Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF)

(“Orezone” or “Company”) reported its operational and financial

results for the first quarter of 2024. The Company will host a

conference call and webcast on May 14, 2024 commencing at 8:00am PT

to discuss its Q1-2024 results. Additional details are provided at

the end of this press release.

All dollar amounts are in USD unless otherwise

stated and abbreviation “M” means million.

Patrick Downey, President and CEO, commented

“Our Bomboré mine had another quarter of consistent performance,

delivering 30,139 ounces of gold production, mine earnings of $27

million, and positive free cashflow. In addition, we successfully

commissioned the powerline connection to the national grid and

substantially completed the construction of the MV3 resettlement

site which will open mining access to the Siga East deposit in the

third quarter of 2024.

Importantly, we continue to reinvest in the

Bomboré mine and, after a careful review of available financing

alternatives, the Company has decided to pursue its Phase II Hard

Rock Expansion in two stages to better align capital requirements

with funding sources. We have now received a debt proposal for the

first stage of the expansion from our senior lender, Coris Bank,

which we expect to finalize in the very near future.”

2024 FIRST QUARTER

HIGHLIGHTS

|

(All mine site figures on a 100% basis) |

|

Q1-2024 |

Q1-2023 |

|

Operating Performance |

|

|

|

|

Gold production |

oz |

30,139 |

41,301 |

|

Gold sales |

oz |

31,229 |

43,139 |

|

Average realized gold price |

$/oz |

2,066 |

1,892 |

|

Cash costs per gold ounce sold1 |

$/oz |

1,127 |

799 |

|

All-in sustaining costs1 (“AISC”) per gold ounce sold |

$/oz |

1,324 |

926 |

|

Financial Performance |

|

|

|

|

Revenue |

$000s |

64,685 |

81,712 |

|

Earnings from mine operations |

$000s |

26,882 |

39,670 |

|

Net income attributable to shareholders of Orezone1 |

$000s |

11,697 |

22,560 |

|

Net income per common share attributable to shareholders of

Orezone1 |

|

|

|

|

BasicDiluted |

$$ |

0.030.03 |

0.070.06 |

|

Adjusted EBITDA1 |

$000s |

25,928 |

42,645 |

|

Adjusted earnings attributable to shareholders of Orezone1 |

$000s |

7,736 |

24,574 |

|

Adjusted earnings per share attributable to shareholders of

Orezone1 |

$ |

0.02 |

0.07 |

|

Cash and Cash Flow Data |

|

|

|

|

Operating cash flow before changes in working capital |

$000s |

20,357 |

41,137 |

|

Operating cash flow |

$000s |

13,637 |

38,926 |

|

Free cash flow1 |

$000s |

2,013 |

31,498 |

|

Cash, end of period |

$000s |

15,597 |

45,172 |

1 Cash costs, AISC, Adjusted EBITDA, Adjusted

earnings, Adjusted earnings per share, and Free cash flow are

non-IFRS measures. See “Non-IFRS Measures” section below for

additional information.

-

Safety: Continued strong safety performance in

Q1-2024 with 1.41 million hours worked without a lost-time

injury.

- Debt

Reduction: Principal repayment of XOF 3.0 billion ($5.0

million) in Q1-2024 on the Company’s senior loans with Coris Bank

International (“Coris Bank”).

-

Liquidity: On May 10, 2024, the Company closed and

drew down on a XOF 12.0 billion (~$20 million) bridge loan with

Coris Bank in order to improve the Company’s cash position. The

Company intends to refinance the bridge loan with the project loan

for its Phase II hard rock expansion with Coris Bank expected in

Q3-2024.

The Phase II Hard Rock

Expansion

A hard rock plant, to complement the existing

Phase I oxide plant, is required to process the fresh rock and

lower transition mineral reserves of the Bomboré orebody.

The Company originally contemplated constructing

a 4.4 million tonnes per annum (“Mtpa”) hard rock plant in a single

stage as outlined in its 2023 feasibility study. Following a recent

review of available financing sources, the Company has decided to

complete this brownfield expansion in two stages to better manage

its capital requirements. Stage 1 will consist of an initial

2.5Mtpa hard rock plant, with a future Stage 2 expansion increasing

hard rock plant throughput to 5.0Mtpa – 7.0Mtpa.

A preliminary capital cost for this initial

2.5Mtpa hard rock plant is estimated at $80 million, significantly

less than the $167.5 million estimated for the 4.4Mtpa hard rock

plant. The Company expects to finance the construction costs of

this Stage 1 hard rock plant (rescoped “Phase II Hard Rock

Expansion”) primarily through senior debt and cash flow generated

from its Phase I oxide operations during the construction

period.

The Company has significantly advanced

discussions with Coris Bank for additional project debt and

anticipates concluding a binding debt commitment in June 2024.

Based on forecasted construction and key equipment timelines, the

Company expects first gold from the Phase II Hard Rock Expansion to

be achieved in late 2025.

The Company intends to provide more detailed

guidance for its Phase II Hard Rock Expansion later this year after

the Company has secured a binding debt commitment and Board

approval to proceed with the expansion.

BOMBORÉ GOLD MINE (100% BASIS) –

OPERATING HIGHLIGHTS

|

|

|

Q1-2024 |

Q1-2023 |

|

Safety |

|

|

|

|

Lost-time injuries frequency rate (LTIFR) |

per 1M hours |

0.00 |

0.00 |

|

Personnel-hours worked |

000s hours |

1,410 |

928 |

|

Mining Physicals |

|

|

|

|

Ore tonnes mined |

tonnes |

2,402,533 |

2,205,056 |

|

Waste tonnes mined |

tonnes |

3,123,099 |

2,382,135 |

|

Total tonnes mined |

tonnes |

5,525,631 |

4,587,191 |

|

Strip ratio |

waste:ore |

1.3 |

1.1 |

|

Processing Physicals |

|

|

|

|

Ore tonnes milled |

tonnes |

1,355,619 |

1,445,693 |

|

Head grade milled |

Au g/t |

0.78 |

0.96 |

|

Recovery rate |

% |

89.0 |

92.2 |

|

Gold produced |

Au oz |

30,139 |

41,301 |

|

Unit Cash Cost |

|

|

|

|

Mining cost per tonne |

$/tonne |

3.48 |

2.91 |

|

Mining cost per ore tonne processed |

$/tonne |

8.02 |

6.51 |

|

Processing cost |

$/tonne |

9.24 |

9.21 |

|

Site general and admin (“G&A”) cost |

$/tonne |

3.79 |

3.23 |

|

Cash cost per ore tonne processed |

$/tonne |

21.05 |

18.96 |

|

Cash Costs and AISC Details |

|

|

|

|

Mining cost (net of stockpile movements) |

$000s |

10,867 |

9,417 |

|

Processing cost |

$000s |

12,520 |

13,322 |

|

Site G&A cost |

$000s |

5,134 |

4,667 |

|

Refining and transport cost |

$000s |

117 |

148 |

|

Government royalty cost |

$000s |

5,132 |

4,912 |

|

Gold inventory movements |

$000s |

1,416 |

2,019 |

|

Cash costs1 on a sales

basis |

$000s |

35,186 |

34,485 |

|

Sustaining capital |

$000s |

4,018 |

3,530 |

|

Sustaining leases |

$000s |

73 |

187 |

|

Corporate G&A cost |

$000s |

2,069 |

1,731 |

|

All-In Sustaining Costs1

on a sales basis |

$000s |

41,346 |

39,933 |

|

Gold sold |

Au oz |

31,229 |

43,139 |

|

Cash costs per gold ounce

sold1 |

$/oz |

1,127 |

799 |

|

All-In Sustaining Costs per gold ounce

sold1 |

$/oz |

1,324 |

926 |

1 Non-IFRS measure. See “Non-IFRS Measures” section

for additional details.

Bomboré Production Results

Gold production in Q1-2024 was 30,139 ounces, a

decline of 27% from the 41,301 ounces produced in Q1-2023. The

lower gold production is attributable to an 18% decrease in head

grades, a 6% decline in plant throughput, and a 3% decrease in

plant recoveries. The better head grade achieved in Q1-2023 was

primarily the result of processing of high-grade stockpiles

accumulated during the Phase I construction which have now been

fully depleted. Mill availability in Q1-2024 was impacted by the

commissioning of grid power to site and from the shortage of power

from the national grid towards the end of the quarter. In addition,

as mining deepens in the certain pits, the quantity of transition

ore has started to increase. The presence of transition ore results

in slightly lower metallurgical recoveries, lower plant throughput,

and additional plant maintenance due to the harder nature of the

ore.

Plant throughput, head grades, and recoveries

are expected to improve from a greater blend of oxide ore once

mining commences at Siga East in Q3-2024.

Bomboré Operating Costs

AISC per gold ounce sold in Q1-2024 was $1,324,

a 43% increase from the $926 per ounce sold in Q1-2023. The higher

AISC is primarily the result of: (a) lower Q1-2024 gold production

and sales as explained above; (b) greater per ounce royalty costs

from new royalty rates that took effect in October 2023 and from a

higher realized selling price; and (c) increased mining costs.

Cash cost per ore tonne processed in Q1-2024 was

$21.05 per tonne, an increase of 11% from the $18.96 per tonne in

Q1-2023. The higher cash cost in Q1-2024 was predominantly due to

increased mining and site G&A costs, and from fewer ore tonnes

processed. Mining costs have increased as lower benches are mined

resulting in longer hauls and more transition material that

requires drill-and-blast prior to excavation. In addition, unit

mining costs have increased from a higher strip ratio and more

management fees from the mobilization of a second mining contractor

in July 2023 to supplement material movement of the main mining

contractor. Site G&A costs reflect greater spending for

security as the Company expands its operations into the southern

portion of the mining permit.

Processing costs per ore tonne has remained

relatively stable from $9.21 per tonne in Q1-2023 to $9.24 per

tonne in Q1-2024. Unit processing costs were expected to decline in

Q1-2024 from 2023 levels upon the introduction of grid power to the

Bomboré mine at the end of January 2024; however, the power costs

savings from using grid power has been offset by greater blend of

transition ore requiring higher per tonne consumption of power,

grinding media, and main reagents; more plant maintenance to

address higher equipment wear; and from lower plant throughput

resulting in fixed processing costs being absorbed over fewer

tonnes in Q1-2024. Furthermore, the mine relied on more self

generated power beginning in March 2024 from lower-than-expected

availability of grid power as the dry season impacted the

contributions of hydropower to the national grid.

Bomboré Growth Capital

Projects

Grid Power Connection

The commissioning of the powerline to connect

Bomboré to Burkina Faso’s national energy grid commenced in January

2024 and was successfully energized by the end of the same month.

As of March 31, 2024, the Company has incurred costs of $19.3M for

the grid power connection, of which $1.1M was incurred in

Q1-2024.

Resettlement Action Plan (“RAP”) Phases II and

III

RAP Phases II and III involve the construction

of three new resettlement communities (MV3, MV2, and BV2) in order

to relocate households currently residing within the southern half

of the Bomboré mining permit. The Company has sequenced MV3 first

in order to gain access to mining areas that are currently

contemplated in the 2024 mine plan.

Construction of MV3 was substantially completed

in April 2024 with the Company now organizing with local leaders

and residents to relocate families into their new resettlement

homes later in Q2-2024. In parallel, the Company has commenced

earthworks for the next resettlement site (MV2) and awarded

contracts to local companies to begin construction shortly.

As of March 31, 2024, the Company has incurred

project-to-date costs of $13.5M for RAP Phases II and III, of which

$3.1M was incurred in Q1-2024.

NON-IFRS MEASURES

The Company has included certain terms or

performance measures commonly used in the mining industry that is

not defined under IFRS, including “cash costs”, “AISC”, “EBITDA”,

“adjusted EBITDA”, “adjusted earnings”, “adjusted earnings per

share”, and “free cash flow”. Non-IFRS measures do not have any

standardized meaning prescribed under IFRS, and therefore, they may

not be comparable to similar measures presented by other companies.

The Company uses such measures to provide additional information

and they should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with IFRS. For a

complete description of how the Company calculates such measures

and reconciliation of certain measures to IFRS terms, refer to

“Non-IFRS Measures” in the Management’s Discussion and Analysis for

the three months ended March 31, 2024 which is incorporated by

reference herein.

CONFERENCE CALL AND WEBCAST

The condensed consolidated interim financial

statements and Management’s Discussion and Analysis are available

at www.orezone.com and on the Company’s profile on SEDAR+ at

www.sedarplus.ca. Orezone will host a conference call and audio

webcast to discuss 2024 first quarter results on May 14, 2024 at

8:00am PT (11:00am ET).

| Webcast |

|

Date: |

Tuesday, May 14, 2024 |

| Time: |

8:00 am Pacific time (11:00 am

Eastern time) |

| Please register for

the webcast here: Orezone Q1-2024 Conference Call and

Webcast |

| |

Conference CallToll-free in U.S.

and Canada: 1-800-715-9871International callers: +646-307-1963Event

ID: 2084420

QUALIFIED PERSONS

The scientific and technical information in this

news release was reviewed and approved by Dr. Pascal Marquis, Geo.,

Senior Vice President of Exploration and Mr. Rob Henderson, P. Eng,

Vice President of Technical Services, both of whom are Qualified

Persons as defined under NI 43-101 Standards of Disclosure for

Mineral Projects.

About Orezone Gold

Corporation

Orezone Gold Corporation (TSX: ORE OTCQX: ORZCF)

is a West African gold producer engaged in mining, developing, and

exploring its 90%-owned flagship Bomboré Gold Mine in Burkina Faso.

The Bomboré mine achieved commercial production on its oxide

operations on December 1, 2022, and is now focussed on its staged

hard rock expansion that is expected to materially increase annual

and life-of-mine gold production from the processing of hard rock

mineral reserves. Orezone is led by an experienced team focused on

social responsibility and sustainability with a proven track record

in project construction and operations, financings, capital

markets, and M&A.

The technical report entitled Bomboré Phase II

Expansion, Definitive Feasibility Study is available on SEDAR+ and

the Company’s website.

Patrick DowneyPresident and Chief Executive

Officer

Vanessa PickeringManager, Investor Relations

Tel: 1 778 945 8977 / Toll Free: 1 888 673

0663info@orezone.com / www.orezone.com

For further information please contact

Orezone at +1 (778) 945-8977 or visit the Company’s

website at

www.orezone.com.

The Toronto Stock Exchange neither approves nor

disapproves the information contained in this news release.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains certain information

that constitutes “forward-looking information” within the meaning

of applicable Canadian Securities laws and “forward-looking

statements” within the meaning of applicable U.S. securities laws

(together, “forward-looking statements”). Forward-looking

statements are frequently characterized by words such as “plan”,

“expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”,

“potential”, “possible” and other similar words, or statements that

certain events or conditions “may”, “will”, “could”, or “should”

occur.

All forward-looking statements are subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements including, but not

limited to, terrorist or other violent attacks, the failure of

parties to contracts to honour contractual commitments, unexpected

changes in laws, rules or regulations, or their enforcement by

applicable authorities; social or labour unrest; changes in

commodity prices; unexpected failure or inadequacy of

infrastructure, the possibility of project cost overruns or

unanticipated costs and expenses, accidents and equipment

breakdowns, political risk, unanticipated changes in key management

personnel, the spread of diseases, epidemics and pandemics

diseases, market or business conditions, the failure of exploration

programs, including drilling programs, to deliver anticipated

results and the failure of ongoing and uncertainties relating to

the availability and costs of financing needed in the future, and

other factors described in the Company's most recent annual

information form and management’s discussion and analysis filed on

SEDAR+ on www.sedarplus.ca. Readers are cautioned not to place

undue reliance on forward-looking statements.

Forward-looking statements are based on the

applicable assumptions and factors management considers reasonable

as of the date hereof, based on the information available to

management at such time. These assumptions and factors include, but

are not limited to, assumptions and factors related to the

Company’s ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; the Company’s ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the price and market for outputs, including gold; foreign

exchange rates; taxation levels; the timely receipt of necessary

approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

Although the forward-looking statements

contained in this press release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this press release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this press release.

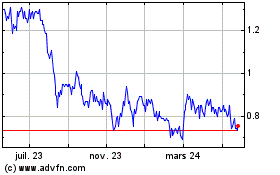

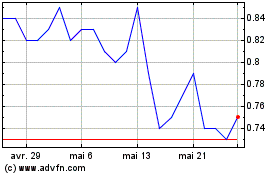

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025