New SEC Climate Disclosure Rule Brings Required Transparency to Sustainability Data

07 Mars 2024 - 2:00PM

Business Wire

Workiva survey reveals 88% of institutional

investors are more likely to invest in companies that integrate

financial and ESG data

Workiva Inc. (NYSE:WK), the company powering transparent

reporting for a better world, applauds the climate disclosure rules

introduced by the U.S. Securities and Exchange Commission (SEC) on

March 6, 2024. These new rules enhance and standardize the

disclosure of climate-related data and associated financial risks,

with the goal of providing investors with consistent, comparable,

and reliable data in annual reports and registration

statements.

“The climate disclosure rule elevates the significance of

climate data in public filings to reflect its importance to

investors in assessing company performance and evaluating risk,”

said Julie Iskow, president and chief executive officer of Workiva.

“Organizations will need to begin thinking about following a

consistent disclosure process for financial and sustainability

information, including assurance, on both numbers and narrative.

This is what Workiva does. This is what assured integrated

reporting is all about.”

Earlier this week, Workiva published insights from the 2024

Executive Benchmark on Integrated Reporting survey, which included

perspectives from more than 800 executives and 100 institutional

investors in North America. 92% of institutional investors surveyed

acknowledge the importance of ESG data in evaluating long-term

financial outlook and organizational risks, and 88% emphasize that

ESG should be approached with the same rigor as financial

reporting.

The survey highlights a significant advantage for executives

whose companies integrate financial and ESG reporting: they are

nearly twice as confident in complying with the SEC climate

disclosure rules as those who do not (68% versus 37%). Integrated

reporting goes beyond regulatory compliance, with 91% of executives

agreeing that it provides stakeholders with a comprehensive view of

performance and value creation.

These findings underscore the crucial role of accurate business

reporting and emphasize the need for companies to prioritize

non-financial reporting to promote confidence and transparency for

organizations and their stakeholders, regardless of regulatory

mandates. Read the full report here.

The SEC released a fact sheet outlining the new requirements,

accessible here. Below are the essential points to note from the

SEC's recent climate-related disclosure mandates:

- Scope 1 and 2 emissions, if material, with reasonable assurance

for large accelerated filers and limited assurance for accelerated

filers (with a phase-in period)

- An additional financial statement footnote disclosing the

impact of climate-related events, mitigation efforts, and

transition activities (subject to existing financial statement

audit requirements)

- Disclosure of climate-related risks and their material impact

on strategy and financial performance

- Quantitative and qualitative disclosures on activities

undertaken to mitigate or adapt to climate-related risks (if these

activities are undertaken)

- Inline XBRL™ tagging requirements

The new rule will pose challenges for sustainability and

financial reporting teams. Consistency between reports will be

heavily scrutinized, and many organizations have different

reporting timelines for financial and sustainability reports.

Addressing these requirements will require companies to adopt

technology that can streamline processes, connect data and teams,

and ensure data consistency, accuracy, and integrity.

To learn more about how companies can act on these new

requirements from the SEC and to get additional insights from the

survey, join:

Workiva & Deloitte for a webinar on March 13, 2024 at 11:00

am EDT. Click here to register Workiva & PwC US for a webinar

on March 14, 2024 at 11:00 am EDT. Click here to register.

About Workiva

Workiva Inc. (NYSE:WK) is on a mission to power transparent

reporting for a better world. We build and deliver the world’s

leading cloud platform for assured, integrated reporting to meet

stakeholder demands for action, transparency, and disclosure of

financial and non-financial data. Workiva offers the only unified

SaaS platform that brings customers’ financial reporting,

Environmental, Social, and Governance (ESG), and Governance, Risk,

and Compliance (GRC) together in a controlled, secure, audit-ready

platform. Our platform simplifies the most complex reporting and

disclosure challenges by streamlining processes, connecting data

and teams, and ensuring consistency. Learn more at workiva.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240307763268/en/

Media Inquiries:

Rotha Brauntz Lauren Covello press@workiva.com

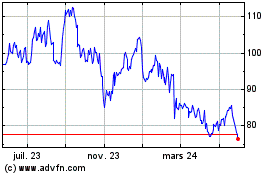

Workiva (NYSE:WK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

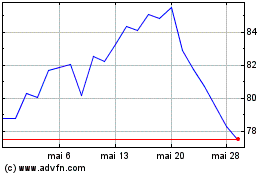

Workiva (NYSE:WK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025