Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

09 Mai 2024 - 4:32PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 9, 2024

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Publicly-held Company

Corporate Taxpayer’s ID (CNPJ / ME) 02.421.421/0001-11

Corporate Registry (NIRE) 33.300.324.631

MATERIAL FACT

CLARIFICATIONS ON NEWS ABOUT THE ADMINSITRATIVE

PROCESS JUDGED BY THE SUPERIOR CHAMBER OF TAX APPEALS OF THE CARF

TIM S.A. (“TIM” or “Company”)

(B3: TIMS3; NYSE: TIMB), in accordance with article 157 of Law no. 6,404/1976, with the provisions of CVM Resolution No. 44, informs its

shareholders, the market in general and other interested parties, in clarification to journalistic articles about the administrative proceeding

judged by the Superior Chamber of Tax Appeals of CARF, the following:

Initially, it is important to inform that

the publications are not 100% accurate, which is why we detail below what happened in the trial mentioned in the publications.

In a decision handed down yesterday, by

the Superior Chamber of Tax Appeals of CARF, within the scope of the PAF administrative process no. 10480.721765/2011-46, that deals with

several subjects, mainly the deductibility of the goodwill amortized by the Company as a result of the acquisitions it has promoted since

the privatization process, as well as well as the possibility of using tax losses in situations of corporate restructuring, the Company

informs that it had a partial administrative success of around 45% of the total in judgment, with the difference being subject to appeal

in court.

The aforementioned publications state that

TIM would have “lost” a case worth more than R$1 billion, however, the information does not match the reality of the facts,

with the amount that was under discussion in this judgment having an updated value of approximately R$ 700 million.

It is important to clarify that since the

beginning of the process in 2011 (initial value of R$ 1.265 billion) the Company has already been successful in obtaining more than 70%

of the total amount discussed at the administrative level.

It should also be mentioned that, from

an accounting point of view, considering that the discussion on the topic can still be taken to court, there is no additional impact that

is not already registered on the Company's balance sheet.

The Company will keep its shareholders

and the market in general duly informed about the relevant updates related to this subject, pursuant to CVM Resolution No. 44 and applicable

legislation.

Rio de Janeiro, May 09, 2024.

TIM S.A.

Alberto Mario Griselli

Chief Executive Officer and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

May 9, 2024 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

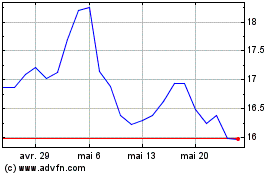

TIM (NYSE:TIMB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

TIM (NYSE:TIMB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024