YPF Can Finance Maxus' Bankruptcy Plan, Judge Says

16 Août 2016 - 3:40AM

Dow Jones News

A bankruptcy triggered by the high cost of cleaning up New

Jersey's contaminated Passaic River inched forward with an

agreement to finance Maxus Energy Corp.'s workout effort.

On Monday, Judge Christopher Sontchi of the U.S. Bankruptcy

Court in Wilmington, Del., indicated he would approve an

approximately $63 million bankruptcy financing package that was

amended after creditors expressed concerns.

Heading into Monday's hearing, Maxus creditors warned the

financing would give Maxus's parent and lender, YPF SA, Argentina's

state-run oil company, too much power to force through a bankruptcy

settlement that takes YPF off the hook for damages from the

contamination of the Passaic River.

Maxus was one of dozens of companies tagged with blame for

discharging hazardous substances into the river decades ago. A New

Jersey state court has ruled that Maxus and an affiliate were

responsible for dumping dioxin, a highly toxic chemical and

suspected carcinogen, into the river in the 1950s and 1960s.

YPF and Maxus agreed to pay New Jersey $130 million to settle

most of the pollution claims in 2013. Cleanup costs for an

eight-mile area of the river range from $1 billion to $3.4 billion,

according to the Environmental Protection Agency.

Maxus Energy filed for chapter 11 bankruptcy protection in June,

hoping to cement a settlement with its parent for $130 million to

cover its environmental obligations. In return, YPF would be

released from legal claims Maxus may have against it in relation to

the cleanup costs.

While the fight over Maxus' bankruptcy financing was resolved

through agreements, the fight over the YPF settlement will continue

in bankruptcy court. If Maxus and YPF prevail, the settlement will

be incorporated in a chapter 11 exit plan.

YPF bought Maxus in 1995. Along with Maxus' oil fields, YPF also

acquired the company's legal liabilities, including those growing

out of the operation of a chemical plant along the river decades

ago. A pesticide plant in Newark produced the Vietnam War-era

defoliant Agent Orange and DDT before being shut down years

ago.

Other companies have been called on to help fund the cleanup of

the Passaic River, which was a major industrial artery with

chemical, paint and other factories. A group of those companies

occupies a seat on the official committee of unsecured creditors in

Maxus' bankruptcy and is watching the proceeding intently, a lawyer

for the group said.

Maxus' bankruptcy financing will cover continued cleanup work,

an obligation YPF must meet. The controversial portion of the

financing was a loan that will mostly be spent on professional fees

of lawyers and advisers working to get the settlement approved,

fees that could top $20 million.

Occidental Chemical Corp., the Occidental Petroleum Corp.

chemical subsidiary that's also known as OxyChem, has been trying

to hold YPF to account for a share of the cleanup costs. OxyChem

lawyer Christopher Shore said the bankruptcy financing threatened

to add to Maxus' financial problems, not relieve them.

Maxus is asking to borrow in bankruptcy more than it can repay,

Mr. Shore said, a factor that effectively gives YPF a veto power

over the wishes of other creditors.

The official committee of unsecured creditors was also concerned

about the concentration of bargaining power in YPF's hands, said

Adam Harris, lawyer for the group.

YPF agreed to limit its repayment rights under the loan to set

the financing up for approval.

Patrick Fitzgerald contributed to this article.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

August 15, 2016 21:25 ET (01:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

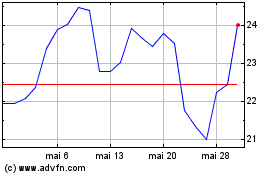

YPF Sociedad Anonima (NYSE:YPF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

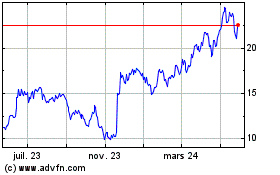

YPF Sociedad Anonima (NYSE:YPF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025