Sonida Senior Living, Inc. (“Sonida” or the “Company”) (NYSE:

SNDA), a leading owner, operator and investor in senior housing

communities, announced today that it has priced an underwritten

public offering of 4,300,000 shares of its common stock upsized

from 4,000,000 shares at launch. The price to the public of the

offering is $27.00 per share. The Company has granted the

underwriters a 30-day option to purchase up to an additional

645,000 shares of the Company’s common stock. The offering is

expected to close on August 19, 2024, subject to customary closing

conditions.

The Company intends to use $102.9 million of the net proceeds

from the offering to fund the purchase price for the proposed

acquisition of eight senior living communities. The Company intends

to use the remaining net proceeds from the offering, including any

net proceeds from the underwriters’ exercise of their option to

purchase additional shares, for other general corporate

purposes.

Morgan Stanley, RBC Capital Markets, LLC and BMO Capital Markets

are acting as joint lead book-running managers of the offering.

The offering is being made only by means of a prospectus

supplement and an accompanying base prospectus, each of which is

part of an effective shelf registration statement previously filed

by the Company with the Securities and Exchange Commission (the

“SEC”). An electronic copy of the preliminary prospectus supplement

and accompanying base prospectus may be obtained at no charge on

the SEC’s website at www.sec.gov. A copy of the preliminary

prospectus supplement and the accompanying base prospectus relating

to the offering may also be obtained from the offices of:

Morgan Stanley & Co. LLC

1585 Broadway, New York, New York 10036,

Attention: Equity Syndicate Desk, with a copy to the Legal

Department

RBC Capital Markets, LLC

Brookfield Place, 200 Vesey Street, 8th

Floor

New York, New York 10281, Attention:

Equity Syndicate Desk

BMO Capital Markets Corp.

151 W 42nd Street, 32nd Floor, New York,

New York 10036, Attention: Equity Syndicate Department, with a copy

to the Legal Department

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of any securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading owner,

operator and investor in independent living, assisted living and

memory care communities and services for senior adults. The Company

provides compassionate, resident-centric services and care as well

as engaging programming operating 83 senior housing communities in

20 states with an aggregate capacity of approximately 9,000

residents, including 70 communities which the Company owns

(including eight communities in which the Company owns varying

interests through two separate joint ventures), and 13 communities

that the Company manages on behalf of a third-party.

For more information, visit www.sonidaseniorliving.com or

connect with the Company on Facebook, Twitter or LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements, which

are subject to certain risks and uncertainties that could cause the

Company’s actual results and financial condition to differ

materially from those indicated in the forward-looking statements,

including, but not limited to, the risks, uncertainties and factors

identified from time to time in the Company’s filings with the SEC;

the Company’s ability to consummate the proposed equity offering in

the size and manner anticipated; the Company’s ability to generate

sufficient cash flows from operations, additional proceeds from

equity issuances and debt financings, and proceeds from the sale of

assets to satisfy its short- and long-term debt obligations and to

fund its acquisitions and capital improvement projects to expand,

redevelop, and/or reposition its senior living communities;

increases in market interest rates that increase the cost of

certain of the Company’s debt obligations; increased competition

for, or a shortage of, skilled workers, including due to general

labor market conditions, along with wage pressures resulting from

such increased competition, low unemployment levels, use of

contract labor, minimum wage increases and/or changes in overtime

laws; the Company’s ability to obtain additional capital on terms

acceptable to it; the Company’s ability to extend or refinance its

existing debt as such debt matures; the Company’s compliance with

its debt agreements, including certain financial covenants and the

risk of cross-default in the event such non-compliance occurs; the

Company’s ability to complete acquisitions, including its proposed

acquisition of eight senior living communities, and dispositions

upon favorable terms or at all including the possibility that the

expected benefits and our projections related to such acquisitions

may not materialize as expected, that such acquisitions not being

timely completed, if completed at all, that prior to the completion

of such acquisitions, the targets’ businesses could experience

disruptions due to transaction-related uncertainty or other factors

making it more difficult to maintain relationships with employees,

residents, other business partners or governmental entities, and

that we may be unable to successfully implement integration

strategies or achieve expected synergies and operating efficiencies

within our expected timeframes or at all; the risk of oversupply

and increased competition in the markets which the Company

operates; the Company’s ability to improve and maintain controls

over financial reporting and remediate the identified material

weakness discussed in its recent Quarterly and Annual Reports filed

with the SEC; the cost and difficulty of complying with applicable

licensure, legislative oversight, or regulatory changes; risks

associated with current global economic conditions and general

economic factors such as inflation, the consumer price index,

commodity costs, fuel and other energy costs, competition in the

labor market, costs of salaries, wages, benefits, and insurance,

interest rates, and tax rates; the impact from or the potential

emergence and effects of a future epidemic, pandemic, outbreak of

infectious disease or other health crisis; and changes in

accounting principles and interpretations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815324734/en/

Investor Relations Jason Finkelstein Ignition Investor

Relations mailto:ir@sonidaliving.com

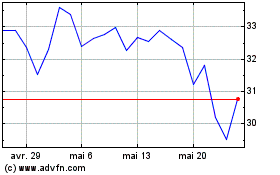

Sonida Senior Living (NYSE:SNDA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Sonida Senior Living (NYSE:SNDA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024