Clairvest Reports Fiscal 2022 Third Quarter Results

10 Février 2022 - 11:35PM

Clairvest Group Inc. (TSX: CVG) today reported results for the

fiscal 2022 third quarter and nine months ended December 31, 2021

and material events subsequent to quarter end. (All figures are in

Canadian dollars unless otherwise stated)

Highlights

- December 31, 2021 book value was

$972.1 million or $64.58 per share compared with $895.9 million or

$59.49 per share as at September 30, 2021

- Net income for the quarter ended

December 31, 2021 was $76.5 million or $5.08 per share. For the

nine months ended December 31, 2021, net income was $123.2 million

or $8.20 per share

- Clairvest and Clairvest Equity

Partners VI (“CEP VI”) made a new equity investment in Delaware

Park racetrack and casino (“Delaware Park”)

- Subsequent to quarter end and as

previously announced, Clairvest and Clairvest Equity Partners V

(“CEP V”) completed the sale of their interest in Also Energy

Holdings Inc. (“AlsoEnergy”)

- Subject to the approval of the Toronto Stock Exchange,

Clairvest’s Board of Directors approved a new normal course issuer

bid

Clairvest’s book value was $972.1 million or

$64.58 per share as at December 31, 2021, compared with $895.9

million or $59.49 per share as at September 30, 2021. The increase

in book value for the quarter was attributable to net income for

the quarter of $76.5 million, or $5.08 per share, which primarily

resulted from an increase in the valuation of AlsoEnergy within our

private equity investment portfolio. During the quarter, the

Company purchased and cancelled 6,000 common shares which was

accretive to the book value per share.

In December 2021, Clairvest announced the sale

of AlsoEnergy which was expected to have a positive impact on

Clairvest’s book value per share of approximately $5 per share.

Subsequent to quarter end, the sale was completed as announced. As

at December 31, 2021, Clairvest’s investment in AlsoEnergy was

carried at approximately the sale proceeds received subsequent to

quarter end.

In December 2021, Clairvest together with CEP VI

made a US$71.2 million equity investment in Delaware Park, a racino

located in Wilmington, Delaware, serving the Delaware, Maryland,

New Jersey, and Pennsylvania markets. Clairvest’s portion of the

investment was US$19.3 million (C$24.6 million).

“Our third quarter was a busy quarter for the

Clairvest team. We closed the acquisition of Delaware Park, our

fifth investment in CEP VI, which is right in the wheelhouse of our

land-based gaming expertise. Additionally, subsequent to quarter

end, we completed the sale of AlsoEnergy for an outstanding result.

In addition, the balance of our portfolio is faring very well. I am

pleased with the continued momentum we have experienced over the

past few months,” said Ken Rotman, CEO of Clairvest. “Looking

ahead, our team is focused on building industry knowledge and

relationships in our active domains, and pursuing attractive

opportunities in this dynamic market environment, which we will

continue to navigate with discipline.”

Subject to the approval of the Toronto Stock

Exchange, Clairvest’s Board of Directors has approved a new normal

course issuer bid to purchase up to 5% of the outstanding common

shares on the Toronto Stock Exchange during a 12-month period

expected to commence on March 8, 2022.

| Summary of

Financial Results – Unaudited |

|

|

|

|

|

|

|

|

|

Financial Results |

Quarter ended |

Nine months ended |

|

December 31 |

December 31 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

($000’s, except per share amounts) |

$ |

|

$ |

|

$ |

|

$ |

|

|

Net investment gain |

90,647 |

|

61,561 |

|

132,580 |

|

111,636 |

|

|

Net carried interest from Clairvest Equity Partners III and IV |

(1,152 |

) |

678 |

|

146 |

|

(7,087 |

) |

|

Distributions, interest income, dividends and fees |

10,269 |

|

9,177 |

|

34,619 |

|

28,334 |

|

|

Total expenses, excluding income taxes |

14,255 |

|

15,476 |

|

26,157 |

|

33,265 |

|

|

Net income and comprehensive income |

76,532 |

|

49,937 |

|

123,191 |

|

90,055 |

|

|

Basic and fully diluted net income per share |

5.08 |

|

3.32 |

|

8.18 |

|

5.98 |

|

|

Financial Position |

December 31 |

March 31, |

|

2021 |

2021 |

|

($000’s, except share information and per share amounts) |

$ |

$ |

|

Total assets |

1,102,950 |

985,025 |

|

Total cash, cash equivalents and temporary investments |

271,708 |

279,373 |

|

Carried interest from Clairvest Equity Partners III and IV |

29,795 |

34,318 |

|

Corporate investments(1) |

708,616 |

534,667 |

|

Total liabilities |

130,879 |

127,218 |

|

Management participation from Clairvest Equity Partners III and

IV |

22,588 |

25,996 |

|

Book value(2) |

972,071 |

857,807 |

|

Common shares outstanding |

15,052,301 |

15,058,401 |

|

Book value per share(2) |

64.58 |

56.96 |

(1) Includes carried interest of $133,224 (March

31: $88,343) and management participation of $91,576 (March 31:

$60,346) from Clairvest Equity Partners V and VI, and $64,987

(March 31, 2021: $65,953) in cash, cash equivalents and temporary

investments held by Clairvest’s acquisition entities.(2) Book value

is a Non-IFRS measure calculated as the value of total assets less

the value of total liabilities.

Clairvest’s third quarter fiscal 2022 financial

statements and MD&A are available on the SEDAR website at

www.sedar.com and the Clairvest website at www.clairvest.com.

About Clairvest Clairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $2.6 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 57 different platform

companies and generated top quartile performance over an extended

period.

Contact Information

Stephanie LoManager, Investor Relations and

MarketingClairvest Group

Inc. Tel: (416)

925-9270Fax: (416) 925-5753stephaniel@clairvest.com

Forward-looking Statements This

news release contains forward-looking statements with respect to

Clairvest Group Inc., its subsidiaries, its CEP limited

partnerships and their investments. These statements are based on

current expectations and are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Clairvest, its subsidiaries, its CEP

limited partnerships and their investments to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include general and economic business conditions and

regulatory risks. Clairvest is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or otherwise.

www.clairvest.com

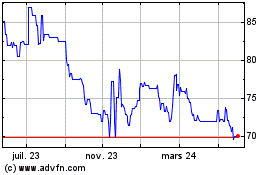

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

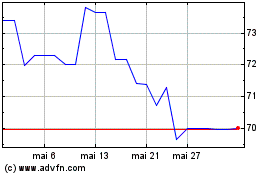

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024