Athabasca Announces Closing of Bought Deal Private Placement for Aggregate Gross Proceeds of $5.75 Million

14 Janvier 2014 - 9:57PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH US NEWSWIRE SERVICES.

Athabasca Minerals Inc. (the "Corporation" or "Athabasca") (TSX VENTURE:ABM) is

pleased to announce the closing of its previously announced bought deal private

placement offering (the "Offering") of units of the Corporation ("Units") with

Primary Capital Inc. ("Primary") acting as underwriter. Pursuant to the

Offering, including the full exercise of the over-allotment option granted to

Primary, the Corporation issued 3,965,517 Units at a price of $1.45 per Unit,

for aggregate gross proceeds of $5,750,000.

Each Unit consists of one common share in the capital of the Corporation (a

"Common Share") and one-half of one common share purchase warrant (a "Warrant").

Each whole Warrant entitles the holder to acquire one Common Share at a price of

$1.75 per share for a period of two years from the date of the closing of the

Offering.

The net proceeds raised from the Offering are expected to be used for upcoming

capital expenditures on new and existing assets, as well as potential growth

initiatives and general working capital purposes. Growth initiatives include

future drilling and resource development at the Corporation's Richardson Project

as well as the development of the Firebag Silica Project.

Primary was paid a cash commission equal to 6% of the aggregate gross proceeds

of the Offering and was granted 237,931 options (the "Agent's Options"), with

each such Agent's Option entitling the holder to acquire one Common Share at a

price of $1.45 per share for a period of two years from the date of the closing

of the Offering.

Pursuant to applicable securities laws, all securities issued pursuant to the

Offering will be subject to a statutory hold period which expires on May 15,

2014.

About Athabasca Minerals

Athabasca Minerals Inc. is a resource company involved in the management,

exploration and development of aggregate projects. These activities include

contract work, aggregate pit management, new aggregate development and

acquisitions of sand and gravel deposits. The Corporation also has industrial

mineral land holdings in Northeast Alberta for the purpose of locating and

developing sources of industrial minerals and aggregates essential to high

growth development of the energy and infrastructure sectors.

Neither the TSX Venture nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture) accepts responsibility for the

adequacy or accuracy of this release.

This press release contains forward-looking statements. More particularly, this

press release contains statements concerning the expected use of proceeds. The

forward-looking statements contained in this document are based on certain key

expectations and assumptions made by the Corporation. Although the Corporation

believes that the expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be placed on the

forward-looking statements because the Corporation can give no assurance that

they will prove to be correct. Since forward-looking statements address future

events and conditions, by their very nature they involve inherent risks and

uncertainties. Actual results could differ materially from those currently

anticipated due to a number of factors and risks. These include, but are not

limited to, the failure to obtain necessary regulatory approvals, the risk that

the transactions described herein are delayed or are not completed. The

forward-looking statements contained in this document are made as of the date

hereof and The Corporation undertakes no obligation to update publicly or revise

any forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

The securities of Athabasca have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, and may not be offered or sold

within the United States or to, or for the account or benefit of, U.S. persons

absent U.S. registration or an applicable exemption from U.S. registration

requirements. This release does not constitute an offer for sale of securities

in the United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Boardmarker Group

Dean Stuart

403-517-2270

dean@boardmarker.net (mailto: dean@boardmarker.net)

www.athabascaminerals.com

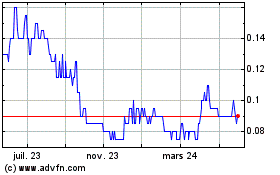

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

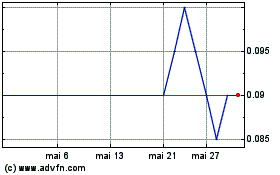

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025