Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 Juin 2024 - 2:28PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

June 2024

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

Vale

on new settlement proposal Rio de Janeiro, June 12, 2024 - Vale S.A. ("Vale") clarifies about press article published by “O Globo”1

mentioning a new proposal for the settlement related to the Fundão dam collapse, in Mariana, Minas Gerais, Brazil. Following the

communications dated April 29, May 3, May 20, and June 6, 2024, Samarco, BHP Brasil and Vale (“the Companies”) have been

engaged in a mediation led by the Brazilian Federal Court of Appeals of the Sixth Region (“TRF6”), with the Brazilian State

and Federal Governments and other public entities (“the Parties”). The Parties seek a definitive settlement of obligations

under the Framework Agreement, the Federal Public Prosecution Office Claim, and other claims by government entities relating to the Samarco

dam failure. As part of the settlement negotiations, Samarco Mineração S.A. (“Samarco”), Vale and BHP Billiton

Brasil Ltda. (“BHP”), have submitted a new settlement proposal to the TRF6 (“New Proposal”) on June 11, in response

to the public authorities’ feedback. The amounts, terms and conditions of the New Proposal are confidential by imposition of Law

13.149/2015 (Rules of Mediation), Code of Civil Procedure of 2015 and Resolution 125/2010 of the National Council of Justice (“CNJ”).

However, considering the leak of confidential information by the above-referenced Article, Vale, in compliance with the sole paragraph

of Article 6 of CVM Resolution 44, informs that the financial value of the New Proposal, considering past and future obligations, totals

R$140 billion, including R$37 billion in amounts already invested on remediation and compensation, a R$82 billion cash payment payable

over 20 years to the Federal Government, the States of Minas Gerais and Espírito Santo and the municipalities, and R$21 billion

in obligations to be performed. The New Proposal amounts are on a 100% basis which includes a 50% contribution from each of BHP Brasil

and Vale as secondary obligors if Samarco cannot fund as the primary obligor. As one of Samarco's shareholders, Vale reaffirms its commitment

to reparation and compensation actions related to Samarco's Fundão dam collapse, and the New Proposal is an effort to reach a

mutually beneficial resolution for all parties, especially for the impacted people, communities, and environment, while creating definitiveness

and legal certainty for the Companies. Gustavo Duarte Pimenta Executive Vice President, Finance and Investor Relations For further information,

please contact: Vale.RI@vale.com Thiago Lofiego: thiago.lofiego@vale.com Luciana Oliveti: luciana.oliveti@vale.com Mariana Rocha: mariana.rocha@vale.com

Patricia Tinoco: patricia.tinoco@vale.com Pedro Terra: pedro.terra@vale.com This press release may include statements that present Vale’s

expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and

uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to

the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d)

the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition

in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast

by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão

de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form 20-F. 1 Entitled: “Companies submitt a new proposal for Mariana settlement:

R$ 140 billion” (“Empresas fazem nova proposta de acordo de reparação para a tragédia de Mariana: R$

140 bi)

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Thiago Lofiego |

| Date: June 12, 2024 |

|

Director of Investor Relations |

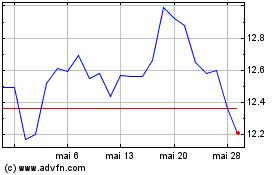

Vale (NYSE:VALE)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Vale (NYSE:VALE)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024