Comprehensive suite of solutions allows

WisdomTree to work with financial advisors to deliver scalable

portfolios to their clients.

WisdomTree, Inc. (NYSE: WT), a global financial innovator, today

introduces Portfolio Solutions, a WisdomTree Asset Management, Inc.

service to empower new and deeper relationships with investment

advisors. Whether opting for self-constructed model portfolios or

third-party model portfolio providers, Portfolio Solutions offers

advisors a robust, scalable, and efficient framework for portfolio

delivery.

Portfolio Solutions enables advisors to leverage WisdomTree’s

model portfolio and research expertise to help advisors make

informed choices on how they deliver and construct portfolios for

their clients so they can spend more time scaling and growing their

businesses. Portfolio Solutions is comprised of three distinct

offerings to help advisors, which include:

For advisor-built portfolios:

- Portfolio Consultations: Offers a personalized in-depth

evaluation of an advisor’s model portfolios, including individual

model portfolio composition analysis, stress testing, examination

of holdings and overlaps, and more.

For outsourced portfolios*:

- CIO-Managed Model Portfolios: Provides access to WisdomTree’s

CIO-Managed Model Portfolios designed to satisfy a wide array of

client investment goals. Advisors can implement these model

portfolios themselves, via model market centers, or on third-party

platforms.

- Shared CIO: Enables advisors to collaborate with WisdomTree’s

dedicated Model Investment Team to build and manage model

portfolios for the advisor’s clients, which includes the option to

delegate trading, rebalancing, and tax optimization tasks.

Portfolio Solutions seeks to provide potential benefits for

advisors. It helps advisors manage and implement asset allocation

decisions, employ a consistent investment and client communication

process, save time and resources, and make their practice more

valuable. A growth opportunity for WisdomTree, Portfolio Solutions

allows us to add substantial value to the advisor’s investment

process that the advisor can follow in providing investment advice

to its clients.

“More and more, advisors are seeking help regarding their

portfolios, and WisdomTree’s goal is to be their strongest partner

in the delivery and management of their portfolios and growing

their business,” said Thomas Skrobe, Head of Product Solutions at

WisdomTree. “We’re excited to provide an offering that enables

advisors to collaborate with WisdomTree to help deliver portfolios

for their clients so they could spend more time building their

businesses and deepening client relationships. We believe that

providing a full range of portfolio services is a growth

opportunity for the advisors we serve and well-positions us to

provide timely insights and drive incremental flows.”

The introduction of the Model Portfolio filter tool marks the

first enhancement under Portfolio Solutions, showcasing

WisdomTree’s commitment to improving portfolio management and

advisor support services. The Model Portfolio filter tool can help

advisors find a WisdomTree CIO-Managed Model Portfolio that is most

suitable for their client’s needs by offering them the ability to

filter by investment objective, risk profile, single or multi-asset

class, region, and platform.

Further information on Portfolio Solutions can be found

here.

WisdomTree’s models business currently has a milestone AUM, with

$3.5 billion in assets, as of April 26, 2024 – and its momentum is

building. Today, there are roughly 2,000 advisors in the U.S. with

at least one account that uses WisdomTree managed models. That

number more than doubled in 2023 with over 1,000 advisors added in

the past 12 months. WisdomTree expects to continue to grow its

accessible market to 80,000 advisors by the end of 2024 (up from

70,000 today) by securing new relationships with additional wealth

management firms. The firm is also prioritizing deepening their

wallet share with the over 2,000 advisors who use WisdomTree

managed models today and looks to add another 1,000 new advisors

using WisdomTree’s models by the end of 2024.

WisdomTree expanded the Portfolio Solutions team with the

strategic new hire of Samuel Rines, Macro Strategist at WisdomTree,

providing advisors with geopolitically risk-aware portfolios that

aim to provide unique market exposure across asset classes and

geographies to help clients navigate through uncertainty. This is

an example of how WisdomTree continues to grow and add top talent

to our Portfolio Solutions business. Insights from Rines can be

found here.

*References to CIO (Chief Investment Officer), “CIO-Managed”,

“Shared CIO” are meant as a general reference to WisdomTree Model

Portfolio subscriptions, consultation regarding WisdomTree Model

Portfolios, and WisdomTree Model Portfolios that may be customized

to firm-specific objectives or unique firm-specific investment

needs (“custom model portfolios”), and WisdomTree is not acting in

an investment advisory, fiduciary or quasi-fiduciary capacity in

connection therewith. Such material, and any assistance provided as

described herein, including portfolio construction, WisdomTree

Model Portfolios, custom model portfolios, asset allocation stress

testing, assessments, discussions, output or other assistance

(whether by WisdomTree personnel or digital tools) are (i) for

information only and are not intended to provide, and should not be

relied on for, tax, legal, accounting, investment or financial

planning advice, (ii) not personalized investment advice or an

investment recommendation from WisdomTree, and (iii) intended for

use only by a financial professional, with other information, as a

resource to help build a portfolio or as an input in the

development of investment advice for its own clients. Such

financial professionals are responsible for making their own

independent judgment as to how to use such information.

WisdomTree Funds are distributed by Foreside Fund Services, LLC.

Thomas Skrobe is a registered representative of Foreside Fund

Services, LLC.

For Financial Advisors: WisdomTree Model Portfolio

information is designed to be used by financial advisors solely as

an educational resource, along with other potential resources

advisors may consider, in providing services to their end clients.

WisdomTree’s Model Portfolios and related content are for

information only and are not intended to provide, and should not be

relied on, for tax, legal, accounting, investment or financial

planning advice by WisdomTree, nor should any WisdomTree Model

Portfolio information be considered or relied upon as investment

advice or as a recommendation from WisdomTree, including regarding

the use or suitability of any WisdomTree Model Portfolio, any

particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are

not intended to constitute investment advice or investment

recommendations from WisdomTree. Your investment adviser may or may

not implement WisdomTree’s Model Portfolios in your account. The

performance of your account may differ from the performance shown

for a variety of reasons, including but not limited to: Your

investment adviser, and not WisdomTree, is responsible for

implementing trades in the accounts; differences in market

conditions; client-imposed investment restrictions; the timing of

client investments and withdrawals; fees payable; and/or other

factors. WisdomTree is not responsible for determining the

suitability or appropriateness of a strategy based on WisdomTree’s

Model Portfolios. WisdomTree does not have investment discretion

and does not place trade orders for your account. This material has

been created by WisdomTree and the information included herein has

not been verified by your investment adviser and may differ from

information provided by your investment adviser. WisdomTree does

not undertake to provide impartial investment advice or give advice

in a fiduciary capacity. Further, WisdomTree receives revenue in

the form of advisory fees for our exchange traded funds and

management fees for our collective investment trusts.

WisdomTree Digital is not a bank and does not itself take

deposits. Demand deposit accounts made available to you as a

WisdomTree Prime user are provided by Stride Bank N.A., Member

FDIC. Digital assets held in WisdomTree Digital accounts are not

legal tender and are not covered by FDIC protections. The

WisdomTree Prime Visa Debit card is issued by Stride Bank N.A.,

Member FDIC, pursuant to a license from Visa USA Inc.

Digital assets (e.g., bitcoin and ether) are considered to be

highly speculative, involve a high degree of risk and have the

potential for loss of the entire investment. Digital assets are

subject to a number of risks, including price volatility.

Transactions in digital assets may be irreversible, and

accordingly, losses due to fraudulent or accidental transactions

may not be recoverable. Legislative and regulatory changes or

actions at the state, federal, or international level may adversely

affect the use, transfer, exchange and value of virtual

currency.

References to “digital gold” refer to the WisdomTree Gold Token,

a digital token recorded on the blockchain representing electronic

document of title to physical gold. The price of gold does

fluctuate and may be affected by numerous factors including supply

and demand, the global financial markets and other political,

financial, or economic events, which may negatively impact gold

prices and the value of a WisdomTree Gold Token.

A blockchain is an open, distributed ledger that digitally

records transactions in a verifiable and immutable (i.e.,

permanent) way using cryptography. A distributed ledger is a

database in which data is stored in a decentralized manner.

Cryptography is a method of storing and transmitting data in a

particular form so that only those for whom it is intended can read

and process it. A blockchain stores transaction data in “blocks”

that are linked together to form a “chain”, and hence the name

blockchain. Blockchain technology is a relatively new and untested

technology, with little regulation. Blockchain systems could be

vulnerable to fraud, particularly if a significant minority of

participants colluded to defraud the rest. Potential risks also

include vulnerability to theft, or inaccessibility, and future

regulatory developments could affect its viability.

There are risks associated with investing, including possible

loss of principal.

Investors and their advisors should consider the investment

objectives, risks, charges and expenses of the funds included in

any Model Portfolio carefully before investing. This and other

information can be obtained in the Fund’s prospectus or summary

prospectus by visiting wisdomtree.com/investments.

Please read the prospectus carefully before you invest.

About WisdomTree WisdomTree is a global financial

innovator, offering a well-diversified suite of exchange-traded

products (ETPs), models, solutions and products leveraging

blockchain technology. We empower investors and consumers to shape

their future and support financial professionals to better serve

their clients and grow their businesses. WisdomTree is leveraging

the latest financial infrastructure to create products that provide

access, transparency and an enhanced user experience. Building on

our heritage of innovation, we are also developing and have

launched next-generation digital products, services and structures,

including digital or blockchain-enabled mutual funds and tokenized

assets, as well as our blockchain-native digital wallet, WisdomTree

Prime®.*

*The WisdomTree Prime digital wallet and digital asset services

are made available through WisdomTree Digital Movement, Inc. (NMLS

ID: 2372500) and WisdomTree Digital Trust Company, LLC, in select

U.S. jurisdictions and may be limited where prohibited by law.

WisdomTree Digital Trust Company, LLC is chartered as a limited

purpose trust company by the New York State Department of Financial

Services to engage in virtual currency business. Visit

https://www.wisdomtreeprime.com or the WisdomTree Prime mobile app

for more information.

WisdomTree currently has approximately $109 billion in assets

under management globally, as of June 20, 2024.

Please visit us on X, formerly known as Twitter, at

@WisdomTreeNews.

WisdomTree® is the marketing name for WisdomTree, Inc. and its

subsidiaries worldwide.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702198578/en/

Media Relations WisdomTree, Inc. Jessica Zaloom +1.917.267.3735

jzaloom@wisdomtree.com

Natasha Ramsammy +1.917.267.3798 nramsammy@wisdomtree.com /

wisdomtree@fullyvested.com

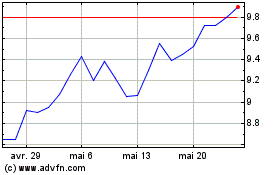

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

WisdomTree (NYSE:WT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024