Board of Directors Authorizes $2 Billion Share

Repurchase Program Over Five Years

Molson Coors Beverage Company (NYSE: TAP, TAP.A; TSX: TPX.B,

TPX.A) today introduced a new plan to accelerate its growth, its

long-term financial outlook, and new capital deployment plans. The

Acceleration Plan, designed to build upon the Company’s growth in

the years ahead, was shared at the Company’s 2023 Strategy Day in

New York City.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231003616121/en/

“Getting to growth was the focus of our 2019 Revitalization

Plan, and as a result of three plus years of work we are on track

to deliver our second straight year of top and bottom-line growth,”

said Gavin Hattersley, President and Chief Executive Officer. “Over

the past few years, long before controversy upended the U.S. beer

industry, we changed how we invest, market, and operate, and we

changed our future. Today we believe we are built for growth, we

expect growth, and we are delivering growth. We turned around

Molson Coors over the past few years, and our focus now is on

accelerating the growth we created in the years ahead.”

“Our long-term growth algorithm anticipates net sales revenue

growth, margin expansion, and attractive earnings per share growth,

while our expected compelling free cash flow generation supports

reinvestment in value creation,” said Tracey Joubert, Chief

Financial Officer. “With substantially improved financial

flexibility, we are pleased to announce a new $2 billion share

repurchase program as part of our balanced and cohesive approach of

prioritizing capital allocation among investing in our business,

reducing net debt, and returning cash to shareholders. As we look

to the future, we are confident in our strategy and ability to

drive compelling returns for our shareholders.”

The Company’s new Acceleration Plan builds off the successes

Molson Coors achieved under its Revitalization Plan since 2019. As

the Company’s Leadership Team outlined during the Strategy Day, the

plan centers on five pillars.

Grow core power brand net revenue. Molson Coors core

brands have been gaining strength, and the Company plans to

consistently grow its core power brand revenue in the years ahead.

In the U.S., Coors Light, Miller Lite, and Coors Banquet, have been

on an upward trajectory for several years, making them well

positioned to benefit from the shifts in consumer purchasing

behavior largely in the premium segment that have occurred in 2023.

Core brands in other large global markets have also been gaining

industry share, including Molson trademark in Canada and Ozujsko in

Croatia. Carling continues to be a top brand in the U.K. The

Company is focused on continuing that momentum for these

brands.

Aggressively premiumize its portfolio. The Company has

aggressively premiumized its portfolio, in both Beer and Beyond

Beer, to meaningfully change the shape of its product portfolio.

With the benefit of major innovation successes, including Madri in

the U.K. and Simply Spiked in North America, the Company has

increased its Net Sales Revenue from its Above Premium portfolio

from 23% in 2019 to 28% in 2022. Building on this strength along

with compelling new innovations, particularly in Beyond Beer, the

Company’s goal is for its Above Premium portfolio to reach

approximately one-third of its Net Sales Revenue excluding contract

brewing, factored and distributor owned brands in the medium

term.

Scale and expand in beyond beer. The Company’s Beyond

Beer portfolio includes Flavor, Spirits, and Non-Alcoholic. This

Beyond Beer portfolio supports the Company’s premiumization efforts

and is focused on scalable products in higher-growth segments. From

diversified flavor, including winners like Simply Spiked and Arnold

Palmer Spiked, to acclaimed whiskey brands under the Coors Spirits

Company, to energy drinks through its partnership with Dwayne

Johnson’s ZOA Energy, the Company expects its Beyond Beer portfolio

to drive about half of its Above Premium net sales revenue growth

over the medium term.

Invest in its capabilities. Molson Coors intends to

continue to invest in building leading capabilities and

efficiencies, including digital transformation, marketing

effectiveness, sales execution, and sustainability initiatives.

Since 2019, the Company increased aluminum can production capacity,

built a new U.S. variety packer, added a can line in Croatia, built

a new state-of-the-art brewery in Canada, broke ground on a major

modernization in its Golden Colorado brewery, and added flavor

production capabilities in the U.S., Canada, and the U.K. The

Company’s digital transformation has enhanced the effectiveness of

its marketing and sales efforts as well. Continued investments in

these capabilities are expected to help drive growth and margin

expansion through productivity improvements, operating

efficiencies, and cost savings.

Support its people, communities, and planet. The Company

recommitted to its core values, the first of which is “Put People

First” along with investing in their success and supporting the

communities in which it operates globally. Hattersley commended the

more than 16,000 employees around the world who helped deliver

growth over the past several years, along with the fundamentals of

the Revitalization Plan.

Financial Outlook:

Long-term Financial Outlook:

- Low-single-digit annual Net Sales Revenue growth, on a constant

currency basis

- Mid-single-digit annual Underlying Income before Income Taxes

growth, on a constant currency basis

- High-single-digit annual Underlying Earnings per Share

growth

- Net Debt to Underlying EBITDA of under 2.5x over the long

term

Share Repurchase:

Today, the Company announced that its Board of Directors

authorized a $2 billion share repurchase program with an expected

program term of five years. The Company intends for its repurchases

to be a mixture of sustained and opportunistic purchases that the

Company believes, with its balanced and cohesive approach, will

improve shareholder value creation.

A webcast of the event is accessible via the Investor Relations

page of the Molson Coors Beverage Company website,

ir.molsoncoors.com. A replay of the webcast will be available once

the event concludes.

Overview of Molson Coors Beverage

Company

For more than two centuries Molson Coors Beverage Company has

been brewing beverages that unite people to celebrate all life’s

moments. From Coors Light, Miller Lite, Molson Canadian, Carling,

and Staropramen to Coors Banquet, Blue Moon Belgian White, Vizzy

Hard Seltzer, Leinenkugel’s Summer Shandy, Miller High Life and

more, Molson Coors produces many beloved and iconic beer brands.

While Molson Coors’ history is rooted in beer, Molson Coors offers

a modern portfolio that expands beyond the beer aisle as well.

Molson Coors Beverage Company is a publicly traded company that

operates through its Americas and EMEA&APAC reporting segments

and is traded on the New York Stock Exchange and Toronto Stock

Exchange. Our Environmental, Social and Governance (ESG) strategy

is focused on People and Planet with a strong commitment to raising

industry standards and leaving a positive imprint on our employees,

consumers, communities, and the environment. To learn more about

Molson Coors Beverage Company, visit molsoncoors.com,

MolsonCoorsOurImprint.com, or on Twitter through @MolsonCoors.

About Molson Coors Canada

Inc.

Molson Coors Canada Inc. (MCCI) is a subsidiary of Molson Coors

Beverage Company (MCBC). MCCI Class A and Class B exchangeable

shares offer substantially the same economic and voting rights as

the respective classes of common shares of MCBC, as described in

MCBC’s annual proxy statement and Form 10-K filings with the U.S.

Securities and Exchange Commission. The trustee holder of the

special Class A voting stock and the special Class B voting stock

has the right to cast a number of votes equal to the number of then

outstanding Class A exchangeable shares and Class B exchangeable

shares, respectively.

FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” within

the meaning of the U.S. federal securities laws. Generally, the

words "expects," "intend," "goals," "plans," "believes,"

"continues," "may," "anticipate," "seek," "estimate," "outlook,"

"trends," "future benefits," "potential," "projects," "strategies,"

and variations of such words and similar expressions are intended

to identify forward-looking statements. Statements that refer to

projections of our future financial performance, our anticipated

growth and trends in our businesses, and other characterizations of

future events or circumstances are forward-looking statements, and

include, but are not limited to, statements under the headings

"Financial Outlook," and “Share Repurchase” with respect to

expectations of cost inflation, limited consumer disposable income,

consumer preferences, overall volume and market share trends,

pricing trends, industry forces, cost reduction strategies,

shipment levels and profitability, the sufficiency of capital

resources, anticipated results, expectations for funding future

capital expenditures and operations, debt service capabilities,

timing and amounts of debt and leverage levels, market share and

expectations regarding future dividends. In addition, statements

that we make in this press release that are not statements of

historical fact may also be forward-looking statements.

Although the Company believes that the assumptions upon which

its forward-looking statements are based are reasonable, it can

give no assurance that these assumptions will prove to be correct.

Important factors that could cause actual results to differ

materially from the Company’s historical experience, and present

projections and expectations are disclosed in the Company’s filings

with the Securities and Exchange Commission (“SEC”). These factors

include, among other things, the deterioration of general economic,

political, credit and/or capital market conditions; our dependence

on the global supply chain and significant exposure to changes in

commodity and other input prices and the impacts of supply chain

constraints and inflationary pressures; weak, or weakening of,

economic, social and other conditions in the markets in which we do

business; loss, operational disruptions or closure of a major

brewery or other key facility; cybersecurity incidents impacting

our information systems, and violations of data privacy laws and

regulations; our reliance on brand image, reputation, product

quality and protection of intellectual property; constant evolution

of the global beer industry and the broader alcohol industry, and

our position within the global beer industry and success of our

product in our markets; competition in our markets; our ability to

successfully and timely innovate beyond beer; changes in the social

acceptability, perceptions and the political view of the beverage

categories in which we operate; labor strikes, work stoppages or

other employee-related issues; ESG issues; climate change and other

weather events; inadequate supply or availability of quality water;

our dependence on key personnel; our reliance on third party

service providers and internal and outsourced systems; impacts

related to the coronavirus pandemic; our significant debt level

subjects us to financial and operating risks, and the agreements

governing such debt, which subject us to financial and operating

covenants and restrictions; deterioration in our credit rating;

impairments of the carrying value of our goodwill and other

intangible assets; the estimates and assumptions on which our

financial projections are based may prove to be inaccurate; our

reliance on a small number of suppliers to obtain the input

materials we need to operate our business; termination or changes

of one or more manufacturer, distribution or production agreements,

or issues caused by our dependence on the parties to these

agreements; unfavorable outcomes of legal or regulatory matters;

our operations in developing and emerging markets; changes to the

regulation of the distribution systems for our products; our

consolidated financial statements are subject to fluctuations in

foreign exchange rates; changes in tax, environmental, trade or

other regulations or failure to comply with existing licensing,

trade and other regulations; risks associated with operating our

joint ventures; failure to successfully identify, complete or

integrate attractive acquisitions and joint ventures into our

existing operations; and other risks discussed in our filings with

the SEC, including our most recent Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. All forward-looking statements

in this press release are expressly qualified by such cautionary

statements and by reference to the underlying assumptions. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. We do not undertake

to update forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

NON-GAAP MEASURES

In addition to financial measures presented on the basis of

accounting principles generally accepted in the U.S. (“U.S. GAAP”),

we also use non-GAAP financial measures, as listed and defined

below, for operational and financial decision making and to assess

Company and segment business performance. These non-GAAP measures

should be viewed as supplements to (not substitutes for) our

results of operations presented under U.S. GAAP. We have provided

reconciliations of all historical non-GAAP measures to their

nearest U.S. GAAP measure and have consistently applied the

adjustments within our reconciliations in arriving at each non-GAAP

measure.

Our management uses these metrics to assist in comparing

performance from period to period on a consistent basis; as a

measure for planning and forecasting overall expectations and for

evaluating actual results against such expectations; in

communications with the board of directors, stockholders, analysts

and investors concerning our financial performance; as useful

comparisons to the performance of our competitors; and as metrics

of certain management incentive compensation calculations. We

believe these measures are used by, and are useful to, investors

and other users of our financial statements in evaluating our

operating performance.

- Underlying Income (Loss) before Income Taxes (Closest GAAP

Metric: Income (Loss) Before Income Taxes) – Measure of the

Company’s income (loss) before income taxes excluding the impact of

certain non-GAAP adjustment items from our U.S. GAAP financial

statements. Non-GAAP adjustment items include goodwill and other

intangible and tangible asset impairments, restructuring and

integration related costs, unrealized mark-to-market gains and

losses, potential or incurred losses related to certain litigation

accruals and settlements and gains and losses on sales of

non-operating assets, among other items included in our U.S. GAAP

results that warrant adjustment to arrive at non-GAAP results. We

consider these items to be necessary adjustments for purposes of

evaluating our ongoing business performance and are often

considered non-recurring. Such adjustments are subjective, involve

significant management judgment and can vary substantially from

company to company.

- Underlying net income (loss) attributable to MCBC (Closest

GAAP Metric: Net income (loss) attributable to MCBC) – Measure

of net income (loss) attributable to MCBC excluding the impact of

non-GAAP adjustment items (as defined above), the related tax

effects of non-GAAP adjustment items and certain other discrete tax

items.

- Underlying net income (loss) attributable to MCBC per

diluted share (also referred to as Underlying Earnings per Share)

(Closest GAAP Metric: Net income (loss) attributable to MCBC per

diluted share) – Measure of underlying net income (loss)

attributable to MCBC (as defined above) per diluted share. If

applicable, a reported net loss attributable to MCBC per diluted

share is calculated using the basic share count due to dilutive

shares being antidilutive. If underlying net income (loss)

attributable to MCBC becomes income excluding the impact of our

non-GAAP adjustment items, we include the incremental dilutive

shares, using the treasury stock method, into the dilutive shares

outstanding.

- Net debt to underlying earnings before interest, taxes,

depreciation, and amortization ("Underlying EBITDA")

(Closest GAAP Metrics: Cash, Debt, & Income (Loss) Before

Income Taxes) – Measure of the Company’s leverage calculated as

Net debt (defined as current portion of long-term debt and

short-term borrowings plus long-term debt less cash and cash

equivalents) divided by the trailing twelve month underlying

EBITDA. Underlying EBITDA is calculated as Net Income (Loss)

excluding Interest expense (income), income tax expense (benefit),

depreciation and amortization, and the impact of non-GAAP

adjustment items (as defined above). This measure is not the same

as the Company’s maximum leverage ratio as defined under its

revolving credit facility, which allows for other adjustments in

the calculation of net debt to EBITDA.

- Constant currency – Constant currency is a non-GAAP

measure utilized to measure performance, excluding the impact of

translational and certain transactional foreign currency movements,

and is intended to be indicative of results in local currency. As

we operate in various foreign countries where the local currency

may strengthen or weaken significantly versus the U.S. dollar or

other currencies used in operations, we utilize a constant currency

measure as an additional metric to evaluate the underlying

performance of each business without consideration of foreign

currency movements. The percentage changes for net sales and

underlying income (loss) before income taxes in constant currency

consider the impact of foreign exchange by translating the current

period local currency results (that also include the impact of the

comparable prior period currency hedging activities) at the average

exchange rates during the respective period throughout the year

used to translate the financial statements in the comparable prior

year period. The result is the current period results in U.S.

dollars, as if foreign exchange rates had not changed from the

prior year period. Additionally, any transactional foreign currency

impacts, reported within the other non-operating income (expense),

net line item, are excluded from our current period results.

Our guidance for any of the measures noted above are also

non-GAAP financial measures that exclude or otherwise have been

adjusted for non-GAAP adjustment items from our U.S. GAAP financial

statements. When we provide guidance for any of the various

non-GAAP metrics described above, we do not provide reconciliations

of the U.S. GAAP measures as we are unable to predict with a

reasonable degree of certainty the actual impact of the non-GAAP

adjustment items. By their very nature, non-GAAP adjustment items

are difficult to anticipate with precision because they are

generally associated with unexpected and unplanned events that

impact our company and its financial results. Therefore, we are

unable to provide a reconciliation of these measures without

unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231003616121/en/

Investor Relations: Greg

Tierney (414) 931-3303

Traci Mangini (415) 308-0151

News Media: Rachel Dickens

(314) 452-9673

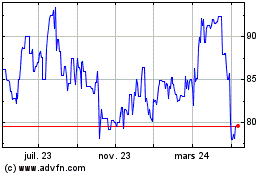

Molson Coors Canada (TSX:TPX.B)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Molson Coors Canada (TSX:TPX.B)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024