STORAGEVAULT CANADA INC.

(“

StorageVault” or the

“

Corporation”) (

SVI-TSX) is

pleased to announce that it has received conditional acceptance

from the Toronto Stock Exchange (the “

TSX”) to

conduct a Normal Course Issuer Bid (“

NCIB”) to

purchase for cancellation, during the 12-month period starting

March 18, 2022: (i) up to 18,931,054 of the outstanding common

shares of the Corporation (the “

Common

Shares”), representing 5% of the 378,621,086

Common Shares outstanding; (ii) outstanding 5.75% senior unsecured

hybrid debentures of the Corporation issued in July 2020 and due on

January 31, 2026 (“

2020

Debentures”) in the aggregate principal amount of

$3,750,000, representing 5% of the currently outstanding

$75,000,000 aggregate principal amount of 2020 Debentures; and

(iii) outstanding 5.50% senior unsecured hybrid debentures of the

Corporation issued in July 2021 and due on September 30, 2026

(“

2021 Debentures” and

collectively, with the 2020 Debentures, the

“

Debentures”) in the aggregate principal amount of

$2,875,000, representing 5% of the currently outstanding

$57,500,000 aggregate principal amount of 2021 Debentures. Each

NCIB will end on March 17, 2023, unless the maximum amount of

Common Shares or Debentures, as applicable, is purchased before

then or StorageVault provides earlier notice of termination.

StorageVault will not acquire through the facilities of the TSX

more than 62,807 Common Shares, $11,700 aggregate principal amount

of 2020 Debentures or $20,400 aggregate principal amount 2021

Debentures, during a trading day, being 25% of the average daily

trading volume of the Common Shares (251,231), 2020 Debentures

($46,800) and 2021 Debentures ($81,600), respectively, on the TSX

from January 26, 2022 until February 28, 2022, subject to certain

prescribed exceptions. The stock symbol on the TSX for the Common

Shares, 2020 Debentures and 2021 Debentures is SVI, SVI.DB and

SVI.DB.B, respectively.

The purchase and payment for the Common Shares

and Debentures will be made by StorageVault through the facilities

of the TSX or alternative trading systems. National Bank Financial

Inc. has been selected as StorageVault’s agent for the NCIB. The

price paid for the Common Shares or Debentures, as applicable, will

be, subject to NCIB pricing rules contained in securities laws, the

prevailing market price of such Common Shares or Debentures, as

applicable, on the TSX at the time of such purchase. StorageVault

intends to fund the purchases out of available cash.

StorageVault believes that the market price of

its Common Shares and Debentures may not reflect their underlying

value and the Board of Directors has authorized this initiative

because, in the Board’s opinion, the proposed purchase of Common

Shares and Debentures pursuant to the NCIB constitutes an

appropriate use of StorageVault’s funds, and the repurchase of its

Common Shares and Debentures is one way of creating securityholder

value.

To the knowledge of StorageVault, no director,

senior officer or other insider of StorageVault currently intends

to sell any Common Shares or Debentures under the NCIB. However,

sales by such persons through the facilities of the TSX may occur

if the personal circumstances of any such person changes or any

such person makes a decision unrelated to these NCIB purchases. The

benefits to any such person whose Common Shares or Debentures are

purchased would be the same as the benefits available to all other

holders whose Common Shares or Debentures are purchased.

StorageVault conducted a previous NCIB for up to

18,312,741 Common Shares and $3,750,000 2020 Debentures through the

facilities of the TSX Venture Exchange, which NCIB ended on January

24, 2022. Pursuant to the previous Common Share NCIB, StorageVault

purchased an aggregate of 875,615 Common Shares, at a volume

weighted average price of $5.11 per Common Share, and no 2020

Debentures were purchased.

About StorageVault Canada

Inc.StorageVault owns and operates 230 storage locations

across Canada. StorageVault owns 197 of these locations plus over

4,500 portable storage units representing over 10.8 million

rentable square feet on over 630 acres of land. StorageVault also

provides last mile storage and logistics solutions and professional

records management services, such as document and media storage,

imaging and shredding services.

For further information, contact Mr. Steven

Scott or Mr. Iqbal Khan:

Tel:

1-877-622-0205ir@storagevaultcanada.com

Forward-Looking Information:

This news release contains “forward-looking information” within the

meaning of applicable Canadian securities legislation. All

statements, other than statements of historical fact, included

herein are forward-looking information. In particular, this news

release contains forward-looking information regarding: the NCIBs,

including the commencement and end date of the NCIBs. There can be

no assurance that such forward-looking information will prove to be

accurate, and actual results and future events could differ

materially from those anticipated in such forward-looking

information. This forward-looking information reflects

StorageVault’s current beliefs and is based on information

currently available to StorageVault and on assumptions StorageVault

believes are reasonable. These assumptions include, but are not

limited to: the underlying value of StorageVault and its Common

Shares and Debentures; the ability of StorageVault to complete

purchases under the NCIBs and final TSX acceptance of the NCIBs;

the level of activity in the storage business and the economy

generally; consumer interest in StorageVault’s services and

products; competition and StorageVault’s competitive advantages;

trends in the storage industry, including macro-trends in relation

to increased growth and growth in the portable storage business;

the availability of attractive and financially competitive asset

acquisitions in the future; the potential closing of previously

announced acquisitions, if any, continuing to proceed as they have

progressed to date; future performance of StorageVault being

consistent with or better than past performance, including revenue

and expenses being consistent with or better than historical

revenue and expenses; and StorageVault’s continued response and

ability to navigate the COVID-19 pandemic being consistent with,

or better than, its ability and response to date. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of StorageVault to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: general business, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; delay or

failure to receive board of directors, third party or regulatory

approvals; the actual results of StorageVault’s future operations;

competition; changes in legislation, including environmental

legislation, affecting StorageVault; the timing and availability of

external financing on acceptable terms; conclusions of economic

evaluations and appraisals; lack of qualified, skilled labour or

loss of key individuals; risks related to the COVID-19 pandemic

including various recommendations, orders and measures of

governmental authorities to try to limit the pandemic, including

travel restrictions, border closures, non-essential business

closures, service disruptions, quarantines, self-isolations,

shelters-in-place, curfews, stay-at-home orders, social distancing

and mandatory vaccination policies, disruptions to markets,

economic activity, financing, supply chains and sales channels,

and a deterioration of general economic conditions including a

possible national or global recession; and the impact that the

COVID-19 pandemic may have on StorageVault which may include: a

short-term delay in payments from customers, an increase in

accounts receivable and an increase of losses on accounts

receivable; decreased demand for the services that StorageVault

offers; and a deterioration of financial markets that could limit

StorageVault’s ability to obtain external financing. A description

of additional risk factors that may cause actual results to differ

materially from forward-looking information can be found in

StorageVault’s disclosure documents on the SEDAR website at

www.sedar.com. Although StorageVault has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. Readers are cautioned that the

foregoing list of factors is not exhaustive. Readers are further

cautioned not to place undue reliance on forward-looking

information as there can be no assurance that the plans, intentions

or expectations upon which they are placed will occur.

Forward-looking information contained in this news release is

expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of StorageVault as of the date of this

news release and, accordingly, is subject to change after such

date. However, StorageVault expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities law.

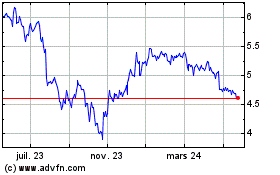

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

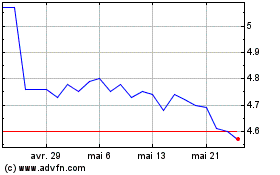

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025