Wilmington Announces 2024 Second Quarter Results

07 Août 2024 - 10:25PM

Wilmington Capital Management Inc. (“Wilmington” or the

“Corporation”) reported a net loss for the three months ended June

30, 2024, of ($0.1) million or ($0.01) per share and net income for

the six months ended June 30, 2024, of $1.1 million or $0.08 per

share. compared to net income of $0.7 million or $0.06 per share

and $0.1 million and $0.01 per share for the same periods in 2023.

A summary of the Corporation’s activities and

the operations of its investees is set out below:

OverviewDuring the past 12

months the Corporation has monetized a number of its investments in

order to unlock the embedded value, which had been substantially

realized, simplify its business, repatriate capital to its

shareholders and pursue transactions better suited to a changing

economic environment.

On May 7, 2024, the Corporation paid a special

dividend and return of capital distribution totaling $2.75 per

Class A and Class B share, or $33.9 million. Class A shareholders

received $1.25 per Class A share as a return of capital and $1.50

as an eligible dividend. Class B shareholders received $1.12 per

Class B share as a return of capital and $1.63 as an eligible

dividend.

On August 7, 2024, the Shareholders of the

Corporation approved the disposition of all or substantially all of

the assets of the Corporation, including the sale of assets of Bow

City 2 Limited Partnership (“Bow City Seton”), a wholly owned

subsidiary of the Corporation. The sale of Bow City Seton is

expected to close in the third quarter of 2024. The Corporation

does not currently have any proposals from prospective purchasers

with respect to any or all of the remaining assets of the

Corporation.

InvesteesSunchaser

PartnershipThe Sunchaser Partnership has seen strong seasonal and

nightly camping demand for the 2024 camping season which is

expected to continue. The introduction of luxury glamping tents at

its Half Moon Lake Resort has seen strong initial interest and

provides additional experiences to campers that may not own a

recreational vehicle.

The development application for the Phase II

expansion of 112 full service sites has been approved and

construction will start in fall 2024. New sites will be available

for seasonal camping in spring 2025.

The Sunchaser Partnership continues to actively

pursue opportunities to expand its footprint in the RV resort and

campground business.

Bay Moorings PartnershipThe re-development of an

existing Marina, Champlain Shores, continues to advance with the

ongoing sale of homes and homesites. Of the 50 available home

sites, 21 sites have been sold. The development, which is owned by

the Bay Moorings Holdings Limited Partnership, is also zoned to

accommodate an 88-condominium unit complex.

Bow City 2 Partnership (Land Held for

Development) On July 4, 2024, the independent Directors of the

Board (the “Board”) approved the sale of the 3.4 acres development

lands on a cost-recovery basis. The sale of the development lands

is expected to close in the third quarter of 2024.

OutlookThe Corporation has

taken great strides to reassess its business opportunities in the

context of a changing economic environment, simplify its business,

and reward shareholders for their support through the payment of

dividends and return of capital. The Corporation will continue to

focus on streamlining its business, reassessing its ongoing

liquidity needs and pursuing potential transactions or

opportunity.

| FINANCIAL

RESULTSCONSOLIDATED STATEMENTS OF INCOME (LOSS)

AND COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

(unaudited) |

Three months ended June 30 |

|

Six months ended June 30, |

|

|

($ thousands, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Management fee revenue |

260 |

|

215 |

|

400 |

|

335 |

|

|

Interest, distributions and other income |

538 |

|

1,012 |

|

1,086 |

|

1,638 |

|

|

|

798 |

|

1,227 |

|

1,486 |

|

1,973 |

|

|

Expenses |

|

|

|

|

| General

and administrative |

(822 |

) |

(440 |

) |

(1,447 |

) |

(907 |

) |

|

Amortization |

(7 |

) |

(7 |

) |

(14 |

) |

(14 |

) |

| Finance

costs |

(2 |

) |

(2 |

) |

(3 |

) |

(4 |

) |

|

Stock-based compensation |

--- |

|

(22 |

) |

(18 |

) |

(71 |

) |

|

|

(831 |

) |

(471 |

) |

(1,482 |

) |

(996 |

) |

|

Fair value adjustments and other activities |

| Fair

value adjustments to investments |

--- |

|

90 |

|

194 |

|

(520 |

) |

| Gain

(loss) on disposition of investments |

(63 |

) |

--- |

|

947 |

|

--- |

|

| Share of

equity accounted loss |

--- |

|

(13 |

) |

--- |

|

(26 |

) |

|

|

(63 |

) |

77 |

|

1,141 |

|

(546 |

) |

|

Income (loss) before income taxes |

(96 |

) |

833 |

|

1,145 |

|

431 |

|

|

Current income tax expense |

(45 |

) |

(73 |

) |

(461 |

) |

(193 |

) |

|

Deferred income tax recovery (expense) |

24 |

|

(50 |

) |

453 |

|

(102 |

) |

|

Provision for income taxes |

(21 |

) |

(123 |

) |

(8 |

) |

(295 |

) |

|

Net income (loss) |

(117 |

) |

710 |

|

1,137 |

|

136 |

|

|

Other comprehensive income |

|

|

|

|

| Items

that will not be reclassified to net income (loss): |

|

|

|

|

|

Fair value adjustments to investments |

--- |

|

--- |

|

--- |

|

(170 |

) |

|

Related income taxes |

--- |

|

(23 |

) |

36 |

|

13 |

|

|

Other comprehensive income (loss), net of income

taxes |

--- |

|

(23 |

) |

36 |

|

(157 |

) |

|

Comprehensive income (loss) |

(117 |

) |

687 |

|

1,173 |

|

(21 |

) |

|

|

|

|

|

|

| Net

income (loss) per share |

|

|

|

|

|

Basic |

(0.01 |

) |

0.06 |

|

0.09 |

|

0.01 |

|

|

Diluted |

(0.01 |

) |

0.06 |

|

0.09 |

|

0.01 |

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

(unaudited) |

June 30, |

|

December 31, |

|

|

($ thousands) |

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Investment in Maple Leaf Partnerships |

910 |

|

22,910 |

|

|

Investment in Sunchaser Partnership |

4,700 |

|

4,700 |

|

|

Investment in Energy Securities |

--- |

|

7,584 |

|

| Land

held for development |

--- |

|

6,632 |

|

|

Right-of-use asset |

49 |

|

64 |

|

|

|

5,659 |

|

41,890 |

|

| CURRENT

ASSETS |

|

|

|

|

|

Cash |

12,615 |

|

10,664 |

|

| Short

term securities |

8,000 |

|

17,000 |

|

| Amounts

receivable and other |

5,537 |

|

4,616 |

|

| Assets

classified as held for sale |

8,200 |

|

--- |

|

|

Total assets |

40,011 |

|

74,170 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

| Deferred

income tax liabilities |

196 |

|

1,773 |

|

|

Lease liabilities |

69 |

|

85 |

|

|

|

265 |

|

1,858 |

|

| CURRENT

LIABILITIES |

|

|

|

|

| Lease

liabilities |

38 |

|

38 |

|

| Income

taxes payable |

1,017 |

|

171 |

|

| Amounts

payable and other |

1,670 |

|

800 |

|

|

Total liabilities |

2,990 |

|

2,867 |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

Shareholders’ equity |

35,619 |

|

51,324 |

|

|

Contributed surplus |

--- |

|

1,132 |

|

| Retained

earnings |

1,183 |

|

10,364 |

|

|

Accumulated other comprehensive income |

219 |

|

8,483 |

|

|

Total equity |

37,021 |

|

71,303 |

|

|

Total liabilities and equity |

40,011 |

|

74,170 |

|

|

|

|

Executive Officers of the Corporation will be

available at 403-705-8038 to answer any questions on the

Corporation’s financial results.

STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS AND OTHER MEASUREMENTSCertain statements

included in this document may constitute forward-looking statements

or information under applicable securities legislation.

Forward-looking statements that are predictive in nature, depend

upon or refer to future events or conditions, include statements

regarding the operations, business, financial conditions, expected

financial results, performance, opportunities, priorities, ongoing

objectives, strategies and outlook of the Corporation and its

investee entities and contain words such as "anticipate",

"believe", "expect", "plan", "intend", "estimate", "propose", or

similar expressions and statements relating to matters that are not

historical facts constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation.

While the Corporation believes the anticipated

future results, performance or achievements reflected or implied in

those forward-looking statements are based upon reasonable

assumptions and expectations, the reader should not place undue

reliance on forward-looking statements and information because they

involve known and unknown risks, uncertainties and other factors,

many of which are beyond the Corporation’s control, which may cause

the actual results, performance and achievements of the Corporation

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information.

Factors and risks that could cause actual

results to differ materially from those contemplated or implied by

forward-looking statements include but are not limited to: the

ability of management of Wilmington and its investee entities to

execute its and their business plans; availability of equity and

debt financing and refinancing within the equity and capital

markets; strategic actions including dispositions; business

competition; delays in business operations; the risk of carrying

out operations with minimal environmental impact; industry

conditions including changes in laws and regulations including the

adoption of new environmental laws and regulations and changes in

how they are interpreted and enforced; operational matters related

to investee entities business; incorrect assessments of the value

of acquisitions; fluctuations in interest rates; stock market

volatility; general economic, market and business conditions; risks

associated with existing and potential future law suits and

regulatory actions against Wilmington and its investee entities;

uncertainties associated with regulatory approvals; uncertainty of

government policy changes; uncertainties associated with credit

facilities; changes in income tax laws, tax laws; changes in

accounting policies and methods used to report financial condition

(including uncertainties associated with critical accounting

assumptions and estimates); the effect of applying future

accounting changes; and other risks, factors and uncertainties

described elsewhere in this document or in Wilmington's other

filings with Canadian securities regulatory authorities.

The foregoing list of important factors that may

affect future results is not exhaustive. When relying on the

forward-looking statements, investors and others should carefully

consider the foregoing factors and other uncertainties and

potential events. Except as required by law, the Corporation

undertakes no obligation to publicly update or revise any

forward-looking statements or information, that may be as a result

of new information, future events or otherwise. These

forward-looking statements are effective only as of the date of

this document.

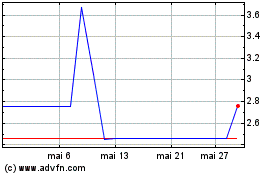

Wilmington Capital Manag... (TSX:WCM.A)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Wilmington Capital Manag... (TSX:WCM.A)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024