UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D) A (1)

OR SECTION 13(E)(1) OF THE

SECURITIES EXCHANGES ACT OF 1934

(AMENDMENT NO. 3)

INCOME OPPORTUNITY REALTY INVESTORS, INC.

(Name of Subject Company)

TRANSCONTINENTAL REALTY INVESTORS, INC.

(Offeror)

(Names of Filing Persons)

Common Stock, Par Value $0.01 per share

(Title of Class of Securities)

452926108

(CUSIP Number of Class of Securities)

Erik L. Johnson, President and Chief Executive Officer

Transcontinental Realty Investors, Inc.

1603 LBJ Freeway, Suite 800

Dallas, Texas 75234

Telephone: (469) 522-4200

(Name, Address and Telephone Number of Persons Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Steven C. Metzger, Esq.

Metzger Law PLLC

4709 W. Lovers Lane, Suite 200

Dallas, Texas 75209

Telephone: 214-740-5030

This Amendment No. 3 to Schedule

TO (this “Amendment”) amends portions of an original Statement on Schedule TO filed December 16, 2024, by Transcontinental

Realty Investors, Inc., a Nevada corporation (the “Offeror” or “TCI”) with respect to TCI’s offer

to purchase up to 100,000 shares of the outstanding shares of common stock, par value $0.01 per share (each a “Share”

and collectively the “Shares”) of Income Opportunity Realty Investors, Inc., a Nevada corporation (“IOR”)

at a purchase price of $18 per Share, net to the seller in cash, without interest (the “Offer Price”) and less

any taxes required to be withheld, upon the terms and conditions set forth in the Offer to Purchase dated December 16, 2024 (the “Offer

to Purchase”) and the related Letter of Transmittal (the “Letter of Transmittal” which together with the

Offer to Purchase, as such may be amended or supplemented from time to time, constitute the “Offer”).

This Amendment is being filed

on behalf of the Offeror to reflect and disclose Shares tendered by the initial Expiration Time of January 15, 2025 at 5 pm, New York

City time, which has been extended to January 29, 2025 at 5 pm New City time (the “Expiration Time”) and to add additional

exhibits. Except as otherwise set forth in this Amendment, the information set forth in the Schedule T/O, as amended by Amendments No.

1 and 2, remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment. Capitalized

terms used but not defined herein have the meanings as scribed to them in the Schedule TO.

ITEMS 1THROUGH 9; ITEM 11.

The Offer to Purchase and Items

1 through 9 and Item 11 of the Schedule TO, to the extent such Items 1 through 9 and Item 11 incorporate by reference the information

contained in the Offer to Purchase, are hereby amended and supplemented by adding the following paragraphs thereto:

On January 15, 2025, the Depositary

advised TCI that as of 5:00 o’clock p.m., New York City time on January 15, 2025, at least 126,915 Shares had been tendered pursuant

to the Offer and not withdrawn.

The full text of the announcement

is attached as Exhibit (A) (5) (C) to this Amendment and is incorporated herein by reference.

Amendments to the Offer to Purchase and Other Exhibits

to the Schedule TO.

The Offer to Purchase and

Items 1 through 9 and Item 11 of the Schedule TO, to the extent such Items 1 through 9 and Item 11 incorporate by reference the

information contained in the Offer to Purchase, have been amended and supplemented by adding the following thereto:

All references regarding the scheduled

expiration of the Offer being “5:00 p.m., New York City time, on January 15, 2025” set forth in the Offer to Purchase, the

Letter of Transmittal, the Notice of Guaranteed Delivery, Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees,

and the Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees are hereby amended and replaced

with “5:00 p.m., New York City time, on January 29, 2025.”

ITEM 12 EXHIBITS.

Item 12 of the Schedule TO is

hereby amended and supplemented to add the following exhibits:

SIGNATURES

After reasonable inquiry and to

the best of the respective knowledge or belief, the undersigned certify that the information set forth in this Amendment is true, complete

and correct.

| |

Dated: January 16, 2025 |

|

TRANSCONTINENTAL REALTY INVESTORS, INC. |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

By: |

/s/ Erik L. Johnson |

|

| |

|

|

|

Erik L. Johnson, President and |

|

| |

|

|

|

Chief Executive Officer |

|

Exhibit (A) (5) (C)

PRESS RELEASE

TRANSCONTINENTAL REALTY INVESTORS, INC ANNOUNCES PRELIMINARY NUMBER

OF SHARES RECEIVED IN TENDER OFFER WHICH HAS BEEN EXTENDED TO JANUARY 29, 2025

Dallas, Texas (January 16, 2025) – Transcontinental Realty Investors,

Inc. (NYSE: TCI) announced today that as of the initial scheduled expiration time on January 15, 2025 at 5 pm local New York City

time the Depositary for the previously announced tender offer to purchase up to 100,000 shares of common stock, par value $0.01 per share

(the “Shares”) of Income Opportunity Realty Investors, Inc. (NYSE American: IOR) for $18 per Share, net to the

seller in cash without interest and less any required withholding taxes (the “Offer”), which has been extended to 5

pm local New York City time on January 29, 2025 that at least 126,915 Shares had been tendered and not withdrawn from the tender offer.

All terms and conditions of the tender offer remain unchanged.

Equiniti Trust Company, LLC, as the Depositary for

the offer advised that of the Shares tendered, approximately 121,358 Shares are from CEDE and 5,557 Shares are from holders of record.

While the number of Shares tendered as of the initial scheduled expiration exceed by approximately 26% the number of Shares sought by

the limited tender offer, TCI does have the right to purchase all Shares tendered and eliminate any pro-ration of Shares. TCI has not

yet made any determination on whether to purchase all Shares tendered and will not make such determination until the scheduled January

29, 2025 expiration time. Holders of Shares tendered to the Depositary may withdraw Shares prior to the Expiration Time of 5 pm New York

City time on January 29, 2025 in accordance with the Withdrawal Rights described in Section 4 of the Offer to Purchase.

The Offer to Purchase and related

tender offer materials have been filed with the SEC. IOR stockholders who need additional copies of the Offer to Purchase and related

tender offer materials or who have questions regarding the Offer should contact D.F. King & Co., Inc., the information agent for the

tender offer at toll free (800) 431-9643 or by email to ior@dfking.com. There is no dealer manager for the tender

offer and no soliciting dealer fees will be paid in the tender offer.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors,

Inc., a Nevada corporation is a Dallas based real estate investment company holding a diverse portfolio of equity real estate located

across the U.S., including office buildings, multifamily and developed and undeveloped land. The company invests in real estate through

direct ownership, leases and partnerships and invests in mortgage loans on real estate. The company also holds mortgage receivables. For

more information, visit the website at www.transconrealty-invest.com.

About Income Opportunity Realty Investors, Inc.

Income Opportunity Realty Investors,

Inc., a Nevada corporation is a Dallas based real estate investment company, currently holds a portfolio of notes receivable. The company

also invests in real estate through direct equity ownership and partnerships. For more information, visit the website at www.incomeopp-realty.com.

Important Information about the Tender Offer

This press release is for informational

purposes only and does not constitute an offer to purchase Shares of IOR common stock, a solicitation to sell such Shares or a solicitation/recommendation

statement under the rules and regulations of the SEC. The tender offer is being made pursuant to a Tender Offer Statement on Schedule

TO, as amended (including the Offer to Purchase, Letter of Transmittal and related Tender Offer documents) which have been filed by the

Offeror with the SEC. These documents contain important information and stockholders of IOR are strongly advised to carefully read these

documents in their entirety before making any decision regarding tendering their Shares. The Offer to Purchase and certain other tender

offer documents, are available to all stockholders of IOR at no expense to them. These documents may be obtained at no charge at the

SECs website at www.sec.gov. The Tender Offer Statement and related materials may also be obtained at no charge

by directing a request by mail or email to the Information Agent for the Tender Offer, D.F. KING & Co., Inc., 48 Wall Street, 22nd

Floor, New York, NY, 10005, or by calling toll free (800) 431-9643 or by email at ior@dfking.com.

Cautionary Statements

Statements in this press release

that are not historical, including statements regarding TCI’s beliefs, expectations, and strategies constitute “forward-looking

statements” within the meaning of the federal securities laws. These statements are subject to risk and uncertainties that could

cause actual results to differ materially from those expressed in the forward-looking statements. Important factors that could cause the

differences are discussed in TCI’s reports on Form 10-Q, 10-K and 8-K that TCI periodically files with the SEC. These factors include

TCI’s revenue and expenses, TCI’s capital needs, TCI’s dependence on significant matters, risks that TCI may incur significant

costs related to certain insurance retention levels. TCI does not undertake to update any forward-looking statements in this press release.

Copies of TCI’s SEC filings, including its annual report on Form 10-K and quarterly reports on Form 10-Q may be obtained by contacting

www.sec.gov or at the SEC Filing Section of TCI’s website at www.transconrealty-invest.com.

Contacts

Transcontinental Realty Investors, Inc.

Investor Relations

Erik Johnson (469) 522-4200

investorrelations@transconrealty-invest.com

Exhibit 107

Calculation of Filing Fee Tables

Table 1 – Transaction Valuation

| |

Transaction

Valuation |

Fee rate |

Amount of

Filing fees |

| Fees to Be Paid |

|

* |

|

| Fees Previously Paid |

|

|

|

| Total Transaction Valuation |

|

|

|

| Total Fees Due for Filing |

|

|

|

| Total Fee Offsets |

|

|

|

| Net Fee Due |

|

|

|

Table 2 – Fee Offset Claims and Sources

| |

Registration

or filer

name |

Form

or filing

type |

File

number |

Initial

filing

date |

Filing

date |

Fee

offset

claimed |

Fee paid

with fee

offset

source |

| Fee Offset Claims |

|

|

|

|

|

|

|

| Fee Offset Sources |

|

|

|

|

|

|

|

Explain how the transaction valuation was determined.

| * | the Fee Rate is $153.10 per million dollars of Transaction Valuation from and after October 1, 2024 pursuant

to SEC Fee Rate Advisory issued August 20, 2014. |

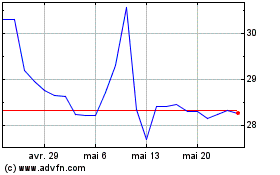

Transcontinental Realty ... (NYSE:TCI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Transcontinental Realty ... (NYSE:TCI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025