment for reinvestment) of such proceeds within 180 days of receipt of such

proceeds in the Project to rectify the issue(s) that gave rise to such proceeds. |

| 1.1.132 | “Net Proceeds” means an amount equal to the sum of all Net Asset Disposition Proceeds

and Net Liquidated Damages Proceeds received by the Obligors from and after the Effective Date. |

| 1.1.133 | “New Event” means: |

| 1.1.133.1 | an event not already described in any ESIA, Corrective Action Plan, ESAP, ESMPs or Authorizations; or |

| 1.1.133.2 | an event described in any of the preceding documents, which is the subject of a material negative change

in circumstances which has been identified. |

| 1.1.134 | “NYSE” means the New York Stock Exchange and any successor thereto. |

| 1.1.135 | “Obligations” means all indebtedness, liabilities and other obligations owed to the

Administrative Agent, the Collateral Agent and the Lenders hereunder or under any other Loan Document, whether actual or contingent, direct

or indirect, matured or not, now existing or hereafter arising. |

| 1.1.136 | “Obligors” means, collectively, the Borrower and each Guarantor, and “Obligor”

means any one of them. |

| 1.1.137 | “OFAC” means The Office of Foreign Assets Control of the US Department of the Treasury. |

| 1.1.138 | “Officer’s Certificate” means a certificate in form satisfactory to the Administrative

Agent, acting reasonably and in the case of any such certificate of the Borrower, signed by a duly authorized officer of the Borrower. |

| 1.1.139 | “Offtake Agreement” has the meaning ascribed thereto in the Stream Agreement. |

| 1.1.140 | “Operating Costs” means those cash expenditures in connection with the development,

construction and operation of the Project, all as determined in accordance with IFRS. |

| 1.1.141 | “Order” means any order, directive, decree, judgment, ruling, award, injunction, direction

or request of any Governmental Body or other decision-making authority of competent jurisdiction. |

| 1.1.142 | “Other Connection Taxes” means, with respect to any Lender, Taxes imposed as a result

of a present or former connection between such Lender and the jurisdiction imposing such Taxes (other than a connection arising solely

from such Lender having executed, delivered, become a party to, performed its obligations under, received payments under, received or

perfected a security interest under or, enforced or engaged in any other transaction pursuant to, any Loan Document). |

| 1.1.143 | “Other Rights” means all licenses, approvals, authorizations, consents, rights (including

surface rights, access rights and rights of way), privileges, mineral claims or franchises held by any Obligor or required to be obtained

from any Person (other than a Governmental Body), for exploration, development, construction and operation of the Project, as such exploration,

development, construction and operation is contemplated by the Planning Documents. |

| 1.1.144 | “Permitted Acquisition” means, (i) prior to the Completion Date, an Acquisition

completed with the prior written consent of the Majority Lenders, and (ii) following the Completion Date, an Acquisition that meets

the following criteria: |

| (a) | such Acquisition is not a hostile acquisition; |

| (b) | the Acquisition is of a business similar to the business of the Obligors; |

| (c) | the purchase price for such Acquisition is funded by: |

| (a) | the issuance of Equity Interests by the Borrower; or |

| (b) | up to $10,000,000 that is cash on hand of the Obligors, provided that the Borrower shall be in compliance

with the financial covenants in Sections 6.13 and 6.14 on a pro forma basis after giving effect to such Acquisition; or |

| (c) | cash on hand of the Excluded Subsidiaries; or |

| (d) | a combination of the foregoing, |

provided that, (i) if any of the

funding for such Acquisition includes cash on hand of the Obligors then the target of such Acquisition (including any assets acquired

and the Equity Interests and assets of any Person acquired, as well as its Subsidiaries) shall be required to become Obligors in accordance

with Section 5.2, and (ii) if any such Acquisition is completed by an Excluded Subsidiary without the use of cash on hand of

the Obligors, then the target of such Acquisition shall be an Excluded Subsidiary.

| 1.1.145 | “Permitted Asset Disposition” means, as at any particular time, a sale, transfer or

other Disposition of: |

| (a) | property and assets to one or more wholly-owned Subsidiaries of the Borrower (that are not Excluded Subsidiaries)

pursuant to and in accordance with the Reorganization Plan; |

| (b) | tangible personal property that is no longer required in the conduct of the Business or is being replaced; |

| (c) | assets of one Obligor to another Obligor, provided that they are subject at all times to the Security; |

| (d) | assets of the Obligors that are not Project Property, including any Excluded Assets, provided that any

disposition of such assets is made on arm’s length terms for a purchase price consisting solely of cash and/or publicly-traded securities;

and |

| (e) | Minerals, in accordance with the Stream Agreement, Offtake Agreement, Permitted Prepay Agreement or otherwise

in the ordinary course of business pursuant to one or more sales contracts with third party purchasers, which are on arm’s length

terms and in compliance with the terms of this Agreement; |

| 1.1.146 | “Permitted Encumbrances” means, in respect of any Collateral, any of the following: |

| (a) | Encumbrances arising from court or arbitral proceedings or any judgment rendered, claim filed or registered

related thereto, provided that the judgment or claim secured thereby are being contested in good faith by such Person, adequate reserves

with respect thereto are maintained on the books of such Person in accordance with IFRS, execution thereon has been stayed and continues

to be stayed and such Encumbrances do not result in an Event of Default or materially impair the operation of the Business of any Obligor; |

| (b) | good faith deposits made in the ordinary course of business to secure the performance of bids, tenders,

contracts (other than for the repayment of borrowed money), leases, surety, customs, performance bonds and other similar obligations,