Stevanato Group S.p.A. (NYSE: STVN), a leading global provider

of drug containment, drug delivery, and diagnostic solutions to the

pharmaceutical, biotechnology, and life sciences industries, today

announced its financial results for the first quarter of 2024.

First Quarter 2024 Highlights

- Revenue for the first quarter of 2024 decreased 1% to €236.0

million compared with the same period last year, and high-value

solutions represented 37% of total revenue.

- For the first quarter, diluted earnings per share were €0.07

and adjusted diluted earnings per share were €0.08.

- Adjusted EBITDA margin for the first quarter was 21.4%.

- The Company is updating its fiscal year 2024 guidance primarily

due to a more pronounced impact from the ongoing industry-wide

destocking in the first quarter and a more gradual recovery in

vials, as well as the postponement of expected orders from a key

customer. The Company now expects revenue in the range of €1,125

million to €1,155 million, adjusted EBITDA in the range of €277.9

million to €292.2 million, and adjusted diluted EPS between €0.51

and €0.55.

First Quarter 2024 Results

For the first quarter of 2024, revenue decreased 1% (40 basis

points on a constant currency basis) to €236.0 million, compared

with the same period last year. The change was due to (i) lower

revenue attributable to glass vials in the Biopharmaceutical and

Diagnostic Solutions Segment resulting from the ongoing destocking

of excess vial inventories that customers accumulated during the

pandemic, and (ii) lower revenue from the Engineering Segment.

Revenue from high-value solutions increased to 37% of total

revenue in the first quarter of 2024, compared with 32% for the

same period last year, driven by demand in syringes and cartridges.

Lower revenue from EZ-fill® vials unfavorably impacted the mix

within high-value solutions in the first quarter of 2024.

Gross profit margin for the first quarter of 2024 decreased to

26.4%, primarily due to product mix resulting from lower revenue

from EZ-fill® vials. In addition, gross profit margin was also

tempered by (i) the underutilization of vial lines, (ii) lower

gross profit from the Engineering Segment, (iii) temporary

inefficiencies related to the start-up of the Company's new

manufacturing facilities in Italy and the United States, and (iv)

higher depreciation. Additionally, the prior-year period benefited

from government grants to subsidize the rise in utility costs which

did not repeat in the first quarter of 2024.

For the first quarter of 2024, operating profit margin decreased

to 10.7%, compared with the same period last year, driven primarily

by lower gross profit.

Franco Moro, Chief Executive Officer, stated, "Industry-wide

vial destocking was more pronounced than previously expected in the

first quarter, especially in our more accretive EZ-fill® vials.

While we believe this is a transitory situation, we now expect a

more gradual recovery in vials, with orders beginning to pick up at

the end of 2024 and into the early part of 2025, with bulk vials

expected to recover first. This, coupled with the postponement of

expected orders related to a large customer, has caused us to take

a more cautious approach to our 2024 guidance. The fundamentals of

our business remain strong, underpinned by favorable secular

tailwinds. We operate in growing end markets with an increasing

presence in biologics, and these factors give us confidence that we

remain ideally positioned to return to higher growth rates once

customer inventories have normalized."

Biopharmaceutical and Diagnostic Solutions Segment

(BDS)

In the first quarter of 2024, revenue from the BDS Segment grew

2% to €198.9 million (2% on a constant currency basis), compared

with the same period last year. Revenue from high-value solutions

increased 15% to €88.0 million, while revenue from other

containment and delivery solutions declined 7% to €111.0 million,

compared with the same period last year.

The change in product mix due to lower revenue from EZ-fill®

vials had the greatest impact on gross profit margin, which

decreased to 27.1% for the first quarter of 2024, compared with the

same period last year. Gross profit margin was also tempered by the

(i) the underutilization on vial lines and associated labor costs,

(ii) temporary inefficiencies tied to the start-up phase of the

Company's new manufacturing facilities, and (iii) higher

depreciation. Additionally, the prior-year period benefited from

government grants to subsidize the rise in utility costs, which did

not repeat in the first quarter of 2024.

Engineering Segment

Revenue from the Engineering Segment decreased 13% to €37.1

million for the first quarter of 2024, compared with the same

period last year. The Company is continuing to focus on executing a

large volume of work currently in progress, and has taken steps to

shore up resources including hiring additional staff to support

these efforts as well as ongoing optimization of its industrial

footprint and streamlining processes to drive operational

efficiencies and shorten lead times.

Gross profit margin was 17.3% for the first quarter of 2024. The

decrease, compared with the same period last year, was driven by

lower marginality on specific projects in process.

Balance Sheet and Cash Flow

On March 26, 2024, the Company closed its underwritten follow-on

public offering of ordinary shares, raising net proceeds of €170.5

million which will be used for capital investment projects, working

capital, and general corporate purposes to ensure an appropriate

level of operating and strategic flexibility. As of March 31, 2024,

the Company had cash and cash equivalents of €186.3 million and net

debt of €186.9 million. As expected, capital expenditures for the

first quarter of 2024 totaled €71.9 million, as the Company

continues to advance its strategic growth investments in capacity

expansion for high-value solutions to meet customer demand.

For the first quarter of 2024, cash flow from operating

activities was €71.6 million. Cash flow used for the purchase of

property, plant, and equipment, and intangible assets totaled

€102.7 million, which were driven predominantly by capital

expenditures. This resulted in negative free cash flow of €30.6

million in the first quarter of 2024.

2024 Guidance

The Company is updating its full year 2024 guidance and now

expects:

- Revenue in the range of €1,125 million to €1,155 million,

- Adjusted EBITDA in the range of €277.9 million to €292.2

million, and

- Adjusted diluted EPS in the range of €0.51 to €0.55.

The Company is maintaining its mid-term targets for fiscal years

2025 to 2027 of low double-digit revenue growth and in 2027 a share

of high-value solutions between 40% and 45% of total revenue and an

adjusted EBITDA margin of approximately 30%.

Executive Chairman, Franco Stevanato, concluded, "We have

experienced significant growth over the last decade, and Stevanato

Group has established its leadership position as a mission-critical

partner in the pharmaceutical supply chain. Our number one priority

in 2024 is execution. We are laser focused on ramping up our new

capacity to meet rising customer demand for high-value solutions,

such as our Nexa syringes and EZ-fill® cartridges. We are

strengthening our processes and driving efficiencies across our

global operations to maximize future growth. We are confident that

we remain on the path to achieve our 2027 mid-term objectives."

Conference call: The Company will host a conference call

and webcast at 8:30 a.m. (ET) on Thursday, May 9, 2024, to discuss

financial results. During the call, management will refer to a

slide presentation which will be available on the morning of the

call on the “Financial Results” page under the Investor Relations

section of the Company's website.

Pre-registration: Participants who pre-register will be

given a conference passcode and unique PIN to gain immediate access

to the call and bypass the live operator. We encourage participants

to pre-register for the conference call using the following link:

https://services.choruscall.it/DiamondPassRegistration/register?confirmationNumber=4544003&linkSecurityString=514976446

Webcast: A live, listen-only webcast of the call will be

available at the following link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=1nyYfUHM

Dial in: Those who are unable to

pre-register may dial in by calling:

Italy:

+39 02 802 09 11

United Kingdom:

+44 1 212 818004

United States:

+1 718 705 8796

United States Toll Free:

+1 855 265 6958

Participants who wish to ask questions during the call are

encouraged to use an HD webphone link:

https://hditalia.choruscall.com/?$Y2FsbHR5cGU9MiZpbmZvPWNvbXBhbnk=

Replay: The webcast will be archived for three months on the

Company’s Investor Relations section of its website at:

https://ir.stevanatogroup.com/financial-results

Forward-Looking Statements

This press release may include forward-looking statements. The

words "gradual," "expects," "continues," "expected," "remain,"

“drive,” "growing," "increasing," "growth," "continuing,"

"established," "strengthening," "driving," "rising," "will,"

"progress," "ensure," "believe," "meet," "maintaining," “expect,”

and similar expressions (or their negative) identify certain of

these forward-looking statements. These forward-looking statements

are statements regarding the Company's intentions, beliefs or

current expectations concerning, among other things, the Company's

future financial performance, including revenue, operating expenses

and ability to maintain profitability and operational and

commercial capabilities; the Company's expectations regarding the

development of the industry and the competitive environment in

which it operates; the expansion of the Company's plants and its

expectations to increase production capacity; the global supply

chain and the Company's committed orders; customer demand and

customers' ability to destock higher inventories accumulated during

the COVID-19 pandemic; the Company's geographical and industrial

footprint; and the Company's goals, strategies and investment

plans. The forward-looking statements in this press release are

based on numerous assumptions regarding the Company’s present and

future business strategies and the environment in which the Company

will operate in the future. Forward-looking statements involve

inherent known and unknown risks, uncertainties and contingencies

because they relate to events and depend on circumstances that may

or may not occur in the future and may cause the actual results,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward looking

statements. Many of these risks and uncertainties relate to factors

that are beyond the Company's ability to control or estimate

precisely, such as conditions in the U.S. capital markets, negative

global economic conditions, inflation, the impact of the conflict

between Russia and the Ukraine, the evolving events in Israel and

Gaza, supply chain and logistical challenges and other factors such

as the Company's ability to continue to obtain financing to meet

its liquidity needs, changes in the geopolitical, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions. For a description of the

risks that could cause the Company’s future results to differ from

those expressed in any such forward looking statements, refer to

the risk factors discussed in our most recent annual report on Form

20-F filed and our most recent filings with the U.S. Securities and

Exchange Commission. Readers should therefore not place undue

reliance on these statements, particularly not in connection with

any contract or investment decision. Except as required by law, the

company assumes no obligation to update any such forward-looking

statements.

Non-GAAP Financial Information

This press release contains non-GAAP financial measures. Please

refer to the tables included in this press release for a

reconciliation of non-GAAP financial measures.

Management monitors and evaluates our operating and financial

performance using several non-GAAP financial measures, including

Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Operating Profit, Adjusted Operating Profit

Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted

Diluted EPS, Capital Employed, Net Cash/Net Debt, Free Cash Flow,

and CAPEX. We believe that these non-GAAP financial measures

provide useful and relevant information regarding our performance

and improve our ability to assess our financial condition. While

similar measures are widely used in the industry in which we

operate, the financial measures we use may not be comparable to

other similarly titled measures used by other companies, nor are

they intended to be substitutes for measures of financial

performance or financial position as prepared in accordance with

IFRS.

About Stevanato Group

Founded in 1949, Stevanato Group is a leading global provider of

drug containment, drug delivery and diagnostic solutions to the

pharmaceutical, biotechnology and life sciences industries. The

Group delivers an integrated, end-to-end portfolio of products,

processes, and services that address customer needs across the

entire drug life cycle at each of the development, clinical and

commercial stages. Stevanato Group’s core capabilities in

scientific research and development, its commitment to technical

innovation, and its engineering excellence are central to its

ability to offer value added solutions to clients. To learn more,

visit: www.stevanatogroup.com.

Consolidated Income

Statement

(Amounts in € millions, except

per share data)

For the three months

ended March 31,

2024

%

2023

%

Revenue

236.0

100.0

%

238.0

100.0

%

Costs of sales

173.8

73.6

%

161.7

68.0

%

Gross Profit

62.2

26.4

%

76.3

32.0

%

Other operating Income

1.3

0.6

%

1.2

0.5

%

Selling and Marketing Expenses

5.8

2.5

%

6.1

2.5

%

Research and Development Expenses

10.7

4.6

%

8.6

3.6

%

General and Administrative Expenses

21.7

9.2

%

22.2

9.3

%

Operating Profit

25.3

10.7

%

40.6

17.1

%

Finance Income

4.2

1.8

%

4.4

1.8

%

Finance Expense

3.8

1.6

%

9.0

3.8

%

Profit Before Tax

25.7

10.9

%

36.0

15.1

%

Income Taxes

6.9

2.9

%

7.8

3.3

%

Net Profit

18.8

8.0

%

28.3

11.9

%

Earnings per share

Basic earnings per ordinary share

0.07

0.11

Diluted earnings per ordinary share

0.07

0.11

Average shares outstanding

265.9

264.7

Average shares assuming dilution

266.0

265.4

Reported Segment

Information

(Amounts in €

millions)

For the three months ended

March 31, 2024

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

198.9

37.1

—

236.0

Inter-Segment

0.5

40.3

(40.8

)

—

Revenue

199.4

77.3

(40.8

)

236.0

Gross Profit

54.1

13.4

(5.3

)

62.2

Gross Profit Margin

27.1

%

17.3

%

26.4

%

Operating Profit

28.2

5.2

(8.1

)

25.3

Operating Profit Margin

14.1

%

6.7

%

10.7

%

For the three months ended

March 31, 2023

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

195.5

42.4

—

238.0

Inter-Segment

0.4

49.4

(49.8

)

—

Revenue

196.0

91.8

(49.8

)

238.0

Gross Profit

66.0

19.9

(9.6

)

76.3

Gross Profit Margin

33.7

%

21.7

%

32.0

%

Operating Profit

38.7

14.0

(12.1

)

40.6

Operating Profit Margin

19.8

%

15.2

%

17.1

%

Cash Flow

(Amounts in €

millions)

For the three months ended

March 31,

2024

2023

Cash flow from operating activities

71.6

37.1

Cash flow used in investing activities

(102.1

)

(114.9

)

Cash flow from financing activities

146.9

8.0

Net change in cash and cash

equivalents

116.3

(69.7

)

Non GAAP Financial Information

This press release contains non-GAAP financial measures. Please

refer to "Non-GAAP Financial Information" on page 4 and the tables

included in this press release for a reconciliation of non-GAAP

financial measures.

Reconciliation of Revenue to Constant

Currency Revenue

(Amounts in € millions)

Three months ended March 31,

2024

Biopharmaceutical and

Diagnostic Solutions

Engineering

Reported Revenue (IFRS GAAP)

198.9

37.1

Effect of changes in currency translation

rates

1.1

—

Organic Revenue (Non-IFRS GAAP)

200.0

37.1

Reconciliation of

EBITDA

(Amounts in €

millions)

For the three months ended

March 31,

Change

2024

2023

%

Net Profit

18.8

28.3

(33.5

)%

Income Taxes

6.9

7.8

(11.6

)%

Finance Income

(4.2

)

(4.4

)

(5.8

)%

Finance Expenses

3.8

9.0

(58.2

)%

Operating Profit

25.3

40.6

(37.8

)%

Depreciation and Amortization

21.7

18.4

17.9

%

EBITDA

47.0

59.0

(20.4

)%

Calculation of Net Profit

margin, Operating Profit Margin, Adjusted EBITDA Margin and

Adjusted Operating Profit Margin

(Amounts in €

millions)

For the three months ended

March 31,

2024

2023

Revenue

236.0

238.0

Net Profit Margin (Net Profit/

Revenue)

8.0

%

11.9

%

Operating Profit Margin (Operating Profit/

Revenue)

10.7

%

17.1

%

Adjusted EBITDA Margin (Adjusted EBITDA/

Revenue)

21.4

%

26.0

%

Adjusted Operating Profit Margin (Adjusted

Operating Profit/ Revenue)

12.3

%

18.3

%

Reconciliation of Reported and

Adjusted EBITDA, Operating Profit, Income Taxes,

Net Profit, and Diluted

EPS

(Amounts in € millions, except

per share data)

Three months ended March 31,

2024

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

47.0

25.3

6.9

18.8

0.07

Adjusting items:

Start-up costs new plants (1)

2.7

2.7

0.7

2.0

0.01

Restructuring and related charges (2)

0.9

0.9

0.2

0.7

0.00

Adjusted

50.6

28.9

7.8

21.5

0.08

Adjusted Margin

21.4

%

12.3

%

Three months ended March 31,

2023

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

59.0

40.6

7.8

28.3

0.11

Adjusting items:

Start-up costs new plants (1)

2.9

2.9

0.8

2.1

0.01

Adjusted

61.9

43.6

8.5

30.4

0.11

Adjusted Margin

26.0

%

18.3

%

(1) During the three months ended March 31, 2024 and 2023, the

Group recorded EUR 2.7 million and EUR 2.9 million, respectively,

of start-up costs for the new plants in Fishers, Indiana, United

States, and in Latina, Italy. These costs are primarily related to

labor costs incurred prior to commercial operation that are

associated with recruiting, hiring, training and travel of

personnel who are employed in the production of our products which

require specialized knowledge.

(2) During the three months ended March 31, 2024, the Group

recorded EUR 0.9 million of restructuring and related charges among

general and administrative expenses and research and development

expenses. These are mainly employee costs related to the

reorganization of some business functions.

(3) The income tax adjustment is calculated by multiplying the

applicable nominal tax rate to the adjusting items.

Capital Employed

(Amounts in €

millions)

As of March 31, 2024

As of December 31, 2023

- Goodwill and intangible assets

81.0

81.0

- Right of Use assets

18.0

18.2

- Property, plant and equipment

1,089.4

1,028.5

- Financial assets - investments FVTPL

0.7

0.7

- Other non-current financial assets

4.5

4.5

- Deferred tax assets

79.1

76.3

Non-current assets excluding FV of

derivative financial instruments

1,272.7

1,209.2

- Inventories

283.1

255.3

- Contract Assets

178.8

172.6

- Trade receivables

221.0

301.8

- Trade payables

(239.4

)

(277.8

)

- Advances from customers

(13.7

)

(22.9

)

- Non-current advances from customers

(41.1

)

(39.4

)

- Contract Liabilities

(25.8

)

(22.3

)

Trade working capital

362.9

367.2

- Tax receivables and Other

receivables

67.3

58.2

- Tax payables and Other liabilities

(112.0

)

(107.0

)

- Current provisions

(1.1

)

(1.1

)

Net working capital

317.1

317.4

- Deferred tax liabilities

(10.2

)

(9.6

)

- Employees benefits

(7.4

)

(7.4

)

- Non-current provisions

(3.9

)

(4.0

)

- Other non-current liabilities

(50.9

)

(48.5

)

Total non-current liabilities and

provisions

(72.4

)

(69.5

)

Capital employed

1,517.4

1,457.1

Net (debt) /cash

(186.9

)

(324.4

)

Total Equity

(1,330.4

)

(1,132.6

)

Total equity and net (debt)/

cash

(1,517.4

)

(1,457.1

)

Free Cash Flow

(Amounts in €

millions)

For the three months ended

March 31,

2024

2023

Net cash flow from operating

activities

71.6

37.1

Interest paid

0.7

0.9

Interest received

(0.2

)

(0.2

)

Purchase of property, plant and

equipment

(100.5

)

(127.7

)

Purchase of intangible assets

(2.2

)

(1.1

)

Free Cash Flow

(30.6

)

(91.0

)

(Net Debt) / Net Cash

(Amounts in €

millions)

As of March 31,

As of December 31,

2024

2023

Non-current financial liabilities

(280.5

)

(255.6

)

Current financial liabilities

(96.2

)

(143.3

)

Other non-current financial assets - Fair

value of derivatives financial instruments

0.2

0.6

Other current financial assets

3.3

4.4

Cash and cash equivalents

186.3

69.6

Net (Debt)/ Cash

(186.9

)

(324.4

)

CAPEX

(Amounts in €

millions)

For the three months ended

March 31,

Change

2024

2023

€

Addition to Property, plants and

equipment

69.7

112.1

(42.4

)

Addition to Intangible Assets

2.2

1.1

1.1

CAPEX

71.9

113.2

(41.3

)

Reconciliation of 2024

Guidance (Updated)

Reported and Adjusted EBITDA,

Operating Profit, Net Profit, Diluted EPS

(Amounts in € millions, except

per share data)

Revenue

EBITDA

Operating Profit

Net Profit *

Diluted EPS

Reported

1,125.0-1,155.0

264.9-279.2

177.4-191.7

128.5-139.3

0.47-0.51

Adjusting items

—

13.0

13.0

9.8

0.04

Adjusted

1,125.0-1,155.0

277.9-292.2

190.4-204.7

138.3-149.2

0.51-0.55

*Amounts may not add due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509725369/en/

Media Stevanato Group media@stevanatogroup.com

Investor Relations Lisa Miles

lisa.miles@stevanatogroup.com

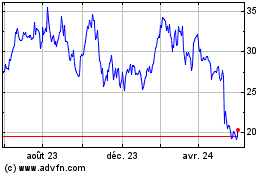

Stevanato (NYSE:STVN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

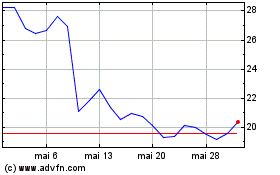

Stevanato (NYSE:STVN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024