Clairvest Group Inc. (TSX: CVG) today reported results for the

fiscal 2024 first quarter ended June 30, 2023 and events which

occurred subsequent to quarter end. (All figures are in Canadian

dollars unless otherwise stated)

Highlights

- June 30, 2023 book value was

$1,225.0 million or $81.54 per share compared with $1,217.7 million

or $81.05 per share as at March 31, 2023

- Net income for the quarter ended

June 30, 2023 was $19.5 million or $1.30 per share

- Clairvest and Clairvest Equity

Partners VI (”CEP VI”) in partnership with ECL Entertainment, LLC

(“ECL”), an experienced gaming operator, completed its investment

in New Hampshire Gaming

- Subsequent to quarter end,

Clairvest announced the final closing of Clairvest Equity Partners

VII (“CEP VII”) at its US$1.2 billion hard cap

- Subsequent to quarter end,

Clairvest and CEP VI invested in Mountain Land Physical Therapy

(“Mountain Land PT”)

- Subsequent to quarter end,

Clairvest and CEP VI invested in NexTech Solutions (“NexTech”)

- Subsequent to quarter end,

Clairvest and CEP VI completed the sale of Arrowhead Environmental

Partners (“Arrowhead”), realizing a 12.3x multiple of invested

capital

- Subsequent to quarter end,

Clairvest appointed a new Chairman of the Board and made other

changes to its Board of Directors

- Subsequent to quarter end,

Clairvest paid $0.8105 in dividends

Clairvest’s book value was $1,225.0 million or

$81.54 per share as at June 30, 2023, compared with $1,217.7

million or $81.05 per share as at March 31, 2023. The increase in

book value for the quarter was attributable to net income for the

quarter of $19.5 million, or $1.30 per share net of $12.2 million

or $0.8105 per share in dividends accrued as at June 30, 2023. The

net income arose from a net increase in the valuation of

Clairvest’s private equity investment portfolio.

In May 2023, Clairvest and CEP VI along with ECL

acquired licensed gaming operations in Southern New Hampshire, with

a plan to build a large-scale gaming facility in Nashua, New

Hampshire (“New Hampshire Gaming”). On closing of the acquisition,

Clairvest and CEP VI invested US$25.2 million in New Hampshire

Gaming in addition to US$24.5 million which had been previously

funded. For Clairvest, it invested US$6.8 million (C$9.2 million)

in addition to US$6.6 million (C$8.9 million) previously

funded.

In April 2023, Clairvest launched CEP VII, a

successor fund of CEP VI, with a target fund size of US$1.0 billion

and a hard cap of US$1.2 billion. As at June 30, 2023, Clairvest

completed the first closing of CEP VII which comprised Clairvest’s

commitment of US$300 million alongside approximately US$700 million

from third party investors. As at August 10, 2023, Clairvest

completed the final closing of CEP VII at the US$1.2 billion hard

cap, with commitments of US$900 million from third party investors

and US$300 million from Clairvest.

In July 2023, Clairvest together with CEP VI

made a US$21.7 million equity investment in Mountain Land PT, an

outpatient physical therapy business in the Mountain West region of

the United States. Clairvest’s portion of the investment was US$5.9

million (C$7.8 million).

In July 2023, Clairvest together with CEP VI

made a US$21.4 million equity investment in NexTech, a U.S. defence

contractor providing integration services related to the testing

and evaluation of communications, cybersecurity, surveillance and

intelligence technologies. Clairvest’s portion of the investment

was US$5.8 million (C$7.7 million).

In August 2023, Clairvest and CEP VI completed

the sale of Arrowhead. At closing, Clairvest and CEP VI received

cash proceeds totalling US$131.4 million. Clairvest’s portion of

the proceeds was US$35.6 million. Clairvest realized a 12.3x

mulitple of invested capital and an IRR of 128% on the investment

in Arrowhead. As at June 30, 2023, Clairvest’s investment in

Arrowhead is carried at a value which approximates the proceeds

received on the sale transaction.

“Fiscal 2024 started off on a very strong note

with the final close of CEP VII, our seventh flagship fund, hitting

the hard cap of US$1.2 billion in under 4 months. This represents

our largest investment program in the history of Clairvest and

comes at a time when a well-capitalized fund is advantageous. We

appreciate the renewed commitments from our existing investors and

are humbled by the reception in the market from new investors as

well," said Ken Rotman, CEO & Managing Director of Clairvest.

"In addition to our successful fundraising efforts, we also

completed three new investments over the last few months and we are

excited about the prospects of each. Another noteworthy highlight

is our blockbuster sale of Arrowhead Environmental Partners which

generated a 12.3x multiple of capital and is a testament to our

partnership-oriented strategy and knowledge and domain based

approach to investing.”

Subsequent to quarter end and following today’s

annual shareholder meeting, Clairvest announced Michael Bregman has

been appointed as the new Chairman of the Board. Michael Bregman

has been a director of Clairvest since 1991. Clairvest also

announced the appointment of Peter Zemsky to its Board of

Directors. Peter Zemsky, Deputy Dean and Strategy Professor at

INSEAD, replaces Joseph J. Heffernan, a long time Clairvest

director and former Chairman, who elected not to stand for

re-election at today’s annual shareholder meeting.

Also subsequent to quarter end, Clairvest paid

an annual ordinary dividend of $0.10 per share and a special

dividend of $0.7105 per share, such that in aggregate, the

dividends represent 1% of the March 31, 2023 book value. Both

dividends were paid on July 27, 2023 to common shareholders of

record as at July 5, 2023 and are eligible dividends for Canadian

income tax purposes.

| Summary of

Financial Results – Unaudited |

|

|

|

|

|

Financial

Results(1) |

Quarter ended |

|

June 30 |

|

2023 |

2022 |

|

|

($000’s, except per share amounts) |

$ |

$ |

|

Net investment gain (loss) |

24,469 |

(11,021 |

) |

|

Net carried interest from Clairvest Equity Partners III and IV |

591 |

(585 |

) |

|

Distributions, interest income, dividends and fees |

11,809 |

8,603 |

|

|

Total expenses, excluding income taxes |

15,831 |

10,576 |

|

|

Net income (loss) and comprehensive income (loss) |

19,462 |

(11,338 |

) |

|

Basic and fully diluted net income (loss) per share |

1.30 |

(0.75 |

) |

|

Financial Position |

June 30 |

March 31, |

|

2023 |

2023 |

|

($000’s, except share information and per share amounts) |

$ |

$ |

|

Total assets |

1,429,070 |

1,429,651 |

|

Total cash, cash equivalents, temporary investments and restricted

cash |

289,939 |

390,832 |

|

Carried interest from Clairvest Equity Partners III and IV |

49,905 |

49,314 |

|

Corporate investments(1) |

911,482 |

891,709 |

|

Total liabilities |

204,058 |

211,924 |

|

Management participation from Clairvest Equity Partners III and

IV |

39,160 |

38,365 |

|

Book value(2) |

1,225,012 |

1,217,727 |

|

Common shares outstanding |

15,024,001 |

15,024,001 |

|

Book value per share(2) |

81.54 |

81.05 |

(1) Includes carried interest of $158,945 (March

31: $151,161) and management participation of $118,382 (March 31:

$112,280) from Clairvest Equity Partners V and VI, and $89,171

(March 31: $102,256) in cash, cash equivalents and temporary

investments held by Clairvest’s acquisition entities.(2) Book value

is a Non-IFRS measure calculated as the value of total assets less

the value of total liabilities.

Clairvest’s first quarter fiscal 2024 financial

statements and MD&A are available on the SEDAR website at

www.sedar.com and the Clairvest website at www.clairvest.com.

About Clairvest Clairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $4.3 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 64 different platform

companies and generated top quartile performance over an extended

period.

Contact Information

Stephanie LoDirector, Investor Relations and

MarketingClairvest Group

Inc. Tel: (416)

925-9270Fax: (416) 925-5753stephaniel@clairvest.com

Forward-looking Statements This

news release contains forward-looking statements with respect to

Clairvest Group Inc., its subsidiaries, its CEP limited

partnerships and their investments. These statements are based on

current expectations and are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Clairvest, its subsidiaries, its CEP

limited partnerships and their investments to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include general and economic business conditions and

regulatory risks. Clairvest is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or otherwise.

www.clairvest.com

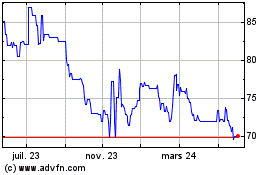

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

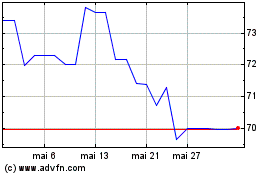

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024