EnWave Reports 2023 Third Quarter Consolidated Interim Financial Results

25 Août 2023 - 3:00PM

EnWave Corporation (TSX-V:ENW | FSE:E4U) (“EnWave”, or the

"Company") today reported the Company’s consolidated

interim financial results for the third quarter ended June 30,

2023.

All values in thousands and denoted in CAD

unless otherwise stated.

- Reported revenue for Q3 2023 of

$2,486, representing a decrease of $174 relative to the comparable

period in the prior year. The decrease was partially offset by

royalty revenues of $394, representing an increase of $93 relative

to the comparable period in the prior year.

- Reported an Adjusted EBITDA(1) loss

of $192 for Q3 2023, an improvement of $32 from the comparable

period in the prior year.

- Reported an overall decrease in

Selling, General & Administrative (“SG&A”) costs (including

Research & Development (“R&D”)) of $569 for Q3 2023

relative to the comparable period in the prior year, with the

decrease primarily related to a continued focus on managing

non-revenue generating spending.

- Reported cash and cash equivalents

of $4,471 and no debt as at June 30, 2023, an increase of $984 from

March 31, 2023.

- Signed a Commercial License

Agreement with Bridgford Foods and sold a 120kW REVTM machine to

produce military ration components for the U.S. Army, among

others.

Consolidated Financial

Performance:

|

($ ‘000s) |

Three months ended June 30, |

|

Nine months ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

Change% |

|

|

2023 |

|

|

2022 |

|

Change% |

|

|

|

|

|

|

|

|

|

| Revenues |

|

2,486 |

|

|

2,660 |

|

(7 |

%) |

|

|

9,906 |

|

|

8,224 |

|

20 |

% |

| Direct

costs |

|

(1,767 |

) |

|

(1,423 |

) |

24 |

% |

|

|

(5,894 |

) |

|

(4,147 |

) |

42 |

% |

| Gross margin |

|

719 |

|

|

1,237 |

|

(42 |

%) |

|

|

4,012 |

|

|

4,077 |

|

(2 |

%) |

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

General and administration |

|

501 |

|

|

736 |

|

(32 |

%) |

|

|

1,753 |

|

|

2,200 |

|

(20 |

%) |

|

Sales and marketing |

|

277 |

|

|

576 |

|

(52 |

%) |

|

|

1,167 |

|

|

1,681 |

|

(31 |

%) |

|

Research and development |

|

408 |

|

|

443 |

|

(8 |

%) |

|

|

1,220 |

|

|

1,530 |

|

(20 |

%) |

|

|

|

1,186 |

|

|

1,755 |

|

(32 |

%) |

|

|

4,140 |

|

|

5,411 |

|

(23 |

%) |

|

|

|

|

|

|

|

|

|

| Net income(loss) continuing

operations |

|

(918 |

) |

|

(807 |

) |

(14 |

%) |

|

|

(974 |

) |

|

(2,191 |

) |

56 |

% |

| Net loss discontinued

operations |

|

(1,031 |

) |

|

(1,208 |

) |

15 |

% |

|

|

(5,703 |

) |

|

(2,463 |

) |

(132 |

%) |

| |

|

|

|

|

|

|

|

| Adjusted EBITDA(1) |

|

(192 |

) |

|

(224 |

) |

14 |

% |

|

|

703 |

|

|

(654 |

) |

207 |

% |

| Loss per share: |

|

|

|

|

|

|

|

|

Basic and diluted – continuous operations |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

|

|

$ |

(0.01 |

) |

$ |

(0.02 |

) |

|

|

Basic and diluted – discontinued operations |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

|

|

$ |

(0.05 |

) |

$ |

(0.02 |

) |

|

|

|

$ |

(0.02 |

) |

$ |

(0.02 |

) |

|

|

$ |

(0.06 |

) |

$ |

(0.04 |

) |

|

(1) Adjusted EBITDA is a non-IFRS

financial measure. Refer to the Non-IFRS Financial Measures

disclosure below for a reconciliation to the nearest IFRS

equivalent. EnWave’s annual consolidated financial statements and

MD&A are available on SEDAR at www.sedar.com and on the

Company’s website www.enwave.net

Key Financial Highlights for the Nine Months Ended Q3

2023 (expressed in ‘000s):

- Revenue for the

nine months ended Q3 2023 of $9,906, compared to $8,224 for the

nine months ended Q3 2022, an increase of $1,682. The increase in

revenue was primarily due to the resale of two large-scale

machines, relative to the comparable period of the prior year which

had one machine resale.

- Royalty Revenues

for the nine months ended Q3 2023 of $1,085, compared to $1,051 for

the nine months ended Q3 2022, an increase of $34. The increase in

royalties was a result of increased production and sales by current

Partners in Q3 2023.

- Gross margin for

the nine months ended Q3 2023 was 41% compared to 50% for the nine

months ended Q3 2022. The decrease in margin was a result of the

overall machine sale mix, including resales, relative to the

comparable period of the prior year.

- SG&A

expenses (including R&D) for the nine months ended Q3 2023 of

$4,140, compared to $5,411 for the nine months ended Q3 2022, a

decrease of $1,271. The decrease resulted from concerted efforts to

maintain discretionary spending, including lower personnel costs

across all departments.

- Adjusted EBITDA

(refer to Non-IFRS Financial Measures section below) for the nine

months ended Q3 2023 was $703, compared to a loss of $654 for the

nine months ended Q3 2022, an increase of $1,357. The increase in

adjusted EBITDA was primarily due to the wind down of NutraDried

and its classification as discontinued operations, the resale of

two large scale machines and the reduction of SG&A expenses

(including R&D).

Significant Corporate Accomplishments in

Q3 2023 and Subsequently:

- Sold a 120kW

REV™ machine to Bridgford Foods in partnership with the United

States Department of Defence for production of military rations.

Bridgford will also use the REVTM technology to develop additional

consumer-branded products at their North Carolina facility.

- Signed a

Technology Evaluation and License Option Agreement with Moleciwl

Cyf of Wales to develop fruit and vegetable products for the Welsh

market.

- Received

approval for a cost-shared funding project through the Food

Processing Growth Fund, for which we gratefully acknowledge the

financial support of the Province of British Columbia through the

Ministry of Agriculture and Food. The program will fund up to 75%

of approved project costs to a maximum contribution in the amount

of $750. The funding will be used for capital additions to the

REVworx™ facility, including but not limited to a retail packaging

system.

- NutraDried

received correspondence from the Internal Revenue Service advising

a tax refund of $497 USD, of an estimated total potential $1,183

USD tax refund, would be issued in Q4 2023 relating to the Employee

Retention Tax Credit for businesses affected during the COVID-19

pandemic. There has not been any additional correspondence from the

Internal Revenue Service concerning the remaining tax refund and

there is no certainty it will be issued.

Non-IFRS Financial

Measures:

This news release refers to Adjusted EBITDA which is a non-IFRS

financial measure. We define Adjusted EBITDA as earnings before

deducting amortization and depreciation, stock-based compensation,

foreign exchange gain or loss, finance expense or income, income

tax expense or recovery and non-recurring impairment, restructuring

and severance charges, government assistance and discontinued

operations. This measure is not necessarily comparable to similarly

titled measures used by other companies and should not be construed

as an alternative to net income or cash flow from operating

activities as determined in accordance with IFRS. Please refer to

the reconciliation between Adjusted EBITDA and the most comparable

IFRS financial measure reported in the Company’s consolidated

financial statements.

|

|

Three months ended June 30, |

Nine months endedJune 30 |

|

($ ‘000s) |

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

| Net (loss) income after income

tax |

(1,949 |

) |

|

(2,015 |

) |

(6,677 |

) |

|

(4,654 |

) |

|

Amortization and

depreciation |

276 |

|

|

323 |

|

841 |

|

|

769 |

|

|

Stock-based

compensation |

103 |

|

|

308 |

|

468 |

|

|

920 |

|

|

Foreign exchange

loss |

54 |

|

|

(48 |

) |

86 |

|

|

18 |

|

|

Finance expense

(income), net |

(22 |

) |

|

- |

|

(33 |

) |

|

(23 |

) |

|

Non-recurring

impairment expense |

315 |

|

|

- |

|

315 |

|

|

- |

|

| Government assistance |

- |

|

|

- |

|

- |

|

|

(147 |

) |

|

Discontinued operations |

1,031 |

|

|

1,208 |

|

5,703 |

|

|

2,463 |

|

|

Adjusted EBITDA |

(192 |

) |

|

(224 |

) |

703 |

|

|

(654 |

) |

Non-IFRS financial measures should be considered

together with other data prepared accordance with IFRS to enable

investors to evaluate the Company's operating results, underlying

performance and prospects in a manner similar to EnWave’s

management. Accordingly, these non-IFRS financial measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. For more information,

please refer to the Non-IFRS Financial Measures section in the

Company’s MD&A available on www.sedar.com.

About EnWave

EnWave is a global leader in the innovation and

application of vacuum microwave dehydration. From its headquarters

in Delta, BC, EnWave has developed a robust intellectual property

portfolio, perfected its Radiant Energy Vacuum (REV™) technology,

and transformed an innovative idea into a proven, consistent, and

scalable drying solution for the food, pharmaceutical and cannabis

industries that vastly outperforms traditional drying methods in

efficiency, capacity, product, quality, and cost.

With more than fifty royalty-generating partners

spanning twenty six countries and five continents, EnWave’s

licensed partners are creating profitable, never-before-seen snacks

and ingredients, improving the quality and consistency of their

existing offerings, running leaner and getting to market faster

with the company’s patented technology, licensed machinery, and

expert guidance.

EnWave’s strategy is to sign royalty-bearing

commercial licenses with food and cannabis producers who want to

dry better, faster and more economical than freeze drying, rack

drying and air drying, and enjoy the following benefits:

- Food and ingredients companies can

produce exciting new products, reach optimal moisture levels up to

seven times faster, and improve product taste, texture, color and

nutritional value.

- Cannabis producers can dry four to

six times faster, retain up to 20% more terpenes and 25% more

cannabinoids, and achieve at least a 3-log reduction in

crop-destroying microbes.

EnWave Corporation

Mr. Brent Charleton, CFAPresident and CEO

For further information:

Brent Charleton, CFA, President and CEO at +1 (778)

378-9616E-mail: bcharleton@enwave.net

Dylan Murray, CPA, CA, CFO at +1 (778) 870-0729E-mail:

dmurray@enwave.net

Safe Harbour for Forward-Looking Information

Statements: This press release may contain forward-looking

information based on management's expectations, estimates and

projections. All statements that address expectations or

projections about the future, including statements about the

Company's strategy for growth, product development, market

position, expected expenditures, the Company ceasing to make

investments in NutraDried, the timing of the wind-down and

dissolution of NutraDried, expectations around the cost of winding

down NutraDried, and the Company's intended focus for the future

are forward-looking statements. These statements are not a

guarantee of future performance and involve a number of risks,

uncertainties and assumptions. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated or intended, including that the

process of winding up NutraDried will involve time and expense to

the Company materially greater than anticipated, that the

realization of assets of NutraDried will not sufficiently cover the

orderly wind-up of NutraDried, which could result in the

requirement for additional funding by the Company to complete such

wind-up, that the foregoing developments will adversely affect the

Company, in terms of cost, management time and focus, outlook or

reputation; the ability of the Company to achieve its longer-term

outlook, the ability to lower costs, and the other risk factors set

forth in the Company's public filings. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

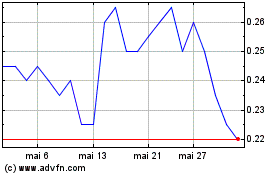

EnWave (TSXV:ENW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

EnWave (TSXV:ENW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024