- Increased Q1 2024 Subscription & Support Revenue by 20%

over Q1 2023

- Total revenues of $176 million in Q1 2024, representing 17%

year-over-year growth

- Achieved 34% YOY Growth of Customers with Annual Contract Value

Over $300K

Workiva Inc. (NYSE:WK), the world’s leading cloud platform for

assured integrated reporting, today announced financial results for

its first quarter ended March 31, 2024.

"The Workiva team delivered another solid quarter, resulting in

subscription revenue growth of 20%," said Julie Iskow, President

& Chief Executive Officer. "Workiva's platform remains a key

differentiator for new logo wins and account expansion deals.

Workiva is the only platform that brings Financial Reporting, ESG

and GRC together in one secure, controlled, audit-ready

environment. We are the platform for assured integrated

reporting."

"In Q1, we generated 66% of subscription revenue from customers

who have multiple solutions," said Jill Klindt, Chief Financial

Officer. "Our focus on multi-solution deals and account expansions

led to the increase in the number of larger subscription contracts.

Workiva had 332 customers with an annual contract value over

$300,000 at the end of the first quarter, growing 34% compared to

the same time last year."

First Quarter 2024 Financial

Results

- Revenue: Total revenue for the first quarter of 2024

reached $176 million, an increase of 17% from $150 million in the

first quarter of 2023. Subscription and support revenue contributed

$155 million, up 20% versus the first quarter of 2023. Professional

services revenue was $21 million, relatively flat compared to the

same quarter in the prior year.

- Gross Profit: GAAP gross profit for the first quarter of

2024 was $134 million compared with $112 million in the same

quarter of 2023. GAAP gross margin was 76.4% versus 74.3% in the

first quarter of 2023. Non-GAAP gross profit for the first quarter

of 2024 was $136 million, an increase of 20% compared with the

prior year's first quarter, and non-GAAP gross margin was 77.7%

compared to 75.5% in the first quarter of 2023.

- Results from Operations: GAAP loss from operations for

the first quarter of 2024 was $18 million compared with a loss of

$47 million in the prior year's first quarter. Non-GAAP income from

operations was $6 million compared with a non-GAAP loss from

operations of $7 million in the first quarter of 2023.

- GAAP Net Loss: GAAP net loss for the first quarter of

2024 was $12 million compared with a net loss of $46 million for

the prior year's first quarter. GAAP net loss per basic and diluted

share was $0.21 compared with a net loss per basic and diluted

share of $0.86 in the first quarter of 2023.

- Non-GAAP Net Income/Loss: Non-GAAP net income for the

first quarter of 2024 was $13 million compared with a loss of $7

million in the prior year's first quarter. Non-GAAP net income per

basic share and diluted share was $0.23 and $0.22, respectively,

compared with a net loss per basic and diluted share of $0.12 in

the first quarter of 2023.

- Liquidity: As of March 31, 2024, Workiva had cash, cash

equivalents, and marketable securities totaling $838 million,

compared with $814 million as of December 31, 2023. Workiva had $71

million aggregate principal amount of 1.125% convertible senior

notes due in 2026, $702 million aggregate principal amount of

1.250% convertible senior notes due in 2028 and $14 million of

finance lease obligations outstanding as of March 31, 2024.

Key Metrics and Recent Business

Highlights

- Customers: Workiva had 6,074 customers as of March 31,

2024, a net increase of 320 customers from March 31, 2023.

- Revenue Retention Rate: As of March 31, 2024, Workiva's

revenue retention rate (excluding add-on revenue) was 98%, and the

revenue retention rate including add-on revenue was 111%. Add-on

revenue includes changes in both solutions and pricing for existing

customers.

- Large Contracts: As of March 31, 2024, Workiva had 1,696

customers with an annual contract value (“ACV”) of more than

$100,000, up 24% from 1,363 customers at March 31, 2023. Workiva

had 961 customers with an ACV of more than $150,000, up 29% from

746 customers in the first quarter of 2023. Workiva had 332

customers with an ACV of more than $300,000, up 34% from 247

customers in the first quarter of 2023.

Financial Outlook

As of May 2, 2024, Workiva is providing guidance as follows:

Second Quarter 2024 Guidance:

- Total revenue is expected to be in the range of $174 million to

$176 million.

- GAAP loss from operations is expected to be in the range of

$24.0 million to $22.0 million.

- Non-GAAP income from operations is expected to be in the range

of $2 million to $4 million.

- GAAP net loss per basic share is expected to be in the range of

$0.32 to $0.29.

- Non-GAAP net income per basic share is expected to be in the

range of $0.16 to $0.19.

- Net income (loss) per basic share is based on 55.2 million

weighted-average shares outstanding.

Full Year 2024 Guidance:

- Total revenue is expected to be in the range of $719 million to

$723 million.

- GAAP loss from operations is expected to be in the range of $76

million to $72 million.

- Non-GAAP income from operations is expected to be in the range

of $27 million to $31 million.

- GAAP net loss per basic share is expected to be in the range of

$0.90 to $0.83.

- Non-GAAP net income per basic share is expected to be in the

range of $0.96 to $1.03.

- Net income (loss) per basic share is based on 55.3 million

weighted-average shares outstanding.

Quarterly Conference

Call

Workiva will host a conference call today at 5:00 p.m. ET to

review the Company’s financial results for the first quarter 2024,

in addition to discussing the Company’s outlook for the second

quarter and full year 2024. To access this call, dial 888-330-2469

(U.S. domestic) or 240-789-2740 (international). The conference ID

is 8736384. A live webcast of the conference call will be

accessible in the "Investor Relations" section of Workiva’s website

at www.workiva.com. A replay of this conference call can also be

accessed through May 9, 2024, at 800-770-2030 (U.S. domestic) or

647-362-9199 (international). The replay pass code is 8736384. An

archived webcast of this conference call will also be available an

hour after the completion of the call in the "Investor Relations"

section of the Company’s website at www.workiva.com.

About Workiva

Workiva Inc. (NYSE:WK) is on a mission to power transparent

reporting for a better world. We build and deliver the world’s

leading cloud platform for assured integrated reporting to meet

stakeholder demands for action, transparency, and disclosure of

financial and non-financial data. Workiva offers the only unified

SaaS platform that brings customers’ financial reporting,

Environmental, Social, and Governance (ESG), and Governance, Risk,

and Compliance (GRC) together in a controlled, secure, audit-ready

platform. Our platform simplifies the most complex reporting and

disclosure challenges by streamlining processes, connecting data

and teams, and ensuring consistency. Learn more at workiva.com.

Non-GAAP Financial

Measures

The non-GAAP adjustments referenced herein relate to the

exclusion of stock-based compensation and amortization of

acquisition-related intangible assets. A reconciliation of GAAP to

non-GAAP historical financial measures has been provided in Table I

at the end of this press release. A reconciliation of GAAP to

non-GAAP guidance has been provided in Table II at the end of this

press release.

Workiva believes that the use of non-GAAP gross profit and gross

margin, non-GAAP income (loss) from operations, non-GAAP net income

(loss) and non-GAAP net income (loss) per share is helpful to its

investors. These measures, which are referred to as non-GAAP

financial measures, are not prepared in accordance with generally

accepted accounting principles in the United States, or GAAP.

Non-GAAP gross profit is calculated by excluding stock-based

compensation expense attributable to cost of revenues from gross

profit. Non-GAAP gross margin is the ratio calculated by dividing

non-GAAP gross profit by revenues. Non-GAAP income (loss) from

operations is calculated by excluding stock-based compensation

expense and amortization expense for acquisition-related intangible

assets from loss from operations. Non-GAAP net income (loss) is

calculated by excluding stock-based compensation expense, net of

tax and amortization expense for acquisition-related intangible

assets from net loss. Non-GAAP net income (loss) per share is

calculated by dividing non-GAAP net income (loss) by the weighted-

average shares outstanding as presented in the calculation of GAAP

net loss per share. Because of varying available valuation

methodologies, subjective assumptions and the variety of equity

instruments that can impact a company’s non-cash expenses, Workiva

believes that providing non-GAAP financial measures that exclude

stock-based compensation expense allows for more meaningful

comparisons between its operating results from period to period.

For business combinations, we generally allocate a portion of the

purchase price to intangible assets. The amount of the allocation

is based on estimates and assumptions made by management and is

subject to amortization. The amount of purchase price allocated to

intangible assets and the term of its related amortization can vary

significantly and are unique to each acquisition and thus we do not

believe it is reflective of ongoing operations. Workiva’s

management uses these non-GAAP financial measures as tools for

financial and operational decision making and for evaluating

Workiva’s own operating results over different periods of time.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in

Workiva’s industry, as other companies in the industry may

calculate non-GAAP financial results differently. In addition,

there are limitations in using non-GAAP financial measures because

the non-GAAP financial measures are not prepared in accordance with

GAAP, may be different from non-GAAP financial measures used by

other companies and exclude expenses that may have a material

impact on Workiva’s reported financial results. Further,

stock-based compensation expense has been and will continue to be

for the foreseeable future a significant recurring expense in

Workiva’s business and an important part of the compensation

provided to its employees. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP. Investors should review the reconciliation

of non-GAAP financial measures to the comparable GAAP financial

measures included below, and not rely on any single financial

measure to evaluate Workiva’s business.

Safe Harbor Statement

Certain statements in this press release are "forward-looking

statements" within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and are subject to the safe

harbor created thereby. These statements relate to future events or

the Company’s future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, levels of activity, performance or achievements of

the Company or its industry to be materially different from those

expressed or implied by any forward-looking statements. In

particular, statements about the Company’s expectations, beliefs,

plans, objectives, assumptions, future events or future performance

contained in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by

terminology such as "may," "will," "could," "would," "should,"

"expect," "plan," "anticipate," "intend," "believe," "estimate,"

"predict," "potential," "outlook," "guidance" or the negative of

those terms or other comparable terminology.

Please see the Company’s documents filed or to be filed with the

Securities and Exchange Commission, including the Company’s annual

reports filed on Form 10-K and quarterly reports on Form 10-Q, and

any amendments thereto for a discussion of certain important risk

factors that relate to forward-looking statements contained in this

report. The Company has based these forward-looking statements on

its current expectations, assumptions, estimates and projections.

While the Company believes these expectations, assumptions,

estimates and projections are reasonable, such forward-looking

statements are only predictions and involve known and unknown risks

and uncertainties, many of which are beyond the Company’s control.

These and other important factors may cause actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Any

forward-looking statements are made only as of the date hereof, and

unless otherwise required by applicable securities laws, the

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

WORKIVA INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share

and per share amounts)

Three months ended March

31,

2024

2023

(unaudited)

Revenue

Subscription and support

$

154,979

$

129,664

Professional services

20,688

20,525

Total revenue

175,667

150,189

Cost of revenue

Subscription and support (1)

27,927

24,133

Professional services (1)

13,596

14,385

Total cost of revenue

41,523

38,518

Gross profit

134,144

111,671

Operating expenses

Research and development (1)

45,495

45,791

Sales and marketing (1)

82,633

70,710

General and administrative (1)

24,299

42,011

Total operating expenses

152,427

158,512

Loss from operations

(18,283

)

(46,841

)

Interest income

10,455

3,717

Interest expense

(3,232

)

(1,501

)

Other income and (expense), net

86

(940

)

Loss before provision for income taxes

(10,974

)

(45,565

)

Provision for income taxes

713

585

Net loss

$

(11,687

)

$

(46,150

)

Net loss per common share:

Basic and diluted

$

(0.21

)

$

(0.86

)

Weighted-average common shares outstanding

- basic and diluted

54,915,852

53,690,242

(1) Includes stock-based compensation expense as follows:

Three months ended March

31,

2024

2023

(unaudited)

Cost of revenue

Subscription and support

$

1,601

$

1,072

Professional services

727

633

Operating expenses

Research and development

4,641

4,697

Sales and marketing

8,038

6,958

General and administrative

8,000

24,682

WORKIVA INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands)

March 31, 2024

December 31, 2023

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

296,066

$

256,100

Marketable securities

542,281

557,622

Accounts receivable, net

87,898

125,193

Deferred costs

37,822

39,023

Other receivables

7,162

7,367

Prepaid expenses and other

25,771

23,631

Total current assets

997,000

1,008,936

Property and equipment, net

23,295

24,282

Operating lease right-of-use assets

11,254

12,642

Deferred costs, non-current

32,848

33,346

Goodwill

110,317

112,097

Intangible assets, net

21,154

22,892

Other assets

6,036

4,665

Total assets

$

1,201,904

$

1,218,860

Liabilities and Stockholders’

Deficit

Current liabilities

Accounts payable

$

9,911

$

5,204

Accrued expenses and other current

liabilities

89,437

97,921

Deferred revenue

367,060

380,843

Finance lease obligations

540

532

Total current liabilities

466,948

484,500

Convertible senior notes, non-current

763,063

762,455

Deferred revenue, non-current

31,085

36,177

Other long-term liabilities

212

178

Operating lease liabilities,

non-current

9,839

10,890

Finance lease obligations, non-current

13,913

14,050

Total liabilities

1,285,060

1,308,250

Stockholders’ deficit

Common stock

55

54

Additional paid-in-capital

584,752

562,942

Accumulated deficit

(664,328

)

(652,641

)

Accumulated other comprehensive (loss)

income

(3,635

)

255

Total stockholders’ deficit

(83,156

)

(89,390

)

Total liabilities and stockholders’

deficit

$

1,201,904

$

1,218,860

WORKIVA INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Three months ended March

31,

2024

2023

(unaudited)

Cash flows from operating

activities

Net loss

$

(11,687

)

$

(46,150

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

2,522

2,800

Stock-based compensation expense

23,007

38,042

(Recovery of) provision for doubtful

accounts

(123

)

106

Realized loss on sale of

available-for-sale securities, net

—

561

Amortization of premiums and discounts on

marketable securities, net

(3,749

)

(1,028

)

Amortization of issuance costs and debt

discount

608

325

Deferred income tax

(295

)

(10

)

Changes in assets and liabilities:

Accounts receivable

36,947

29,363

Deferred costs

1,405

1,770

Operating lease right-of-use asset

1,426

1,295

Other receivables

194

95

Prepaid expenses

(2,273

)

(5,732

)

Other assets

(1,090

)

(74

)

Accounts payable

4,726

207

Deferred revenue

(17,526

)

(9,955

)

Operating lease liability

(987

)

(1,172

)

Accrued expenses and other liabilities

(8,261

)

(4,880

)

Net cash provided by operating

activities

24,844

5,563

Cash flows from investing

activities

Purchase of property and equipment

(203

)

(198

)

Purchase of marketable securities

(116,567

)

(125,815

)

Sale of marketable securities

4,609

43,713

Maturities of marketable securities

129,640

31,905

Purchase of intangible assets

(31

)

(79

)

Net cash provided by (used in) investing

activities

17,448

(50,474

)

Cash flows from financing

activities

Proceeds from option exercises

302

1,457

Taxes paid related to net share

settlements of stock-based compensation awards

(8,611

)

(7,228

)

Proceeds from shares issued in connection

with employee stock purchase plan

7,113

5,546

Principal payments on finance lease

obligations

(129

)

(124

)

Net cash used in financing activities

(1,325

)

(349

)

Effect of foreign exchange rates on

cash

(1,107

)

548

Net increase (decrease) in cash and cash

equivalents

39,860

(44,712

)

Cash and cash equivalents at beginning of

period

256,721

240,197

Cash and cash equivalents at end of

period

$

296,581

$

195,485

Three months ended March

31,

2024

2023

Reconciliation of cash, cash

equivalents, and restricted cash to the consolidated balance

sheets

Cash and cash equivalents at end of

period

$

296,066

$

195,485

Restricted cash included within prepaid

expenses and other at end of period

515

—

Total cash, cash equivalents, and

restricted cash at end of period shown in the consolidated

statements of cash flows

$

296,581

$

195,485

TABLE I

WORKIVA INC.

RECONCILIATION OF NON-GAAP

INFORMATION

(in thousands, except share

and per share)

Three months ended March

31,

2024

2023

Gross profit, subscription and support

$

127,052

$

105,531

Add back: Stock-based compensation

1,601

1,072

Gross profit, subscription and support,

non-GAAP

$

128,653

$

106,603

Gross profit, professional services

$

7,092

$

6,140

Add back: Stock-based compensation

727

633

Gross profit, professional services,

non-GAAP

$

7,819

$

6,773

Gross profit

$

134,144

$

111,671

Add back: Stock-based compensation

2,328

1,705

Gross profit, non-GAAP

$

136,472

$

113,376

Cost of revenue, subscription and

support

$

27,927

$

24,133

Less: Stock-based compensation

1,601

1,072

Cost of revenue, subscription and support,

non-GAAP

$

26,326

$

23,061

Cost of revenue, professional services

$

13,596

$

14,385

Less: Stock-based compensation

727

633

Cost of revenue, professional services,

non-GAAP

$

12,869

$

13,752

Research and development

$

45,495

$

45,791

Less: Stock-based compensation

4,641

4,697

Less: Amortization of acquisition-related

intangibles

890

886

Research and development, non-GAAP

$

39,964

$

40,208

Sales and marketing

$

82,633

$

70,710

Less: Stock-based compensation

8,038

6,958

Less: Amortization of acquisition-related

intangibles

412

601

Sales and marketing, non-GAAP

$

74,183

$

63,151

General and administrative

$

24,299

$

42,011

Less: Stock-based compensation

8,000

24,682

General and administrative, non-GAAP

$

16,299

$

17,329

Loss from operations

$

(18,283

)

$

(46,841

)

Add back: Stock-based compensation

23,007

38,042

Add back: Amortization of

acquisition-related intangibles

1,302

1,487

Income (loss) from operations,

non-GAAP

$

6,026

$

(7,312

)

Net loss

$

(11,687

)

$

(46,150

)

Add back: Stock-based compensation

23,007

38,042

Add back: Amortization of

acquisition-related intangibles

1,302

1,487

Net income (loss), non-GAAP

$

12,622

$

(6,621

)

Net loss per basic and diluted share:

$

(0.21

)

$

(0.86

)

Add back: Stock-based compensation

0.42

0.71

Add back: Amortization of

acquisition-related intangibles

0.02

0.03

Net income (loss) per basic share,

non-GAAP

$

0.23

$

(0.12

)

Net income (loss) per diluted share,

non-GAAP

$

0.22

$

(0.12

)

Weighted-average common shares outstanding

- basic, non-GAAP

54,915,852

53,690,242

Weighted-average common shares outstanding

- diluted, non-GAAP

56,352,572

53,690,242

TABLE II

WORKIVA INC.

RECONCILIATION OF NON-GAAP

GUIDANCE

(in thousands, except share

and per share data)

Three months ending June 30,

2024

Year ending December 31,

2024

Loss from operations, GAAP range

$

(24,000

)

-

$

(22,000

)

$

(76,000

)

-

$

(72,000

)

Add back: Stock-based compensation

24,700

24,700

98,000

98,000

Add back: Amortization of

acquisition-related intangibles

1,300

1,300

5,000

5,000

Income from operations, non-GAAP range

$

2,000

-

$

4,000

$

27,000

-

$

31,000

Net loss per share, GAAP range

$

(0.32

)

-

$

(0.29

)

$

(0.90

)

-

$

(0.83

)

Add back: Stock-based compensation

0.46

0.46

1.77

1.77

Add back: Amortization of

acquisition-related intangibles

0.02

0.02

0.09

0.09

Net income per share, non-GAAP range

$

0.16

-

$

0.19

$

0.96

-

$

1.03

Weighted-average common shares outstanding

- basic

55,200,000

55,200,000

55,300,000

55,300,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502478727/en/

Investor Contact: Mike Rost Workiva Inc.

investor@workiva.com

Media Contact: Rotha Brauntz Workiva Inc.

press@workiva.com

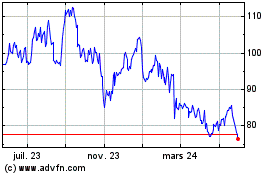

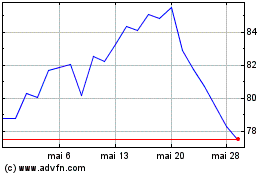

Workiva (NYSE:WK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Workiva (NYSE:WK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025